Apple partners with AR startup to become driving force in indoor navigation

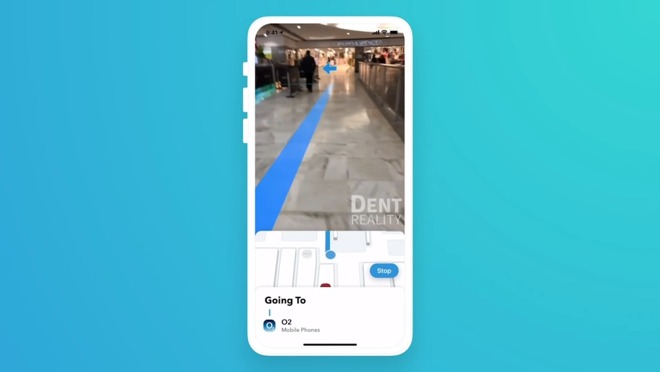

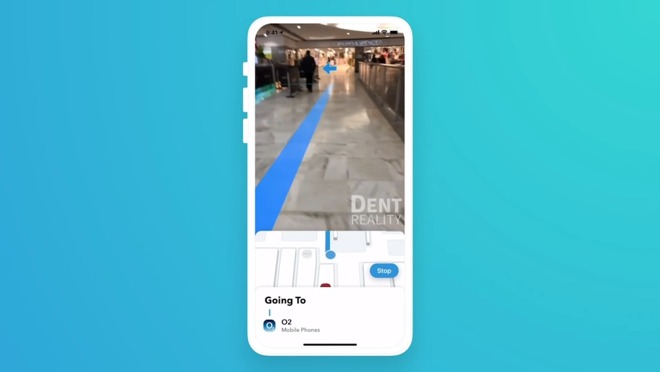

An augmented reality startup named Dent Reality has announced a new partnership with Apple Maps that could have wide-ranging implications for the Cupertino tech giant, the Apple Indoor Maps program, and augmented reality programs as a whole.

Dent Reality is a London-based startup focused on augmented reality systems, including indoor navigation.

Apple has been working on AR systems for years. Those developments have manifested in platforms like ARKit, and Apple is still working on bringing AR to applications like cars and head-mounted devices. But it isn't the only company in this space, and a startup called Dent Reality has made significant advancements itself.

Dent Reality has become an official partner with Apple's indoor mapping initiative, specifically for AR-based navigation and indoor maps, the startup announced in a tweet on Tuesday.

Hart first built an open-source ARKit project, which he posted to GitHub in 2017, that solved the problem of tying AR experiences to real-world locations. Since then, Hart founded Dent Reality, a startup that's been working in the AR sphere -- including AR navigation -- for a couple of years.

Apple, for its part, is providing the underlying Indoor Mapping Data Format (IMDF), a new file format for indoor maps, as well as Wi-Fi-based indoor positioning technology. Dent Reality has built on top of this with their own mapping AR navigation technology, which it provides as its own white-label or as a native software development kit (SDK) via the Indoor Maps Program.

Hart told AppleInsider that the overall goal of the program is to "enable (AR maps) to exist in other places, such as in individual apps which might be more specialized, and on the web." While Apple Maps supports some indoor mapping, Dent Reality is building out a development toolkit for other third-party developers to incorporate their own indoor AR navigation.

Dent Reality is Apple's only partner in the indoor AR navigation space, according to Hart, and it's listed as an official partner in Indoor Maps documentation. In other words, Dent Reality is the company building indoor AR navigation tools based on Apple's Indoor Maps platform that other businesses can implement in Apple Maps or in their own website and app.

As far as when the partnership will bear fruit, Dent Reality said in a tweet that it is currently "setting up projects for later in the year," but Hart said he couldn't reveal which specific companies they're working with.

"We are continuing to work with organizations to deploy AR navigation at key locations, and are also moving deeper into retail stores," Hart told us.

Dent Reality previously debuted a retail-focused AR platform appropriately named Retail AR. That's curiously similar to rumors of an Apple retail-based AR system revealed in an iOS 14 leak. Apple is said to be testing integrating the system at Starbucks and Apple Stores.

Apple reportedly has several AR projects in the works, including some type of head-mounted device.

Apple's AR endeavors, in their current consumer-facing form, mostly revolve around ARKit, its software development platform for AR experiences. But Apple has quite a lot of other AR-related initiatives in the works.

For one, Apple recently introduced indoor maps to its Apple Maps platform in iOS 13. Currently, the navigation was focused solely on top-down mapping, but Dent Reality's announcement suggests that actual indoor navigation using AR is soon to be added -- both to businesses and to consumers.

It's not a new endeavor, either. Apple's work on indoor navigation stretches back to 2014 and 2015, when the company made a key hire and began patenting indoor navigation-related technology.

Perhaps most notably, Apple is rumored to be developing some type of headworn AR or mixed reality (MR) headset or glasses. That's especially relevant in this case because indoor AR navigation is a technology that's seemingly much better-suited to a head-mounted wearable than a smartphone.

Apple is currently testing AR software systems using an HTC Vive-like controller. It also recently debuted a new version of ARKit that takes advantage of the LiDAR sensor in the new iPad Pros and filed a patent for AR virtual assistants.

There are also ties to unrelated technologies like Ultra Wideband (UWB), which appeared in the latest iPhone 11 and iPhone 11 Pro devices. While rumored to be a core technology of an upcoming Apple tracking device, noted Apple analyst Ming-Chi Kuo also believes that the UWB technology could also provide ultra-precise location data for indoor navigation.

Hart said that Apple hasn't revealed much about UWB to developers, but added that Dent Reality is "always open to newer technologies" that could help them build the best user experience.

Dent Reality is a London-based startup focused on augmented reality systems, including indoor navigation.

Apple has been working on AR systems for years. Those developments have manifested in platforms like ARKit, and Apple is still working on bringing AR to applications like cars and head-mounted devices. But it isn't the only company in this space, and a startup called Dent Reality has made significant advancements itself.

Dent Reality has become an official partner with Apple's indoor mapping initiative, specifically for AR-based navigation and indoor maps, the startup announced in a tweet on Tuesday.

Andrew Hart, CEO and cofounder of Dent Reality, told AppleInsider that Apple spotted what the company was working on "early on," and introduced them to what is now the publicly revealed Indoor Maps Program.Announcement: We're now an official partner with Apple Indoor Maps, for providing indoor AR navigation!

We're currently setting up projects for later this year. Get in touch!https://t.co/q0jYaUnJHGpic.twitter.com/aBrmvAEhLX-- Dent Reality (@DentReality)

Hart first built an open-source ARKit project, which he posted to GitHub in 2017, that solved the problem of tying AR experiences to real-world locations. Since then, Hart founded Dent Reality, a startup that's been working in the AR sphere -- including AR navigation -- for a couple of years.

Apple, for its part, is providing the underlying Indoor Mapping Data Format (IMDF), a new file format for indoor maps, as well as Wi-Fi-based indoor positioning technology. Dent Reality has built on top of this with their own mapping AR navigation technology, which it provides as its own white-label or as a native software development kit (SDK) via the Indoor Maps Program.

Hart told AppleInsider that the overall goal of the program is to "enable (AR maps) to exist in other places, such as in individual apps which might be more specialized, and on the web." While Apple Maps supports some indoor mapping, Dent Reality is building out a development toolkit for other third-party developers to incorporate their own indoor AR navigation.

Dent Reality is Apple's only partner in the indoor AR navigation space, according to Hart, and it's listed as an official partner in Indoor Maps documentation. In other words, Dent Reality is the company building indoor AR navigation tools based on Apple's Indoor Maps platform that other businesses can implement in Apple Maps or in their own website and app.

As far as when the partnership will bear fruit, Dent Reality said in a tweet that it is currently "setting up projects for later in the year," but Hart said he couldn't reveal which specific companies they're working with.

"We are continuing to work with organizations to deploy AR navigation at key locations, and are also moving deeper into retail stores," Hart told us.

Dent Reality previously debuted a retail-focused AR platform appropriately named Retail AR. That's curiously similar to rumors of an Apple retail-based AR system revealed in an iOS 14 leak. Apple is said to be testing integrating the system at Starbucks and Apple Stores.

Apple's broader AR developments

Apple reportedly has several AR projects in the works, including some type of head-mounted device.

Apple's AR endeavors, in their current consumer-facing form, mostly revolve around ARKit, its software development platform for AR experiences. But Apple has quite a lot of other AR-related initiatives in the works.

For one, Apple recently introduced indoor maps to its Apple Maps platform in iOS 13. Currently, the navigation was focused solely on top-down mapping, but Dent Reality's announcement suggests that actual indoor navigation using AR is soon to be added -- both to businesses and to consumers.

It's not a new endeavor, either. Apple's work on indoor navigation stretches back to 2014 and 2015, when the company made a key hire and began patenting indoor navigation-related technology.

Perhaps most notably, Apple is rumored to be developing some type of headworn AR or mixed reality (MR) headset or glasses. That's especially relevant in this case because indoor AR navigation is a technology that's seemingly much better-suited to a head-mounted wearable than a smartphone.

Apple is currently testing AR software systems using an HTC Vive-like controller. It also recently debuted a new version of ARKit that takes advantage of the LiDAR sensor in the new iPad Pros and filed a patent for AR virtual assistants.

There are also ties to unrelated technologies like Ultra Wideband (UWB), which appeared in the latest iPhone 11 and iPhone 11 Pro devices. While rumored to be a core technology of an upcoming Apple tracking device, noted Apple analyst Ming-Chi Kuo also believes that the UWB technology could also provide ultra-precise location data for indoor navigation.

Hart said that Apple hasn't revealed much about UWB to developers, but added that Dent Reality is "always open to newer technologies" that could help them build the best user experience.

Comments

In your attempt at sarcasm you just demonstrated how small you are thinking. This will be pretty helpful for places like malls.

I'm also curious why Apple didn't put the U1 UWB chip into the new iPad... Kinda odd I think.

... No your other right.

Stop following the woman in red. And, follow the fat tired looking guy.

You’ve arrived at your destination.

Stock buybacks isn’t necessarily a bad thing as long as you do it in an opportunist manner. Some companies do it to prop up the stock and give investors a false sense of security. IBM for example needed new blood and new products so they needed a transformative acquisition.

Apple doesn’t need a big deal. I think they look at stock buybacks and think of it in terms of keeping their dividend in a certain range. They could increase their dividend or buy back stock... buybacks accomplish more.

I've been investing since I was a kid in 1963. Since buybacks became legal, there has never been a single case of it being useful. It’s just money down the drain that the company could otherwise use for R&D, production, marketing, etc. which would add to sales and the bottom line, which would result in a higher stock price. Even the math of buybacks doesn’t work.

your last point is ridiculous. You should look at what actually happens instead of just throwing out random thoughts. Apple buys back vastly more stock than it pays out in dividends. Buybacks accomplish nothing.

thebproblem is that all of this is done in instants. The rest of us are all behind the curve. By the time we get involved, it’s too late. When Apple’s shares plummeted last year, it was because of the trade war, and some other external problems. When it rose again, it was because of good sales and profits on Apple’s part. Neither the run down, nor the run up had anything to do with buybacks. The same thing was true several years ago when the stock dropped from $700 to below $400. It was a sales issue. When Apple’s sales then popped, the shares jumped n=back in short order.

try to find out where buybacks fit into all of this, and you can’t. It’s just an assumption. If a company’s sales do well, and investors feel they will continue to do so, and the stock will rise. That’s it. If a major buyback occurs during this, can you prove it has anything to do with it, other than j7ust an assumption? No, you can’t. And when shares are falling because of a sales and profit slump, and a major buyback fails to show any affect on i6t, can you prove it slowed the fall? Again, no, you can’t.

and that’s the problem. There has never been any proof that buybacks change anything. It’s just a theory that look as though it should matter, but with no evidence that it does. Most investors buy stocks because of a real increases in EPS, not because of an apparent increase from an artificial source, such as buybacks, which don’t reflect the actual health of the company. Investment is provoked by actual corporate success. There are a number of economists that agree.

and to me, the biggest problem is that Apple spend around $200 billion on buybacks, and borrowed about $120 billion to do it, which they have to pay off. So they gained $120 billion in debt in order to follow a dubious theory. What could they have done with that $200 billion instead?

It also has a short term impact, since any big purchases affect the price through general supply and demand, but that's rarely the point of stock buybacks at all.

I don't think you klnow as much as you think you do.