AppleInsider · Kasper's Automated Slave

About

- Username

- AppleInsider

- Joined

- Visits

- 51

- Last Active

- Roles

- administrator

- Points

- 9,827

- Badges

- 1

- Posts

- 63,192

Reactions

-

Apple Vision Pro is revolutionizing surgical procedures worldwide

As surgeons in other countries get a chance to work with the Apple Vision Pro, they are seeing it as a revolutionary tool -- and a big improvement on previous headsets.

Following examples in the US of the Apple Vision Pro being used in surgeries, a new example has come to light from Brazil. The headset was used in a shoulder arthroscopy procedure dealing with a rupture of the rotator cuff.

The operation, reported on by MacMagazine, was performed in Jaragu do Sul in Santo Domingo. Dr. Bruno Gobbato and his team typically peform this type of operation looking at a screen anyway, using a camera inserted into the injured area.

Gobbato had previously used Microsoft's HoloLens to perform such surgeries. However, the cameras in the Apple Vision Pro had a much higher resolution and better handling of the bright lights focused on the patient's shoulder.

"Shoulder arthroscopy surgery uses a camera inside the joint and surgeons perform it by looking directly at a screen," Dr. Gobbato said. "With this device, I was able to see the image on the size of a movie screen with high resolution, as well as being able to see the patient's exams and 3D models in real time."

He has posted a video of the surgery on YouTube, with the procedure highly sped-up to demonstrate the perspective of a surgeon using the Apple Vision Pro. Gobbato was able to clearly see his notes, the patient's x-rays, and the live camera all at the same time.

Also employed during the surgery was an app called MyMako. It's a 3D program that allows doctors to create models of what they will be doing in the surgery beforehand, and have those models in 3D available to them during the actual procedure.

Despite being used for surgeries previously in the UK, and now Brazil, the Apple Vision Pro is currently only purchasable in the US. Availability in other countries, likely including China, is expected to be announced soon.

Read on AppleInsider

-

Apple Sainte-Catherine store will move to a new location down the street

Apple has plans to move its existing Montreal-based Saint-Cathrerine location to a heritage building in downtown Montreal.

Apple's existing Apple Sainte-Catherine location | Image Credit: Apple

This relocation comes as part of Apple's efforts to revitalize its physical retail presence across the globe. The new Apple retail store will be located at Apple will settle at 1255 Sainte-Catherine Street West, according to sources who told La Press.

The existing store opened in 2008 at 1321 Sainte-Catherine Street West. According to a previous report by Bloomberg, the store is estimated to re-open in its new location by February 2025.

Apple has slowed launches of new stores to focus on renovating and refurbishing existing stores.

In March, it was learned that Apple would open its eighth Apple Store in Shanghai, China.

Read on AppleInsider

-

Fear of Nintendo's wrath is keeping emulators off of the App Store

Despite Apple's recent rule change, it has been a bumpy few days for emulators on the App Store as small developers fear the wrath of Nintendo and others.

Nintendo may be waiting in the shadows to smash any emulator out of existence

Software emulation has been around for decades and is perfectly legal, at least the technology is. The implementation of emulators, business models, and how users obtain games live in this unchallenged legal gray area that developers are scared to test.

The Google Play Store doesn't restrict developers from submitting emulators either, and plenty of popular versions exist. So, since Apple now allows emulators on the App Store, the world has been standing by waiting for a flood of software built to play old video games -- yet it hasn't arrived.

The latest emulator, called Bimmy, came and went in a matter of hours. It was capable of running NES games with the applicable ROMs.

Bimmy was pulled by the developer Tom Salvo without any action from Nintendo or Apple. According to a MacRumors forum post, he pulled it out of fear of reprisal.

Tom Salvo's is clear about why he pulled the emulator.Pulled by me, just out of fear. No one pressured me to, but I got more nervous about it as the day went on. Very sorry to get everyone's hopes up, but hopefully hopefully there will be other more brave devs than me in the future.

The latest removal comes only two days after another public mishap where a developer accidentally violated a license for open source code. The Gameboy emulator was quickly removed after the developer was accused of publishing shovelware filled with ads.

Apple's emulator guidelines don't say much about legality, but it appears to lay the blame at the developer's feet if any legal action is sought. Again, emulators are legal if implemented correctly -- it's the ROMs that live in a legal gray area.The legality of emulators and ROMs

A ROM is simply the data file found on a game disc or cartridge, the Read Only Memory which can be legally obtained if removed from original hardware. Users are expected to obtain ROMs legally, though finding them on the web isn't difficult.

Bimmy was taken down out of fear of reprisal from Nintendo

The ease at which old software can be pirated is a problem for game companies. It removes a potential revenue stream (one these companies seem to have no intention of pursing anyway), but like when people pirated music in the 2000s, it's difficult to enforce and pursue in court.

Instead, companies like Nintendo try to use laws like the Digital Millennium Copyright Act, or DMCA, to take down emulators. Nintendo successfully took down Yuzu, a Switch emulator, because it cracked the console's encryption, thus violating the DMCA.

Other emulators don't need such sophisticated methods to run classic software. Therefore, without the DMCA, there isn't a legal basis to pursue most of these emulators core software -- at least not yet, anyway.

Developers like Tom Salvo are worried about becoming a legal precedent. If Nintendo decided to try its luck against an emulator published in Apple's App Store, it could be successful.

For whatever reason, the same level of scrutiny hasn't been brought to Google's Play Store, where emulators exist by the bucketload. Perhaps the legal gray area protects these emulators, and Apple's App Store will soon be filled with them.

The only way to find out is if a high-profile emulator succeeds at being published to the App Store and remains without a challenge. The problem is finding a developer willing to risk a showdown with Nintendo or Sony.Still waiting on a high-profile emulator for iOS

All eyes are on Riley Testut and his handful of emulators. He created GBA4iOS to emulate Gameboy games, and then he followed up that project with Delta, which can run everything from NES to N64.

Delta emulator is able to run several classic console games

However, Testut has remained quiet about his intentions to bring Delta or GBA4iOS to Apple's App Store. It could prove a conflict of interest as he brings AltStore online as an alternative app marketplace in the EU.

Some speculate Apple's purpose for allowing emulators now, after fighting against the idea since the conception of the App Store, is to undercut Testut's efforts to implement AltStore in the EU. The timing of Apple's guideline update suggests as much.

Many questions still remain about emulation on iOS and Apple's other platforms. While Apple seems ready to approve Gameboy and NES emulators, we've yet to see emulators that require system BIOS files like PlayStation One.

There's no reason why even Nintendo Gamecube or Wii can't run on an iPhone or iPad beyond legal issues. We'll just have to wait and see who is willing to take the gamble between App Store success and lawsuit hell.

Read on AppleInsider

-

Apple warning users about a mercenary spyware attack on iPhones

Users in 92 countries worldwide have had notifications from Apple warning that they may be victims of a severe and sophisticated iPhone hack.

Apple has been warning users of a spyware attack on iPhones

In November 2021, Apple announced that it would alert iPhone users to state-sponsored spyware attacks that it detects, and it has done so. According to Reuters, though, the latest warning concerns a rarer and reportedly much more highly sophisticated attack.

In a notification seen by Reuters, Apple has told certain users in 92 countries that they have potentially been victims of a "mercenary spyware attack." The attack is an attempt to "remotely compromise the iPhone."

It's known that India is one of the 92 countries affected, but there is no detail of any of the others. Neither Apple nor any of the countries' governments have commented.

Separately, however, India's government did previously attack Apple over its similar warnings in October 2023. In that case, the warnings chiefly went to journalists and opposition politicians in the country.

Read on AppleInsider

-

External drive support in macOS Sonoma is partially broken, and it's probably Apple's faul...

An issue preventing some external drives from mounting onto a Mac running macOS Sonoma has plagued users for months, and it probably was caused by changes Apple made to drive handling.

A LaCie external drive

Hardware support is a common source of problems for operating system updates, and macOS is no exception. Updates to operating systems can cause some types of devices connected to a Mac or MacBook to suddenly stop working, infuriating users in the process.

In some cases, this is a relatively short-lived issue that Apple corrects quickly.

For example, macOS Sonoma 14.4 caused problems with some USB hubs in monitors, as well as breaking printing by removing the core CUPS software, and even causing Java processes to terminate unexpectedly.

Apple's macOS 14.4.1 update did fix these problems mere weeks after their discovery.

However, sometimes the issues are left to linger for a very long time before being addressed. In the case of some external drives, it's something that has been an issue for months, without any sign of inbound fixes on the way.External drives and exFAT

If you're a user who lives in both the macOS and Windows ecosystems, you may have to ferry files between the two physically. While using network or cloud storage is an option, there are instances where using an external drive is better.

One example is for content creation, as video editing projects can easily swamp a Mac's storage, with fast external drives frequently used to handle massive file storage and project transfers to different systems.

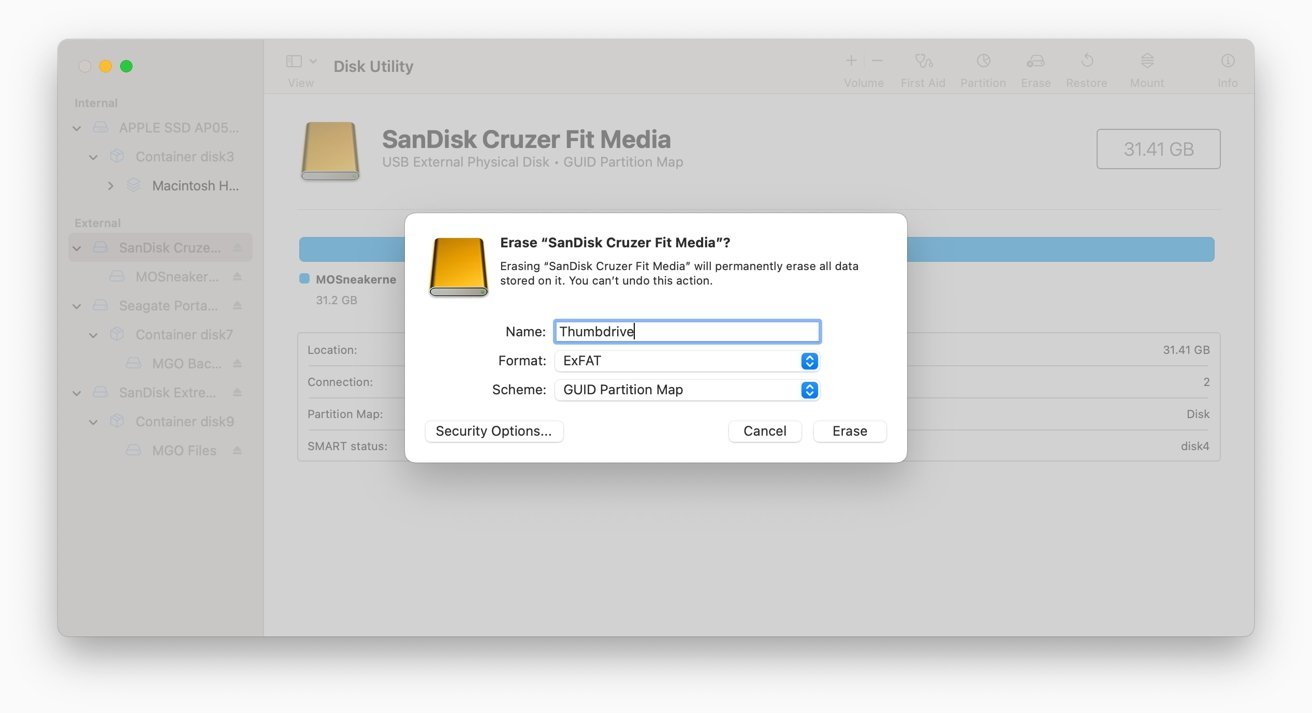

Disk Utility can be used to format external drives to exFAT.

In such cases, you would need a drive to be formatted in a way that both macOS and Windows can use without many problems. In most cases, the best way forward is to format the drive with exFAT (Extensible File Allocation Table), a file system that can easily handle large file sizes and works across many platforms.

Unlike the Windows-preferred NTFS or Apple's APFS, exFAT can be read from and written to by both Macs and Windows PCs without requiring any extra software assistance. In a multi-platform environment, it's almost always the best formatting option for external drives.macOS Sonoma complaints

Shortly after the introduction of macOS Sonoma, complaints started to surface on Apple's Community Support forum. The complaints featured irate users discovering that their external disks were not reliably being mounted in macOS at all.

Many complaints followed the same tropes, namely that the disks wouldn't appear after plugging them in to a USB or Thunderbolt port. In some instances, users would try to get the drives mounted in Disk Utility, but they wouldn't be accessible either.

In some cases, it appeared that the complainants thought the drives were unreadable, causing projects and files to not be usable and impacting productivity.

In a few instances, users encountered periodic bouts of drive failure. One from March 8 explains that multiple drives mounted correctly at first, but didn't after a reboot.

The same user formatted the drive and encountered the same thing, with an initial mount before a post-reboot failure.

Multiple external hard drives

From checking multiple posts on the topic, it seems that the problem isn't drive specific, nor is it affecting just single drives or RAID assemblies. It also appears to affect both Apple Silicon and Intel-based Macs, eliminating that as a variable.

While there is some confusion about encryption, it again doesn't seem to be a factor here, as others report the issue with plainly-formatted drives.

There are some commonalities at play, though.

For a start, nearly all of the complaints about the issue mention the use of exFAT on the drive. There are some complaints about APFS but they are rare compared to exFAT.

Secondly, it's only on Macs running macOS Sonoma. In the few early instances of users downgrading back to macOS Ventura, the drives were accessible again without issue.

That narrows the field of potential issues down, making it likely to be something to do with how macOS Sonoma handles exFAT.An exFAT change

Back in the release notes of macOS Sonoma 14, Apple mentions a "New Feature" under the topic of File System. It states:The implementations of the exfat and msdos file systems on macOS have changed; these file systems are now provided by services running in user-space instead of by kernel extensions. If the application has explicit checks or support for either the exfat or msdos file systems, validate the applications with those file systems and report any issues. (110421802)

Checking through subsequent notes, there are no further changes relating to exFAT in later macOS Sonoma updates. Given the timing of complaints coming to light and the lack of changes to the situation in macOS itself, this seems like the most likely candidate behind the problems.

It isn't entirely clear why Apple made the change, as it doesn't explicitly spell out why it shifted from running exFAT under user-space instead of under kernel extensions. However, it is likely to be a preemptive security move on Apple's part.

In short, "user-space" refers to everything within macOS that isn't the kernel. This means anything running within it is subject to the access rules of user IDs, which can limit the utility of files depending on how they are set up.

Services running under a kernel extension don't have to deal with any access rules, since they effectively run under "root" instead.

By shifting exFAT away from the kernel and running under user-space, the related services are theoretically more secure. But, it's only truly useful if everything is set up perfectly and that nothing will interfere with the service when used under normal conditions.

While we don't know exactly what's happening here, there is evidently something going awry that Apple needs to look into.A fix or a long wait

From the sheer number of complaints in the Apple Support forum, it is an issue that Apple will almost certainly know about. Some posts also claim they have contacted Apple Support directly and that they are "aware" of reports.

However, knowing if a fix is on the way or not is another matter entirely. With no change in the situation since launch, it may be quite a while longer before Apple actually fixes whatever is wrong in macOS Sonoma.

In lieu of an Apple-provided fix, there are still a few options available to users stuck in this situation.

Some users have reported that downgrading to macOS Ventura worked for them. For the more technologically inclined, they may wish to check out some third-party tools that could help, such as macFUSE.

Switching from exFAT to another Mac-compatible format would also be a workaround, but not necessarily if you have data stored on the drives you want to keep. In that particular instance, connecting the drive up to a Mac running an older operating system or to a Windows PC that could read exFAT drives would be required.

After mounting the drives, the next move would be to back up the data, allowing you to format the drive and restore it from the backup.

There is also the possibility of using APFS or HFS with the external drives. While they will work with Mac without issue, it is possible to mount the drives onto a Windows PC using some extra software.

None of the solutions offer a quick fix that provides total access to the data on the Mac itself. Since Apple hasn't really made a move for itself to solve the problem, unfortunate users may have to force themselves to fix things for themselves.

Read on AppleInsider