There are now more paid streaming TV watchers than cable subscribers

The rapid global growth of video streaming, a market Apple is tipped to enter, has reached a point where there are more subscriptions to streaming services than there are traditional cable subscriptions, though the lion's share of revenue still goes to the cable companies.

Streaming services like Netflix and Amazon Prime Instant Video have enjoyed a meteoric rise over the last few years, with the streaming industry now forcing more established media distributors and content creators to pay attention. In a recent Theme report by the Motion Picture Association of America for 2018, the size of the streaming industry is shown to be too big for studios to ignore.

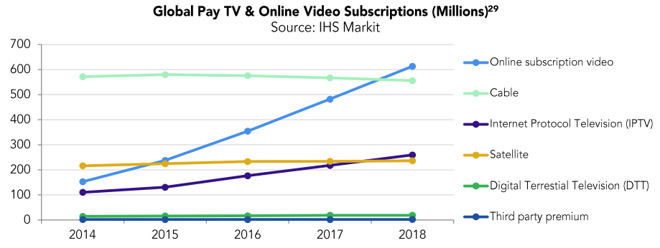

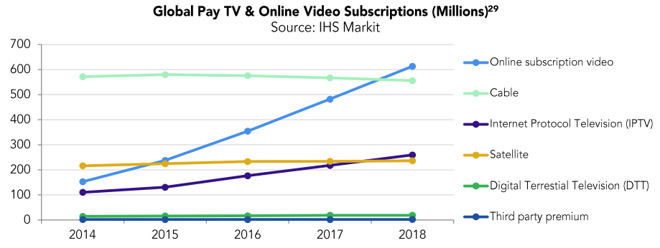

In the section titled "Global Pay TV and Online Video, the MPAA reveals the number of subscriptions to video streaming services grew 27 percent year-on-year, rising to 613.3 million, based on data from IHS Markit. The increase makes 2018 the first year on record where online streaming video service subscriptions were higher than those for cable subscriptions, which dropped 2 percent to 556 million.

Internet Protocol TV (IPTV) just overtook satellite in the year, with both between 200 million and 300 million subscriptions.

According to the MPAA, households could be counted multiple times within the results, as in a family could have both a cable subscription and one to a streaming service. The results do not advise on households that subscribe to just one service, nor how many subscriptions were made per household.

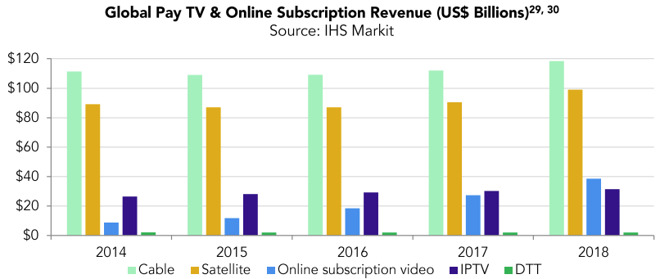

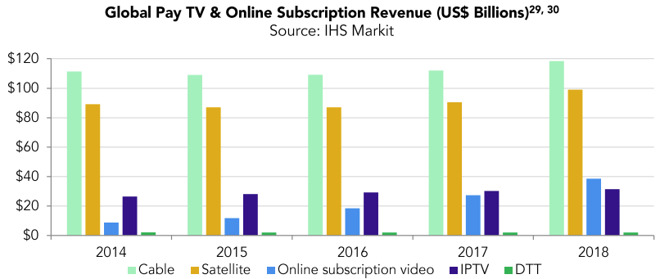

Despite the higher numbers, cable continues to have a disproportionately high amount of subscription revenue. Cable revenue went up $6.2 billion to $118 billion for 2018, with satellite close behind with almost $100 billion, but online subscription video is still at around $40 billion in revenue by comparison, despite the growth.

The report also highlights the TV and movie industry is continuing to grow overall, with a 9-percent year-on-year increase for combined theatrical and home entertainment revenue of $96.8 billion, up 25 percent from five years ago. Global home entertainment spending grew 16 percent to $55.7 billion, with US spending up 12 percent.

The report arrives ahead of Apple's "It's show time" March 25 event, widely expected to involve the launch of an on-demand video service.

The March 25 event will reportedly be a star-studded affair, with appearances by people such as J.J. Abrams, Jennifer Garner, and Steve Carrell to commemorate the unveiling of Apple's original video content project, which has seen the investment of at least $1 billion so far into TV shows and movie productions.

As well as the video service, Apple is also expected to launch Apple News magazines, a paid subscription that allows users to read digital magazines from their Mac or iPad.

Streaming services like Netflix and Amazon Prime Instant Video have enjoyed a meteoric rise over the last few years, with the streaming industry now forcing more established media distributors and content creators to pay attention. In a recent Theme report by the Motion Picture Association of America for 2018, the size of the streaming industry is shown to be too big for studios to ignore.

In the section titled "Global Pay TV and Online Video, the MPAA reveals the number of subscriptions to video streaming services grew 27 percent year-on-year, rising to 613.3 million, based on data from IHS Markit. The increase makes 2018 the first year on record where online streaming video service subscriptions were higher than those for cable subscriptions, which dropped 2 percent to 556 million.

Internet Protocol TV (IPTV) just overtook satellite in the year, with both between 200 million and 300 million subscriptions.

According to the MPAA, households could be counted multiple times within the results, as in a family could have both a cable subscription and one to a streaming service. The results do not advise on households that subscribe to just one service, nor how many subscriptions were made per household.

Despite the higher numbers, cable continues to have a disproportionately high amount of subscription revenue. Cable revenue went up $6.2 billion to $118 billion for 2018, with satellite close behind with almost $100 billion, but online subscription video is still at around $40 billion in revenue by comparison, despite the growth.

The report also highlights the TV and movie industry is continuing to grow overall, with a 9-percent year-on-year increase for combined theatrical and home entertainment revenue of $96.8 billion, up 25 percent from five years ago. Global home entertainment spending grew 16 percent to $55.7 billion, with US spending up 12 percent.

The report arrives ahead of Apple's "It's show time" March 25 event, widely expected to involve the launch of an on-demand video service.

The March 25 event will reportedly be a star-studded affair, with appearances by people such as J.J. Abrams, Jennifer Garner, and Steve Carrell to commemorate the unveiling of Apple's original video content project, which has seen the investment of at least $1 billion so far into TV shows and movie productions.

As well as the video service, Apple is also expected to launch Apple News magazines, a paid subscription that allows users to read digital magazines from their Mac or iPad.

Comments

That won't last.

I believe the majority of cable/satellite households also have Netflix, etc., but their primary watching is done via cable/satellite. If the point of the article is to say more people stream than use cable, then it's not really so.

The bad part about all this from the consumer's standpoint is that the market is becoming much more fragmented. Each of the various options has something that people want but there's no single place to get it all so you end up with separate Netflix, HBO, Hulu and ESPN subscriptions and end up paying as much as you would have with Comcast. Of course, I'd rather give my money to anyone but comcast, so I guess it's still a win.

Like many AI readers, I'm a gadget junkie at heart and I'm struggling to get excited about this event, much less just about anything that adds yet another subscription to my monthly budget. It's death by a thousand cuts. Yeah, it makes sense for Apple's bottom line, but I'm just not feeling it.

Expectations are very low. Let's see what Apple can do to flip the script.

Hey, maybe Apple will announce a new larger screen iPod Touch ... something, anything, a tiny bit of antidote to help offset the effects of yet another subscription affliction.

And yes a pox on these dozens of subscriptions. they're like a cloud of mosquitoes, and about as entertaining.

A whole lotta "streaming subscribers" are actually cable subscribers who happen to sign up for Netflix too. Every other streaming service is far behind them. The article isn't identifying the numbers for those who use cable/satellite distinct from those who only use streaming services. Reading it rather than skimming makes that clear.

They’ve already spent to get cable run to the majority of homes. Their costs are low. Instead of being competitive they bleed the rock (customers) because they could. Now, customers with options are giving them the finger.

When I watch cable (or satellite) at a friends, their is so many commercials TV was unwatchable.

You pay for the service then the greedy @#$& waste your time with more and more commercials? It might make Cable more profitable, but very few are going to stick with them when other options are available.

Cable knows they’re pissing off customers so they’re buying content to try to force customers to stay. Good luck with that...

I’m unlikely to sign up for Apple’s streaming service, because I abandoned TV 5 years ago, but I wish them luck.

The importance of access to local TV is going to be critical for many traditional customers and that is a large market. That his why I'm looking at what Apple is offering today. I'll be happy to acquitter their offering as long as my basics are included - and I believe that a lot of people are like me.