Apple stock taking a beating on analyst note predicting soft summer iPhone X demand

Apple stock, and the market, are both taking a big hit after a notable analyst predicted in "in-line" quarterly earnings report accompanied with predictions for the June quarter being lower than what Wall Street is currently expecting.

"We expect Apple to report an in-line March quarter," Katy Huberty from Morgan Stanley wrote in a note to investors on Friday, that has been provided to AppleInsider. "But [we] are cautious into earnings on May 1 due to our belief that June quarter consensus estimates need to be revised lower."

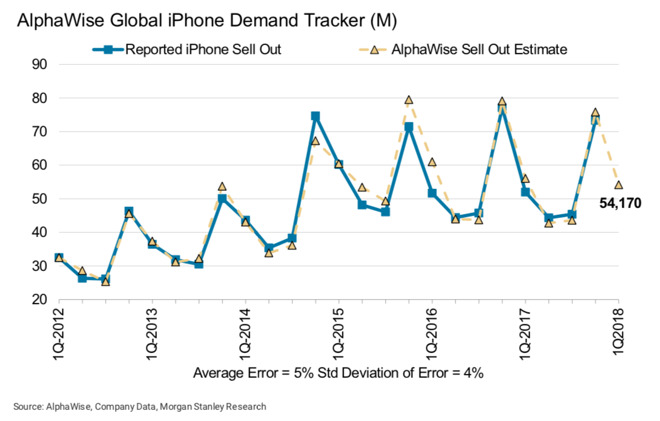

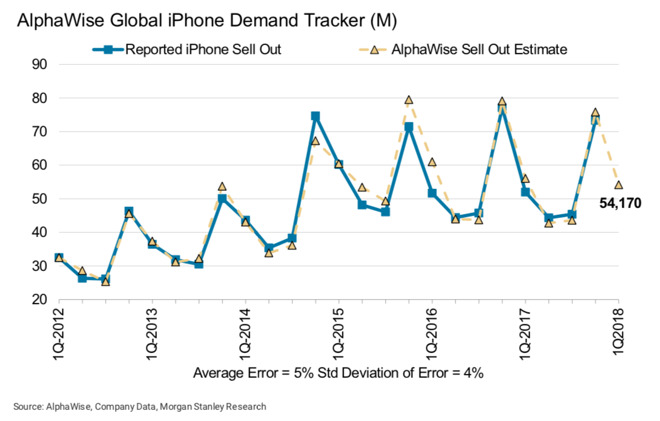

Huberty claims iPhone supplier checks and weak data surrounding the Chinese iPhone market are the bases for her report.

However, Huberty still suggests that a dip is an opportunity to buy the stock, and that the group would be "buyers on any weakness" assuming that Services retain growth, and Apple continues its stock buyback program.

Morgan Stanley lowered its June quarter iPhone sales estimate to 34 million from 40.5 million. This stands in contrast to the 43 million average forecast by assorted Wall Street prognosticators.

Huberty lowered her price target to $200 from $203 for the company's stock. At Noon Eastern time on Friday, AAPL was priced at $166.87. The last time the stock was this low was April 2, when it closed the day at $166.68.

For the second fiscal quarter of 2018 that ended in March, Morgan Stanley predicts that Apple will report a year-over-year 3 percent growth of iPhone sales, climbing to 52.3 million phones. Revenue is expected to hit $60.2 billion with a gross margin of 38.5 percent.

Factors expected to impact Apple's earnings estimates for the third quarter include elevated DRAM prices, a weaker dollar than expected, and low NAND pricing. Huberty also predicts that Apple will shovel another $150 billion into stock buybacks.

Apple CEO Tim Cook has historically warned Wall Street's pundits to not read too much into supply chain checks.

"The supply chain is very complex, and we obviously have multiple sources for things," said Cook in 2014 responding to reports of dismal iPhone sales that weren't true. "Even if a particular data point were factual, it would be impossible to interpret that data point as to what it meant for our business."

Regardless if the predictions are accurate or not, fear is setting in amongst investors after a series of reports once again predicting a quarter that Apple has yet to issue guidance for. CNBC's Jim Cramer noted on the air on Friday morning that he would be "less worried about Apple after it reports."

Apple earnings, and quarterly predictions, are on May 1.

"We expect Apple to report an in-line March quarter," Katy Huberty from Morgan Stanley wrote in a note to investors on Friday, that has been provided to AppleInsider. "But [we] are cautious into earnings on May 1 due to our belief that June quarter consensus estimates need to be revised lower."

Huberty claims iPhone supplier checks and weak data surrounding the Chinese iPhone market are the bases for her report.

However, Huberty still suggests that a dip is an opportunity to buy the stock, and that the group would be "buyers on any weakness" assuming that Services retain growth, and Apple continues its stock buyback program.

Morgan Stanley lowered its June quarter iPhone sales estimate to 34 million from 40.5 million. This stands in contrast to the 43 million average forecast by assorted Wall Street prognosticators.

Huberty lowered her price target to $200 from $203 for the company's stock. At Noon Eastern time on Friday, AAPL was priced at $166.87. The last time the stock was this low was April 2, when it closed the day at $166.68.

For the second fiscal quarter of 2018 that ended in March, Morgan Stanley predicts that Apple will report a year-over-year 3 percent growth of iPhone sales, climbing to 52.3 million phones. Revenue is expected to hit $60.2 billion with a gross margin of 38.5 percent.

Factors expected to impact Apple's earnings estimates for the third quarter include elevated DRAM prices, a weaker dollar than expected, and low NAND pricing. Huberty also predicts that Apple will shovel another $150 billion into stock buybacks.

Apple CEO Tim Cook has historically warned Wall Street's pundits to not read too much into supply chain checks.

"The supply chain is very complex, and we obviously have multiple sources for things," said Cook in 2014 responding to reports of dismal iPhone sales that weren't true. "Even if a particular data point were factual, it would be impossible to interpret that data point as to what it meant for our business."

Regardless if the predictions are accurate or not, fear is setting in amongst investors after a series of reports once again predicting a quarter that Apple has yet to issue guidance for. CNBC's Jim Cramer noted on the air on Friday morning that he would be "less worried about Apple after it reports."

Apple earnings, and quarterly predictions, are on May 1.

Comments

Of course. Earnings are a week and a half out. Never fail right before earnings these rumors of soft iPhone demand or production cuts surface. And it’s the same as always: this quarter is going to be OK but next quarter will be bad. Now they’re worried about June, in 3 months they’ll be saying they’re worried about September.

I'm sure Jobs would go nuclear on samsung.

I know I'll probably get slammed for not defending Apple, but the stock has really has become the year's worst performer on the DJI. Am I the only one to think that Apple is an embarrassment despite sitting on so much cash? It's as though Apple doesn't know what to do. They don't want to update their computers in a timely fashion. They don't want to diversify their hardware business from near total dependency on the iPhone. They're not into any cloud business like most tech companies. They're not into streaming video despite there being so much low-hanging fruit. It just seems as though Apple is deliberately coasting with their business. I'm sure Apple could be secretly doing stuff behind the scenes, but it's just so hard to tell. It could be just part of a grand scheme but it leaves me scratching my head.

It could very easily happen again. Whether or not it is due to soft iPhone sales or something else may never be known. It may just be overly enthusiastic analysts who have to bring their estimates back in line with reality.

Man I remember the downslide in the post-Scully days and AAPL investors had a lot more rationality... but we live in a post-fact world now

Not to say iPhone sales are going to drop but the age of high growth is over.

@Kuyangkoh: manipulations? Take a look at the Nasdaq Option Chain, and maybe you will get confirmed. I think it is a manipulation, yes. Not the first time, that they push down Apple stock.

As for Apple buying on the dips, I don't believe they can do that (as a public company this could be viewed as stock manipulation). Rather the Board approves a repurchase program (which I expect them to do again on May 1st) that is executed internally on a predetermined time schedule.

I follow the stock very closely and agree with Huberty's assessments of an "in-line" quarter and lower June Qtr guidance. My prediction is that the Board will double their percentage increase in dividend yield (this has averaged about 11% per year so I'm expecting a 20-25% increase on May 1st), and an increase in the ongoing share buy-back program - all funded by the repatriation of offshore funds.

That said I purchased my first APPL shares when they first went public and have been in and out of the stock ever since. I'm long term bullish for APPL and believe that it will win the race to be the first $`1T market cap company in the history of the world. But not all of their products are great and the stock is certainly not going to go straight up. 2018 is a transition year for Apple as the resources dedicated to the new Campus (which is absolutely amazing) and geo-political issues impact Apple's focus on making great products.