Apple blows away Wall Street earnings estimates, even with weak China iPhone sales

Apple has released its financial results for the Q2 2024 quarter, with earnings beating predictions despite China iPhone fears.

Apple beat earnings estimates

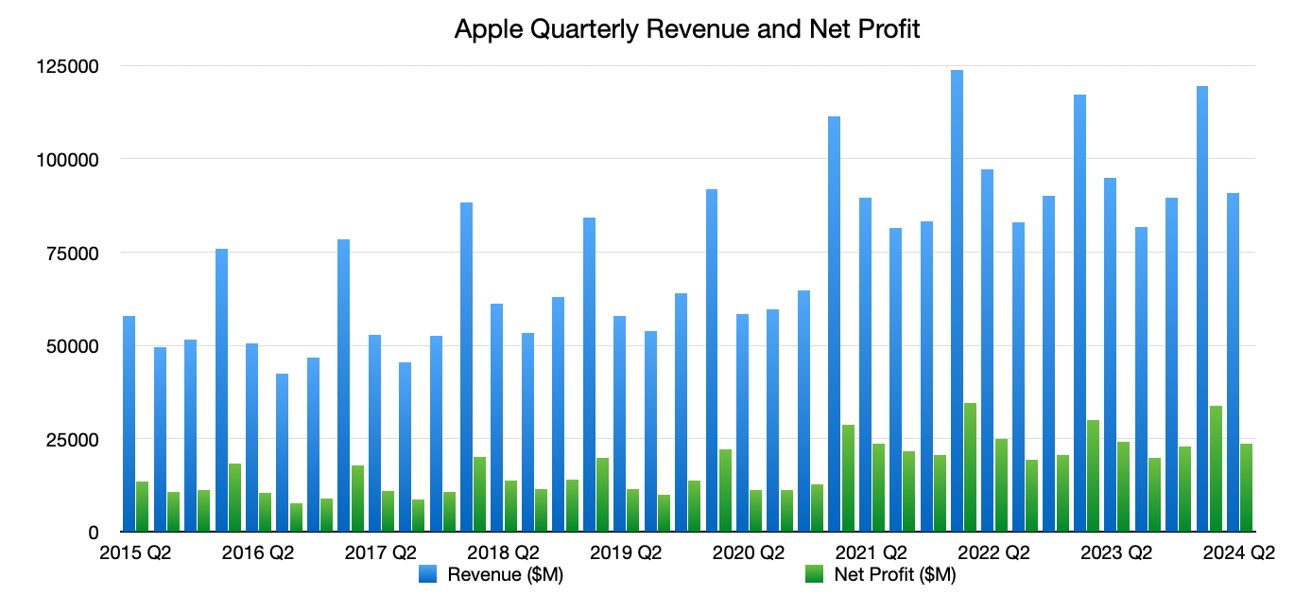

Following after the improved Q1 2024 results, Apple has issued its Q2 results. Typically the second quarter figures are lower than Q1 and its high quarterly sales.

The figures were released on Tuesday, ahead of the customary analyst and investor conference call. During the call, CEO Tim Cook and CFO Luca Maestri are expected to expand on the figures and comments made in the results release.

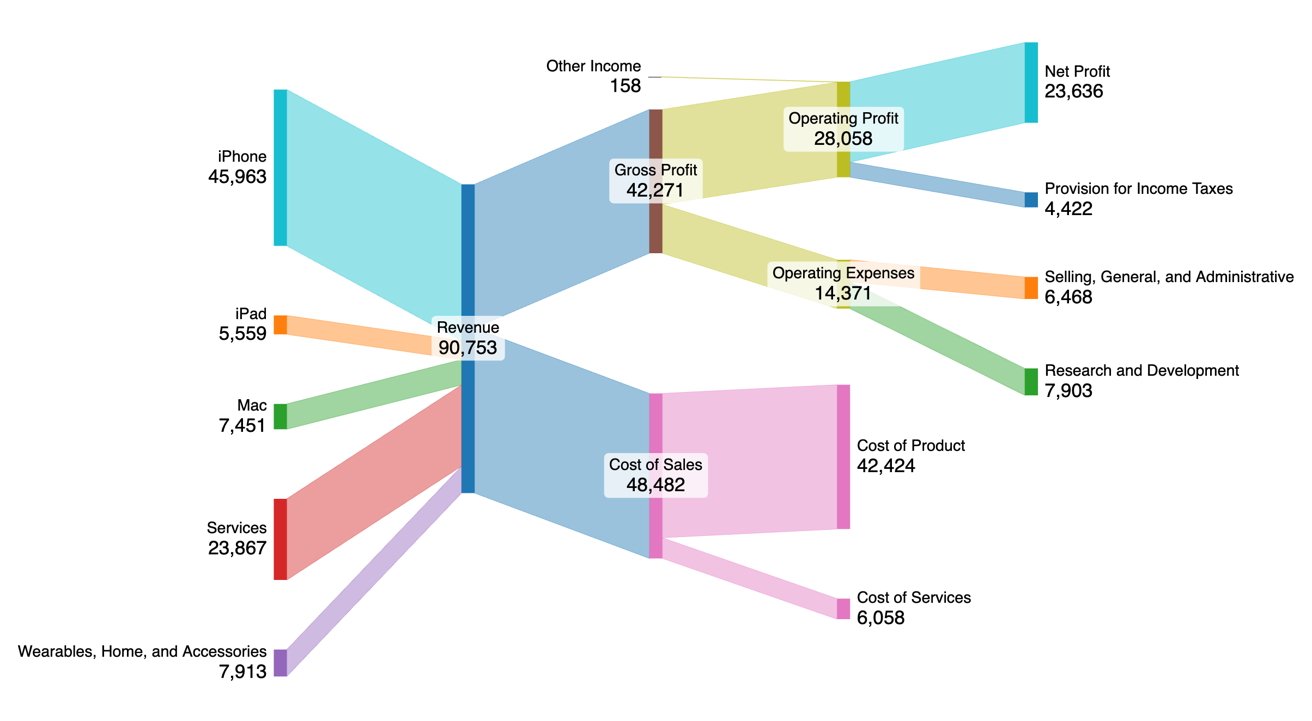

For the second quarter, Apple's revenue reached $90.75 billion, down from the $94.8 billion reported in Q2 2023. The earnings per share of $1.53 is up from $1.52 in the year-ago quarter.

The Wall Street consensus expected Apple to land at a low estimate of $82.32 billion and a high estimate of $86.15 billion, with an EPS of $1.50.

Apple Revenue and Net Profit, as of Q2 2024

As the post-holiday quarter, there were comparatively fewer product introductions. There was February's release of the Apple Vision Pro, but it is being sold in relatively low numbers, at least compared to Apple's other product categories.

There were also M3 Apple Silicon updates to the MacBook Air range.

For Q2 2024, iPhone hauled in $45.96 billion, down from $51.3 billion for Q2 2023. Mac stayed relatively flat, going from $7.2 billion one year ago to $7.45 billion this time.

iPad moved from $6.7 billion to $5.56 billion, and Wearables, Home, and Accessories shifted from $8.76 billion in Q2 2023 to $7.9 billion. Services, the constantly reliably growing sector, moved from $20.9 billion in Q2 2023 to $23.9 billion this time around.

Apple's 2024 Q2 as a Sankey chart

"During the quarter, we were thrilled to launch Apple Vision Pro and to show the world the potential that spatial computing unlocks," said CEO Tim Cook. "We're also looking forward to an exciting product announcement next week and an incredible Worldwide Developers Conference next month."

"Thanks to very high levels of customer satisfaction and loyalty, our active installed base of devices has reached a new all-time high across all products and all geographic segments, and our business performance drove a new EPS record for the March quarter," said Luca Maestri.

As part of the release, Apple's Board has also authorized another $110 billion in share buybacks.

More details will be released about Apple's quarterly fortunes during the analyst call.

Read on AppleInsider

Comments

It may be a "better than expected" result, but it is not a healthy reaction of the stock market.

Apple announces $110 billion buyback which currently drives the stock up.

The services story is becoming increasingly pronounced and thus a source of exposure given the anti-trust activities looking to unlock the walled garden and threaten the partnership with Google.

All things being equal then Services may get into relative gross margin contribution parity with hardware in Q3 2025.

Below is my calcs on the recent quarterly results for services. Errors may be in there

Also, Massive Attack is simply amazing.

I expect them to go all in with the 16 Pro's and then the M4 Mac's later this year, unless they get us excited again this autum, this downward trend will continue!

Better explanation of the modest dip — last year everybody was buying devices after a couple years of chilling during a global pandemic you may have heard about. This year we aren’t and the devices of last year are fine for most people.

just got a 13 mini refurb. Not a mark on it but battery only 84%..