WSJ author & research firm that botched iPhone X demand doubling down on iPhone XS

Apple built and began selling its high-end OLED iPhone XS and iPhone XS Max models a month ahead of iPhone XR availability in an effort to sell users more expensive models before facing competition from its own new lower-priced, entry-level LCD phone -- at least according to the columnist and the think tank that were totally wrong about iPhone X sales last year.

It's the opposite of a secret that Apple's less expensive iPhone XR won't become available for another five weeks. The report observed that "the staggered release gives Apple a month to sell the higher-end models without cheaper competition from itself. It also simplifies logistics and retail demands and could strengthen Apple's ability to forecast sales and production of all three models through the Christmas holidays," both ideas it again attributed to "analysts and supply chain experts," rather than Mickle's own predictions.

In 2017, Apple was ready to sell its more conventional iPhone 8 models first, while the all-new iPhone X didn't become available until November. A year ago, this was reported as having a "dampening effect" on iPhone 8 sales as consumers waited for the fancier new model, an idea again repeated by the Journal in an effort to make the mundane sound edgy and incisively critical.

Not in the case of the super-premium iPhone XS, according to Mickle and his partners. After thinking heavily and consulting some "supply chain experts," the paper reported that consumers would be totally fooled by Apple's product availability, and spring into action to buy phones priced at $999 to almost $1500 simply because the $750 XR won't be available for another month.

Apple's marketing chief Phil Schiller cleverly used his body to briefly obscure the prices of new phones during the keynote, leaving customers rushing to the Wall Street Journal to understand what was going on

Of course, the less-cynical explanation is simply that iPhone X shipped later last year because it was an entirely new product, and iPhone XR this year for the same reason. In fact, that's what Apple told the Journal.

Additionally, Apple is already selling even more discounted iPhone 7 and iPhone 8 models starting at $450, so anyone looking for bargains rather than an ultra-premium new device isn't exactly being bamboozled by Apple's straightforward presentation of its offerings.

While iPhone 8 was a significantly new model new last year, it was based upon the previous iPhone 7 design that Apple had a year of experience in assembling -- and much more if you count the lineage back to the iPhone 6. This year's iPhone XS models are similarly improvements upon the iPhone X model Apple has now been building for a year and is experienced with.

The new XR involves an entirely new display based on an advanced LCD panel with an all-new precision backlight designed to illuminate the rounded corners of a rigid display technology rather than wrapping back upon itself as flexible OLEDs can.

The Journal cynicism about Apple's XR release isn't just thrown out as a grumbling editorial. It's presented by the paper as news, complete with nonsensical "sourcing" that involves "supply chain experts," as if to give some credibility back to a pseudoscientific practice that's been less useful than astrology and alchemy in reading Apple's tea leaves with any accuracy.

Generally, BOM estimates are used almost exclusively against Apple to portray its products as costing far less to build that what the finished goods sell for, with the tone being that profit margins are too high and customer-abusive.

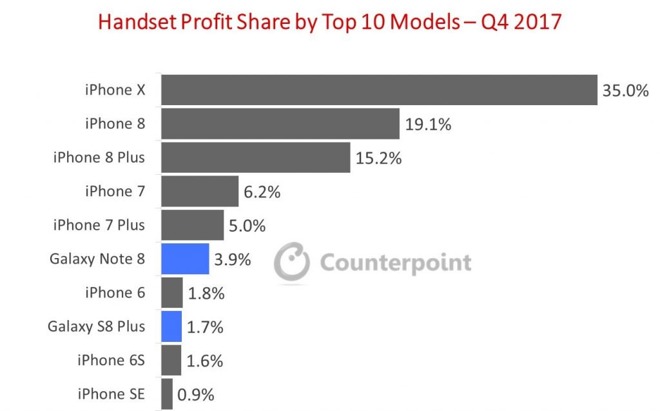

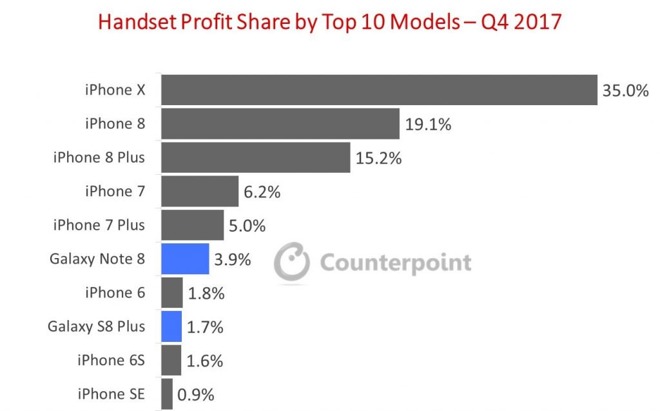

At first glance, this is easy to misinterpret. Unless of course, you're charting out Apple's share of industry profits with the intent of making China's production look profitable, in which case analysts estimate that $30 billion worth of quarterly iPhone revenues only generated about $6 billion in profits.

Apple CEO Tim Cook at a Chinese Foxconn factory.

Here, Mickle uses two BOMs from a source I've never seen BOMs from before: analyst Mehdi Hosseini, with trading firm Susquehanna International Group. Usually, BOMs are generated by a think tank that specializes in putting together these really brainy accounting efforts. Here, an analyst scribbled up BOMS prior to any tear-downs that only materialized on Thursday morning. This is some next level magic-ball gazing.

Hosseini's numbers, supposedly accurate to the dollar, claim that the XR costs $331 to build, while the XS and XS Max supposedly cost $355 and $371.

This is absolutely ridiculous on so many levels it's hard to know where to start. First off, if the two engineering efforts only differ in component costs by $23 dollars, Apple wouldn't be selling them at the prices it set, with the XS a solid $250 higher.

Apple would either be foolishly leaving money on the table with the XR, or radically holding back demand for its best XS models by pricing them as such an unwarranted premium. The reality is-- as has long been known-- that Apple consistently aims to reach a target profit margin, sometimes suppressing its profits to launch new tech, and sometimes riding higher at the tail end of a production as components become cheaper. But Apple simply doesn't have massive shifts of profit margins on this level between its new product offerings.

And if it did, it wouldn't be giving its supposedly massively more profitable XS models with profit margins of $644 and $730 per device a brief window of pre-orders before dropping profitability by a huge degree with the XR -- which would only deliver $420 per device.

If these numbers were real, Apple wouldn't have introduced the iPhone XR at all this month, and would have secretly held it until iPhone XS orders were entirely satiated, then launched it as a cheaper alternative to boost up sales. That's what other companies do all the time. That's what Apple did with the iPhone SE.

Telling us that Apple allocated just five weeks of exclusive XS sales -- when customers know the XR is coming at $750 -- is just insulting. It's about as insulting as telling us that an analyst knows enough about the components and build costs of brand new iPhones before they land in the hands of customers to generate a reliable BOM.

On top of all this, the same author who cited Hosseini's BOM as evidence that the XS and XR only cost Apple a difference of $23 to build wrote a piece for the Wall Street Journal just a few months ago that claimed iPhone X's OLED screen cost "about $97 out of $376 in total estimated cost per device," and then used this fact-from-the-air to claim that its new display was primarily responsible for its $999 price, causing it to cost so much that nobody was buying it.

The same sources who claimed iPhone X was not selling well because of its price are now saying customers won't even notice the price of the iPhone XS

On a simpler device, such as a commodity PC, you can total up the cost of off-the-shelf components pretty easily. On a proprietary, highly integrated device with custom designed silicon and few commodity parts that aren't customized by Apple in partnership with their makers, there's no way to really know how much parts cost.

That's because the cost per component is related to volume. Nobody really knows exactly how much custom components like the OLED display or the A12 Bionic cost until they result in sales over a period of time, because the cost is related to the volume it eventually ships at, and how fast the prices of those components can be brought down (which is directly related to demand volume).

In Apple's conference calls, even its executives commonly note surprise in the dramatic effects of shifting component costs among commodity parts like DRAM and flash storage. The costs of developing custom silicon and producing chips in volume is complicated by the emergence of unanticipated issues: everything from political squabbles to storms and earthquakes hitting Apple's production partners.

A big part of Apple's efforts involve hedging against component cost shifts. There is no simple price tag on components that can be added up to a neat, precise number that can serve as a foundation for unbridled speculation by journalists -- particularly Mickle, who has a background in sports writing, not technology.

Compare, for example, even the reasonably well-known cost of a rather commodity component such as storage memory chips. You could have generated an estimated BOM for Apple's iPhone 8 and Google's Pixel 2 last year, but in reality the fact that Apple subsequently shipped well over 200 million phones with similar memory chips while Google's partners HTC and LG each shipped a negligible number of smartphones means they couldn't ride the same economies of scale as Apple in even among basic commodity components.

Now consider the custom silicon work both Apple and Google did in creating camera logic chips. Apple built this work into its A11 Bionic and shipped it across 120 million high-end iPhones. Google likely faced higher costs in ramping up its silicon efforts (whereas Apple was continuing custom SoC work it's been doing since 2009), but then wasn't able to amortize these expenses across the scant few million devices it produced, then sold at fire sale pricing with steep discounts.

Clearly there's no way to compare BOM costs that simplify all this behind a guestimate for "camera logic chip."

The iPhone X BOM estimate Mickle previously cited a few months ago suggested that all of the development expenses related to Face ID were somehow covered by a "camera module" that costs $16.70, as if TrueDepth was available off the shelf and Apple just pushed a shopping cart through a Walmart and put 50 million into its basket and then refused to buy another 40 million, because it ended up being so expensive that "some" ended up not buying it. This sort of reporting is not journalism. It's farcical nonsense.

To recap: even if they were ever close to being accurate, BOMs are widely misleading to use in estimating the profit margins of a device, unless you also know their shipping volumes. And nobody today knows how many iPhones Apple will sell, nor what the mix will be. The Journal cited build estimates from UBS, supposedly sourced from the supply chain, but the number of devices Apple builds in advance are not preordained to sell at an equal pace.

Last year, demand for several of Apple's products including the iPhone X and AirPods exceeded Apple's expectations. Across the last three cycles of iPhone 6 through iPhone 8 Plus models, Apple continued to describe its production mix as a learning process, with the demand for larger phones increasingly shifting upward.

Even Apple didn't know this when it placed its first orders, before it began producing them and long before they went on sale. And a few years ago, Apple -- and everyone else -- appeared to think that iPhone 5c would outsell the better but more expensive 5s.

Whenever Apple changes its orders in response to demand -- which happens constantly -- this is reported breathlessly as worrisome and potentially beleaguering. Yet, the same people who report supply chain order changes as alarming are using reports of Apple's purported initial orders as an airtight model for determining demand and component costs before they even go on sale. You can't have it both ways.

At the end of January, the same Journal author Tripp Mickle reported as if factual (based on unnamed sources he described as being "familiar with the matter") that Apple was "slashing planned production" of iPhone X "in a sign of weaker-than-expected demand."

And just like BOMs, he pulled out numbers that were uncritically recited even though they couldn't pass any sort of sobriety test. Mickle fabulously claimed Apple had slashed orders by 50 percent, from "roughly 40 million initially planned" to "about 20 million," before casually adding that "other people familiar with the iPhone supply chain said Apple had cut orders for components used in the iPhone X by 60 percent."

Had this actually occurred, it would have involved a lot of companies simply going out of business. In reality, Apple's suppliers-- even those with significant dependance upon Apple's production of iPhone X-- didn't note experiencing this at all. Even the difference in Mickle's "50 or 60 percent" ballparks would have resulted in $4 billion worth of lost production.

Capturing just how detached from reality Mickle was in his writing, recall that he wrote that "iPhone X was promoted as the smartphone of the future, with features including a sharp, organic light-emitting diode display and facial-recognition technology, but troubles incorporating the new technology led to delays in the manufacturing process, and forced Apple to abandon the use of fingerprints as an option to unlock the phones."

That wasn't true at all. Apple's executives explicitly debunked the idea that the Wall Street Journal picked up and reported as if it were true and supported by some sort of reporting work rather than just a fiction recited as an anecdote posing a historical event.

Yet the fact that the Journal published such cocksure yet farcical reports of iPhone X facing doom because of customers couldn't afford it, or weren't interested in its new technology, or because Apple was fumbling to deliver it is a black eye that is still visible as the same people roll out a story this year that is just as fantastical and untethered to reality, seeking to legitimize absurd BOMs and dubious supply chain checks.

Notably, the idea that last year's iPhone X wasn't selling as well as expected was also recited by Consumer Intelligence Research Partners, which also claimed in January that iPhone 8 was outselling iPhone X, based on survey data. This year, an analyst from the same group was cited by the Journal as contradicting Apple in outlining the idea that iPhone XS and XR were a "Dutch Auction," and being sold like airplane seats to extract the most money from buyers.

After a solid decade of peddling the story that Apple was being pushed out of business by Android, then Samsung, then Xiaomi, then everyone collectively building phones in China, then disinterested customers who can't afford an iPhone X, maybe the Journal needs to hire actual reporters rather than clickbait fabulists concocting tales of doom for Apple, even as it handily outperforms the industry worldwide.

News from Captain Obvious

On one hand, it's fairly obvious that Apple is producing and selling its XS models first-- that's what it announced it would do. But for some reason, Wall Street Journal columnist Tripp Mickle thought it was necessary to source this idea as coming from "people familiar with Apple's production plans," which could correctly be interpreted as "anyone who watched the keynote presentation."It's the opposite of a secret that Apple's less expensive iPhone XR won't become available for another five weeks. The report observed that "the staggered release gives Apple a month to sell the higher-end models without cheaper competition from itself. It also simplifies logistics and retail demands and could strengthen Apple's ability to forecast sales and production of all three models through the Christmas holidays," both ideas it again attributed to "analysts and supply chain experts," rather than Mickle's own predictions.

In 2017, Apple was ready to sell its more conventional iPhone 8 models first, while the all-new iPhone X didn't become available until November. A year ago, this was reported as having a "dampening effect" on iPhone 8 sales as consumers waited for the fancier new model, an idea again repeated by the Journal in an effort to make the mundane sound edgy and incisively critical.

Is Apple holding back iPhone XR deliveries to bamboozle its buyers?

But hold on -- if consumers knew last year that iPhone X was coming and held off on iPhone 8, can't they also manage to wait for the XR (a significantly shorter wait given that it ships in October rather than November as the original X did)?Not in the case of the super-premium iPhone XS, according to Mickle and his partners. After thinking heavily and consulting some "supply chain experts," the paper reported that consumers would be totally fooled by Apple's product availability, and spring into action to buy phones priced at $999 to almost $1500 simply because the $750 XR won't be available for another month.

Apple's marketing chief Phil Schiller cleverly used his body to briefly obscure the prices of new phones during the keynote, leaving customers rushing to the Wall Street Journal to understand what was going on

Of course, the less-cynical explanation is simply that iPhone X shipped later last year because it was an entirely new product, and iPhone XR this year for the same reason. In fact, that's what Apple told the Journal.

Additionally, Apple is already selling even more discounted iPhone 7 and iPhone 8 models starting at $450, so anyone looking for bargains rather than an ultra-premium new device isn't exactly being bamboozled by Apple's straightforward presentation of its offerings.

While iPhone 8 was a significantly new model new last year, it was based upon the previous iPhone 7 design that Apple had a year of experience in assembling -- and much more if you count the lineage back to the iPhone 6. This year's iPhone XS models are similarly improvements upon the iPhone X model Apple has now been building for a year and is experienced with.

The new XR involves an entirely new display based on an advanced LCD panel with an all-new precision backlight designed to illuminate the rounded corners of a rigid display technology rather than wrapping back upon itself as flexible OLEDs can.

The Journal cynicism about Apple's XR release isn't just thrown out as a grumbling editorial. It's presented by the paper as news, complete with nonsensical "sourcing" that involves "supply chain experts," as if to give some credibility back to a pseudoscientific practice that's been less useful than astrology and alchemy in reading Apple's tea leaves with any accuracy.

Dropping the BOM

If that wasn't bad enough, the Journal conjured up another fantasy-data boogeyman to lend credence a completely false premise. What's worse than supply chain experts? How about BOM estimates. You know, those precise numbers that analysts guess up and then are recited as if facts across widespread syndication. I've asked executives about component BOM (bill of materials) estimates, and the answer is always "they're wrong, far too low."Generally, BOM estimates are used almost exclusively against Apple to portray its products as costing far less to build that what the finished goods sell for, with the tone being that profit margins are too high and customer-abusive.

At first glance, this is easy to misinterpret. Unless of course, you're charting out Apple's share of industry profits with the intent of making China's production look profitable, in which case analysts estimate that $30 billion worth of quarterly iPhone revenues only generated about $6 billion in profits.

Apple CEO Tim Cook at a Chinese Foxconn factory.

Here, Mickle uses two BOMs from a source I've never seen BOMs from before: analyst Mehdi Hosseini, with trading firm Susquehanna International Group. Usually, BOMs are generated by a think tank that specializes in putting together these really brainy accounting efforts. Here, an analyst scribbled up BOMS prior to any tear-downs that only materialized on Thursday morning. This is some next level magic-ball gazing.

Hosseini's numbers, supposedly accurate to the dollar, claim that the XR costs $331 to build, while the XS and XS Max supposedly cost $355 and $371.

This is absolutely ridiculous on so many levels it's hard to know where to start. First off, if the two engineering efforts only differ in component costs by $23 dollars, Apple wouldn't be selling them at the prices it set, with the XS a solid $250 higher.

Apple would either be foolishly leaving money on the table with the XR, or radically holding back demand for its best XS models by pricing them as such an unwarranted premium. The reality is-- as has long been known-- that Apple consistently aims to reach a target profit margin, sometimes suppressing its profits to launch new tech, and sometimes riding higher at the tail end of a production as components become cheaper. But Apple simply doesn't have massive shifts of profit margins on this level between its new product offerings.

And if it did, it wouldn't be giving its supposedly massively more profitable XS models with profit margins of $644 and $730 per device a brief window of pre-orders before dropping profitability by a huge degree with the XR -- which would only deliver $420 per device.

If these numbers were real, Apple wouldn't have introduced the iPhone XR at all this month, and would have secretly held it until iPhone XS orders were entirely satiated, then launched it as a cheaper alternative to boost up sales. That's what other companies do all the time. That's what Apple did with the iPhone SE.

Telling us that Apple allocated just five weeks of exclusive XS sales -- when customers know the XR is coming at $750 -- is just insulting. It's about as insulting as telling us that an analyst knows enough about the components and build costs of brand new iPhones before they land in the hands of customers to generate a reliable BOM.

On top of all this, the same author who cited Hosseini's BOM as evidence that the XS and XR only cost Apple a difference of $23 to build wrote a piece for the Wall Street Journal just a few months ago that claimed iPhone X's OLED screen cost "about $97 out of $376 in total estimated cost per device," and then used this fact-from-the-air to claim that its new display was primarily responsible for its $999 price, causing it to cost so much that nobody was buying it.

The same sources who claimed iPhone X was not selling well because of its price are now saying customers won't even notice the price of the iPhone XS

BOM estimates aren't factual numbers

The problem with these BOMs is that they can't possibly be right over any length of time.On a simpler device, such as a commodity PC, you can total up the cost of off-the-shelf components pretty easily. On a proprietary, highly integrated device with custom designed silicon and few commodity parts that aren't customized by Apple in partnership with their makers, there's no way to really know how much parts cost.

That's because the cost per component is related to volume. Nobody really knows exactly how much custom components like the OLED display or the A12 Bionic cost until they result in sales over a period of time, because the cost is related to the volume it eventually ships at, and how fast the prices of those components can be brought down (which is directly related to demand volume).

In Apple's conference calls, even its executives commonly note surprise in the dramatic effects of shifting component costs among commodity parts like DRAM and flash storage. The costs of developing custom silicon and producing chips in volume is complicated by the emergence of unanticipated issues: everything from political squabbles to storms and earthquakes hitting Apple's production partners.

A big part of Apple's efforts involve hedging against component cost shifts. There is no simple price tag on components that can be added up to a neat, precise number that can serve as a foundation for unbridled speculation by journalists -- particularly Mickle, who has a background in sports writing, not technology.

Compare, for example, even the reasonably well-known cost of a rather commodity component such as storage memory chips. You could have generated an estimated BOM for Apple's iPhone 8 and Google's Pixel 2 last year, but in reality the fact that Apple subsequently shipped well over 200 million phones with similar memory chips while Google's partners HTC and LG each shipped a negligible number of smartphones means they couldn't ride the same economies of scale as Apple in even among basic commodity components.

Now consider the custom silicon work both Apple and Google did in creating camera logic chips. Apple built this work into its A11 Bionic and shipped it across 120 million high-end iPhones. Google likely faced higher costs in ramping up its silicon efforts (whereas Apple was continuing custom SoC work it's been doing since 2009), but then wasn't able to amortize these expenses across the scant few million devices it produced, then sold at fire sale pricing with steep discounts.

Clearly there's no way to compare BOM costs that simplify all this behind a guestimate for "camera logic chip."

The iPhone X BOM estimate Mickle previously cited a few months ago suggested that all of the development expenses related to Face ID were somehow covered by a "camera module" that costs $16.70, as if TrueDepth was available off the shelf and Apple just pushed a shopping cart through a Walmart and put 50 million into its basket and then refused to buy another 40 million, because it ended up being so expensive that "some" ended up not buying it. This sort of reporting is not journalism. It's farcical nonsense.

To recap: even if they were ever close to being accurate, BOMs are widely misleading to use in estimating the profit margins of a device, unless you also know their shipping volumes. And nobody today knows how many iPhones Apple will sell, nor what the mix will be. The Journal cited build estimates from UBS, supposedly sourced from the supply chain, but the number of devices Apple builds in advance are not preordained to sell at an equal pace.

Last year, demand for several of Apple's products including the iPhone X and AirPods exceeded Apple's expectations. Across the last three cycles of iPhone 6 through iPhone 8 Plus models, Apple continued to describe its production mix as a learning process, with the demand for larger phones increasingly shifting upward.

Even Apple didn't know this when it placed its first orders, before it began producing them and long before they went on sale. And a few years ago, Apple -- and everyone else -- appeared to think that iPhone 5c would outsell the better but more expensive 5s.

Whenever Apple changes its orders in response to demand -- which happens constantly -- this is reported breathlessly as worrisome and potentially beleaguering. Yet, the same people who report supply chain order changes as alarming are using reports of Apple's purported initial orders as an airtight model for determining demand and component costs before they even go on sale. You can't have it both ways.

This all happened before

Most tellingly, the people involved in this Journal report got it completely wrong last year, even well after Apple shipped its new iPhones and think tanks had months of time and tons of data to process in creating their estimates of what Apple had sold in the previous quarter. Actually in this case they just interviewed 500 people.At the end of January, the same Journal author Tripp Mickle reported as if factual (based on unnamed sources he described as being "familiar with the matter") that Apple was "slashing planned production" of iPhone X "in a sign of weaker-than-expected demand."

And just like BOMs, he pulled out numbers that were uncritically recited even though they couldn't pass any sort of sobriety test. Mickle fabulously claimed Apple had slashed orders by 50 percent, from "roughly 40 million initially planned" to "about 20 million," before casually adding that "other people familiar with the iPhone supply chain said Apple had cut orders for components used in the iPhone X by 60 percent."

Had this actually occurred, it would have involved a lot of companies simply going out of business. In reality, Apple's suppliers-- even those with significant dependance upon Apple's production of iPhone X-- didn't note experiencing this at all. Even the difference in Mickle's "50 or 60 percent" ballparks would have resulted in $4 billion worth of lost production.

Capturing just how detached from reality Mickle was in his writing, recall that he wrote that "iPhone X was promoted as the smartphone of the future, with features including a sharp, organic light-emitting diode display and facial-recognition technology, but troubles incorporating the new technology led to delays in the manufacturing process, and forced Apple to abandon the use of fingerprints as an option to unlock the phones."

That wasn't true at all. Apple's executives explicitly debunked the idea that the Wall Street Journal picked up and reported as if it were true and supported by some sort of reporting work rather than just a fiction recited as an anecdote posing a historical event.

Yet the fact that the Journal published such cocksure yet farcical reports of iPhone X facing doom because of customers couldn't afford it, or weren't interested in its new technology, or because Apple was fumbling to deliver it is a black eye that is still visible as the same people roll out a story this year that is just as fantastical and untethered to reality, seeking to legitimize absurd BOMs and dubious supply chain checks.

Notably, the idea that last year's iPhone X wasn't selling as well as expected was also recited by Consumer Intelligence Research Partners, which also claimed in January that iPhone 8 was outselling iPhone X, based on survey data. This year, an analyst from the same group was cited by the Journal as contradicting Apple in outlining the idea that iPhone XS and XR were a "Dutch Auction," and being sold like airplane seats to extract the most money from buyers.

After a solid decade of peddling the story that Apple was being pushed out of business by Android, then Samsung, then Xiaomi, then everyone collectively building phones in China, then disinterested customers who can't afford an iPhone X, maybe the Journal needs to hire actual reporters rather than clickbait fabulists concocting tales of doom for Apple, even as it handily outperforms the industry worldwide.

Comments

The WSJ writer is incompetent and his reputation is on the line now with the rest of the Rags that report such garbage in attempt to down grade Apple, as well as other companies. No retraction can wipe out the damage these Non-Factual Publications cause to the stock price.

They have not even studied the specs of the phones or products.

They remain Anal-ysts in my opinion.

TomE

Thank you !!

Theses analysts’ predictions are no different that the stock market reports. The market goes up and they pick some positive report from the day to attribute it to. If it goes down, then they find a negative story and do the same.

As the AI story points out, you can find reasons to spin it either way. As a consumer, I really don’t care. People have the information about the new phones. If they’re interested in the Xr and can wait, they’ll wait a few months, if they want the top of the line, then they get it now.

As for the cost estimates, I completely agree. There is no way for anyone to know the production costs of the custom chips Apple uses, or, on a simpler level, even his much it costs to make the metal frames. We know Apple makes a nice profit on their phones, and that part of that profit goes to R&D for next year’s model, just like every manufacturer out there. Again, as a consumer what matters to me is price & value. Is the phone worth the cost. If it is, I buy it.

1. The naysayers' claim is baseless if they don't know for sure that net Profit as a % of ASP is higher for the more expensive phones. If you don't have that data, everything else in that claim is just baseless.

2. If the claim were true, Apple would schedule 'iPhone Cheap' release for a time when 'iPhone Expensive' supply historically usually catches up with the demand which happens about January of each year. Would that be October? Less than a month from main release?!! Many 1st week orders of iPhone Expensive are still shipping in October. So, if we follow your logic, Apple will not succeed because iPhone expensive unshipped ordered will just get cancelled and people will simple buy iPhone Cheap which would then be available. We know that not to be the case.

3. The naysayers' argument would only be true if the most sold iPhone in the period between October and next August (when iPhone Cheap and iPhone Expensive are both in the market) ... ever happens to be iPhone Cheap. Extrapolate data from iPhone 5s and 5c.

4. In what universe does someone wake up in the middle of the night to rush to pay $1500 for something if he could pay $750 with certainty 3 weeks later?

5. If that were true, you'd expect the 64GB (cheapest) variant of the iPhone Expensive to be the first to sell out. But it was not.

6. If the argument is true, it will also be true for iPad Pro 2017 and iPad 2018 (Would the iPad Pro buyer have bought iPad if it was released same time? See how absurd that is?).

Stating the obvious: Apple 1st wave buyers are not driven much by price. Again: Apple first wave buyers ... not driven much by price. Trying to understand Apple 1st wave consumer behaviour (where price plays a low determinative role ) with an Android consumer mindset (where price is probably the main determinant) leads to this kind of absurd abstraction.

if he will be reporting true fact then he will lost his job.

The only one that's remotely accurate was the Newton-killer. Palm, ironically, later buried by iPhone, can legitimately, though posthumously, claim that title.

DED’s article is correct, but misses the point slightly.

They’re getting it wrong deliberately because they’re manipulating the stock price.

The reality is that they sold far less of the premium, in unit sales, than prior premium, top tier, models - and the only reason they were able to claim a 10% increase in sales, is that the iPhone X was 30% higher priced - yet only yielded a 10% boost in revenue numbers?

Do the math. Someone sold over 20% less than they expected.

The only reason why iPhone scored a notch-up in unit numbers, is because iPhone 7 and iPhone 8 remained solid, familiar performers, with the iPhone SE bringing up a solid rear.

It’s all in how Apple words and phrases their success numbers.

But thanks for playing.