Why Apple's guidance correction is causing less panic versus 2019

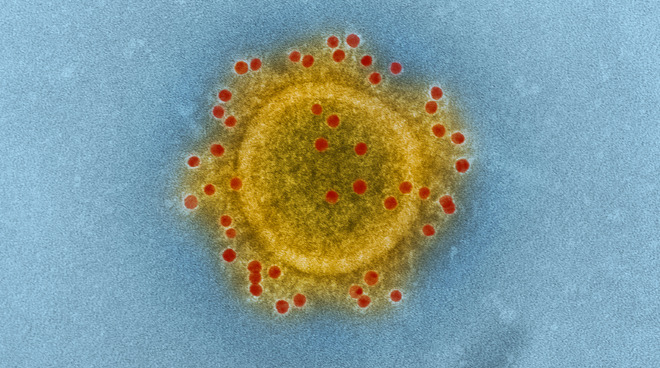

For the second time in two years, Apple has issued a correction to its revenue guidance. After looking foolish for sensationalizing Apple's downfall last year, analysts and tech media reporters are exercising more caution in their coverage of how business interruptions by the coronavirus might affect the company.

Coronavirus is causing less panic than last year's economic miss

Yet despite the concerning prospect of interruptions related to the COVID-19 outbreak in China-- affecting not only the company's sales within China but also Apple's production of devices there for users globally-- analysts have downplayed any long term impacts. Apple's shares have already recovered from the sharper decline seen in pre-market trades, where shares had temporarily fallen by more than $10 or 3%.

Apple's notice a year ago that it would miss its anticipated revenue guidance-- similarly blamed on conditions in China-- resulted in a much greater 8.6% drop in Apple's share price in pre-market trading, which grew even worse after the market opened.

In part, the more cautious reaction to negative news affecting Apple appears to be grounded in a new understanding of Apple's value. Rather than being perceived as a struggling phone maker that's desperately trying to pivot away from hardware into selling subscription content as it bleeds away unit shipments and market share to Android handset makers, investors now see Apple as a cash machine that is uniquely capable of attracting and retaining loyal customers with its innovative products and services, largely isolated from direct completion with cheap Androids. Apple is also increasingly recognized to be adept at handling global production issues with operational precision.

Those shifts in understanding have rewarded investors with a doubling of Apple's share price over just the last year. Yet major industry journalists, bloggers, and analysts failed to grasp what was happening, primarily because they had invented or were repeating tired media narratives that were not true, rather than trying to understand what Apple was doing and being able to inform their audiences.

Note that AppleInsider correctly detailed what was happening a year ago, noting that the correction was "an opportunity," and that Apple itself "has $71 billion already allocated to buying back its stock, now available at a massive discount thanks to incessantly manipulative financial reporting." That wasn't a popular take at the time.

Cook attributed the worse than expected results to slower than anticipated iPhone upgrades, which he blamed on the economic weakness in emerging countries, a shift away from carrier subsidies, a stronger dollar causing Apple's prices to rise in other currencies, and a surge in battery upgrades associated with cheap $29 battery swaps the company had offered through the end of 2018.

"Lower than anticipated iPhone revenue, primarily in Greater China, accounts for all of our revenue shortfall to our guidance and for much more than our entire year-over-year revenue decline," Cook explained. He countered that lower unit sales of iPhones in the quarter were partially offset by strong sales of other hardware and services. Sales of iPads, Macs, Watches, other accessories, and services grew by 19%.

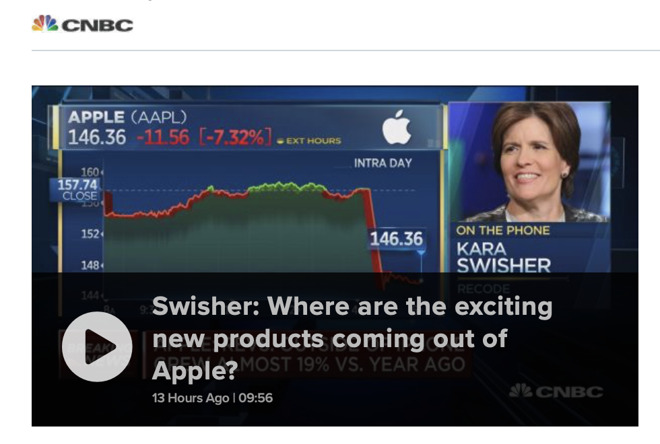

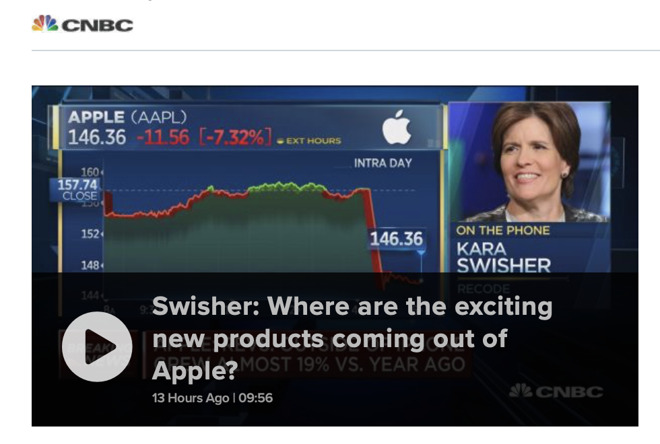

Kara Swisher of Recode appeared on CNBC to advance the idea that Apple's problem wasn't just temporary economic weakness or iPhone upgrades deferred by battery upgrades but was instead an "innovation problem."

"The innovation cycle has slowed down at Apple," Swisher claimed. "Where is their exciting new product, and where are their exciting new entrepreneurs within that company?"

Yet Apple itself had made it clear that "innovation" was not the problem. The company had just a few months earlier held an event in Brooklyn, unveiling the new Apple Watch Series 4 capable of capturing an EKG along with revamped new MacBook Air and iPad Pro offerings.

Cook even stated that Apple had subsequently struggled to keep up with demand for its "unprecedented number of new products to ramp during the quarter," adding that sales of all three of those new products were supply-constrained, rather than being overlooked by customers looking for more "exciting innovation."

And while Apple's sales of iPhones were down, it was still selling the most premium smartphones of any vendor by a huge margin. There was not a "more innovative" phone maker enticing away Apple's customers. Instead, there were record sales of products like Apple Watch that were ensuring that once Apple's customers did upgrade their phone, they'd again be sticking with an iPhone.

That's the importance of comprehending the value of an active user base over simple unit shipments, a subject Apple called specific attention to in fiscal 2019. Nobody should have been too surprised that iPhone 11 would bounce Apple's phone revenues back into record territory the next year after battery upgrades went away, and economic conditions improved with the deescalation of the trade war.

CNBC touted Toni Sacconaghi as a top Apple analyst but he was dramatically wrong on the company's future prospects

CNBC continued to refer to Sacconaghi as the "top #1 analyst" covering Apple, but that simply wasn't true. Philip Elmer-DeWitt of Apple 3.0 reported that Sacconaghi was instead among the more than a dozen other analysts who "have been scrambling to keep up with the stock all quarter long."

In December, Sacconaghi even appeared on CNBC to admit that "we have been neutral on Apple this year and it's been the wrong call. We missed it," referring to the massive increase in Apple's share price over the last year as it raced upward to reach a market cap of $1.3 Trillion-- the highest achieved by any tech company, ever. How does the "top analyst" miss a $700 billion increase for his clients?

Just two weeks later, Gurman published a follow-up piece that claimed the exact opposite: that Apple's notice to shareholders had actually stated that iPhone upgrades were not as strong as expected because of "higher prices."

Mark Gurman at Bloomberg provided disproportionate, informercial-like coverage of Google's Pixel products without any scrutiny of their pricing strategy, while claiming iPhones were too expensive

Gurman wasn't alone in maintaining his media narrative that high prices were killing iPhone sales. Japan's Nikkei and the Wall Street Journal also repeated the same theory on "high pricing" for years. All three had earlier insisted that iPhone X was not selling well in 2017 due to its price, a claim that turned out to be totally wrong.

All three again turned around and repeated the same claims about last year's iPhone XS and iPhone XS, with the Wall Street Journal specifically calling iPhone XR a failure that "can't sell" under the sensational headline "The Phone That's Failing Apple." That model was actually the top-selling, most profitable phone of the year.

Those claims were also false. If consumers in China were turning on Apple as an American brand, why were they continuing to buy up record numbers of other Apple products rather than switching to cheap Huawei PCs, tablets, watches, knockoff AirPods and other products?

And rather than attacking Apple as a foreign threat, China itself cut taxes on iPhone sales to help spur its economy. When Apple passed this savings on to buyers, a variety of sources from CNBC to Venture Beat claimed Apple was "slashing" its prices in a desperate attempt to compete with cheap Androids. That wasn't true either, as Apple's most popular iPhone XR was repriced by only about $45, a change that would have no real impact on the supposed competition with Huawei phones selling at on average price around $250.

Bloomberg discussed rising prices without thinking about unit sales--because it was excited about Androids

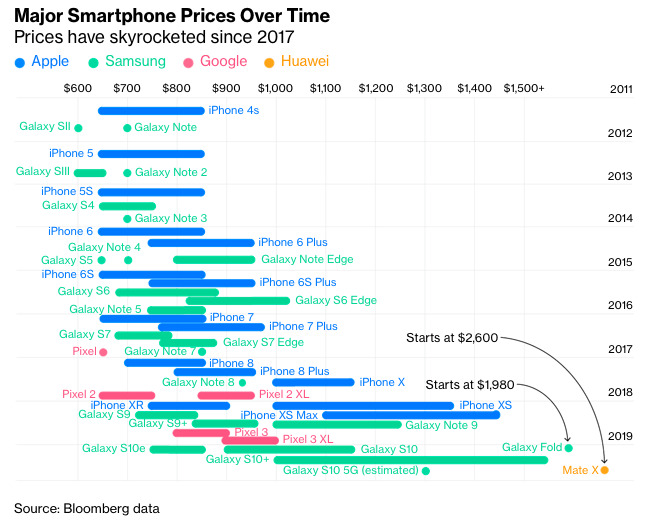

Writing for Bloomberg, Gurman even stated that "the move [to raise Android prices] seems to have hurt Apple" in the quarter before those very expensive folding phones from Samsung and Huawei were even released. Ultimately, both expensive introductions failed at launch, were subsequently delayed for months, and never resulted in significant sales.

Android bloggers, including Dieter Bohn of the Verge and Joana Stern of the Wall Street Journal, initially hyped up Samsung's $1,980 Galaxy Fold, until it became clear that the device was purely unfit to even sell and was removed from the market.

Yet after chiding Apple over its MacBook keyboards, mocking the company for claiming that keyboard issues were "only affecting a small number of users," and demanding to know "should $1,200 MacBooks be breaking due to dust and debris!? Absolutely not!" Stern subsequently blew off concerns about the much more expensive Galaxy Fold, minimized the issue by saying it "only affected a limited number of Galaxy Fold samples," and offered no dramatically intoned criticism for Samsung releasing an even more expensive device that completely failed after exposure to debris.

Only after we noted the double standard in reporting by the Wall Street Journal did Stern publish a retraction of sorts that said Samsung shouldn't be treating its customers as beta testers.

Yet as soon as Samsung released its next flip-folding Galaxy Z-- lacking liquid and dust resistance, suffering immediate scratching issues, and priced above $1,350 for a middle-tier specced Android phone-- Stern celebrated its launch with a cute video rather than scathing criticism for again serving up another inherently flawed, incredibly expensive beta concept to its customers.

The market now appears to be understanding that media narratives on Apple have been dramatically wrong for too long to take seriously anymore.

Coronavirus is causing less panic than last year's economic miss

Less than one third the impact on Apple's shares versus 2019

Apple's shares opened 2.5% lower following its announcement over the long weekend that it expected to miss its previously stated revenue guidance of between $63 billion and $67 billion in the March quarter.Yet despite the concerning prospect of interruptions related to the COVID-19 outbreak in China-- affecting not only the company's sales within China but also Apple's production of devices there for users globally-- analysts have downplayed any long term impacts. Apple's shares have already recovered from the sharper decline seen in pre-market trades, where shares had temporarily fallen by more than $10 or 3%.

Apple's notice a year ago that it would miss its anticipated revenue guidance-- similarly blamed on conditions in China-- resulted in a much greater 8.6% drop in Apple's share price in pre-market trading, which grew even worse after the market opened.

In part, the more cautious reaction to negative news affecting Apple appears to be grounded in a new understanding of Apple's value. Rather than being perceived as a struggling phone maker that's desperately trying to pivot away from hardware into selling subscription content as it bleeds away unit shipments and market share to Android handset makers, investors now see Apple as a cash machine that is uniquely capable of attracting and retaining loyal customers with its innovative products and services, largely isolated from direct completion with cheap Androids. Apple is also increasingly recognized to be adept at handling global production issues with operational precision.

Those shifts in understanding have rewarded investors with a doubling of Apple's share price over just the last year. Yet major industry journalists, bloggers, and analysts failed to grasp what was happening, primarily because they had invented or were repeating tired media narratives that were not true, rather than trying to understand what Apple was doing and being able to inform their audiences.

Note that AppleInsider correctly detailed what was happening a year ago, noting that the correction was "an opportunity," and that Apple itself "has $71 billion already allocated to buying back its stock, now available at a massive discount thanks to incessantly manipulative financial reporting." That wasn't a popular take at the time.

How the mainstream media botched its coverage of Apple in 2019

At the beginning of January 2019, Apple's chief executive Tim Cook addressed shareholders with a notice that the company's performance would fall short of its anticipated guidance of $89 billion to $93 billion for the December quarter, taking aim instead at revenues of $84 billion.Cook attributed the worse than expected results to slower than anticipated iPhone upgrades, which he blamed on the economic weakness in emerging countries, a shift away from carrier subsidies, a stronger dollar causing Apple's prices to rise in other currencies, and a surge in battery upgrades associated with cheap $29 battery swaps the company had offered through the end of 2018.

"Lower than anticipated iPhone revenue, primarily in Greater China, accounts for all of our revenue shortfall to our guidance and for much more than our entire year-over-year revenue decline," Cook explained. He countered that lower unit sales of iPhones in the quarter were partially offset by strong sales of other hardware and services. Sales of iPads, Macs, Watches, other accessories, and services grew by 19%.

Apple wasn't suffering from an "innovation problem"

Yet rather than simply reporting what Cook had detailed, prominent media bloggers discounted Cook's statements and raced to make up their own stories about what was happening. Their theories may have seemed plausible at the time, but they were not true and did not play out as predicted because they weren't based on anything factual.

Kara Swisher of Recode appeared on CNBC to advance the idea that Apple's problem wasn't just temporary economic weakness or iPhone upgrades deferred by battery upgrades but was instead an "innovation problem."

"The innovation cycle has slowed down at Apple," Swisher claimed. "Where is their exciting new product, and where are their exciting new entrepreneurs within that company?"

Yet Apple itself had made it clear that "innovation" was not the problem. The company had just a few months earlier held an event in Brooklyn, unveiling the new Apple Watch Series 4 capable of capturing an EKG along with revamped new MacBook Air and iPad Pro offerings.

Cook even stated that Apple had subsequently struggled to keep up with demand for its "unprecedented number of new products to ramp during the quarter," adding that sales of all three of those new products were supply-constrained, rather than being overlooked by customers looking for more "exciting innovation."

And while Apple's sales of iPhones were down, it was still selling the most premium smartphones of any vendor by a huge margin. There was not a "more innovative" phone maker enticing away Apple's customers. Instead, there were record sales of products like Apple Watch that were ensuring that once Apple's customers did upgrade their phone, they'd again be sticking with an iPhone.

That's the importance of comprehending the value of an active user base over simple unit shipments, a subject Apple called specific attention to in fiscal 2019. Nobody should have been too surprised that iPhone 11 would bounce Apple's phone revenues back into record territory the next year after battery upgrades went away, and economic conditions improved with the deescalation of the trade war.

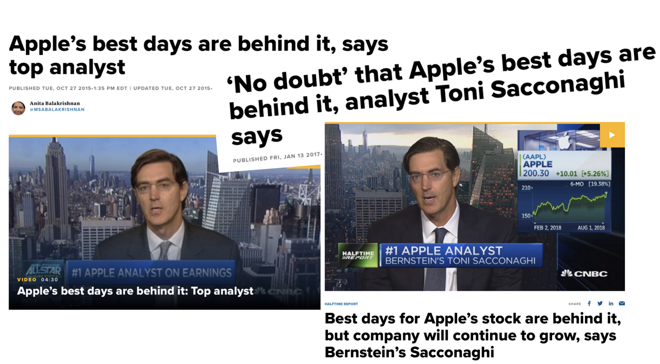

Apple's best days weren't behind it

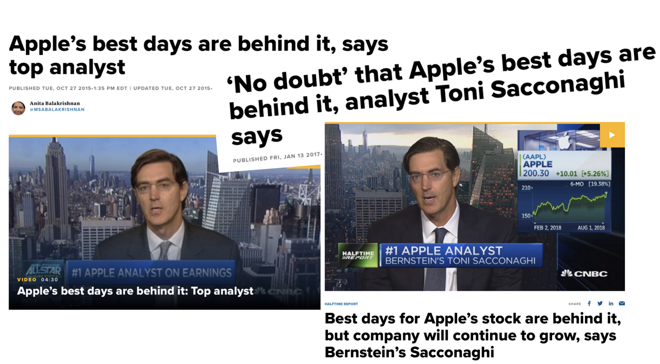

Toni Sacconaghi, the "Bernstein Bear" analyst on Apple, also repeated appeared on CNBC to claim that "Apple's best days are behind it," in 2015, 2017, and 2018.

CNBC touted Toni Sacconaghi as a top Apple analyst but he was dramatically wrong on the company's future prospects

CNBC continued to refer to Sacconaghi as the "top #1 analyst" covering Apple, but that simply wasn't true. Philip Elmer-DeWitt of Apple 3.0 reported that Sacconaghi was instead among the more than a dozen other analysts who "have been scrambling to keep up with the stock all quarter long."

In December, Sacconaghi even appeared on CNBC to admit that "we have been neutral on Apple this year and it's been the wrong call. We missed it," referring to the massive increase in Apple's share price over the last year as it raced upward to reach a market cap of $1.3 Trillion-- the highest achieved by any tech company, ever. How does the "top analyst" miss a $700 billion increase for his clients?

Apple wasn't suffering from "higher prices"

Writing for Bloomberg, Mark Gurman initially chided Cook's statement for failing to mention "that Apple had priced its new models at stratospheric levels," effectively claiming that Cook was misleading investors in refusing to acknowledge that the reason why iPhone sales were down was due to competition from cheaper Androids.Just two weeks later, Gurman published a follow-up piece that claimed the exact opposite: that Apple's notice to shareholders had actually stated that iPhone upgrades were not as strong as expected because of "higher prices."

Mark Gurman at Bloomberg provided disproportionate, informercial-like coverage of Google's Pixel products without any scrutiny of their pricing strategy, while claiming iPhones were too expensive

Gurman wasn't alone in maintaining his media narrative that high prices were killing iPhone sales. Japan's Nikkei and the Wall Street Journal also repeated the same theory on "high pricing" for years. All three had earlier insisted that iPhone X was not selling well in 2017 due to its price, a claim that turned out to be totally wrong.

All three again turned around and repeated the same claims about last year's iPhone XS and iPhone XS, with the Wall Street Journal specifically calling iPhone XR a failure that "can't sell" under the sensational headline "The Phone That's Failing Apple." That model was actually the top-selling, most profitable phone of the year.

Apple wasn't suffering from Huawei popularity or patriotic boycotts

False coverage of iPhone sales, demand, and supposed "production cuts" were also replete with the theory that Huawei was displacing iPhone sales with its much cheaper Androids, fueled by a patriotic boycott of iPhones by Chinese nationals in support of domestic brands.Those claims were also false. If consumers in China were turning on Apple as an American brand, why were they continuing to buy up record numbers of other Apple products rather than switching to cheap Huawei PCs, tablets, watches, knockoff AirPods and other products?

And rather than attacking Apple as a foreign threat, China itself cut taxes on iPhone sales to help spur its economy. When Apple passed this savings on to buyers, a variety of sources from CNBC to Venture Beat claimed Apple was "slashing" its prices in a desperate attempt to compete with cheap Androids. That wasn't true either, as Apple's most popular iPhone XR was repriced by only about $45, a change that would have no real impact on the supposed competition with Huawei phones selling at on average price around $250.

Apple wasn't suffering from expensive folding phones

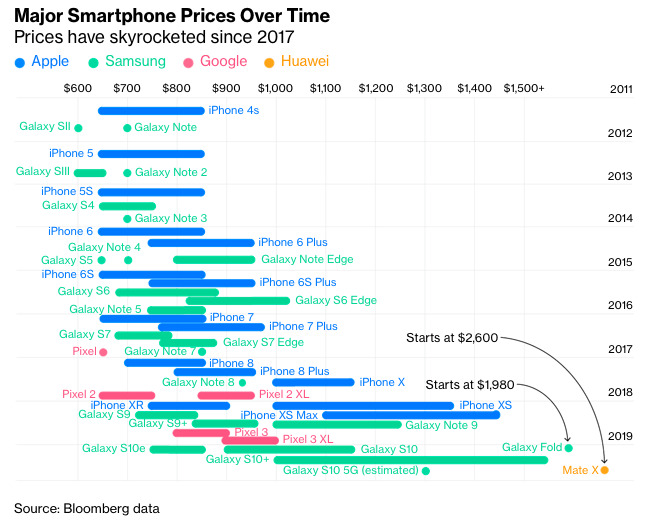

After Apple posted results for the winter quarter that destroyed these media narratives, Bloomberg radically reversed its story on phone pricing the following month, bizarrely cheering on the introduction of very expensive Androids and charting out the rising asking prices of Google, Samsung, Huawei (below) without ever pointing to any data showing that none of these expensive new models were actually selling in volumes in any way comparable to iPhones.

Bloomberg discussed rising prices without thinking about unit sales--because it was excited about Androids

Writing for Bloomberg, Gurman even stated that "the move [to raise Android prices] seems to have hurt Apple" in the quarter before those very expensive folding phones from Samsung and Huawei were even released. Ultimately, both expensive introductions failed at launch, were subsequently delayed for months, and never resulted in significant sales.

Android bloggers, including Dieter Bohn of the Verge and Joana Stern of the Wall Street Journal, initially hyped up Samsung's $1,980 Galaxy Fold, until it became clear that the device was purely unfit to even sell and was removed from the market.

Yet after chiding Apple over its MacBook keyboards, mocking the company for claiming that keyboard issues were "only affecting a small number of users," and demanding to know "should $1,200 MacBooks be breaking due to dust and debris!? Absolutely not!" Stern subsequently blew off concerns about the much more expensive Galaxy Fold, minimized the issue by saying it "only affected a limited number of Galaxy Fold samples," and offered no dramatically intoned criticism for Samsung releasing an even more expensive device that completely failed after exposure to debris.

Only after we noted the double standard in reporting by the Wall Street Journal did Stern publish a retraction of sorts that said Samsung shouldn't be treating its customers as beta testers.

How does one seek to base their career on mocking the actually very low failure rate of MacBook keyboards and then wildly promote the first gen folding screen of an Android phone that is clearly not going to last and is nothing more than a wildly overpriced gimmick?

-- Daniel Eran Dilger (@DanielEran)

Yet as soon as Samsung released its next flip-folding Galaxy Z-- lacking liquid and dust resistance, suffering immediate scratching issues, and priced above $1,350 for a middle-tier specced Android phone-- Stern celebrated its launch with a cute video rather than scathing criticism for again serving up another inherently flawed, incredibly expensive beta concept to its customers.

The market now appears to be understanding that media narratives on Apple have been dramatically wrong for too long to take seriously anymore.

Comments

The rest is just mindless fanboy venting on the bad bad media, not remotely related to Apples altered guidance or the reaction on the stock market, as is typical for DED editorials. It could have been copy pasted from any of his editorials. I mean, what has the Galaxy Z Flip to do with this current situation for example? Nothing. Absolutely nothing.

Oh, and if I had to answer the question in the title; there is less panic because this was expected to happen, is not happening to Apple alone and most importantly is not caused by a lack of demand as was the case last year. That last one is more reason to panic as investor. This current setback in the Chinese market and supply issues is known to be temporary.

And you were wrong about Apple's supply chain being prepared for the coronavirus, not more so than other companies. Are you willing to admit that?

Instead, I noted that Apple is well positioned to get through a temporary problem, and contrasted that with the situation for Huawei and other Android makers who are seeing not only sales disruptions, but are desperately dependent on year-round volume sales, trade shows, retail discounting, and Chinese sales to a far greater degree than Apple.

It is impossible to argue that Apple is not prepared for crisis after turning around sales in China last year and surviving previous supply chain disasters such as the devastation in Japan.

On the other hand, the wild media narratives of doom described in the article have been wrong, wrong, wrong over the last year. Point your waging finger where it belongs.

As it turns out Samsung may be impacted less than Apple, better positioned to weather the "Corona-virus effect" as they have less exposure to and dependence on China.

In the editorial:

"But all that mysterious complexity serves a critically important function. It makes Apple resilient to crisis." Again, about the supply chain, not sales. Also note the absolute of resilient.

"If there's any need to be concerned about who will be affected by any global event—including the most recent coronavirus in China—it's certainly not Apple that anyone needs to voice concerns about." This is below a large portion of text praising Apple's supply chain as magical (Japan, smelters, previous virus, the whole nine yards), clearly implying the supply chain will be unaffected, not sales.

How hard is it to admit you were wrong?

Why did you want to know?

EDIT: I get it, you were hoping she was to cast shade on what she had to say. No, there's not obvious connections to Google.

There's a differing level of credibility between the following groups (ranked from highest to lowest):

The latter are the least credible.

If you really understood the financial markets, you'd be making a hell of a lot more investing rather than writing.

https://www.scmp.com/week-asia/geopolitics/article/2120452/china-wins-its-war-against-south-koreas-us-thaad-missile

"Seoul signs up to military constraints in return for Beijing lifting economic sanctions, setting a worrying precedent for China’s regional rivals"

and this;

https://www.scmp.com/week-asia/politics/article/2114232/beyond-thaad-real-reason-why-china-angry-south-korea

"China clearly won’t let South Korea forget its displeasure at the deployment of THAAD (Terminal High Altitude Area Defence), which China insists can be used to spy on its own missile programmes. The approval of the system deployment was given by Moon’s predecessor Park Geun-hye

in July 2016. The first two THAAD batteries went operational in April this year. In the wake of escalating North Korean provocations, the Moon administration is to deploy four more. In retaliation, Beijing is effectively embarking on economic sanctions. Apart from the pullback of Chinese tourists, Lotte’s business in China has taken a hit, while sales of Korean restaurants in the Beijing area have plunged by a third year-on-year and sales of Hyundai and Kia Motors have fallen by half. Many small and medium-sized Korean businesses in China are leaving the country."

...

"But this stage of the complementarity-driven expansion of economic ties seems to be over, giving way to rivalry. Having increased its exposure to China, the export-oriented South Korean economy is grappling with the “China challenge” rather than capitalising on the “China opportunity”. Chinese companies are directly competing with their South Korean counterparts in the areas where the latter used to dominate."

THAAD;

https://missilethreat.csis.org/system/thaad/

It's a little bit more complex than just China has home grown OEM's that Samsung has to compete with, and belies the nature of trade with China, which eventually becomes adversarial.

I will state that Samsung is in an excellent position to dominate sales outside of China vs Huawei, which will be constrained by lack of Google Services, but Apple sales will likely be only deferred for the short term if there are indeed supply chain issues.

If you really understood DED, you'd know there's more to his writing than making money.

How hard is it for you to read without applying your personal bias to what you read? There was clearly NO such "implication". You simply cherry-picked what you wanted to hear.

Look. Apple is absolutely in better shape to withstand any slowdown due to the '19 novel coronavirus, simply because of its massive cash flow. But what is the source of that cash flow? It stems from its "magical" JIT manufacturing setup of stupendous dimensions and highest quality. Sure, it takes time to set the JIT wheels in motion when they've come to a halt. But guess what: They ALWAYS come to a halt during Chinese New Year! All that's happened is that they've stayed halted a while longer.

Indeed, if Apple wanted to, they could have spun up the machine sooner. But instead, they've chosen to keep those gathering places closed, at no small expense to the company, helping to save lives. Because, you see, that matters to the leadership of Apple more than mere profit.

When Apple feels that it's safe enough, it'll turn the key and open its factories and its stores. And all that pent up demand will eventually be satisfied, since people who buy into the Apple ecosystem are extremely loyal. Once things recover in a month or two, Apple will actually begin to see an increase in sales over and above what would have been expected.

You said: "And you were wrong about Apple's supply chain being prepared for the coronavirus, not more so than other companies." Nope. The supply chain IS prepared for the '19 novel coronavirus. Once the green light is given, Apple will turn the key and be back in business.

But, as DED said, those competitors that are living close to their vest with very little profit are going to have a much harder time overcoming the disruption.

Next time, try getting your objective glasses on and actually reading what it is that DED wrote.

Now, it does have to be said that, in countries like China where industries are heavily supported by the state, they don't necessarily have to make a profit to "stay in business". (They also don't have to concern themselves with how many people die over their screwups.) But they have other problems, not the least of which is that subsidizing businesses is a good way to weaken them. And it isn't possible to create creativity and ingenuity by fiat. IOW, before China can truly step up to match Apple, it's going to have to give it's people substantially more freedom.

Good luck with that.

"I believe there is an expectation (hope) that the coronavirus will be better under control in the coming 3 months..."

Huge efforts are being made to try to contain the spreading of the virus while a vaccine is developed and mass produced. And no expense is being spared in either effort. It's a good bet that it will be successful enough to bring the percentages of deaths down to about the level of a typical influenza event before it really gets it's hooks in the world.

"The market doesn't like surprises - this move actually helped shed some light on expectations."

Yep. Apple can't give a new guidance number because they don't have enough detailed information. But they can indicate that it looks less likely that they can match the previous guidance. In December of 2018, they actually were close enough to the end of the quarter that they could make a good estimate and thus were forced to issue a new guidance number. That in turn forced them to stop all buybacks about halfway through December, and not pursue any more buybacks until after their earnings report at the end of January. With no major Apple presence in the market to support AAPL's stock price, the bottom dropped out of AAPL. That won't happen this time because they were able to come out much earlier with the news of this "black swan" event impacting revenue and earnings this quarter more severely than expected, and by avoiding issuing a new guidance number they can continue to buy back stock clear up to their normal "blackout" date in early to mid April.

I suppose Abalos65 and others would suggest companies shouldn’t need to retain legal teams. After all, if they prepare properly they would never do anything or get involved with anything that would cause them to be sued. Airbags at the bottom of every set of stairs and under every chair, personnel to escort employees and customers to and from their cars so there’s never a slip and fall or a parking lot robbery, medical staff on hand at the cafeteria to respond in case someone chokes, the absurd list would be miles long. But hey, a company should never get sued so get working on that list.

Transactional. That’s how I refer to these one-dimensional arm-chair quarterbacks who suddenly are geniuses regarding how Apple should have behaved. But in November last year how many commenters here were chiming in about how Apple should be prepared to 100% avoid a coming disease outbreak or pandemic? And giving a prescription for the steps it should be taking at that time?

I’m prepared for a flat tire… and yet I will also be affected if I need to change a tire. Additionally I am prepared for earthquakes, hurricanes, and the zombie apocalypse, but I’d still be affected by all of them should those natural disasters present themselves.

But being fair: Getting bought by The Verge already foretold their future editorial slant. It's remarkable just how much b/s Nilay Patel will attempt to spin about every Apple product. Frequently criticising features that he praises in Samsung. Samsung is literally his God, I have a feeling the Verge wouldn't exist without them.