Apple Card opened up to more users ahead of official launch

Apple has increased the number of people who can sign up for Apple Card ahead of its official launch, with more iPhone users now able to apply for the credit card from their devices.

On Monday Apple started sending out invitations to a preview program for Apple Card, allowing a select number of customers to sign up and use the credit card before a public launch in the United States later this month. At the time, it was advised interested parties could sign up for notifications for when the card would be available for application in the future.

According to tips from AppleInsider readers, it appears that the application process is not limited to just those included in the preview program. Eight readers said that they were able to apply for the Apple Card from their devices on Wednesday and Thursday morning, without getting the invitation in advance.

Sources inside Apple not authorized to speak on behalf of the company confirmed the expansion to AppleInsider, and added that a full release is yet to come.

In both instances, the readers followed Apple's guide to signing up involving accessing the Wallet app, pressing the Plus button to add a card, and saw the option for Apple Card. After verifying their identity and providing other details relating to the application process, they were then approved, with one claiming it took "about 10 seconds" to go through.

The readers were also asked if they wanted a physical card, then after verifying their address, were informed they would receive their card in three to five days time. Apple Card, produced in partnership with Goldman Sachs, is a digital-first card, with the physical card allowing the service to be used with retailers that do not yet support contactless Apple Pay payments.

The card is open to US citizens or lawful residents aged 18 or over, are using an iPhone compatible with Apple Pay, are using the latest version of iOS, and can pass the card's background checks.

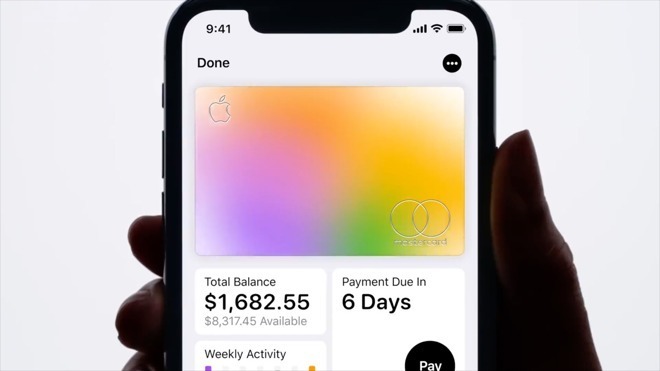

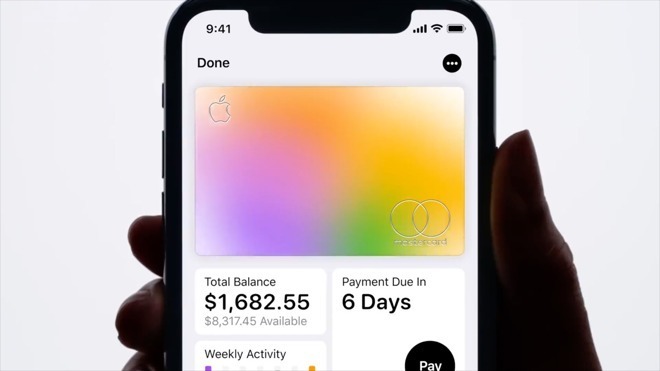

Along with the promise of a competitive interest rate, a considerable reduction of fees compared with other credit cards, and Daily Cash rewards for spending, Apple Card aims to offer a better customer experience, including showing spending habits within the Wallet app and highlighting how much and when a customer should pay what they owe.

On Monday Apple started sending out invitations to a preview program for Apple Card, allowing a select number of customers to sign up and use the credit card before a public launch in the United States later this month. At the time, it was advised interested parties could sign up for notifications for when the card would be available for application in the future.

According to tips from AppleInsider readers, it appears that the application process is not limited to just those included in the preview program. Eight readers said that they were able to apply for the Apple Card from their devices on Wednesday and Thursday morning, without getting the invitation in advance.

Sources inside Apple not authorized to speak on behalf of the company confirmed the expansion to AppleInsider, and added that a full release is yet to come.

In both instances, the readers followed Apple's guide to signing up involving accessing the Wallet app, pressing the Plus button to add a card, and saw the option for Apple Card. After verifying their identity and providing other details relating to the application process, they were then approved, with one claiming it took "about 10 seconds" to go through.

The readers were also asked if they wanted a physical card, then after verifying their address, were informed they would receive their card in three to five days time. Apple Card, produced in partnership with Goldman Sachs, is a digital-first card, with the physical card allowing the service to be used with retailers that do not yet support contactless Apple Pay payments.

The card is open to US citizens or lawful residents aged 18 or over, are using an iPhone compatible with Apple Pay, are using the latest version of iOS, and can pass the card's background checks.

Along with the promise of a competitive interest rate, a considerable reduction of fees compared with other credit cards, and Daily Cash rewards for spending, Apple Card aims to offer a better customer experience, including showing spending habits within the Wallet app and highlighting how much and when a customer should pay what they owe.

Comments

With a squeaky clean credit rating of 780 and income over 100K, I got the top interest rate of 23.99% and 8K limit.

When I set it up, the pre-entered address was outdated and I had to correct it, I’m also a Permanent Resident as opposed to a Citizen, after clicking “no” to “are you a US citizen?” I then had to photograph both sides of my driving license.

They are giving people with almost perfect credit the highest possible interest rate - they obviously don’t have this approval process working quite right!

Also, I’ve updated Apple Watch to the latest version and the option to add Apple Card from iPhone to Apple Watch appears in the Watch app settings. However, it’s not working! I’m unable to successfully add it to Apple Watch right now.

edit: Also got an email from Apple saying there were changes to my billing information even though all my information was up to date. All they added was the Apple Card Balance and the Apple Cash Balance. When I added a bank account it gave me the option to use the same one I had for Apple Cash. Everything went nice and easy.

The card associated with your Apple ID was changed to the new one.

I don't think that income has any effect on the rate. My suspicion is that they use more for targeted marketing than for credit worthiness decisions.

Yes, you do get the option to order the physical card. Verified.

For the people who have theirs, I’m curious - Is getting a physical card optional? Also, a previous thread stated that the card wasn’t compatible with Quicken and other financial software. Can anyone confirm or refute that?