JPMorgan to shut down Chase Pay app in early 2020

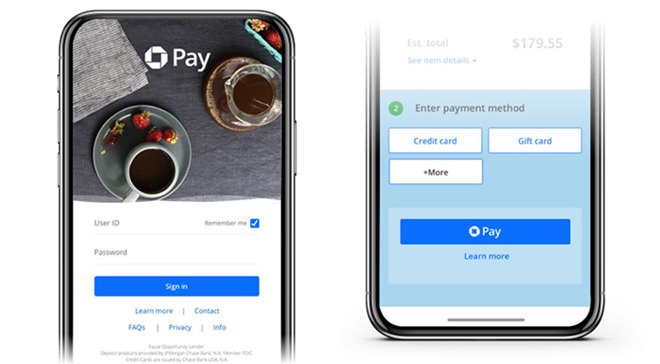

JPMorgan Chase on Wednesday notified customers of its Chase Pay mobile payments solution that the service will soon be unavailable for in-store use, leaving a once-touted payments platform dead on a road already littered with failed products.

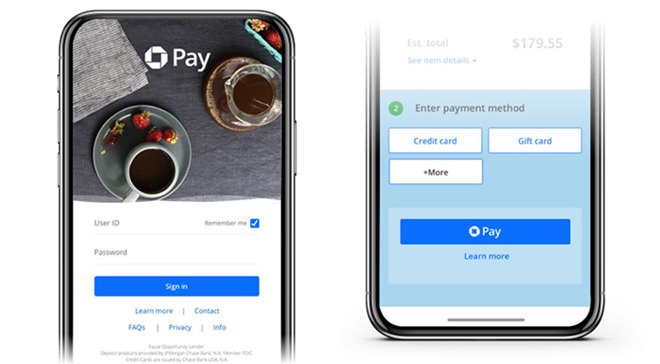

Starting in early 2020, Chase Pay customers will no longer be able to use the smartphone app at physical point-of-sale terminals, according to an announcement posted to the platform's dedicated website. Chase plans to continue processing purchases made online and through supported apps.

JPMorgan began to notify existing customers of the change via email, reports Bloomberg.

The demise of Chase Pay, at least in stores, ends a four-year experiment in mobile payments that began life in 2015 through a partnership with the Merchant Customer Exchange. At the time, Chase elected to integrate MCX's now-defunct CurrentC platform to create a smartphone app that replaced credit cards with scannable barcodes.

CurrentC failed to gain traction and was ultimately killed off after a brief beta period in June 2016. Nine months later, JPMorgan snapped up the platform and other FinTech assets from MCX.

"When we started this, it was four years ago -- the payment space has changed a lot over the period of time and customer behavior has changed," Chase Pay chief Eric Connolly told the publication. "A lot of merchants have shifted to buy online, pick up in store' and have invested in their online presence and their apps."

Chasing the money, Chase Pay is refocusing efforts on web and app payments. As noted by Bloomberg, however, an industry study by website PYMNTS.com estimates JPMorgan's solution was accepted by fewer than 1% of online merchants at the end of the June quarter. The bank believes Chase Pay will grow its share of the market and on Wednesday announced upcoming support from GrubHub and its portfolio company LevelUp, the Chase Center app and more than 60,000 merchants in the Big Commerce network.

"We continue to focus on our customers and they are using the Chase Pay button on merchant websites and in merchant apps, and now their tap-to-pay Chase cards more than ever," Connolly said in a prepared statement. "So, we're shifting our focus to expand Chase Pay's presence in more merchant apps and websites."

As competing payments platforms struggle to gain footing, Apple Pay continues to increase its slice of the market. Morgan Stanley analysts in July called Apple's solution "the clear leader among app/phone-based digital wallets," noting high year-over-year growth in online usage. While PayPal remains the transaction king in both number and volume, Apple Pay is slowly catching up.

Apple's payments strategy is expected to get a boost with the recent launch of Apple Card, a digital- and NFC-first credit card product that features deep integration with Apple Pay.

Starting in early 2020, Chase Pay customers will no longer be able to use the smartphone app at physical point-of-sale terminals, according to an announcement posted to the platform's dedicated website. Chase plans to continue processing purchases made online and through supported apps.

JPMorgan began to notify existing customers of the change via email, reports Bloomberg.

The demise of Chase Pay, at least in stores, ends a four-year experiment in mobile payments that began life in 2015 through a partnership with the Merchant Customer Exchange. At the time, Chase elected to integrate MCX's now-defunct CurrentC platform to create a smartphone app that replaced credit cards with scannable barcodes.

CurrentC failed to gain traction and was ultimately killed off after a brief beta period in June 2016. Nine months later, JPMorgan snapped up the platform and other FinTech assets from MCX.

"When we started this, it was four years ago -- the payment space has changed a lot over the period of time and customer behavior has changed," Chase Pay chief Eric Connolly told the publication. "A lot of merchants have shifted to buy online, pick up in store' and have invested in their online presence and their apps."

Chasing the money, Chase Pay is refocusing efforts on web and app payments. As noted by Bloomberg, however, an industry study by website PYMNTS.com estimates JPMorgan's solution was accepted by fewer than 1% of online merchants at the end of the June quarter. The bank believes Chase Pay will grow its share of the market and on Wednesday announced upcoming support from GrubHub and its portfolio company LevelUp, the Chase Center app and more than 60,000 merchants in the Big Commerce network.

"We continue to focus on our customers and they are using the Chase Pay button on merchant websites and in merchant apps, and now their tap-to-pay Chase cards more than ever," Connolly said in a prepared statement. "So, we're shifting our focus to expand Chase Pay's presence in more merchant apps and websites."

As competing payments platforms struggle to gain footing, Apple Pay continues to increase its slice of the market. Morgan Stanley analysts in July called Apple's solution "the clear leader among app/phone-based digital wallets," noting high year-over-year growth in online usage. While PayPal remains the transaction king in both number and volume, Apple Pay is slowly catching up.

Apple's payments strategy is expected to get a boost with the recent launch of Apple Card, a digital- and NFC-first credit card product that features deep integration with Apple Pay.

Comments

We don't really want online payments in the US to become a two horse match race like iOS (iPhone) vs. Android (mostly Samsung).

Remember, Apple Pay only works for Apple customers -- and not at all in many countries.

Strong competition in this space is good. In the end, Apple Pay's biggest competitor won't be PayPal, it'll be AliPay.

Nope. We said it sucked four years ago, Apple Pay was older and better even then.

No, competition is not good when it’s a system designed to help the merchants while hindering the consumer. CurrenC and this rebranding were both downgrades from Apple Pay.

And any merchant taking AP is not limited to Apple customers, because that same NFC POS terminal can do other NFC payments.

I never knew you or used you, but even you (Chase Pay) deserve an obituary.

Sometimes the better competitor wins. Sometimes they don't (VHS beat Beta). Sometimes there are several or more competent players that share the market (Visa, MC, Amex, Discover, JCB, etc.).

Apple has had its share of duds and it often has not been the first to market. Heck, even the current iteration of Apple Card isn't all that good compared to many other no annual fee credit cards.

In a free market economy, companies are allowed to compete. If companies like Microsoft, Nokia, Motorola and RIM can all stumble and fail in the smartphone market, it's not because they weren't given a chance.

For sure, Toyota, Honda, and Nissan weren't pumping out great automobiles from Day 1. It took them decades.

Anyhow, enjoy your Palm Pilot.

As as far as countries, Apple Pay is in 56 Countries, and that is nothing to sneeze at.

https://en.m.wikipedia.org/wiki/Apple_Pay

Competition is good. Flat out copying technology and crapping out half-baked spyware off the backs of innovators is not.

"like iOS (iPhone) vs. Android (mostly Samsung)."

Which proves my point.

ApplePay certainly still has a long way to go, but so far they are on the right track and support is solid. While the USA has limited wireless payments, the rest of the world certainly does and Apple Pay has benefitted greatly. The tangible Apple Card for the USA is an excellent way to address the gap until the USA becomes comfortable with wireless payment technologies.

JPM says that they spend 11.5 billion dollars in IT spending every year. Probably a large part of that is to upgrade their servers but a growing part of that pie is to do things like Chase Pay and JPM coin. Hope the company is more successful with the later.

I really think that they should have kept Finn. N26 just got released in the US.

But since that seems to be the game plan– even copying as competition is good. If manufacturers, designers, developers, etc aren't spurred to design better to distance themselves from the copycats or other innovators then many consumers will vote, or should, with their wallets. Strong competition is only bad if you're on a bad team.