How to buy HomePod using Apple's financing options

Apple's HomePod is shaping up to be a hot commodity for early adopters, but the premium speaker is priced well above competing products from Amazon and Google. If you want to score one on launch day, but lack the cheddar, you might want to consider Apple's financing options.

As we explained in our HomePod buyer's guide, preorders for Apple's high-end home speaker kick off on Friday, likely a minute after midnight Pacific time. Initially, HomePod is limited to Australia, the U.S. and the UK, and each region has different financing options available to customers.

In the U.S., Apple offers special financing through a partnership with Barclaycard. For a single HomePod purchase, which comes out to $349 not including tax, customers who sign up for a Barclaycard Visa and buy the device within 30 days of opening their account can avoid paying interest if the final amount is paid in full within six months.

If you buy two HomePods (assuming there is no cap at launch), the no interest payment period jumps up to 12 months. Customers who buy three or more HomePods can take up to 18 months to pay off their purchase interest free.

To take advantage of the offer, users must apply for a Barclaycard Visa by visiting this website. When approved, return to the online Apple store and sign in using your Apple ID -- Barclaycard Visa should automatically show up as a payment option.

It is recommended that users apply before Friday. In such cases, customers can check application status and, once approved, access their credit before shopping.

In addition to the promotional no interest term, Barclaycard Visa holders earn rewards points for purchases. Every 2,500 points nets a $25 Apple Store Gift Card or iTunes Gift Card. Cardholders get 3 points for every $1 spent at Apple, 2 points for every $1 spent at restaurants and 1 point for every $1 spent on other purchases.

In the UK, buyers have two installment payment options to choose from. The first is PayPal Credit, which allows approved users to 6, 12, 18 or 24 equal monthly payments with a fixed 14.9 percent interest rate over the plan's duration.

Buyers can also elect to purchase their HomePod with Barclays, which offers a more flexible installment period ranging from 3 to 18 months with a variable interest rate of 14.9 percent, though a minimum order of 399 pounds is required. Alternatively, Barclays allows customers to make payments over 24, 36 or 48 months.

To buy HomePod with UK financing, first add HomePod to your bag. Continue through the checkout process until you reach Payment & Details, where you select the Instalments button. Choose from PayPal Credit or Barclays (Barclays installments only available for orders with two or more HomePods) and fill out the application form. Both PayPal and Barclays provide instant decisions on credit applications.

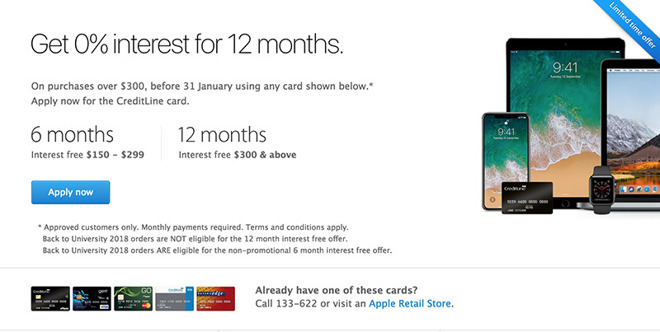

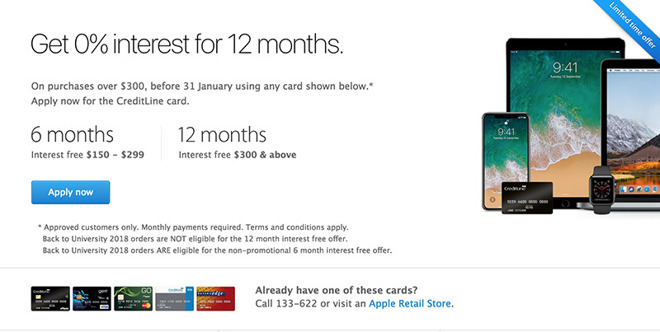

Australia's financing is a bit more flexible than its U.S. and UK counterparts in that it supports a wider number of card issuers and has no statutory time limit on purchases. As long as you have a CreditLine card acquired through Apple or a Buyer's Edge, CreditLine, Gem Visa or GO Mastercard, your HomePod purchase will qualify for the no interest, 12 month payment period.

It should be noted that Apple is running the interest free financing rate term as a limited time promotion that ends on Jan. 31.

If you don't already have one of the cards listed above, first visit this website to apply for a CreditLine card through Apple.

There is one major caveat to the promotion, however, in that all purchases must be made at an Apple store

or through Telesales, which can be access by calling 133-622.

As we explained in our HomePod buyer's guide, preorders for Apple's high-end home speaker kick off on Friday, likely a minute after midnight Pacific time. Initially, HomePod is limited to Australia, the U.S. and the UK, and each region has different financing options available to customers.

Financing in the U.S.

In the U.S., Apple offers special financing through a partnership with Barclaycard. For a single HomePod purchase, which comes out to $349 not including tax, customers who sign up for a Barclaycard Visa and buy the device within 30 days of opening their account can avoid paying interest if the final amount is paid in full within six months.

If you buy two HomePods (assuming there is no cap at launch), the no interest payment period jumps up to 12 months. Customers who buy three or more HomePods can take up to 18 months to pay off their purchase interest free.

To take advantage of the offer, users must apply for a Barclaycard Visa by visiting this website. When approved, return to the online Apple store and sign in using your Apple ID -- Barclaycard Visa should automatically show up as a payment option.

It is recommended that users apply before Friday. In such cases, customers can check application status and, once approved, access their credit before shopping.

In addition to the promotional no interest term, Barclaycard Visa holders earn rewards points for purchases. Every 2,500 points nets a $25 Apple Store Gift Card or iTunes Gift Card. Cardholders get 3 points for every $1 spent at Apple, 2 points for every $1 spent at restaurants and 1 point for every $1 spent on other purchases.

UK buyers

In the UK, buyers have two installment payment options to choose from. The first is PayPal Credit, which allows approved users to 6, 12, 18 or 24 equal monthly payments with a fixed 14.9 percent interest rate over the plan's duration.

Buyers can also elect to purchase their HomePod with Barclays, which offers a more flexible installment period ranging from 3 to 18 months with a variable interest rate of 14.9 percent, though a minimum order of 399 pounds is required. Alternatively, Barclays allows customers to make payments over 24, 36 or 48 months.

To buy HomePod with UK financing, first add HomePod to your bag. Continue through the checkout process until you reach Payment & Details, where you select the Instalments button. Choose from PayPal Credit or Barclays (Barclays installments only available for orders with two or more HomePods) and fill out the application form. Both PayPal and Barclays provide instant decisions on credit applications.

Down Under

Australia's financing is a bit more flexible than its U.S. and UK counterparts in that it supports a wider number of card issuers and has no statutory time limit on purchases. As long as you have a CreditLine card acquired through Apple or a Buyer's Edge, CreditLine, Gem Visa or GO Mastercard, your HomePod purchase will qualify for the no interest, 12 month payment period.

It should be noted that Apple is running the interest free financing rate term as a limited time promotion that ends on Jan. 31.

If you don't already have one of the cards listed above, first visit this website to apply for a CreditLine card through Apple.

There is one major caveat to the promotion, however, in that all purchases must be made at an Apple store

or through Telesales, which can be access by calling 133-622.

Comments

Financing a fully loaded iMac Pro for 8k... sure.

I keep two savings account for emergency repairs for the house and for the car. The last car I had was very reliable, so when I eventually wore it out, I had enough saved up to buy a new car.

When I first saw a payday loan advert, I had to sit down. I was amazed that anyone would take out a loan with an interest rate of 1500%.

And shopping online isn't all that easy for people who are 'cash only'. Some people prefer to use debit cards, but for years they failed to offer the same (or any) fraud protection as credit cards.

When using credit is mentioned there are alway idiots lining up to parade the banner 'If you buy on credit, you can't afford it!' mantra. As though they never buy on credit and always use cash. The bulk of them are probably liars.

A lot of people shouldn't have credit cards. But for many of us, they're tools for better shopping and money management. We can actually make a little profit by spending wisely. We may be in the minority but the benefits are better than being 'cash only'. But if you can't handle a credit card, then of course it's prudent to be 'cash only'.

The only thing worse than these idiots (who need to feel superior) are the idiots who feel the need to say 'Who needs this toy? NOBODY!' because they don't want one. Or hate Apple and it's products. But that's another post.

When using other people's money benefits me, I'm all in.

What you said. The only downside to this is having to open a new credit card, which can adversely affect your credit score, i.e. because of a credit application, and if approved, because now you have another X thousand dollars of available credit. Otherwise, a 0% loan is a no-brainer. Of course, they're counting on the fact that most people won't pay it off in six months, which will cause all of the accrued interest to be added to the account.