Citigroup bailed on Apple Card because of worries about profits

Citigroup was in the running to become the U.S. financial partner for the Apple Card, but abandoned the effort late into negotiations because of worries about "acceptable profit," a report claimed on Tuesday.

Other interested bidders included Barclays, Synchrony and JP Morgan Chase, said CNBC, citing multiple sources. Citigroup's exact worries were unmentioned, but it's suggested that the Apple Card may have been unattractive because of a lack of fees, the potential for lower interest rates, and app-based features that help people avoid debt or pay it down faster.

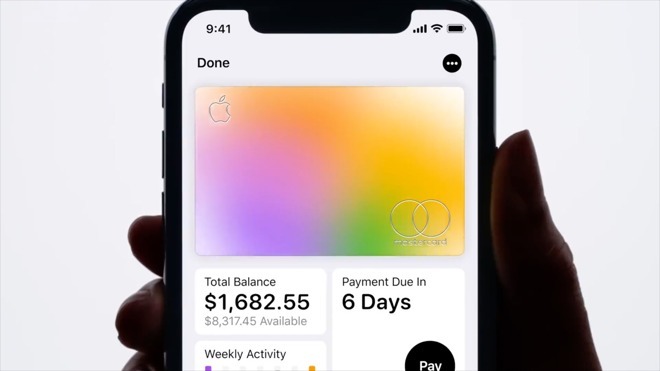

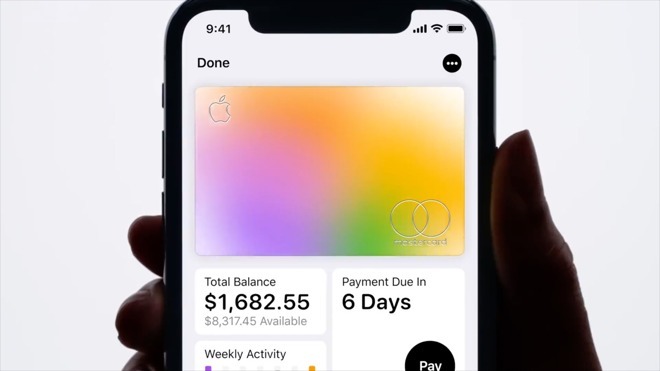

Apple introduced the Apple Card at its March 25 press event, partnering with Goldman Sachs. The card should launch in the U.S. sometime this summer, and while it will primarily be digital -- letting people do same-day signups on their iPhone -- there will also be a real-world titanium version that links with Apple's Wallet app via NFC.

The Apple Card will in fact be Goldman Sachs' first-ever credit card, a move into consumer finance intended to offset declining trading revenues. That should in fact make it a safer bet versus Citi, CNBC suggested, since it doesn't have to overhaul any technology or jeopardize existing profit streams. At the same time, it will suddenly have to serve millions of card customers, and doesn't have any experience in the field.

"Goldman Sachs seeks to disrupt consumer finance by putting the customer first," claimed a spokesman. "We are excited for customers to use Apple Card, which is designed to help people take control of their financial lives."

Other interested bidders included Barclays, Synchrony and JP Morgan Chase, said CNBC, citing multiple sources. Citigroup's exact worries were unmentioned, but it's suggested that the Apple Card may have been unattractive because of a lack of fees, the potential for lower interest rates, and app-based features that help people avoid debt or pay it down faster.

Apple introduced the Apple Card at its March 25 press event, partnering with Goldman Sachs. The card should launch in the U.S. sometime this summer, and while it will primarily be digital -- letting people do same-day signups on their iPhone -- there will also be a real-world titanium version that links with Apple's Wallet app via NFC.

The Apple Card will in fact be Goldman Sachs' first-ever credit card, a move into consumer finance intended to offset declining trading revenues. That should in fact make it a safer bet versus Citi, CNBC suggested, since it doesn't have to overhaul any technology or jeopardize existing profit streams. At the same time, it will suddenly have to serve millions of card customers, and doesn't have any experience in the field.

"Goldman Sachs seeks to disrupt consumer finance by putting the customer first," claimed a spokesman. "We are excited for customers to use Apple Card, which is designed to help people take control of their financial lives."

Comments

This is the best ad for a financial product I’ve ever seen!

Hopefully I'm wrong because at the end of the day it's average people that could be affected. Maybe Goldman has cha-

"Goldman Sachs seeks to disrupt consumer finance by putting the customer first," claimed a Goldman Sachs spokesman. "We are excited for customers to use Apple Card, which is designed to help people take control of their financial lives."

↑↑ Should put everybody on edge.

USA Today, May 9, 2019

Before people start screaming about this being political, just think about what AI is saying in this article about Citigroup. Credit Card companies are today's LEGAL loansharks and very few people in our government are doing anything to stop it.

"Goldman Sachs seeks to disrupt consumer finance by putting the customer first," claimed a Goldman Sachs spokesman. "We are excited for customers to use Apple Card, which is designed to help people take control of their financial lives."

At least there is one company trying to buck the trend. I'm sure Goldman Sachs and Apple are still making some money on this deal but like medical insurance companies, there's no reason why credit cad companies should be making a vulgar amount of money doing practically nothing.

They should cap interest rates of those dollar mart or similar outfit ads for "20 dollar for 1000l payday loan instead. Barking on the wrong tree IMHO.

Back in the day before you could make electronic payments, we use to have Citibank for our American Airline CC. My wife used it all the time for work travel so we always paid it off. All of a sudden we started get hit with interest even though we paid in full. Call them up ask why, they said the payment was late, like by a day and some times longer depending which day in the week the due date fell. Even though we always paid the bill ~3 days before it was due, i.e. dropped it in the mail at the post office, just like all our other CC and bills. For some reason Citibank was the only one arriving late.

What I eventually figure out, Citibank did not consider it paid until they deposited your check, so if the due date was Saturday and they did not deposit it Friday when the payment arrived and deposited it Monday you got nails for 2 days of interest, plus of the entire next billing cycle you were charge interest for the average daily balance. So we backup the payment day to 5 days or made sure if would arrive 2 days prior to a weekend due date. But the problem persisted, I complained to them and informed them US law considers a bill paid based on the post mark on the envelop not when it arrives at their processing facility (since US mail at the time could be delayed for lots of reason consumers were not to be penalize for late payment if it was post marked prior to the payment due date). When I ask them to what the post mark was on the envelop they claim they did not have it as far as they were concern it was late. At this point I dumped them as CC company and never looked back.

I had second run in with them which I had not choice in. I had Employee Stock Purchase Plan with a company I worked at and Smith Barney was the holding company for the stock and Citibank bought them a few years into the plan. Once Citibank took over, it took forever to get my money when I sold stock. Smith Barney use to allow electronic deposit of funds at no cost, when Citibank took over, they would charge you $50 to do deposit wire transfer. When you are only making sometimes a few hundred on a ESPP transaction it was not worth giving Citibank $50, so they would mail you a check. Those check would take 2 to 3 weeks to get, even though it only takes 3 days to clear the stock transaction. I caught them sitting on the check, they used a stamping machine and it dates the envelop when they put on the stamp. Many times the envelops were stamped 3 to 4 days after the sale as you would expect, but the check would not arrive for a week or two later. When called on this they blamed the post office.

Citibank most likely passed on the deal because Apple would have held them to a higher standard, and Apple would encourage people to pay off the card.

The reason CC interest rates are high due is to the fact it is unsecure loan of money that any one can walk away from and people do every day. If you are willing to pay high interest rate on a card to helping those who choose to walk way from their debts.

Stop expecting the government to fix your problem, learn how to manage money.

This is why interest rates are high

The problem with their whole act is there are tons of pathetic people who actually think like this.

How about: Personal Responsibility. GASP! Don't fucking use a credit card and not pay it off assholes!

I was talking about people using other people's money to buy things that does not have value and as soon as you buy it loses most of it value it is had any value. No one is complaining about interest rates on mortgages. As I said if you paying interest in a CC you buying things you can not afford in the first place. You do not need to come from money to get ahead, my parents taught me to buy want you can afford, and save for what you want. I taught both my kids this and they both have CC and neither carry balances on their CC both are in their early 20"s

It wasn't hard to go to Chase Online and set it up to pay off the balance every month automatically. Then you don't get into that hole. Back in my younger days, I would have a big balance on my credit cards and Interest always added. Only paid so much and it would barely drop down. Other than what I added to my Amazon Chase card this month, I don't owe anything on any of my credit cards. That debt hanging over your head month after month sucks. Only spend what you can afford and pay it off every month. No need to keep up with the Joneses.

The government is simply trying to stop as many cheaters as they can, something we pay taxes for. Of course, some people feel it's ok to cheat others as well as to blatantly steal from others (declaring bankruptcy is another one of those legal ways to not pay people what they are owed and is usually done by people with a lot of money).

You can continue to deflect from what's being presented with your comments or look at what's really going on and come up with constructive comments.

In no way is that living beyond my means or anything else. It's me getting cashback or miles or whatever card I am on at the time in return for not needing cash on hand. And it's more secure than a debit card if someone skims it. So just looking at a stat about what percent of people are using cards for basic necessities doesn't tell the entire story.