Apple's Q1 earnings hit hard by iPhone production problems

Apple has hauled in $117.15 billion in revenue for its first quarter results of 2023, with the earnings impacted by both an economic downturn and Chinese factory issues.

Apple CEO Tim Cook

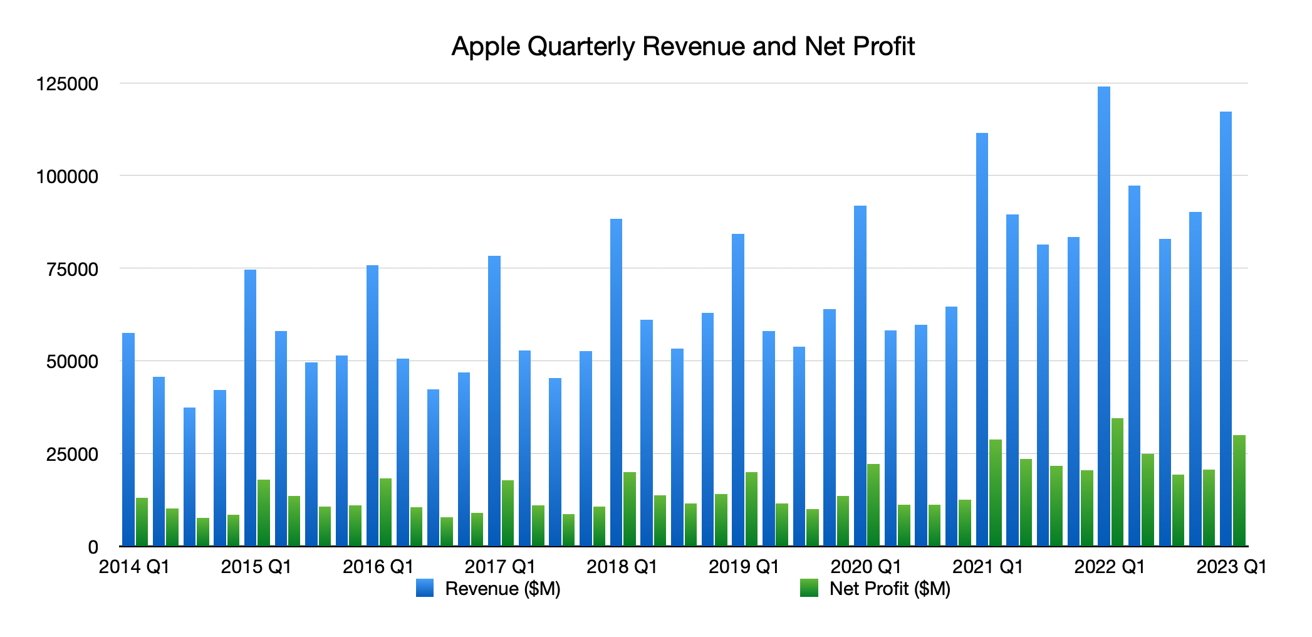

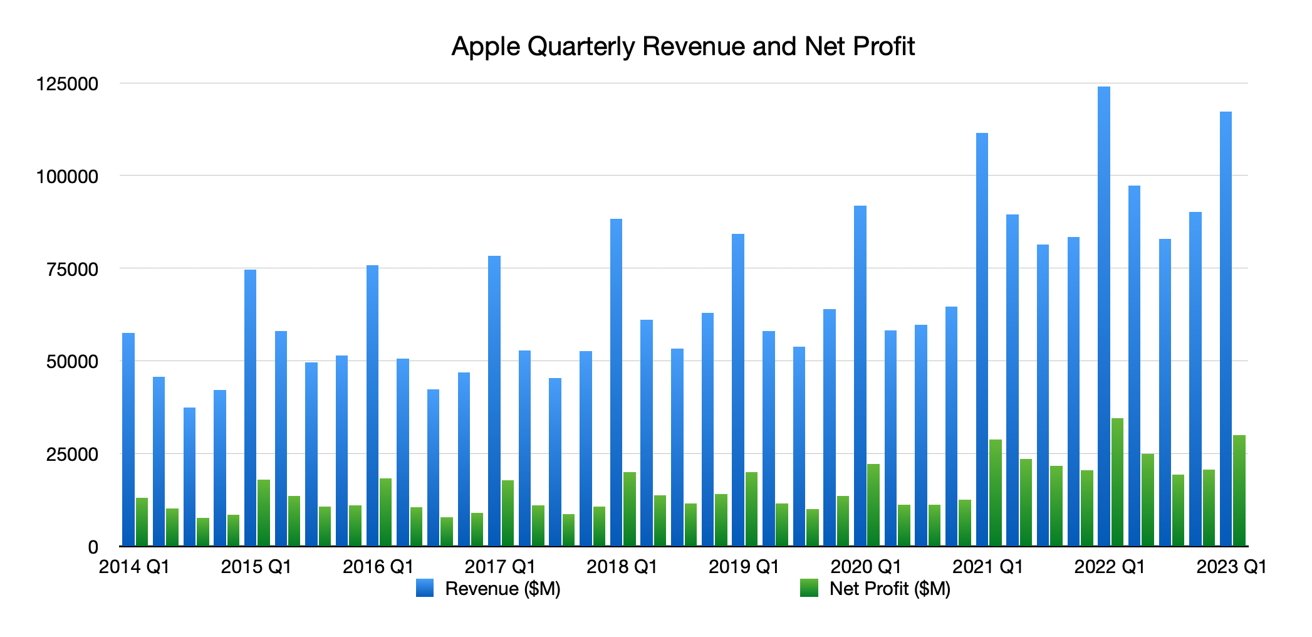

Announced on Thursday before the traditional conference call with analysts, Apple's $117.15 billion for the quarter ending December 2022 is a decline from the $123.9 billion reported in Q1 2022, which was a record-setting period. The earnings per share of $1.88 for the quarter is down from the $2.10 seen one year prior.

For context, this is the first year-over-year quarterly drop in revenue for Apple since 2019. It is also classifiable as the largest quarterly drop since September 2016, albeit a claim distorted by comparing the scale of the holiday quarters against a much quieter period.

Apple's quarterly revenue and net profit.

The Q1 2023 results follow after the Q4 2022 results, which saw it earn $90.15 billion and an earnings per share of $1.29.

The Wall Street consensus on Apple's shares before the results release forecast an average revenue of $121.2 billion, and an EPS of 1.94.

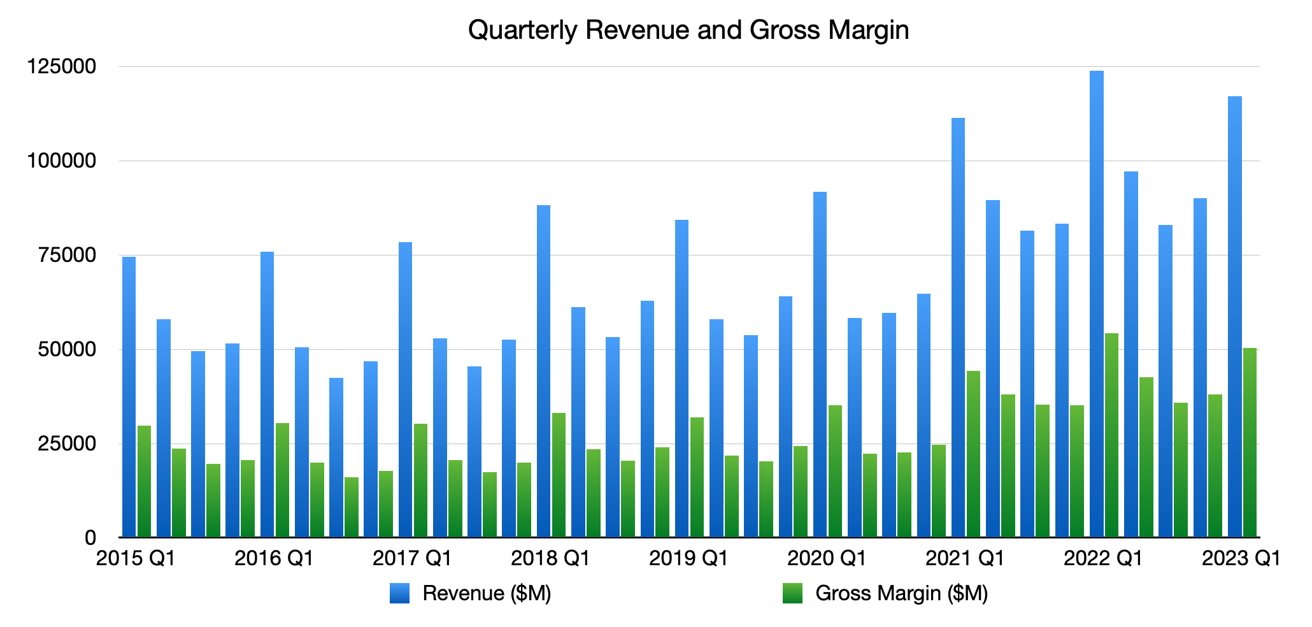

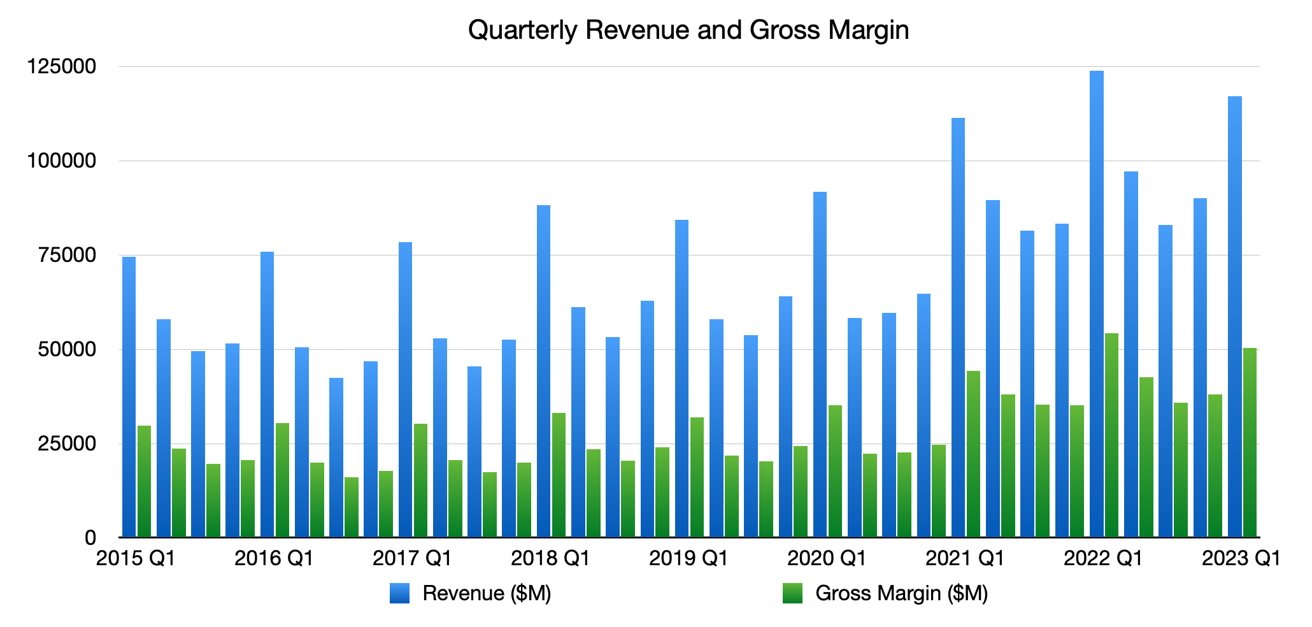

The gross margin for the period of $50.3 billion is down from $54.2 billion four quarters ago, with operating expenses changing from $12.7 billion in Q1 2022 to $14.3 million for Q1 2023. Net profit reached $29.998 billion, down from $34.6 billion.

Apple quarterly revenue and gross margin.

The holiday quarter benefited from the usual release of many flagship product updates from the company, including the iPhone 14 range, the Apple Watch Series 8, Apple Watch SE Gen 2, Apple Watch Ultra, Second-generation AirPods Pro, sixth-generation iPad Pro, 10th-generation iPad, and the third-generation Apple TV.

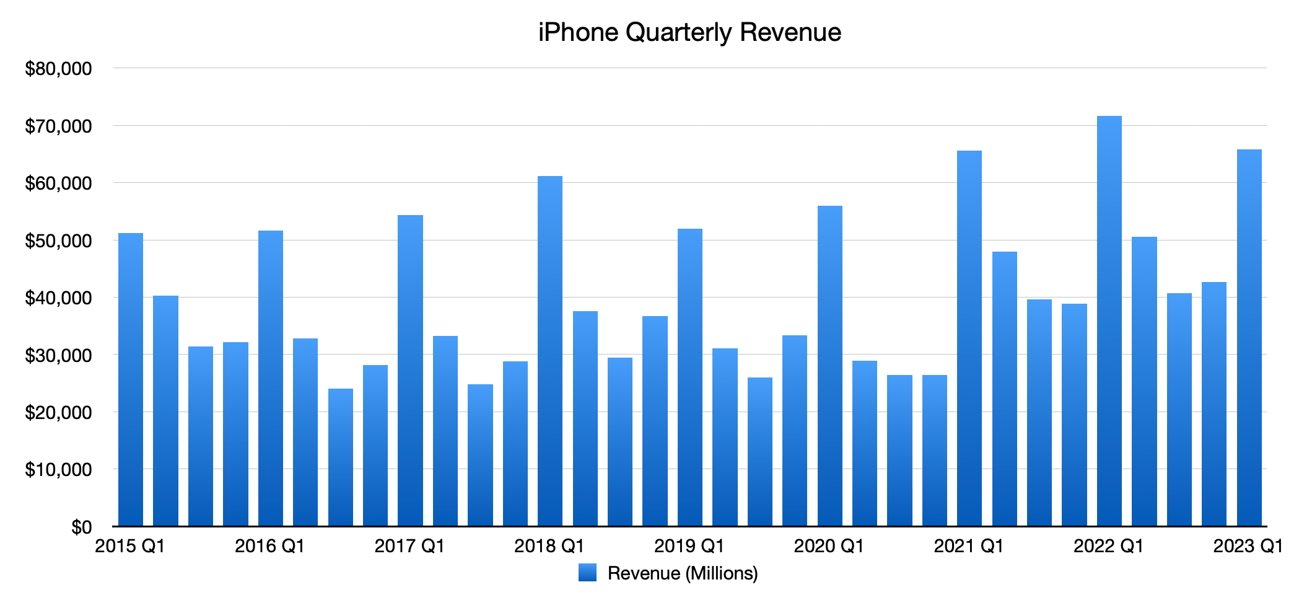

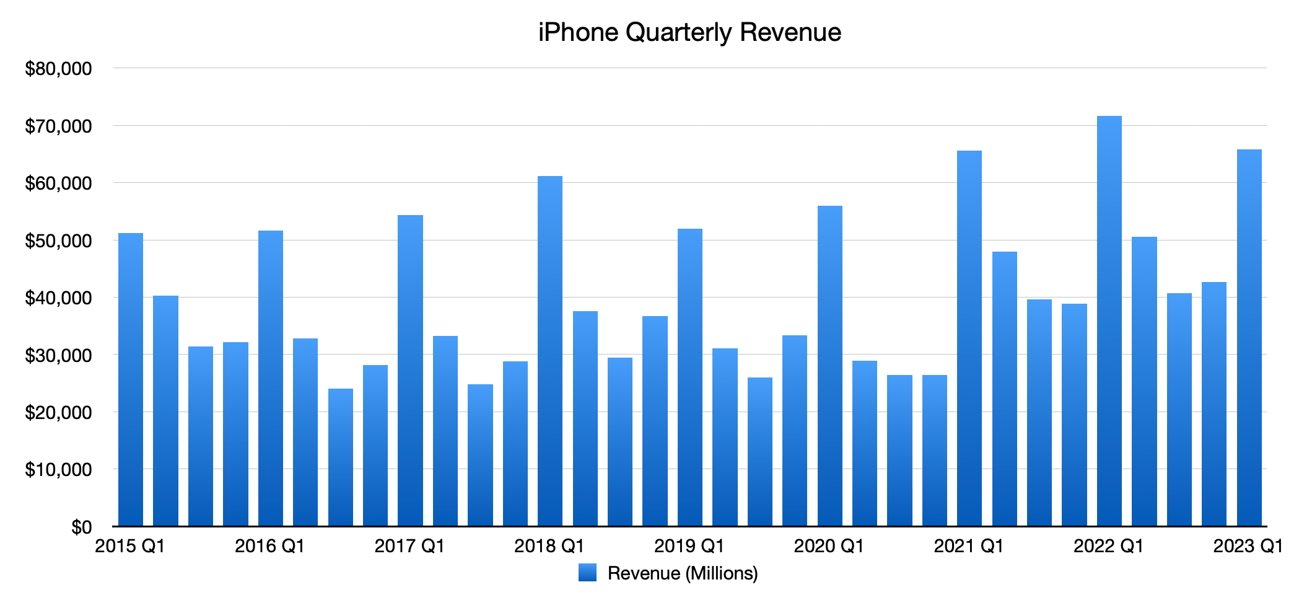

The usual high-revenue item on the list, iPhone brought in $65.78 in revenue for the quarter, down from $71.6 billion seen the year-ago quarter. In pre-results speculation, analysts believed the Zhengzhou factory issues impacted shipments of the Pro model iPhones, with some sales pushed back into the March quarter.

Apple's iPhone revenue over time, to Q1 2023

Mac revenues are down year-on-year at $7.74 billion versus $10.8 billion. Revenue from iPad rose to $9.4 billion from $8.4 billion last year.

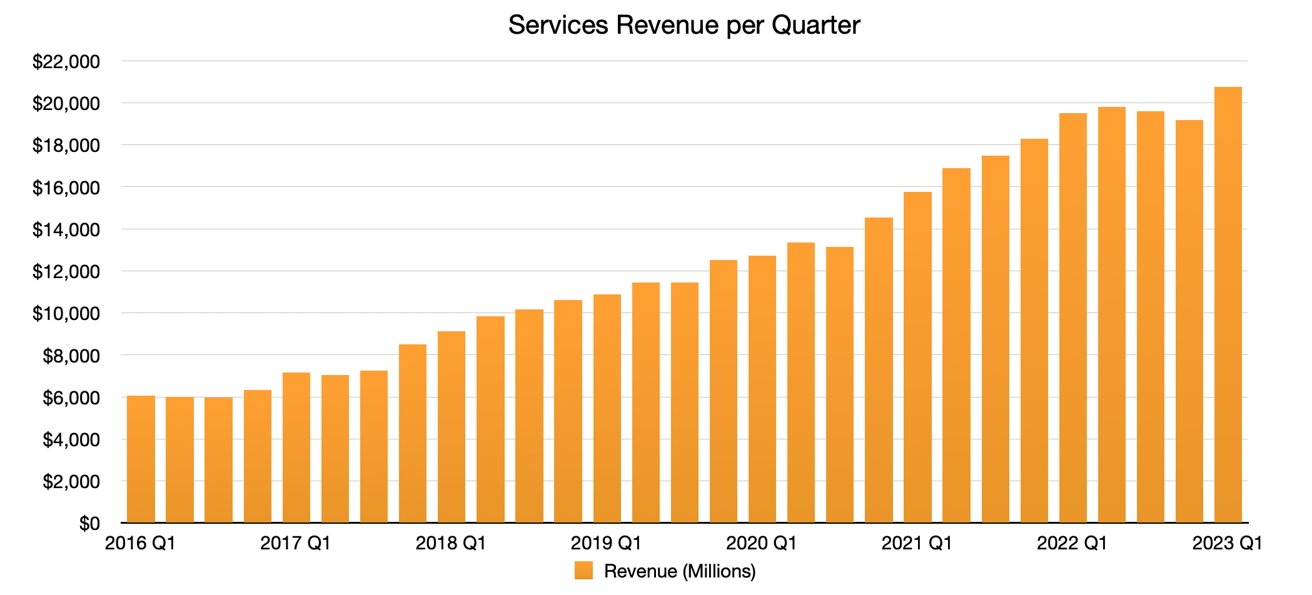

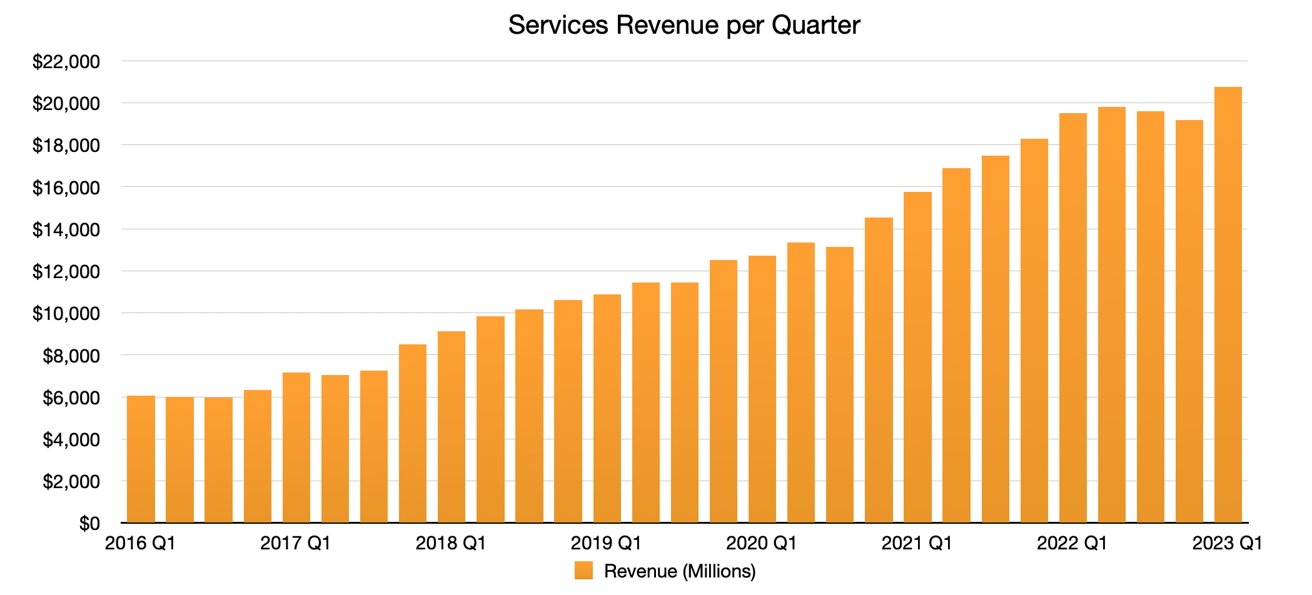

Wearables, Home, and Accessories reached $13.48 billion, down year-on-year from $14.7 billion. The reliable Services arm continued its growth to $20.77 billon for the quarter, up from $19.5 billion.

"As we all continue to navigate a challenging environment, we are proud to have our best lineup of products and services ever, and as always, we remain focused on the long term and are leading with our values in everything we do," said Apple CEO Tim Cook.

"We set an all-time revenue record of $20.8 billion in our Services business, and in spite of a difficult macroeconomic environment and significant supply constraints, we grew total company revenue on a constant currency basis," said Luca Maestri, Apple's CFO.

Apple's quarterly services revenue

In a continuation of a practice that occurred since the start of the pandemic, Apple has declined to offer detailed guidance on its future quarterly results.

A cash dividend of $0.23 per share of common stock has been declared by Apple's board of directors, payable on February 16 to shareholders of record as of the close of business on February 13.

More information about Apple's quarter will be raised as part of the analyst call, which follows the release of the results.

This story is breaking. Refresh for the most current information

Read on AppleInsider

Apple CEO Tim Cook

Announced on Thursday before the traditional conference call with analysts, Apple's $117.15 billion for the quarter ending December 2022 is a decline from the $123.9 billion reported in Q1 2022, which was a record-setting period. The earnings per share of $1.88 for the quarter is down from the $2.10 seen one year prior.

For context, this is the first year-over-year quarterly drop in revenue for Apple since 2019. It is also classifiable as the largest quarterly drop since September 2016, albeit a claim distorted by comparing the scale of the holiday quarters against a much quieter period.

Apple's quarterly revenue and net profit.

The Q1 2023 results follow after the Q4 2022 results, which saw it earn $90.15 billion and an earnings per share of $1.29.

The Wall Street consensus on Apple's shares before the results release forecast an average revenue of $121.2 billion, and an EPS of 1.94.

The gross margin for the period of $50.3 billion is down from $54.2 billion four quarters ago, with operating expenses changing from $12.7 billion in Q1 2022 to $14.3 million for Q1 2023. Net profit reached $29.998 billion, down from $34.6 billion.

Apple quarterly revenue and gross margin.

The holiday quarter benefited from the usual release of many flagship product updates from the company, including the iPhone 14 range, the Apple Watch Series 8, Apple Watch SE Gen 2, Apple Watch Ultra, Second-generation AirPods Pro, sixth-generation iPad Pro, 10th-generation iPad, and the third-generation Apple TV.

The usual high-revenue item on the list, iPhone brought in $65.78 in revenue for the quarter, down from $71.6 billion seen the year-ago quarter. In pre-results speculation, analysts believed the Zhengzhou factory issues impacted shipments of the Pro model iPhones, with some sales pushed back into the March quarter.

Apple's iPhone revenue over time, to Q1 2023

Mac revenues are down year-on-year at $7.74 billion versus $10.8 billion. Revenue from iPad rose to $9.4 billion from $8.4 billion last year.

Wearables, Home, and Accessories reached $13.48 billion, down year-on-year from $14.7 billion. The reliable Services arm continued its growth to $20.77 billon for the quarter, up from $19.5 billion.

"As we all continue to navigate a challenging environment, we are proud to have our best lineup of products and services ever, and as always, we remain focused on the long term and are leading with our values in everything we do," said Apple CEO Tim Cook.

"We set an all-time revenue record of $20.8 billion in our Services business, and in spite of a difficult macroeconomic environment and significant supply constraints, we grew total company revenue on a constant currency basis," said Luca Maestri, Apple's CFO.

Apple's quarterly services revenue

In a continuation of a practice that occurred since the start of the pandemic, Apple has declined to offer detailed guidance on its future quarterly results.

A cash dividend of $0.23 per share of common stock has been declared by Apple's board of directors, payable on February 16 to shareholders of record as of the close of business on February 13.

More information about Apple's quarter will be raised as part of the analyst call, which follows the release of the results.

This story is breaking. Refresh for the most current information

Read on AppleInsider

Comments

Apple will then go right on making great products and healthy profits.

I considered a new iPhone for Christmas but prices across the board were too high to justify a purchase. I'm sure many, many people were in a similar situation.

Mac revenue was down but, post pandemic, that is understandable too.

If we are going to call this 'a miss' it's because that's what it is, but not to the point of management even needing to prepare the markets beforehand. Everyone in the industry is suffering from the same underlying issues.

The 'good' news is that given the prolonged nature of the forecast downturn, Apple might drop prices or get aggressive on promotions.

Dream on about price drops, let Spotify lose money or Netflix, promotions? can Apple or Microsoft, or Google, be promoted at any higher level? The answer is no.

Can’t sell what you haven’t made maybe this might get Apple to release their full range of computers using the M2 or the M3 families of SOC‘s within the same calendar year, there are many people waiting for the rest of the range to be released before upgrading, i.e., a bigger, screen iMac, or a Mac Pro, everyone who wants a laptop or an iPad got theirs, but there are many other people who want something that they haven’t released i.e., the bigger screen iMac, or the Mac Pro, can’t sell what you haven’t made.

With both the giant global transportation and medical/health markets still yet to be exploited by Apple innovations, it's likely a bright and long future before that plateau comes. And that's what the stock will reflect going forward. For innovation leaders like Apple and Tesla (and Nvidia and Regeneron and a few others) quarterly earnings squiggles are just minor footnotes in a much larger story.

So overall, I come away from this report feeling pretty good about AAPL.

Without the currency fluctuations Apple increased revenue YoY. I don't see any need for Apple to change what they're doing.

I appreciate that Apple are a business and they're there to sell and profit.

I've been an Apple customer since the 80's and supported the company by continuing to buy its products during the difficult years.

That said, their prices continue to increase, to a point that in my opinion, is excessive today. I had been purchasing a new iPhone, Apple Watch, iPad Pro and MacBook Pro as well as services every year without fail for a decade plus.

The past year was the first time I decided to pull the plug on that - not because the money isn't there - rather in response to the ever increasing prices and eye gouging (in my opinion). I feel that my loyalty is being taken advantage of. Pulled the plug on Apple Music and happily using Spotify as well.

I'll happily continue to use Apple products, because frankly they're the best. However they won't be extracting anywhere near the money they have been over the vears.

The Christmas period creates artificial demand and now that is over it will be a long wait to September. If demand for iPhone (Apple’s biggest revenue generator by a huge margin) slacks I can guarantee you those discounts and/or promotions will be released worldwide.

That is exactly what happened when Apple issued its last profit warning which, by coincidence, occurred during the Christmas period.

Discounts were plunked on its front page before Christmas Day. That was unheard of and wasn't that long ago.

All EU indicators point to disposable income being in short supply due to rising inflation, stimulated by high energy prices (both direct and indirect). We're still in winter. China is showing no signs of recovery.

I think Apple prices are actually really good value due to quality and millions of people agree.

I expect my Apple purchases to increase significantly over the coming years.

If you have followed Apple over the years, you would have figured out that Apple does not drop the price. They usually will make something and put more features into it and keep it at the same price.

The bitching about Apple’s prices is incessant. Financial analyst’s have always expressed the thought that Apple should drop their prices and pick up marketshare, and that’s something that they will probably never do they’re not interested in marketshare.

Apple is only interested in profit share and building the best products they can, expecting some massive price drop to be in line with the Clone makers or the Android market just isn’t going to happen and this quarter’s results again have shown that they don’t have too the problem this quarter isn’t the price the problem is the availability of supply.

If you live in Europe, or any place else where the dollar isn’t your currency you will pay for any fluctuation in price or taxes levied and it will be added to the bill. Going forward Apple’s market share in Europe will be probably less than 23%, only the upper crust will be buying Apple products, Europe will be like everywhere else it will be Android country like most of the Third World.