Apple may never be able to quit manufacturing in China

A new report says Apple has trying to move operations away from China for a decade, and if it can ever accomplish it, the move will take another 20 years.

Tim Cook visits Luxshare factory in 2017. Source: Apple

Apple and all major technology firms have been working to reduce their dependency on China, because of increased tensions between the country and the US, plus the impact of COVID measures. However, the Financial Times reports that Apple is by far the most reliant on China, and so much so that it may never be able to completely move away.

Reportedly, Microsoft's revenues from hardware are only 6% of its total. Samsung closed its plants in China in 2019, although that was less because of wanting to move, and more because its local market share had fallen from 20% to under 1%.

The Financial Times says that in comparison, Apple directly employs 14,000 people in China, and most of its 1.5 million workers in the global supply chain are in the country.

Apple, and its main iPhone supplier Foxconn, have taken high-profile steps to move manufacturing to India, and Vietnam However, a former Microsoft executive told the publication that Vietnam, for example, is "years and years" away from being truly competitive.

"It was incredibly challenging [for us] in terms of ramp up, set up, and getting that working the way it was working in China," the unnamed executive said. "The infrastructure was either very new and hadn't been proven -- or it didn't exist."

"We had challenges with sourcing components, because all of our tier-two, tier-three sourcing was still all in China," he or she continued. "So we ended up shipping a lot of semi-finished goods from China to Vietnam for final assembly."

The executive may have been describing the situation when Microsoft bought Nokia in 2013, and moved production to Vietnam. According to the Financial Times, Nokia also then faced problems with the weather, inadequate transportation -- and even organized crime.

Currently it's estimated that the number of workers in Chinese factories is greater than the total population of Vietnam. China's own statistics say 293 million people worked in factories in 2021, where 100 million people live in Vietnam.

Even if Apple, or other firms, were able to establish an equivalent supply chain in India, Vietnam, or anywhere else, there would still be the fact that China is a smelting source. So at the very least, raw metal would still come from there.

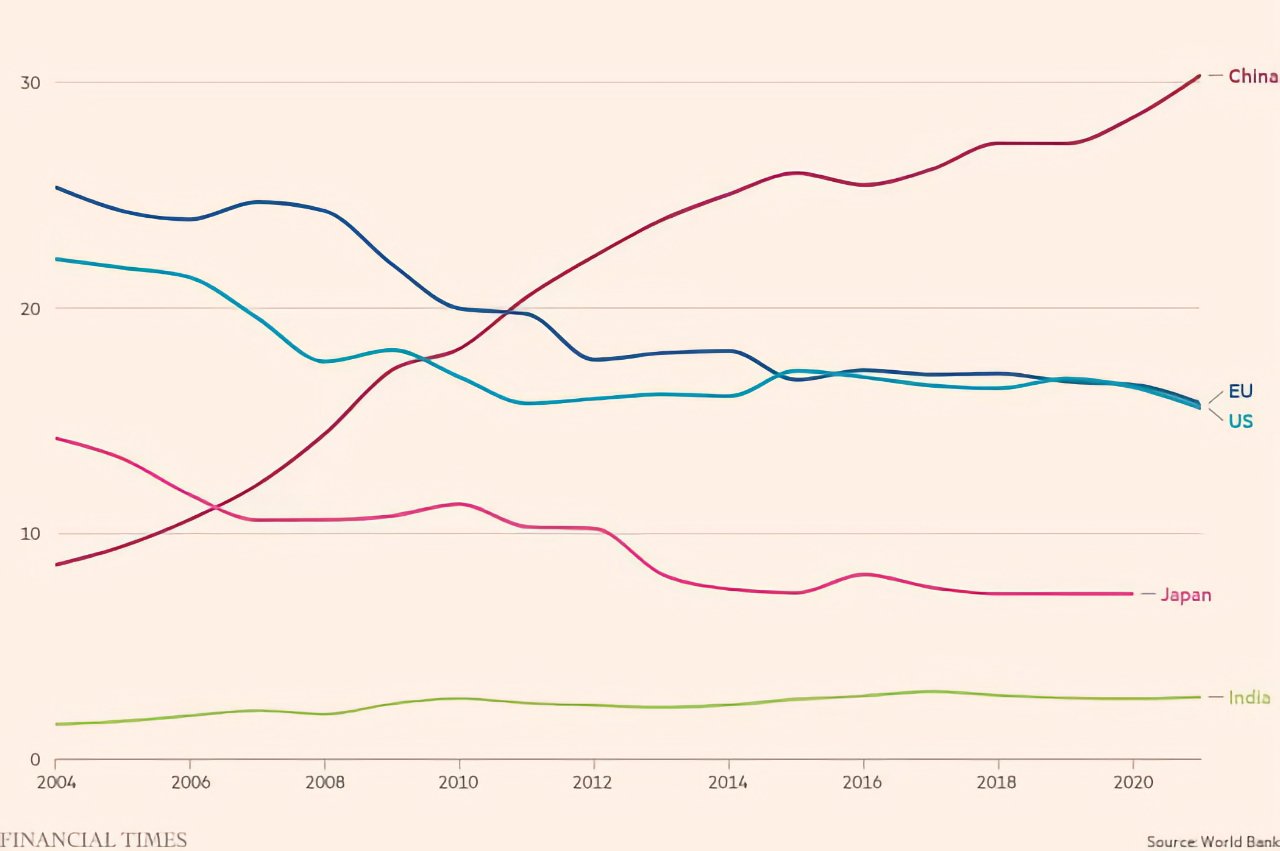

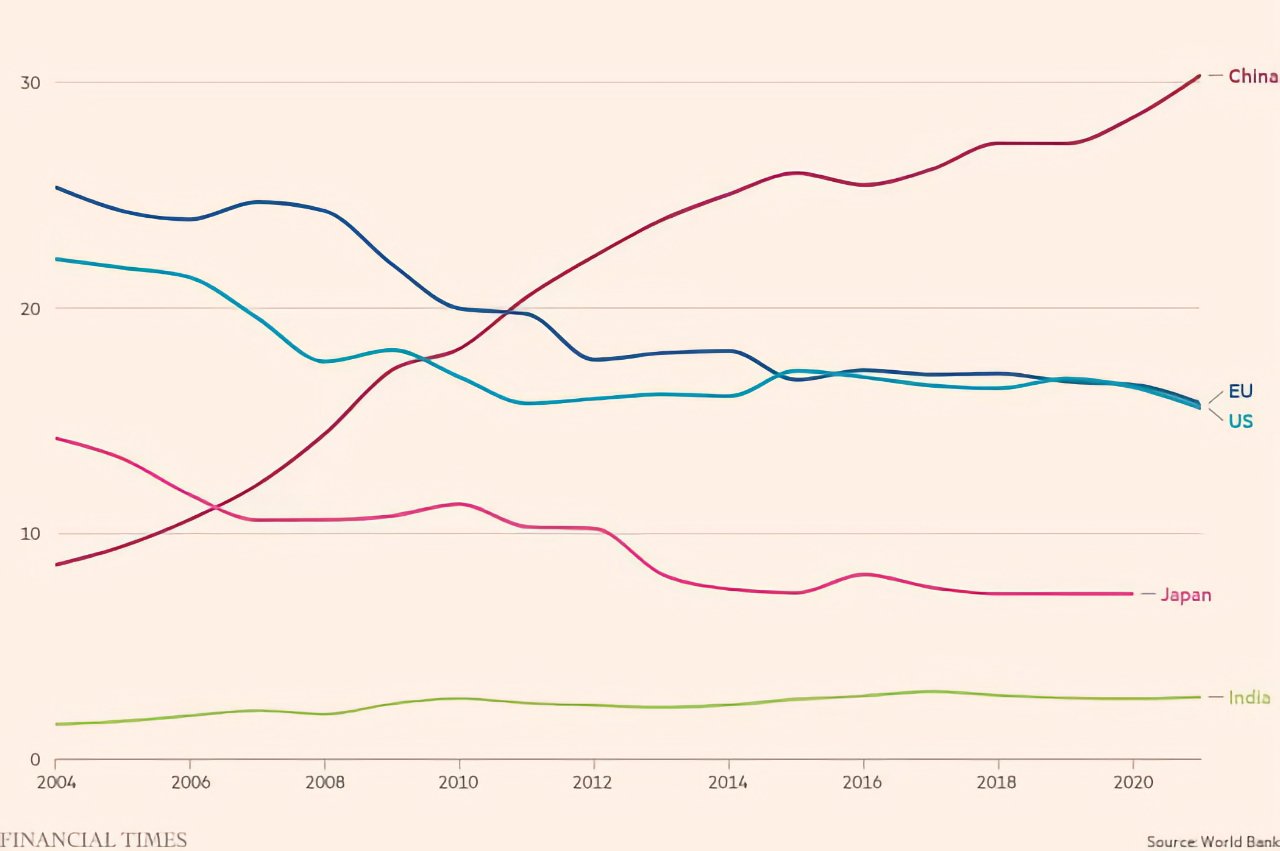

Share of global manufacturing value added (%). Source: Financial Times/World Bank

According to the Financial Times, during his 2017 visit to Luxshare, workers asked if Apple was going to move.

"We're not doing that," Cook reportedly replied. "Manufacturing our products requires deep engineering skills, flexible supply chain management, and exceptional quality standards."

"We won't be shifting production for the sake of lowering costs," he continued.

He was reassuring the workers, and he was speaking in 2017 before the Trump administration began putting tariffs on US buyers of goods from China.

Nonetheless, Apple is not going to be making lower quality iPhones or using less capable suppliers, just to cut its dependency on China.

"Apple can't diversify," an unnamed former Apple engineer told the Financial Times. "China is going to dominate labour and tech production for another 20 years."

Read on AppleInsider

Tim Cook visits Luxshare factory in 2017. Source: Apple

Apple and all major technology firms have been working to reduce their dependency on China, because of increased tensions between the country and the US, plus the impact of COVID measures. However, the Financial Times reports that Apple is by far the most reliant on China, and so much so that it may never be able to completely move away.

Reportedly, Microsoft's revenues from hardware are only 6% of its total. Samsung closed its plants in China in 2019, although that was less because of wanting to move, and more because its local market share had fallen from 20% to under 1%.

The Financial Times says that in comparison, Apple directly employs 14,000 people in China, and most of its 1.5 million workers in the global supply chain are in the country.

Apple, and its main iPhone supplier Foxconn, have taken high-profile steps to move manufacturing to India, and Vietnam However, a former Microsoft executive told the publication that Vietnam, for example, is "years and years" away from being truly competitive.

"It was incredibly challenging [for us] in terms of ramp up, set up, and getting that working the way it was working in China," the unnamed executive said. "The infrastructure was either very new and hadn't been proven -- or it didn't exist."

"We had challenges with sourcing components, because all of our tier-two, tier-three sourcing was still all in China," he or she continued. "So we ended up shipping a lot of semi-finished goods from China to Vietnam for final assembly."

The executive may have been describing the situation when Microsoft bought Nokia in 2013, and moved production to Vietnam. According to the Financial Times, Nokia also then faced problems with the weather, inadequate transportation -- and even organized crime.

It all comes back to China

The issue of sending parts from China to be just assembled in countries such as India is reportedly routine enough that there is a term for the assembly companies. These suppliers are known as Final Assembly, Test and Pack (FATP).Currently it's estimated that the number of workers in Chinese factories is greater than the total population of Vietnam. China's own statistics say 293 million people worked in factories in 2021, where 100 million people live in Vietnam.

Even if Apple, or other firms, were able to establish an equivalent supply chain in India, Vietnam, or anywhere else, there would still be the fact that China is a smelting source. So at the very least, raw metal would still come from there.

Share of global manufacturing value added (%). Source: Financial Times/World Bank

Apple's commitment to China

Apple has been criticised for its apparent willingness to repeatedly bow to pressure from the Chinese government. But it has also directly spoken about staying in the country, or at least Tim Cook has.According to the Financial Times, during his 2017 visit to Luxshare, workers asked if Apple was going to move.

"We're not doing that," Cook reportedly replied. "Manufacturing our products requires deep engineering skills, flexible supply chain management, and exceptional quality standards."

"We won't be shifting production for the sake of lowering costs," he continued.

He was reassuring the workers, and he was speaking in 2017 before the Trump administration began putting tariffs on US buyers of goods from China.

Nonetheless, Apple is not going to be making lower quality iPhones or using less capable suppliers, just to cut its dependency on China.

"Apple can't diversify," an unnamed former Apple engineer told the Financial Times. "China is going to dominate labour and tech production for another 20 years."

Read on AppleInsider

Comments

And it really is an even more complicated marriage because really it is a manage-a-trois if TSMC in Taiwan is included in the equation.

Regardless of what America-First proponents say we live in a global economy and it is tough to roll this clock back.

I think we need to bring some essential manufacturing back into this country…but 1/4 billion hand assembled iPhones per annum is never coming back.

To 100% remove China -- or any other major country -- from the supply chain of a company the size of Apple is clearly unrealistic. If nothing else, there will be production in China to meet demand in China.

But it is realistic, meaningful, and feasible to substantially reduce dependence on China. That's going to happen, not just for Apple but for many other companies, too.

However, reducing dependency is not the same as quitting a country.

The EU started its EU processor initiative to reduce dependencies on US and other foreign technology. It was a stated strategic goal.

Apple might, in time, be able to obtain manufacturing capacity that is co-located with Samsung's suppliers - Apple still uses several components that Samsung provides - but it's not something that can happen quickly.

With that said, highly relying on China is very problematic as Pandemic and Geopolitics conflicts show. Divestifying from China is important for global company like Apple.

The EPI microprocessors will use some ARM IP. The accelerators will be based on RISC-V.

The goal is EU technological sovereignty. The current setup draws on over 10 years of research. The EPI was formally established in 2018. The first chip was successfully taped out in late 2021. 30 European countries are involved.