Gartner, IDC were both wildly wrong in guessing Apple's Q4 Mac shipments

Two research groups that estimate global PC shipments not only served up incorrect data as fact, but also used the bogus figures to reach entirely false conclusions about Apple's Macs in the global PC market. This isn't the first time they've been so wrong but outlines the lack of accuracy from third-party "sales estimates" as Apple prepares to stop reporting its official sales numbers altogether.

MacBook Air on display at Apple's Tuesday reveal

In the middle of October, Garner and IDC both issued reports on worldwide PC shipments that pretended to portray highly accurate shipment data right down to the individual thousand of PC boxes shipped by each of the world's top five major manufacturers by volume.

The reality is that among the manufacturers they report sales from, none apart from Apple publish verifiable data on their actual shipments. And now that Apple has reported its Mac shipments, it's clear that estimates from Gartner and IDC do not deserve solid confidence.

Garner reported that Apple had sold 4.928 million Macs in calendar Q3, while IDC issued a parallel report that credited Apple with sales of 4.762 million. That's a difference between the two of 166 thousand Macs, something that should have already raised eyebrows. But Apple's actual sales for the quarter were officially reported as 5.3 million. That means third-party "estimates" were off by as much as a double-digit percentage.

Both research groups coach their figures as "channel shipments," the flow of inventory that is independent of actual end sales to consumers or businesses. Quarterly channel shipment estimates would be misleading even if they could be verified as accurate. That's because channel sell-in by vendor doesn't really reflect true market share at all.

If one company ships excessive inventory into the channel without actually selling it, it would appear to be performing better than a company with better inventory management during the quarter. That's not really the case at all.

But it wasn't just that the unit numbers were significantly wrong for Apple. Gartner also presented Apple's PC market share as if it had fallen significantly, and reported Mac shipment growth as having dropped by 8.5 percent over the year-ago quarter. But Apple's Mac sales were actually effectively flat from 5.4 million in the year-ago quarter, even as the overall PC market contracted. So Apple's share of the market actually increased. Everything Gartner reported about Apple was wrong.

IDC similarly reported that both Apple's market share and sales growth had fallen dramatically, penciling in an even steeper drop of 11.6 percent-- and portraying it the worst performing brand in the top five in terms of units. The company even detailed that idea in a press release blurb that stated, "Apple finished the quarter in 5th place, declined over 11%, and was the only top 5 company to underperform the overall market."

As with Gartner's "insight" on Apple, every bit of IDC's take was wrong, too..

With sales of 5.3 million Macs, Apple would have actually been number four ahead of Acer -- assuming Garner was right about that -- and not fifth globally. Further, Apple's sales did not decline by double digits, and it did not underperform the overall market -- which IDC estimated to have fallen by 0.9 percent in shipments.

Gartner and IDC are not just wrong in creating numbers to report. They're wrong in charting out their take of what's actually happening in the industry.

If Gartner and IDC are that wrong about Mac shipments, their PC numbers are even more untrustworthy.

And of course, moving forward into fiscal 2019, Apple will no longer report its Mac and iPad unit sales each quarter. That means the final verifiable data we now have to challenge analyst estimates will be gone. The only way we will know that Apple isn't doomed is if it is still in business.

The direction of the market on a quarterly basis (in terms of unit market share and growth) will also be a huge question mark. The only way we will know that Gartner and IDC have unreliable data is that they've had unreliable data and insight in the past. After all, IDC once predicted that both Windows Phone and Windows Tablets would be hits that crushed the growth Apple's iPhone and iPad, without offering any actual facts supporting the idea either time.

It is pretty clear that the PC market has not been growing, even if the guesswork numbers from Gartner and IDC can't really be relied upon to be factual. But we also know that Gartner and IDC have spent the last decade issuing gerrymandered data to make it look like tablets-- specifically iPads sold by Apple-- weren't having any material, discernible effect on PC sales, undeniably to make Microsoft's Windows business look better than it was.

Both firms have refused to consider iPads to be a "PC," while waffling back and forth over whether other devices are PCs or not. Some of their earlier reports counted Windows Tablet PCs as computers, and the two companies remain at odds over whether Microsoft's latest Surface "detachable" tablet/notebooks are a PC or not.

Gartner counts them, specifically noting that it includes "ultramobile premiums (such as Microsoft Surface) but not Chromebooks or iPads," while IDC states that its figures "do not include Tablets or x86 Servers," adding the unclear phrasing that, "Detachable Tablets and Slate Tablets are part of the Personal Computing Device Tracker but are not addressed in this press release."

That's right, just over a half million units now makes a company a significant U.S. PC maker, at least if you don't count large swaths of devices including Chromebooks sold to K12 and millions of iPads sold globally.

Gartner also presented Microsoft as experiencing growth in its U.S. Surface sales despite only shipping an estimated 11,000 more units than the year-ago quarter. But there's no reason for confidence in Gartner's ability to get Surface numbers correct down to 11 thousand when it clearly didn't count Macs correctly on the scale of hundreds of thousands of units. In fact, Gartner's global Mac units were off by a figure larger than half of all the Surface PCs it guessed were sold in the U.S.

Most notably, the Tom Warren wrote for Verge a cheerleading piece that celebrated the idea that Surface "secured this top spot in the US," noting only that "the company still has some work to do before that position is replicated worldwide." That casual reference of "some work to do" would literally require Microsoft to boost its sales by 400 percent, effectively pushing Acer or Asus out of the top five with more than four million sales each.

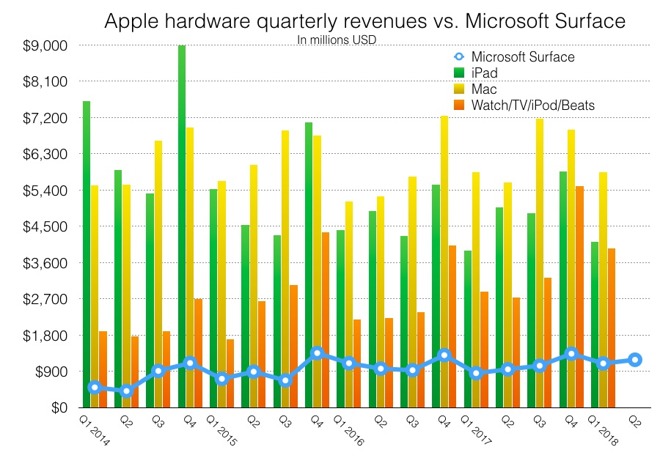

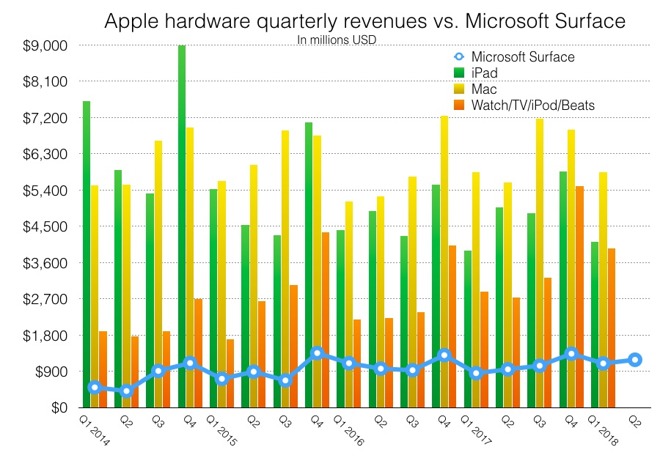

In reality, Surface hasn't effectively grown its sales beyond about a million units over many years of trying. Anyone writing about the PC industry should know that and should be able to push back on questionable data from one research group that has spent its entire existence buttering up Microsoft's image.

Instead, Warren simply repeated Gartner's data as if it were unassailable facts, making up an excuse for the wild divergence between its guesswork and IDC's by explaining that the two count Windows-based tablets and Chromebooks differently. That doesn't explain, however, why the two delivered such a huge difference in Mac sales, as Apple makes neither Windows-based tablets nor Chromebooks, and the Verge ostensibly is aware of that.

And while Warren made a big deal about Surface and its 602,000 units breaking into the U.S. "top five," he didn't even mention Apple's figures or the huge discrepancy between the two firms, instead only repeating their incorrect conclusions with the statement that "there has been an increasing consolidation towards top PC makers like Lenovo, HP, and Dell recently, with Apple, Acer, and Asus all losing share of the market to others" [emphasis ours].

That's purely false in regards to Apple, both for the quarter and as a general trend. Over the last several years, Apple's Mac sales have resisted the implosion in demand experienced by PC makers, even as Apple has also sold millions of iPads, a product that has undeniably had a competitive impact on PC sales, both in sales to consumers and in the enterprise.

I previously reported that both firms had reported Apple's U.S. Mac sales as falling year-over-year when in reality Apple noted that its sales had experienced double-digit growth in the U.S. and other regions.

And of course, if both firms hadn't worked so hard to exclude Apple's tablets from their figures of PCs which had always included tablets until Apple started making iPads, they'd have to recognize Apple as regularly being the largest computer maker globally. Despite much media handwringing about Apple's year-over-year decrease in iPad sales back in 2014, the company has continued to sell a leading volume of millions of tablets each quarter.

In Q2, Apple sold 11.5 million -- more than Samsung, Lenovo, and Huawei (the next three largest vendors, according to IDC) combined. Apple's iPad sales are segregated away into tablets by some research firms to avoid comparisons with PC shipments, but they remain strong enough for even IDC to be forced to recently admit that iPads are "leading the tablet market 'unabated.'"

Canalys is one market research company that does report combined sales of PCs and tablets without excluding iPads. Starting in Q1 2014, Canalys noted that Apple was the largest global vendor of computers, with Lenovo in second place and HP, Samsung, and Dell nearly tied for third place, with each selling about half the total number of computing devices (not including phones or iPods) as Apple.

Apple's chief executive Tim Cook again noted at the company's most recent event that it sells more iPads every year than every PC maker's sales of notebooks. But it's a big, valuable business to create figures and text that portray the opposite of reality and to report these as fact, even when the people who do this know-- or should know-- that they are not being honest.

MacBook Air on display at Apple's Tuesday reveal

In the middle of October, Garner and IDC both issued reports on worldwide PC shipments that pretended to portray highly accurate shipment data right down to the individual thousand of PC boxes shipped by each of the world's top five major manufacturers by volume.

The reality is that among the manufacturers they report sales from, none apart from Apple publish verifiable data on their actual shipments. And now that Apple has reported its Mac shipments, it's clear that estimates from Gartner and IDC do not deserve solid confidence.

Garner reported that Apple had sold 4.928 million Macs in calendar Q3, while IDC issued a parallel report that credited Apple with sales of 4.762 million. That's a difference between the two of 166 thousand Macs, something that should have already raised eyebrows. But Apple's actual sales for the quarter were officially reported as 5.3 million. That means third-party "estimates" were off by as much as a double-digit percentage.

Both research groups coach their figures as "channel shipments," the flow of inventory that is independent of actual end sales to consumers or businesses. Quarterly channel shipment estimates would be misleading even if they could be verified as accurate. That's because channel sell-in by vendor doesn't really reflect true market share at all.

If one company ships excessive inventory into the channel without actually selling it, it would appear to be performing better than a company with better inventory management during the quarter. That's not really the case at all.

But it wasn't just that the unit numbers were significantly wrong for Apple. Gartner also presented Apple's PC market share as if it had fallen significantly, and reported Mac shipment growth as having dropped by 8.5 percent over the year-ago quarter. But Apple's Mac sales were actually effectively flat from 5.4 million in the year-ago quarter, even as the overall PC market contracted. So Apple's share of the market actually increased. Everything Gartner reported about Apple was wrong.

IDC similarly reported that both Apple's market share and sales growth had fallen dramatically, penciling in an even steeper drop of 11.6 percent-- and portraying it the worst performing brand in the top five in terms of units. The company even detailed that idea in a press release blurb that stated, "Apple finished the quarter in 5th place, declined over 11%, and was the only top 5 company to underperform the overall market."

As with Gartner's "insight" on Apple, every bit of IDC's take was wrong, too..

With sales of 5.3 million Macs, Apple would have actually been number four ahead of Acer -- assuming Garner was right about that -- and not fifth globally. Further, Apple's sales did not decline by double digits, and it did not underperform the overall market -- which IDC estimated to have fallen by 0.9 percent in shipments.

Gartner and IDC are not just wrong in creating numbers to report. They're wrong in charting out their take of what's actually happening in the industry.

Wrong on Macs

The fact that Gartner and IDC were both so wrong about Apple's Mac sales is particularly shocking because Apple reports its Mac shipments every quarter, making it easier to refine the model that analysts use to make their sales projections. No other PC maker issues verified sales data every quarter, meaning there's no way for outside estimates to check their own math against reality.If Gartner and IDC are that wrong about Mac shipments, their PC numbers are even more untrustworthy.

And of course, moving forward into fiscal 2019, Apple will no longer report its Mac and iPad unit sales each quarter. That means the final verifiable data we now have to challenge analyst estimates will be gone. The only way we will know that Apple isn't doomed is if it is still in business.

The direction of the market on a quarterly basis (in terms of unit market share and growth) will also be a huge question mark. The only way we will know that Gartner and IDC have unreliable data is that they've had unreliable data and insight in the past. After all, IDC once predicted that both Windows Phone and Windows Tablets would be hits that crushed the growth Apple's iPhone and iPad, without offering any actual facts supporting the idea either time.

It is pretty clear that the PC market has not been growing, even if the guesswork numbers from Gartner and IDC can't really be relied upon to be factual. But we also know that Gartner and IDC have spent the last decade issuing gerrymandered data to make it look like tablets-- specifically iPads sold by Apple-- weren't having any material, discernible effect on PC sales, undeniably to make Microsoft's Windows business look better than it was.

Both firms have refused to consider iPads to be a "PC," while waffling back and forth over whether other devices are PCs or not. Some of their earlier reports counted Windows Tablet PCs as computers, and the two companies remain at odds over whether Microsoft's latest Surface "detachable" tablet/notebooks are a PC or not.

Gartner counts them, specifically noting that it includes "ultramobile premiums (such as Microsoft Surface) but not Chromebooks or iPads," while IDC states that its figures "do not include Tablets or x86 Servers," adding the unclear phrasing that, "Detachable Tablets and Slate Tablets are part of the Personal Computing Device Tracker but are not addressed in this press release."

Embarrassingly desperate flattery

This all makes it particularly absurd that Gartner fixated its own press release on Surface, extolling Microsoft as the "fifth place PC vendor" in the U.S. during the quarter, with sales of 602,000 machines.That's right, just over a half million units now makes a company a significant U.S. PC maker, at least if you don't count large swaths of devices including Chromebooks sold to K12 and millions of iPads sold globally.

Gartner also presented Microsoft as experiencing growth in its U.S. Surface sales despite only shipping an estimated 11,000 more units than the year-ago quarter. But there's no reason for confidence in Gartner's ability to get Surface numbers correct down to 11 thousand when it clearly didn't count Macs correctly on the scale of hundreds of thousands of units. In fact, Gartner's global Mac units were off by a figure larger than half of all the Surface PCs it guessed were sold in the U.S.

Uncritical support for bad data

Despite issuing numbers that were so off base that they portrayed the very direction of the market and of individual companies incorrectly, numbers issued by the two companies were picked up and presented as fact by a variety of tech blogs.Most notably, the Tom Warren wrote for Verge a cheerleading piece that celebrated the idea that Surface "secured this top spot in the US," noting only that "the company still has some work to do before that position is replicated worldwide." That casual reference of "some work to do" would literally require Microsoft to boost its sales by 400 percent, effectively pushing Acer or Asus out of the top five with more than four million sales each.

In reality, Surface hasn't effectively grown its sales beyond about a million units over many years of trying. Anyone writing about the PC industry should know that and should be able to push back on questionable data from one research group that has spent its entire existence buttering up Microsoft's image.

Instead, Warren simply repeated Gartner's data as if it were unassailable facts, making up an excuse for the wild divergence between its guesswork and IDC's by explaining that the two count Windows-based tablets and Chromebooks differently. That doesn't explain, however, why the two delivered such a huge difference in Mac sales, as Apple makes neither Windows-based tablets nor Chromebooks, and the Verge ostensibly is aware of that.

And while Warren made a big deal about Surface and its 602,000 units breaking into the U.S. "top five," he didn't even mention Apple's figures or the huge discrepancy between the two firms, instead only repeating their incorrect conclusions with the statement that "there has been an increasing consolidation towards top PC makers like Lenovo, HP, and Dell recently, with Apple, Acer, and Asus all losing share of the market to others" [emphasis ours].

That's purely false in regards to Apple, both for the quarter and as a general trend. Over the last several years, Apple's Mac sales have resisted the implosion in demand experienced by PC makers, even as Apple has also sold millions of iPads, a product that has undeniably had a competitive impact on PC sales, both in sales to consumers and in the enterprise.

This all happened before

Gartner and IDC have previously issued "preliminarily" numbers that didn't match Apple's actual sales. But the two have also detailed their own private estimates in submarkets (such as within the U.S.) where Apple doesn't break down detail. For years, Apple has reported global units by segment (Macs, iPads, etc) and regional sales by revenue, but not specific unit sales by region.I previously reported that both firms had reported Apple's U.S. Mac sales as falling year-over-year when in reality Apple noted that its sales had experienced double-digit growth in the U.S. and other regions.

And of course, if both firms hadn't worked so hard to exclude Apple's tablets from their figures of PCs which had always included tablets until Apple started making iPads, they'd have to recognize Apple as regularly being the largest computer maker globally. Despite much media handwringing about Apple's year-over-year decrease in iPad sales back in 2014, the company has continued to sell a leading volume of millions of tablets each quarter.

In Q2, Apple sold 11.5 million -- more than Samsung, Lenovo, and Huawei (the next three largest vendors, according to IDC) combined. Apple's iPad sales are segregated away into tablets by some research firms to avoid comparisons with PC shipments, but they remain strong enough for even IDC to be forced to recently admit that iPads are "leading the tablet market 'unabated.'"

Canalys is one market research company that does report combined sales of PCs and tablets without excluding iPads. Starting in Q1 2014, Canalys noted that Apple was the largest global vendor of computers, with Lenovo in second place and HP, Samsung, and Dell nearly tied for third place, with each selling about half the total number of computing devices (not including phones or iPods) as Apple.

Apple's chief executive Tim Cook again noted at the company's most recent event that it sells more iPads every year than every PC maker's sales of notebooks. But it's a big, valuable business to create figures and text that portray the opposite of reality and to report these as fact, even when the people who do this know-- or should know-- that they are not being honest.

Comments

I only recall them doing that on a few occasions. They mostly announce milestones, like the recent 100 million Mac installed base.

“Both research groups coach their figures“

Did you mean “couch their figures “?

I can see Apple’s strategy here as they choose to be less transparent as unit sales decline and price increases make up for the difference. After all, winning on market share can still be a very unprofitable venture that is not sustainable.

By still showing unit sales figures and adding this visibility such things as Apple Watch sales, Apple shows an honest reality to shareholders. It helps them understand how Apple is going up market and the success of various business lines. It also allows them to hold the board and management team accountable. By choosing to not be opaque, Apple has an opportunity to lead here - doing so by example. I hope they they reconsider their stance. Shareholders can and should bring this as a requirement. As consumers of their product, we should also expect nothing less.

First, a product is turned into a category ‘ipads’*, while a seperate category “notebooks” (which appeared in the slide’s title) is broken into brands to misdirect. Also, I feel like there was a notebook brand missing. I can’t quite put my finger on it.....

*it does show that Apple is selling a lot of iPads, but if all those columns to the right of them were stacked it wouldn’t fit the narrative Cook was attempting to shape. He doesn’t own an RDF.

anyway, back on topic, what What NHT and Soli said.

while the Anal_ists (no mispelling) are good at what they do they really don’t know. So why give them something to guess on. It’s revenue vs revenue and profit Vs profit that counts Not how many or ASP

As a general rule, all Apple services require an Apple device. If you don’t own an Apple device you are unlikely to use Apple services. Apple Music on android is about the only one I can think of off hand, and I bet that isn’t that popular.

Moving hardware prices up into the Burberry market, and the limits that places on hardware growth, ultimately threatens services revenue growth. You can only extract additional revenue from existing hardware owners to a point. Ultimately in Apple’s business model, hardware purchases have to expand to also grow services revenue.

Your second claim is also ludicrous, as customers of the units have no bearing in this conversation between corporation and investor. I suspect you are only a consumer and this comment is the tip-off.

It's true, but with an important caveat. In his article "Lasts Longer" http://www.asymco.com/2018/09/13/lasts-longer/ , Horace Diedu points out the error of thinking about Apple in terms of "market share" rather than "installed base". Robert Paul Leitao put it this way recently on ped30.com:

"The violent sell-off in Apple illustrates a clear and pervasive misunderstanding of Apple’s emerging revenue model and a knee-jerk unwillingness to forego conventional approaches to the valuation of the company.

Apple has entered a “post-iPhone era” in which revenue and profit growth will be driven less by reported device unit sales and more by an expanding global base of device owners leveraging the most advanced eco-system of devices and services on the planet.

The robust global market for pre-owned iPhones through both formal and informal channels is not reflected in Apple’s quarterly unit sales. It is, however, reflected in the fast growth of Services revenue.

Nothing about Apple’s fundamentals has changed. The company reported record September quarter revenue, net income and earnings per share. Despite very heavy forex pressures, management is guiding to the highest quarterly revenue in the company history in the December quarter which will deliver record quarterly revenue, net income and earnings per share (again)."

So it's NOT true that "Moving hardware prices up into the Burberry market, and the limits that places on hardware growth, ultimately threatens services revenue growth." At least not for Apple.

Agreed. This is a great article that goes to into that.

https://www.aboveavalon.com/notes/2018/10/22/the-gray-markets-impact-on-iphone-pricing

Actually, I now think you may have been commenting on my post....

Tim: "Sales are up. Luca?"

Luca: "Yes, sales are up!"

Tim: "We won't be taking questions this time. Thanks for listening in! Goodbye, everyone!"