Losing your iPhone makes paying off Apple Card a hassle

Apple Card, like any service that lives solely on iPhone, becomes a major inconvenience when a device is lost or stolen, with users in some cases forced to contact customer service to perform essential tasks like paying off their balance.

Apple Card is Apple's answer to traditional and sometimes complicated credit card solutions. It is also a product that promises to make the iPhone and its accompanying iOS device ecosystem much more sticky.

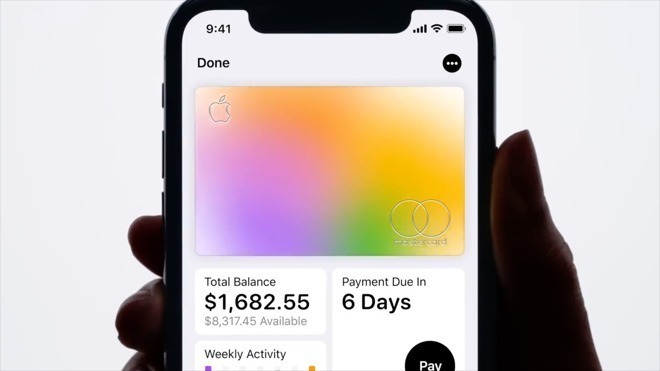

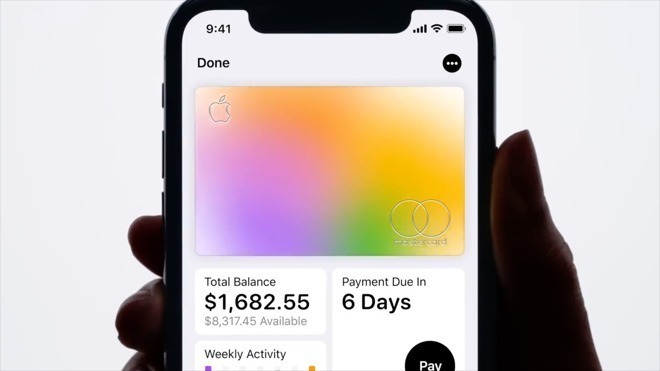

Similar to Apple Pay, Wallet is the hub through which Apple Card functions. From here users can manage card preferences, view recent purchases, peruse past statements, quickly see spending breakdowns, calculate payments and more. And for now, it's only available on iOS.

The process is not only feature-rich, but -- with no alternative means of accessing card data -- extremely secure. Therein lies the rub.

As noted by BuzzFeed News, Apple currently restricts most actions to Wallet, including paying off an existing balance. With no online alternative, misplacing, losing or having an iPhone stolen means users are stripped of access to Apple's lone avenue of account management.

According to an Apple Support representative, Apple Card holders without their primary device can access Wallet on another iOS device or call Apple Support to speak with an Apple Card specialist from card issuer Goldman Sachs. To make a payment, users will need to furnish their name, date of birth, last four digits of their Social Security number and the phone number tied to the account, the report said.

Alternatively, activating payment scheduling can lower the risk of incurring interest charges until the iPhone is returned or a new handset is purchased.

A hassle, yes, but for some the price is worth paying for effective account security.

Apple Card is slowly rolling out to early adopters in the U.S. as part of a product preview that began last week. Launched in partnership with Goldman Sachs and Mastercard, Apple's offering is touted as a novel credit card product that offers unique features like Daily Cash and easy to understand payment breakdowns.

Apple Card is Apple's answer to traditional and sometimes complicated credit card solutions. It is also a product that promises to make the iPhone and its accompanying iOS device ecosystem much more sticky.

Similar to Apple Pay, Wallet is the hub through which Apple Card functions. From here users can manage card preferences, view recent purchases, peruse past statements, quickly see spending breakdowns, calculate payments and more. And for now, it's only available on iOS.

The process is not only feature-rich, but -- with no alternative means of accessing card data -- extremely secure. Therein lies the rub.

As noted by BuzzFeed News, Apple currently restricts most actions to Wallet, including paying off an existing balance. With no online alternative, misplacing, losing or having an iPhone stolen means users are stripped of access to Apple's lone avenue of account management.

According to an Apple Support representative, Apple Card holders without their primary device can access Wallet on another iOS device or call Apple Support to speak with an Apple Card specialist from card issuer Goldman Sachs. To make a payment, users will need to furnish their name, date of birth, last four digits of their Social Security number and the phone number tied to the account, the report said.

Alternatively, activating payment scheduling can lower the risk of incurring interest charges until the iPhone is returned or a new handset is purchased.

A hassle, yes, but for some the price is worth paying for effective account security.

Apple Card is slowly rolling out to early adopters in the U.S. as part of a product preview that began last week. Launched in partnership with Goldman Sachs and Mastercard, Apple's offering is touted as a novel credit card product that offers unique features like Daily Cash and easy to understand payment breakdowns.

Comments

OMG, say it isn't so! How will someone be able to contact customer service is they don't have their phone!

a month to replace it.

Thank you.

It is so standard and so common that, for most people, its like assuming that the car they are buying has an engine or steering wheel. You shouldn't have to ask.

You are far from alone in that being a deal breaker.

I prefer to pay bills by having my bank perform an ACH transaction for the specified amount. Plus, I avoid linking in any way my bank account to anything -- even my iPhone.

I think it would be great if paying through your phone was an option. But making it the ONLY option is pretty restrictive.

just enter your banks routing information and account number, save and its there. You can add multiple bank accounts. the card arrives in about 4 days.

just enter your banks routing information and account number, save and its there. You can add multiple bank accounts. the card arrives in about 4 days.

I'd be interested in somebody with the card reviewing what accessing Setting > Wallet on an iPad reveals. I'd like to see Apple put the Wallet app on the iPad (along with the Activity app).

I think this is infomercial level of inconvenience, and while accurate, it borders on FUD. For 99.993146% of users, the loss of the phone far outweighs the possibility of not making a credit card payment.

Bank auto-bill pay? Not on my dressing. First, picking a value for the minimum payment will vary with the balance. Second, it's not a consideration if you don't carry a balance, which at many of the interest rates being given, would be prudent. Third, while I use auto-bill pay for subscriptions and paying off the monthly balance on my cards, I'd never allow a company or corporation (except my bank, natch) to debit my account. I tell my bank who to pay and how much and they just do it. I've heard to many horror stories about companies accidentally double or triple billing, or failing to cancel billing when a customer terminated a service. So I'll just avoid those hoops from the jump.

I have a spare backup phone, should disaster strike. What I don't know is if activating it and signing into iCloud gets me all my Wallet information. Of all the things to worry about, this is not on my Worry List.