Will the COVID-19 disaster sink Apple's premium hardware?

The same people who have consistently failed to comprehend Apple's business model over the last few decades are now postulating that COVID-19's economic devastation will make Apple's products broadly unaffordable on a global level.

Prior to examining how Apple as a company is performing under the incredible pressures of 2020's pandemic circumstances, take a look at where the company was just as the COVID-19 epidemic began. Apple was clearly not on the 'perilous edge of near doom' that so many media bloggers were insisting that it was.

Because it appeared that iPhones were no longer able to maintain their historical unit growth, tech media columnists largely latched onto the narrative that the company was desperately falling behind in hardware and was now "pivoting, in a strategy reversal" to subscription content, supposedly following the lead of Netflix, Spotify, and other media darlings that make very little money. This was not even remotely true.

How could Apple possibly replace its iPhone cash machine with a handful of new Services such as Arcade, TV+, News+, and a new Apple Card, none of which appeared capable of generating massive revenues? It all sounded very troubling and ominous.

The reality, of course, was that Apple wasn't "pivoting away" from anything; it was merely strengthening its relationship with its installed base of customers in order to ensure their repeat business when buying new hardware. This was obvious because Apple has long done the same thing using software, including its Pro Apps and iWork titles, and with hardware products like Apple Watch, which help to ensure that iPhone users remain iPhone users in the future.

Sure enough, Services turned out to be an effort in how to make the Apple ecosystem sticker. Rather than being a "pivot," the new Services were merely a continuation of Apple's "Walled Garden" of iTunes, Pro Apps, the App Store, and its more recent offerings of iCloud and Apple Music, each of which has increasingly cultivated a "paradise ecosystem" largely protected from malware scams, atrocious privacy violations, and wild lapses in security updates, although certainly not without flaws and controversy.

The WSJ incredibly imagined that Apple's Walled Garden was the problem and needed "blasting"

Apple isn't focused on selling the wall itself; it sells the experience inside the wall. Apple now has a billion customers who voluntarily choose to largely remain inside that wall, not because they can't leave, but because Apple's curated experience has given them good reasons to stick around.

It just so happened that Apple's "Walled Garden," despite being initially intended to run as "revenue neutral," ended up generating significant revenues on its own, with operating margins that were higher than Apple's hardware.

That was technically true, but only in the sense that its also true that luxury resorts build fancy poolside bars and book DJs and performers to entertain their guests so they will show up and pay to enjoy the experience, rather than staying at home and saving all that money drinking $3 beers at the seedy bowling alley down the street that gets shut down by the health department every few months, frequented by some shady people who are looking to steal your wallet.

You can dramatically compare the price of a drink on either side of that "Walled Garden," but without considering the overall experience you're getting-- and the risks that come with settling for cheap-- that price differential itself isn't very meaningful, and for most people, not even relevant in their decision making.

As with real estate, while price is important, location is paramount. Apple's Walled Garden is, in effect, a desirable location for consumers who want to use apps, play games, and enjoy other content without worrying about being spied on, tracked, or otherwise harmed by uncurated markets teeming with malware, data collection ploys, unanticipated privacy violations, or even just the nuisance of wading through adware and fake apps that pretend to be something they are not.

Apple's "location" of the App Store, Apple Music, Arcade, TV+ and other Services are not by any means perfect or completely free from any legitimate complaints. But compared to the Wild West free-for-all represented by Android stores and the once-vaunted notion of permissive side-loading of apps from any source, or the tumbleweeds of Windows Mobile 10, or Huawei's market lacking essential Google apps, Apple's ecosystem is an extremely desirable, exclusive prime location for mainstream users to invest in.

It took about as long for many tech media columnists to similarly absorb the reality that Apple's premium-priced iPad was defining the tablet market and reshaping the PC industry, and wasn't effectively being undercut or shoved out of relevance by lower-priced Android tablets no matter how cheap they got. Consumers weren't just shopping for low prices, they were looking at the overall experience.

Across the heyday of the Windows PC from 1995 to 2010, it was broadly accepted that most consumers were really only shopping for computers based on price. While it was true that cheaper price tiers of Windows PCs hurt the sales of Apple's more expensive Macs, it was also true that there were also much cheaper PC alternatives that didn't run Windows that consumers simply weren't buying, despite being significantly less expensive.

Many of the same people who struggle to understand why consumers have been buying iPhones and iPads when there are much cheaper Androids available were just as puzzled at why consumers a decade or two ago were buying Windows PCs rather than less expensive Linux PCs. But the reason was the same: buyers found that the overall experience was worth paying a premium to achieve.

The fans of Linux who migrated to Android are similarly convinced that once consumers recognize the difference in price, the market for Apple's premium hardware will collapse--and that any economic downturn will hasten that. But these same columnists have long revealed that their theories are based on myopic, ideological tech enthusiast hopes and not any reflection of what consumers are actually doing.

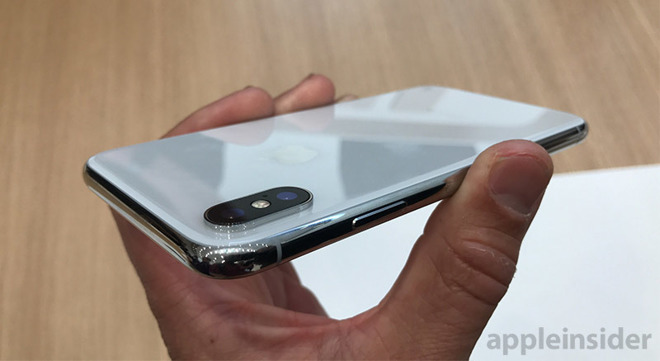

Bloomberg, the Wall Street Journal and Japan's Nikkei were all convinced that nobody could afford iPhone X

When Bloomberg repeats that Androids 'are now cheaper and quite serviceable' as its logic for predicting a wave of defections from iPhones to new devices from Huawei and Samsung, it's not because that is actually happening. It's simply a hope that keeps repeating itself, removed from any understanding of why people buy things at all. For a large part, that's because these writers have never directly produced or sold a valuable product, and simply have no frame of reference outside of a juvenile understanding that people shop based on price alone.

That's simply not true, particularly as you rise along the economic ladder. The more luxurious the experience delivered, the less price matters.

Yet the full-on delusion of price centric buying does not square with the fact that Apple has been selling virtually all of the premium tech devices capable of being sold at a sustainable profit. Across the last year, Apple's hardware business simply wasn't in the desperate straits that these blogger-critics imagined.

The company wasn't blindingly leaping off a burning platform into the choppy waters of Services that don't make tremendous amounts of money.

Instead, Apple's 2019 doubled down on the company's historical strategy of hardware offerings sold within the Walled Garden of its ecosystem with the blockbuster releases of AirPods Pro, Apple Watch Series 5, iPhone 11, and the luxuriously-priced new 16 inch MacBook Pro-- all racking up another record quarter just before the crisis of a global coronavirus pandemic hit.

If it were ever to release one or two bad productions, the whole thing would begin to fall apart and implode into oblivion. At least that was the theory, or you might say, fantasy.

That ended up also being proven false. Apple has a long history of releasing weak or poorly launched products that didn't remain in production very long, from Steve Jobs' G4 Cube, Xserve, and iPod HiFi to Tim Cook's well, most of Apple's recent deliveries have been billion-dollar blockbusters, even if they haven't eclipsed iPhone unit sales. But we've seen various new Mac and iPad launches that were merely ok, rather than being show-stopping milestones in the history of tech. The show still went on.

iPhone has long been the "blockbuster of blockbusters," but Apple has released several generations that weren't super exciting. It might be hard to recall, but Jobs' iPhone 3G and 3GS were iterative advances, and the last iPhone 4S model he saw ship struggled to remain technically competitive with its Android peers, many of which had already moved forward to deliver larger screens, fancier cameras, and support for new 4G LTE networks years before Apple did, at prices that were notably cheaper.

What the product did have was a superior experience, delivered with iTunes, the App Store library, and Apple's new Siri.

Apple's overall experience beat Android cheap pricing and novel features

Pundits at the time began predicting that Apple couldn't survive without cheap iPhone pricing in the range of around $300, but they were fantastically wrong. Apple's pricing instead incrementally notched up. But it certainly wasn't higher prices that were drawing new customers into the Walled Garden.

It was an increasingly appealing overall experience that has caused Apple's ecosystem to flourish and its installed base to continually expand.

Under Cook, the iPhone shifted from significant tweaks each year to major, ambitious annual advances. In large part, that was driven by the company's rapidly increasing resources, clout, revenues, and profits. So the higher prices Apple incrementally floated were, in fact, enriching the overall experience Apple could deliver.

Once Apple began developing its own silicon engines with A4, A5, A6, A7, A8 and so on, it became increasingly easier to pull ahead of the rest of the world that was working to make Android commodity products in partnership with the shrinking number of remaining chip vendors that could stay in business without strong and reliable profits.

Apple is clearly a hardware company, but it is also strongly differentiated from its hardware peers that sell commodity products that are forced to compete largely in price. Apple's iOS, apps, and Services create an ecosystem that largely protects Apple from direct comparisons with cheaper alternatives.

Pundits love to cite Huawei and Samsung as being "as good or better" competitors with cheaper priced offerings, but if that were true Apple wouldn't have had a blockbuster 2019 while Samsung and Huawei fought in vain to sell their own premium-priced products and struggled to increase their profitability in selling their bread-and-butter Androids priced below $300. The fact that the "tablet industry" was never really significant outside of Apple's iPad is further evidence that Apple isn't merely selling hardware, but is instead selling an experience.

This isn't to say that price doesn't matter at all. Apple clearly boosted its sales over the last launch of the iPhone 11 by offering reduced pricing, easier financing, and other incentives. But those price-based incentives were minor-- in the realm of around $50 difference-- and were completely isolated from the massive price differential of nearly $500 between average iPhone prices and the average selling price of Androids, or similar disparities between iPads, AirPods and Apple Watch and the vastly cheaper products offered as alternatives.

The obsession with low pricing-- without regard for the overall experience being delivered-- has been decisively proven to be comically wrong.

That's actually what most tech companies did in the 2000s. Palm issued only minor updates to its Pilot handhelds over its years of influence; Microsoft only shipped out a significantly new version of Windows every several years; even PC vendors and Apple's own Mac business relied mainly on incremental spec bumps delivered largely via denser new RAM and moderately faster processors.

The slow, incrementally iterative series of updates that tech companies dribbled out in the 1990s and 2000s seemed safe right up until a rival company introduced a major new leap and took over their business. In nearly every case, that rival was Apple.

Palm was blindsided by iPhone; Windows by Mac OS X; and PCs by iPad. Apple doesn't need to be warned about being complacent; it wrote the rules on how to devastate complacent industry segments. It has continued to perfect this strategy in areas such as NFC payments with Apple Pay and in wearables with Apple Watch and AirPods, leaving competitors who had once been ahead in the race completely flat-footed.

Apple Watch sold an experience that beat lower-priced smartwatches

Apple Watch sold an experience that beat lower-priced smartwatches

It was Jobs' Apple that created the rule that consumer hardware needed a major, flashy update every year-- starting with iPod and continuing with iPhone and iPad. If anyone can afford to break that rule, it's also Apple, if only because the company is so far ahead in terms of its ability to generate profits and retain its customers, even with premium pricing. And yet there isn't any sign that Apple plans to do so.

In the minds of many tech media personalities, Apple is competing against Huawei, Samsung, Pixel, and Surface. But in reality, Apple is largely competing against what it shipped last year.

All of the facts we have pointed to the reality that Android makers are competing for sales against each other, while Apple is largely servicing its own base of users, with only a relatively minor influx of new Android converts and an even lower number of iOS users defecting away to try alternatives. At the same time, iPad, Apple Watch and AirPods are indeed reaching new customers and pulling them into the Walled Garden. We know this because of the high numbers of buyers new to Apple's platforms.

Apple's installed base of users continues to grow significantly. And because those consumers joined for the experience rather than being attracted by cheap pricing, they're much less likely to leave just because a competitor offers a low price. Huawei, Samsung, Pixel, and Surface are finding that its extremely difficult and expensive to consistently deliver a very attractive, desirable overall experience.

That again tells us that Apple's toughest competitor will be the strength of its existing products. Face with tight economic circumstances, users with an iPhone X might choose to stick with the experience they have rather than paying for an upgrade to Apple's latest iPhone 12. But that's a deferred purchase, not a sale lost to a competitor that might never return.

Among Android licensees, the fight isn't just to get users to upgrade, but also to prevent them from going with another cheaper Android maker capable of delivering the same basic experience. That's cutthroat, and in a world where economic conditions are much worse, it will be a bloodbath for Android makers to flood out cheap new devices in the massive volumes needed to break even.

These companies were already barely making any money during the economic boom. They have no margin to relax.

Rather than retracting into hibernation, Apple's ambitions continue to run full throttle despite the current situation. Instead of canceling its developer conference as Google did with I/O, Apple announced that WWDC20 will simply adapt, enabling it to continue to advance its latest technology and help its developers continue to support it regardless of the complications posed under the new normal of a global pandemic.

"This June, WWDC20 brings a completely new online experience to millions of talented and creative developers around the world"

A core reason for that is that Apple's platforms define the premium experience that users pay for. Google's work on Android is merely the least it can do to maintain volume shipments of cheap devices it can use to present advertising and collect analytics from.

The Android experience can tread water without losing sales because Android's customers are attracted to its extremely low price points regardless of its flaws.

Over the long term, that difference in platform investment will have a significant impact. Google previously "took a year off" a decade ago when it sidelined work on Android 2.0 phones to concentrate on Android Honeycomb 3.0, which was exclusively aimed at delivering tablets that could compete with iPad. Google not only failed in that respect but also squandered a year of Android phone development that allowed Apple more time to refine its iOS experience to compete against the rest of the world's hardware makers, which by 2010 were largely lining up behind Android.

Apple is vastly better positioned today, so any complacent relaxing or distraction in Androidland will have an even greater impact on the difference in experience Apple can deliver. Looking at tablets, smartwatches, and even earbuds, it's pretty clear that Android is already struggling to deliver just the status quo.

Apple is pretty clearly planning for a future leap in AR and wearables that Android partners will have an extremely difficult time matching even with the full attention of Google. Any loss in interest or diversion of resources toward ads or Chrome or health initiatives or robots whatever else Alphabet plans to do will be disastrous for the future of Android.

Imagine the situation Apple would be in today if it had squandered its cash pile to frantically buy up huge acquisitions it hoped could allow it to catch up in chat, video sharing, social networking, or other areas that all turned out to be worth a lot less than having more than $100 billion to spend just as the global economy crashed under the weight of a pandemic.

That's effectively what Google and Facebook have done, under the assumption that advertising would never run into any problems. Now consider how easy it will be for those two massive ad networks to sustain their vast tentacles of moonshots and experiments while ad revenues continue to dry up as the world takes a deep breath.

A report by Variety recently noted that "ad spending is falling off a cliff amid the COVID-19 pandemic," and that Facebook and Google are estimated to see lost ad revenues of $44 billion just this year. While consumers stuck at home tend to be using various services more, Facebook noted in a blog posting last week that "we don't monetize many of the services where we're seeing increased engagement."

Contrast that with Apple's Walled Garden, where a significant bump in App Store sales and adoption of new Services from those billion pockets in quarantine is contributing directly to higher-margin revenues. Once the current situation improves, the deferred hardware purchases that Apple will likely suffer through this year will bounce back with a surge of replacements and upgrades. That can't be said of ad spending.

In the next segment, we'll take an expanded look at what Apple has been doing since the crisis struck, and what this tells us about Apple and its ability to survive and maintain its innovation trajectory despite extremely difficult circumstances.

Prior to examining how Apple as a company is performing under the incredible pressures of 2020's pandemic circumstances, take a look at where the company was just as the COVID-19 epidemic began. Apple was clearly not on the 'perilous edge of near doom' that so many media bloggers were insisting that it was.

The Services "pivot" that didn't happen in 2019

Just over a year ago, Apple threw a Tim Cook event at its Steve Jobs Theater, unveiling a series of new products that were neither purely hardware nor software, but classified as "Services."Because it appeared that iPhones were no longer able to maintain their historical unit growth, tech media columnists largely latched onto the narrative that the company was desperately falling behind in hardware and was now "pivoting, in a strategy reversal" to subscription content, supposedly following the lead of Netflix, Spotify, and other media darlings that make very little money. This was not even remotely true.

How could Apple possibly replace its iPhone cash machine with a handful of new Services such as Arcade, TV+, News+, and a new Apple Card, none of which appeared capable of generating massive revenues? It all sounded very troubling and ominous.

The reality, of course, was that Apple wasn't "pivoting away" from anything; it was merely strengthening its relationship with its installed base of customers in order to ensure their repeat business when buying new hardware. This was obvious because Apple has long done the same thing using software, including its Pro Apps and iWork titles, and with hardware products like Apple Watch, which help to ensure that iPhone users remain iPhone users in the future.

Sure enough, Services turned out to be an effort in how to make the Apple ecosystem sticker. Rather than being a "pivot," the new Services were merely a continuation of Apple's "Walled Garden" of iTunes, Pro Apps, the App Store, and its more recent offerings of iCloud and Apple Music, each of which has increasingly cultivated a "paradise ecosystem" largely protected from malware scams, atrocious privacy violations, and wild lapses in security updates, although certainly not without flaws and controversy.

The WSJ incredibly imagined that Apple's Walled Garden was the problem and needed "blasting"

Apple isn't focused on selling the wall itself; it sells the experience inside the wall. Apple now has a billion customers who voluntarily choose to largely remain inside that wall, not because they can't leave, but because Apple's curated experience has given them good reasons to stick around.

It just so happened that Apple's "Walled Garden," despite being initially intended to run as "revenue neutral," ended up generating significant revenues on its own, with operating margins that were higher than Apple's hardware.

Location, location, location: Apple's Walled Garden

Apple's most cynical critics initially invented and promoted the term "Walled Garden" for iTunes and the App Store as a disparaging way to suggest that Apple was "locking in" consumers so they won't want to leave to buy cheaper hardware from cloners.That was technically true, but only in the sense that its also true that luxury resorts build fancy poolside bars and book DJs and performers to entertain their guests so they will show up and pay to enjoy the experience, rather than staying at home and saving all that money drinking $3 beers at the seedy bowling alley down the street that gets shut down by the health department every few months, frequented by some shady people who are looking to steal your wallet.

You can dramatically compare the price of a drink on either side of that "Walled Garden," but without considering the overall experience you're getting-- and the risks that come with settling for cheap-- that price differential itself isn't very meaningful, and for most people, not even relevant in their decision making.

As with real estate, while price is important, location is paramount. Apple's Walled Garden is, in effect, a desirable location for consumers who want to use apps, play games, and enjoy other content without worrying about being spied on, tracked, or otherwise harmed by uncurated markets teeming with malware, data collection ploys, unanticipated privacy violations, or even just the nuisance of wading through adware and fake apps that pretend to be something they are not.

Apple's "location" of the App Store, Apple Music, Arcade, TV+ and other Services are not by any means perfect or completely free from any legitimate complaints. But compared to the Wild West free-for-all represented by Android stores and the once-vaunted notion of permissive side-loading of apps from any source, or the tumbleweeds of Windows Mobile 10, or Huawei's market lacking essential Google apps, Apple's ecosystem is an extremely desirable, exclusive prime location for mainstream users to invest in.

Experience is worth more than money

Just as the initial mainstream reports of a novel coronavirus began to surface at the beginning of this year, Apple's Walled Garden of Services was finally being recognized and appreciated by investors. Even the slower, trailing edge of the tech media was beginning to understand this, after having such a hard time grasping that Services not only supported Apple's hardware but was becoming a significant source of high margin revenues on its own, something Cook first began stressing five years earlier in 2014.It took about as long for many tech media columnists to similarly absorb the reality that Apple's premium-priced iPad was defining the tablet market and reshaping the PC industry, and wasn't effectively being undercut or shoved out of relevance by lower-priced Android tablets no matter how cheap they got. Consumers weren't just shopping for low prices, they were looking at the overall experience.

Across the heyday of the Windows PC from 1995 to 2010, it was broadly accepted that most consumers were really only shopping for computers based on price. While it was true that cheaper price tiers of Windows PCs hurt the sales of Apple's more expensive Macs, it was also true that there were also much cheaper PC alternatives that didn't run Windows that consumers simply weren't buying, despite being significantly less expensive.

Many of the same people who struggle to understand why consumers have been buying iPhones and iPads when there are much cheaper Androids available were just as puzzled at why consumers a decade or two ago were buying Windows PCs rather than less expensive Linux PCs. But the reason was the same: buyers found that the overall experience was worth paying a premium to achieve.

The fans of Linux who migrated to Android are similarly convinced that once consumers recognize the difference in price, the market for Apple's premium hardware will collapse--and that any economic downturn will hasten that. But these same columnists have long revealed that their theories are based on myopic, ideological tech enthusiast hopes and not any reflection of what consumers are actually doing.

Bloomberg, the Wall Street Journal and Japan's Nikkei were all convinced that nobody could afford iPhone X

When Bloomberg repeats that Androids 'are now cheaper and quite serviceable' as its logic for predicting a wave of defections from iPhones to new devices from Huawei and Samsung, it's not because that is actually happening. It's simply a hope that keeps repeating itself, removed from any understanding of why people buy things at all. For a large part, that's because these writers have never directly produced or sold a valuable product, and simply have no frame of reference outside of a juvenile understanding that people shop based on price alone.

That's simply not true, particularly as you rise along the economic ladder. The more luxurious the experience delivered, the less price matters.

Yet the full-on delusion of price centric buying does not square with the fact that Apple has been selling virtually all of the premium tech devices capable of being sold at a sustainable profit. Across the last year, Apple's hardware business simply wasn't in the desperate straits that these blogger-critics imagined.

The company wasn't blindingly leaping off a burning platform into the choppy waters of Services that don't make tremendous amounts of money.

Instead, Apple's 2019 doubled down on the company's historical strategy of hardware offerings sold within the Walled Garden of its ecosystem with the blockbuster releases of AirPods Pro, Apple Watch Series 5, iPhone 11, and the luxuriously-priced new 16 inch MacBook Pro-- all racking up another record quarter just before the crisis of a global coronavirus pandemic hit.

Apple isn't just a hardware company

Last year's erroneous idea of a "Services pivot" that echoed among various prominent bloggers got Apple entirely wrong, but their previous narrative was also incorrect. Before jumping on the "pivot from hardware" bandwagon, the best way to get other tech bloggers to nod along in agreement with you was to repeat that Apple's hardware business was basically a film studio that produced hit movies.If it were ever to release one or two bad productions, the whole thing would begin to fall apart and implode into oblivion. At least that was the theory, or you might say, fantasy.

That ended up also being proven false. Apple has a long history of releasing weak or poorly launched products that didn't remain in production very long, from Steve Jobs' G4 Cube, Xserve, and iPod HiFi to Tim Cook's well, most of Apple's recent deliveries have been billion-dollar blockbusters, even if they haven't eclipsed iPhone unit sales. But we've seen various new Mac and iPad launches that were merely ok, rather than being show-stopping milestones in the history of tech. The show still went on.

iPhone has long been the "blockbuster of blockbusters," but Apple has released several generations that weren't super exciting. It might be hard to recall, but Jobs' iPhone 3G and 3GS were iterative advances, and the last iPhone 4S model he saw ship struggled to remain technically competitive with its Android peers, many of which had already moved forward to deliver larger screens, fancier cameras, and support for new 4G LTE networks years before Apple did, at prices that were notably cheaper.

What the product did have was a superior experience, delivered with iTunes, the App Store library, and Apple's new Siri.

Apple's overall experience beat Android cheap pricing and novel features

Pundits at the time began predicting that Apple couldn't survive without cheap iPhone pricing in the range of around $300, but they were fantastically wrong. Apple's pricing instead incrementally notched up. But it certainly wasn't higher prices that were drawing new customers into the Walled Garden.

It was an increasingly appealing overall experience that has caused Apple's ecosystem to flourish and its installed base to continually expand.

Under Cook, the iPhone shifted from significant tweaks each year to major, ambitious annual advances. In large part, that was driven by the company's rapidly increasing resources, clout, revenues, and profits. So the higher prices Apple incrementally floated were, in fact, enriching the overall experience Apple could deliver.

Once Apple began developing its own silicon engines with A4, A5, A6, A7, A8 and so on, it became increasingly easier to pull ahead of the rest of the world that was working to make Android commodity products in partnership with the shrinking number of remaining chip vendors that could stay in business without strong and reliable profits.

Apple is clearly a hardware company, but it is also strongly differentiated from its hardware peers that sell commodity products that are forced to compete largely in price. Apple's iOS, apps, and Services create an ecosystem that largely protects Apple from direct comparisons with cheaper alternatives.

Pundits love to cite Huawei and Samsung as being "as good or better" competitors with cheaper priced offerings, but if that were true Apple wouldn't have had a blockbuster 2019 while Samsung and Huawei fought in vain to sell their own premium-priced products and struggled to increase their profitability in selling their bread-and-butter Androids priced below $300. The fact that the "tablet industry" was never really significant outside of Apple's iPad is further evidence that Apple isn't merely selling hardware, but is instead selling an experience.

This isn't to say that price doesn't matter at all. Apple clearly boosted its sales over the last launch of the iPhone 11 by offering reduced pricing, easier financing, and other incentives. But those price-based incentives were minor-- in the realm of around $50 difference-- and were completely isolated from the massive price differential of nearly $500 between average iPhone prices and the average selling price of Androids, or similar disparities between iPads, AirPods and Apple Watch and the vastly cheaper products offered as alternatives.

The obsession with low pricing-- without regard for the overall experience being delivered-- has been decisively proven to be comically wrong.

Apple and the rule of big annual updates

Similarly, the idea that Apple could slip up and permanently fall behind its competitors after missing a hardware technology update cycle-- such as folding screens or 5G modems-- was also decisively proven wrong over the last year. With roughly a billion "pockets" in its installed base of customers, it's clear Apple could continue to simply replace broken iPhones for a few years without even delivering much in the way of incredible new strides in mobile technology, and it would remain comfortably positioned as the most profitable tech company.That's actually what most tech companies did in the 2000s. Palm issued only minor updates to its Pilot handhelds over its years of influence; Microsoft only shipped out a significantly new version of Windows every several years; even PC vendors and Apple's own Mac business relied mainly on incremental spec bumps delivered largely via denser new RAM and moderately faster processors.

The slow, incrementally iterative series of updates that tech companies dribbled out in the 1990s and 2000s seemed safe right up until a rival company introduced a major new leap and took over their business. In nearly every case, that rival was Apple.

Palm was blindsided by iPhone; Windows by Mac OS X; and PCs by iPad. Apple doesn't need to be warned about being complacent; it wrote the rules on how to devastate complacent industry segments. It has continued to perfect this strategy in areas such as NFC payments with Apple Pay and in wearables with Apple Watch and AirPods, leaving competitors who had once been ahead in the race completely flat-footed.

Apple Watch sold an experience that beat lower-priced smartwatches

Apple Watch sold an experience that beat lower-priced smartwatchesIt was Jobs' Apple that created the rule that consumer hardware needed a major, flashy update every year-- starting with iPod and continuing with iPhone and iPad. If anyone can afford to break that rule, it's also Apple, if only because the company is so far ahead in terms of its ability to generate profits and retain its customers, even with premium pricing. And yet there isn't any sign that Apple plans to do so.

In the minds of many tech media personalities, Apple is competing against Huawei, Samsung, Pixel, and Surface. But in reality, Apple is largely competing against what it shipped last year.

All of the facts we have pointed to the reality that Android makers are competing for sales against each other, while Apple is largely servicing its own base of users, with only a relatively minor influx of new Android converts and an even lower number of iOS users defecting away to try alternatives. At the same time, iPad, Apple Watch and AirPods are indeed reaching new customers and pulling them into the Walled Garden. We know this because of the high numbers of buyers new to Apple's platforms.

Apple's installed base of users continues to grow significantly. And because those consumers joined for the experience rather than being attracted by cheap pricing, they're much less likely to leave just because a competitor offers a low price. Huawei, Samsung, Pixel, and Surface are finding that its extremely difficult and expensive to consistently deliver a very attractive, desirable overall experience.

That again tells us that Apple's toughest competitor will be the strength of its existing products. Face with tight economic circumstances, users with an iPhone X might choose to stick with the experience they have rather than paying for an upgrade to Apple's latest iPhone 12. But that's a deferred purchase, not a sale lost to a competitor that might never return.

Among Android licensees, the fight isn't just to get users to upgrade, but also to prevent them from going with another cheaper Android maker capable of delivering the same basic experience. That's cutthroat, and in a world where economic conditions are much worse, it will be a bloodbath for Android makers to flood out cheap new devices in the massive volumes needed to break even.

These companies were already barely making any money during the economic boom. They have no margin to relax.

What happens in 2020?

Rather than being hopelessly weak in terms of competitive pricing and precariously in danger as media critics have preached for years, Apple has been focused on building a solid launch site for its future premium experiences within the Walled Garden. Now that things have been turned upside down by an unanticipated pandemic, Apple's forward-thinking ecosystem built for its solid installed base of users is enabling it to react to very difficult conditions from a position of strength that its peers lack.Rather than retracting into hibernation, Apple's ambitions continue to run full throttle despite the current situation. Instead of canceling its developer conference as Google did with I/O, Apple announced that WWDC20 will simply adapt, enabling it to continue to advance its latest technology and help its developers continue to support it regardless of the complications posed under the new normal of a global pandemic.

"This June, WWDC20 brings a completely new online experience to millions of talented and creative developers around the world"

A core reason for that is that Apple's platforms define the premium experience that users pay for. Google's work on Android is merely the least it can do to maintain volume shipments of cheap devices it can use to present advertising and collect analytics from.

The Android experience can tread water without losing sales because Android's customers are attracted to its extremely low price points regardless of its flaws.

Over the long term, that difference in platform investment will have a significant impact. Google previously "took a year off" a decade ago when it sidelined work on Android 2.0 phones to concentrate on Android Honeycomb 3.0, which was exclusively aimed at delivering tablets that could compete with iPad. Google not only failed in that respect but also squandered a year of Android phone development that allowed Apple more time to refine its iOS experience to compete against the rest of the world's hardware makers, which by 2010 were largely lining up behind Android.

Apple is vastly better positioned today, so any complacent relaxing or distraction in Androidland will have an even greater impact on the difference in experience Apple can deliver. Looking at tablets, smartwatches, and even earbuds, it's pretty clear that Android is already struggling to deliver just the status quo.

Apple is pretty clearly planning for a future leap in AR and wearables that Android partners will have an extremely difficult time matching even with the full attention of Google. Any loss in interest or diversion of resources toward ads or Chrome or health initiatives or robots whatever else Alphabet plans to do will be disastrous for the future of Android.

Imagine the situation Apple would be in today if it had squandered its cash pile to frantically buy up huge acquisitions it hoped could allow it to catch up in chat, video sharing, social networking, or other areas that all turned out to be worth a lot less than having more than $100 billion to spend just as the global economy crashed under the weight of a pandemic.

That's effectively what Google and Facebook have done, under the assumption that advertising would never run into any problems. Now consider how easy it will be for those two massive ad networks to sustain their vast tentacles of moonshots and experiments while ad revenues continue to dry up as the world takes a deep breath.

A report by Variety recently noted that "ad spending is falling off a cliff amid the COVID-19 pandemic," and that Facebook and Google are estimated to see lost ad revenues of $44 billion just this year. While consumers stuck at home tend to be using various services more, Facebook noted in a blog posting last week that "we don't monetize many of the services where we're seeing increased engagement."

Contrast that with Apple's Walled Garden, where a significant bump in App Store sales and adoption of new Services from those billion pockets in quarantine is contributing directly to higher-margin revenues. Once the current situation improves, the deferred hardware purchases that Apple will likely suffer through this year will bounce back with a surge of replacements and upgrades. That can't be said of ad spending.

In the next segment, we'll take an expanded look at what Apple has been doing since the crisis struck, and what this tells us about Apple and its ability to survive and maintain its innovation trajectory despite extremely difficult circumstances.

Comments

https://en.wikipedia.org/wiki/Betteridge%27s_law_of_headlinesWith the upcoming financial depression we just have seen the start of, people are going to first cut on subscriptions; cloud services, music, media streaming, software subscriptions, then anything premium.

People are going to get much more aware of purchasing products that creates jobs in their countries and not someone elsewhere. Equally they are going become much more focused on that their hard earned money don't stuff the coffers of international companies that hardly give anything back to their markets (taxes, job creation, local economic growth).

We will see what kind of resilience Apple has as this combination of public health crisis & economic crisis unfolds.

The Apple of 2008-9 was a very different company than the Apple of 2020 in not only size and overhead, but sources of revenue and their stickiness.

Apple now has topped out in its ability to drive iPhone income by jumping the average selling price and we all know Mac sales are tanking. Over on the services side, Apple Music has converted +/- 1 Billion iTunes accounts to a small fraction willing to pay monthly for low-quality streaming music. Also on services, Apple is shelling out tons of money to create content to feed its streaming service with little income as they are giving it away to a significant portion of the user base. Note also that production is shut down everywhere and Apple does not have a large catalog of content as AT&T (HBOMax), Disney, CBS, Comcast/NBCU(Peacock), Netflix or Amazon have. It will not take long for customers to burn through what little Apple has in the can.

Apple in the Great Recession was a lean & smallish company that sold things directly. Apple today is a large company with many mouths to feed and depends upon financing to sell iPhones and rental fees to support services that are month to month. If the recession lasts any length of time people will drop the subscriptions and quite possibly the expensive phones for a cheap device that does not require a monthly payment. The Apple of old was debt phobic and Tim Cook has turned Apple into a debt-laden company.

If we see a v-shaped recovery Apple might be OK, but if we get in a long cycle recession Apple will have some serious restructuring to do. Look at Disney where Iger was put back in charge of the empire he just handed over to a successor. The lights are out in Orlando, Anaheim, Tokyo, Paris and Shanghai Disney parks, the cruise business is DOA, ESPN has no live sports and they are carrying a ton of debt.

What is anyone waiting to come out of Facebook or Google, and what of those things would anyone actually pay for?

I don't get your contrast between Jobs and Cook. Jobs tried many more wild things out as desperate reaches than Cook ever has. Jobs introduced iPod Socks and floated out some pretty bad software and internet services, including multile things he felt compelled to appoligize in public for. Cook has rather deftly launched hit after hit, even after the obvious product niches were filled.

Cook is sailing a much larger ship. He can hire smart people to make design decisions. Jobs had a magical vision for knowing what upcoming generations would want and need. But if he were still around, he'd likely still be pushing for fake leather trim on windows and shiny chrome knobs in the UX, stuff that just slows down real progress in utility. Jobs was sort of notorious his whole life for occasionally prioitizing something really inessential over the greater good of a product.

Apple would be far worse off if Cook blustered along as if he thought he were really The Visioary rather than being really excellent at operations. At this scale, Apple should be run by somebody capable of delegating work to a design talent team, rather than somebody who is there to stroke their "I'm a genius ego." Imagine if Apple run by some ultra privelaged rich dick who thinks he's smarter than he really is, like Elon.

Didn’t think so.

The current situation is not going to change Apple’s value proposition, which is based on the perceived value of their products. Affordability and attainability by some segment of current buyers may very well take a hit, but changing the formula and jeopardizing the brand value to account for a temporary downturn could lead to permanent damage. Makes no sense. You don’t sink a ship to put out a fire in one compartment.

As Apple goes forward with hardware advancement such as SOCs and LiDAR it allows software development to take place that isn't available to others without access to supporting hardware. On the other side of this pandemic I expect Apple will have a multi-year hardware and software advantage that allows AR and AI features that others can't replicate. While the media focusses on Apples shortcomings with Siri, Apple is reaching far beyond cloud based voice assistants.

WhiteChapel, Kiron

BTW, Cloud-based voice assistants are becoming passe'. Apple will eventually be moving it on-device just as others have begun to do.

Apple is doing its valuable creative, design, engineering, planning, product work domestically and shipping the routine low-value jobs elsewhere because nobody in the US is qualified to run precision manufacturing and basic labor and there's nowhere to do it and no supply chain to support it.

You really need to reconsider what you think about jobs.

Also, you're right that working people who can suddenly not feed themselves or pay rent are going to be cutting services and other luxuries. But Apple's installed base includes a vast number of independently rich people who are at most going to be inconvenienced by this turmoil. The damage is going to hit certain groups far harder than others, as grossly unfair as that is. And those hurt the most are at the bottom, using Android phones already.

Apple also pays the most taxes in the US, and its sales are hit by state sales tax etc. Substantiate what you're claiming because it sounds awfully weak.

Yes they do. It's cheaper to trade it in every two years and keep buying the latest new premium iPhone than buying a cheap $300 Android every year and watching it glitch out and end up with zero residual value.

Yes, one of the things Apple really needs to work on improving. But it is well-positioned to do that, given that it has powerful on-device hardware and has Siri deployed across a billion users.