Apple's road back to a $300 share price after the coronavirus changed everything

Amid one of the worst economic downturns in years, Apple has outperformed most expectations that analysts have placed on it. Just shy of two months into the COVID-19 pandemic, its share price has returned to levels not seen since before the crisis.

Apple's share price are back up to pre-coronavirus levels as of early May.

The COVID-19 pandemic has hurt Apple's revenues and demand for its products across the globe. The Cupertino tech giant proved its resilience during the pandemic by outperforming expectations and returning to pre-crisis share price by early May. Here's what that road looked like for the company.

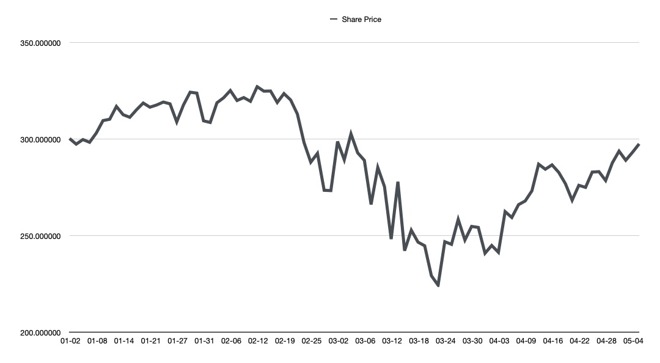

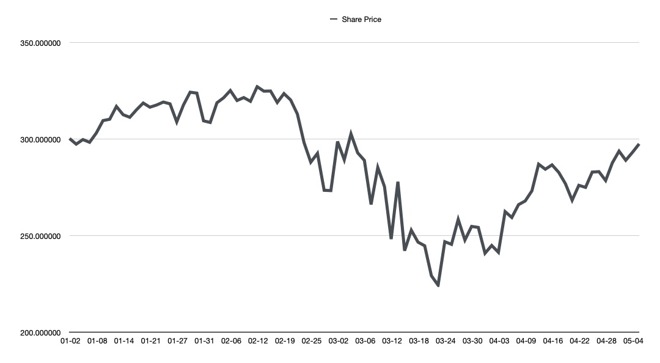

Apple's closing share price from the beginning of 2020 through early May.

Apple started off 2020 with a very strong financial position, with a record-smashing holiday quarter that pulled in revenue of $91.8 billion, although coronavirus was a concern in China in January, Apple's position appeared upbeat across the board.

As the coronavirus spread in China, Apple was forced to contend with the fallout from the outbreak in that region. Foxconn and other suppliers were forced to shut down their factories and keep them shuttered throughout February. The key Apple partner took its biggest revenue hit in years as a result.

On the retail and demand side, the company closed all of its retail stores and offices throughout Greater China in early February, and although early indications suggested Apple would reopen by Feb. 10, retail and office operations remained closed far beyond that date.

On Feb. 17, the Cupertino tech giant warned investors that it would likely miss revenue guidance for the second quarter due to both supply chain issues and weakened demand in China -- a critical region for the company's production and sales.

As the coronavirus continued to spread across the world, the world's financial markets began taking a beating. The NASDAQ started plummeting in February and March, as more countries and companies across the world had to deal with mandated stay-at-home orders and social distancing guidelines.

It was a similar story for Apple's stock price. That price reached its lowest point of $224.37 on March 23, causing Apple to dip below the $1 trillion market capitalization that it had been the first to achieve.

China began recovering in March, with Apple's supply chain in the region reaching normality by mid-month. Elsewhere, however, Apple shuttered all of its retail locations outside of China, and they remained closed throughout April and early May.

As the world transitioned to remote learning and work-from-home policies, Apple's stock began recovering. The company eventually regained its $1 trillion valuation, and throughout April, Apple's share price has largely recovered to pre-coronavirus levels.

On April 30, the Cupertino tech giant reported earnings that exceeded Wall Street expectations. Although revenue was still down from pre-pandemic levels, the company's results proved to investors that it could maintain a relatively strong position during COVID-19.-l-l.jpg)

Apple's iPhone SE, priced at $399, is a device tailor-made for uncertain economic times.

The first visible sign of Apple's slow march toward recovery, at least in China, was likely the company's reopening of retail locations in mid-March.

At its second fiscal quarter of 2020 earnings call on April 30, Apple indicated that store foot traffic levels have not recovered fully in China. More consumers, however, have switched to online retail, which aided the company's revenue and sales numbers in the region.

But even in the midst of the global crisis, Apple launched new iPad Pro models alongside a Magic Keyboard accessory that ushered in cursor and trackpad support for the company's tablet lineup. Although that $350 accessory may have seemed questionable in a period of economic recession, the changes to iPadOS represented a broader and more significant shift for Apple's tablets.

The iPad Pro lineup, as well as a new lower-cost MacBook Air with a Magic Keyboard, likely contributed to Apple's report of an all-time high in the Mac and iPad user base. While other segments like iPhone shrank, Apple's iPad and Mac numbers actually saw an uptick, likely due to a wide transition to distance learning and work from home among its customer base.

The launch of the iPhone SE, a powerful smartphone at an affordable price point, was another factor aiding Apple's return to pre-coronavirus levels. Apple CEO Tim Cook noted that the company had seen a "strong customer response" to the affordable smartphone.

All of those products signaled that Apple wasn't pausing its usual pace of product releases during COVID-19. At its April 30 earnings call, Cook reiterated that new products were Apple's "lifeblood."

Other product segments also helped to offset the damage done to iPhone shipments during the second quarter. Apple's Services saw a year-over-year jump of 17%, and its Wearables segment surged 23% to a new quarterly record.

The earnings call itself, which actually reported growth in the company despite the global crisis, also contributed to an overall positive outlook on Apple's long-term prospects. Despite a slight dip on May 30 after Apple's Q2 2020 results, Apple's share price is up nearly 3% since the drop.

Looking ahead, Apple's rumored "iPhone 12" lineup is likely to drive iPhone shipments well into 2021 and beyond.

Apple did not provide guidance for the June quarter, citing the unpredictability and uncertainty of the economy during the global pandemic. Despite that, many analysts have suggested that Apple's long-term outlook appears bright.

JP Morgan's Samik Chatterjee, for example, expects Apple to outperform the broader market. The Cupertino tech giant remains a top pick for Morgan Stanley analyst Katy Huberty, who says that Apple's long-term growth prospects appear sustainable. Many other analysts agree on the company's strong balance sheet.

With supply chain production in China normalizing, there's also a greater chance that the company's rumored 5G iPhone is on-track for a release sometime in the fall.

Importantly, that device is largely expected to drive iPhone revenues well into 2021. Key Apple supply chain partner Qualcomm, for example, expects 5G smartphone demand to remain solid across 2020 despite a downturn in the broader smartphone market.

Apple also recently authorized a boost to its share repurchase endeavors by $50 billion, and due to low interest rates during COVID-19, the company recently tapped the bond market to raise fresh capital for corporate purposes.

With efforts like the Apple-Google Exposure Notification API, combined with loosening of social distancing and lockdown restrictions across the world, it's also probable that Apple could begin reopening its retail footprint globally through 2020. In June, Apple is holding its first virtual WWDC, where it's expected to debut new operating system updates as it usually does.

During its April 30 conference call, Cook said that he was confident in Apple's ability to bounce back strongly from the COVId-19 pandemic. Other signs, like early indications that consumer spending is slowly recovering, could also bode well for the Cupertino tech giant.

The COVID-19 pandemic has shaken up the tech industry. Although Apple has not escaped the effects of the crisis, it is much better equipped than rivals to maintain its strong financial position after it's "over" -- or a new normal is established

Apple's share price are back up to pre-coronavirus levels as of early May.

The COVID-19 pandemic has hurt Apple's revenues and demand for its products across the globe. The Cupertino tech giant proved its resilience during the pandemic by outperforming expectations and returning to pre-crisis share price by early May. Here's what that road looked like for the company.

Apple and COVID-19 -- a timeline

Apple's closing share price from the beginning of 2020 through early May.

Apple started off 2020 with a very strong financial position, with a record-smashing holiday quarter that pulled in revenue of $91.8 billion, although coronavirus was a concern in China in January, Apple's position appeared upbeat across the board.

As the coronavirus spread in China, Apple was forced to contend with the fallout from the outbreak in that region. Foxconn and other suppliers were forced to shut down their factories and keep them shuttered throughout February. The key Apple partner took its biggest revenue hit in years as a result.

On the retail and demand side, the company closed all of its retail stores and offices throughout Greater China in early February, and although early indications suggested Apple would reopen by Feb. 10, retail and office operations remained closed far beyond that date.

On Feb. 17, the Cupertino tech giant warned investors that it would likely miss revenue guidance for the second quarter due to both supply chain issues and weakened demand in China -- a critical region for the company's production and sales.

As the coronavirus continued to spread across the world, the world's financial markets began taking a beating. The NASDAQ started plummeting in February and March, as more countries and companies across the world had to deal with mandated stay-at-home orders and social distancing guidelines.

It was a similar story for Apple's stock price. That price reached its lowest point of $224.37 on March 23, causing Apple to dip below the $1 trillion market capitalization that it had been the first to achieve.

China began recovering in March, with Apple's supply chain in the region reaching normality by mid-month. Elsewhere, however, Apple shuttered all of its retail locations outside of China, and they remained closed throughout April and early May.

As the world transitioned to remote learning and work-from-home policies, Apple's stock began recovering. The company eventually regained its $1 trillion valuation, and throughout April, Apple's share price has largely recovered to pre-coronavirus levels.

On April 30, the Cupertino tech giant reported earnings that exceeded Wall Street expectations. Although revenue was still down from pre-pandemic levels, the company's results proved to investors that it could maintain a relatively strong position during COVID-19.

Key drivers of Apple's recovery from COVID-19 hit

-l-l.jpg)

Apple's iPhone SE, priced at $399, is a device tailor-made for uncertain economic times.

The first visible sign of Apple's slow march toward recovery, at least in China, was likely the company's reopening of retail locations in mid-March.

At its second fiscal quarter of 2020 earnings call on April 30, Apple indicated that store foot traffic levels have not recovered fully in China. More consumers, however, have switched to online retail, which aided the company's revenue and sales numbers in the region.

But even in the midst of the global crisis, Apple launched new iPad Pro models alongside a Magic Keyboard accessory that ushered in cursor and trackpad support for the company's tablet lineup. Although that $350 accessory may have seemed questionable in a period of economic recession, the changes to iPadOS represented a broader and more significant shift for Apple's tablets.

The iPad Pro lineup, as well as a new lower-cost MacBook Air with a Magic Keyboard, likely contributed to Apple's report of an all-time high in the Mac and iPad user base. While other segments like iPhone shrank, Apple's iPad and Mac numbers actually saw an uptick, likely due to a wide transition to distance learning and work from home among its customer base.

The launch of the iPhone SE, a powerful smartphone at an affordable price point, was another factor aiding Apple's return to pre-coronavirus levels. Apple CEO Tim Cook noted that the company had seen a "strong customer response" to the affordable smartphone.

All of those products signaled that Apple wasn't pausing its usual pace of product releases during COVID-19. At its April 30 earnings call, Cook reiterated that new products were Apple's "lifeblood."

Other product segments also helped to offset the damage done to iPhone shipments during the second quarter. Apple's Services saw a year-over-year jump of 17%, and its Wearables segment surged 23% to a new quarterly record.

The earnings call itself, which actually reported growth in the company despite the global crisis, also contributed to an overall positive outlook on Apple's long-term prospects. Despite a slight dip on May 30 after Apple's Q2 2020 results, Apple's share price is up nearly 3% since the drop.

Looking ahead

Looking ahead, Apple's rumored "iPhone 12" lineup is likely to drive iPhone shipments well into 2021 and beyond.

Apple did not provide guidance for the June quarter, citing the unpredictability and uncertainty of the economy during the global pandemic. Despite that, many analysts have suggested that Apple's long-term outlook appears bright.

JP Morgan's Samik Chatterjee, for example, expects Apple to outperform the broader market. The Cupertino tech giant remains a top pick for Morgan Stanley analyst Katy Huberty, who says that Apple's long-term growth prospects appear sustainable. Many other analysts agree on the company's strong balance sheet.

With supply chain production in China normalizing, there's also a greater chance that the company's rumored 5G iPhone is on-track for a release sometime in the fall.

Importantly, that device is largely expected to drive iPhone revenues well into 2021. Key Apple supply chain partner Qualcomm, for example, expects 5G smartphone demand to remain solid across 2020 despite a downturn in the broader smartphone market.

Apple also recently authorized a boost to its share repurchase endeavors by $50 billion, and due to low interest rates during COVID-19, the company recently tapped the bond market to raise fresh capital for corporate purposes.

With efforts like the Apple-Google Exposure Notification API, combined with loosening of social distancing and lockdown restrictions across the world, it's also probable that Apple could begin reopening its retail footprint globally through 2020. In June, Apple is holding its first virtual WWDC, where it's expected to debut new operating system updates as it usually does.

During its April 30 conference call, Cook said that he was confident in Apple's ability to bounce back strongly from the COVId-19 pandemic. Other signs, like early indications that consumer spending is slowly recovering, could also bode well for the Cupertino tech giant.

The COVID-19 pandemic has shaken up the tech industry. Although Apple has not escaped the effects of the crisis, it is much better equipped than rivals to maintain its strong financial position after it's "over" -- or a new normal is established

Comments

And as usual, much of the media and tech press were completely wrong about Apple, again. I've learned a long time ago to simply tune their garbage out.

I think that the case can be made that many of Apple's offerings are basically essential items, like a toothbrush, or toilet paper or food.

Computers and phones are entrenched in most people's daily lives. They are also essential for many businesses, as people use them to conduct business on, not to mention all of the many other uses that people use their devices for, like banking, ordering food, ordering items online, entertainment, games, streaming video, staying in touch with friends, relatives etc.

It doesn't matter what's happening in the world, virus, war, zombie invasion, they remain highly essential items, perhaps even more so when there is a crisis taking place.

Well, that's the thing. Playing the markets in regards to Apple seems like shooting fish in a barrel. You just have to watch the general bozo news, and then actually follow the Apple-related tech news. The bozo news impacts the stock price because, apparently, few of the 'experts' and day-traders seem to have an actual clue about the reality of Apple and their place in the world.

Yeah, I saw some really scary charts the other day, comparing a bunch of aspects of this to the Great Depression (it's currently looking WAY worse, by orders of magnitude). But, the question is how quickly it will be over (or allowed to be over), and then what percentage of those job losses will end up going back to work... and of course how high the spike of job losses will go.

Yeah, but how much of that is just people shifting to on-line buying for everything they can vs going out to the stores? I don't know anyone who is spending extra money right now (besides people stocking up on essentials). I suppose some are spending to transition from office to home, but that won't last long (ie. initial bump).

As for spending, surely you mean to include American corporations, as they are receiving the majority of the trillions of "stimulus" money (from congress and the federal reserve), significant portions in the form of massive grants and forgivable loans. The first round of airline bailouts includes 70% they don't have to pay back.

Covid19 didn’t do anything to the economy. The government’s actions to deal with the population are what has hurt the economy.

We could have very easily not had the extent of the economic shutdown if people took more personal responsibility and were willing to go to the annoying hassle of being ‘clean’. I’ve seen people touching pinpads at the supermarket wearing gloves thinking they’re avoiding the virus, but then use their smartphone and touch their purse and clothing and hair with the same gloves...?

People love to place blame on others for the extent of the outbreak in the US, but the fault lays on the population.

The people who are willing, skilled, and have the opportunity to create jobs and products (i.e. usually ‘rich’ people) need incentives to actually do it. You may not like that reality but it’s still true. Every single time the incentives are taken away in a country the job makers leave, reduce, or stop. That’s reality.

That's why printing new money is easy. People will spend the money just the same and the more that's spent, the more that's taxed, which goes back to the government.

This economic system should really be the rule rather than the exception. One that guarantees an income for everyone. Just now the economy only works for the wealthy. When a situation like this occurs, it's just another vacation for them. For the people who live from one paycheck to another, it means they don't eat because the wealthy stop the flow of money and maintain their massive hoard at the expense of everyone else. But some have little choice or they'd run out of money quickly because it's not cycling back to them when their businesses are on hold.

A lot of the lost income is just deferred though. Someone who would have bought an Apple product now will buy it later as long as they also get their income back. Most jobs should recover eventually in entertainment, hotels, restaurants, retail, manufacturing, shipping as the demand for non-essential items returns.

Social distancing doesn't have to become the new normal. This pandemic happened due to a virus that didn't need to exist. If it came from low income people in China doing irresponsible things with animals, they need to start heavily regulating this and on failure to do so, other countries need to start giving them heavy sanctions until they do. Similarly if it originated from a research lab. It's obvious that no country would want to take responsibility for the outbreak, China hasn't been forthcoming with all the evidence needed but they can't hold back a full investigation on this:

https://www.reuters.com/article/us-health-coronavirus-china-idUSKBN22J10G

In the following article, they mention that the wet markets are a source of cheap food for low income people and a source of income for farmers:

https://www.vox.com/future-perfect/2020/4/15/21219222/coronavirus-china-ban-wet-markets-reopening

Sort out the economic model we live by and that problem goes away. There's no reason they can't just sell approved animal species and earn a living that way or even better, make more food from plants.

The world we live in can easily be free of pollution, use sustainable energy, have an economic model that works for everyone, have responsible food production and it doesn't have to come at anyone's expense.

If we don't do this, pandemics will keep happening because we have efficient, cheap international travel. This virus was severe because of the infection rate. The lockdown happened because of the rate people were dying, not just the amount of people. People talk about annual/seasonal death rates from other viruses, over 250k people died from this worldwide in a few weeks with millions of currently active infections. Without a lockdown, it could have been much higher than this. Maybe people would have built an immunity without a lockdown but that hasn't been the case with historical pandemics until there was a massive loss of life. The safest approach was to do the lockdown until people know more about how to deal with it.

Warren Buffet seemed to confirm all of that when he said he didn't see anything worth buying right now....

https://congressionaldish.com/cd213-cares-act-the-trillions-for-covid-19-law/

Then you'll have a better idea what they actually did and didn't do. The media, yes, does a terrible job of reporting, and that's when they do good. Most of the time, you're more misinformed than when you started.

The main problem is that how they defined small business was just plain silly. Under 500 employees per location! And, the banks were allowed to pick how to distribute it, so they went with their biggest and most established clients first. The 'small business' funds got quickly cleaned out by the big corporations, and then the rest of the money went to... the big corporations.

Now, it's certainly true that the big corporations create jobs, so it is important to protect them as well as businesses at every level, down to each citizen. But, when you're giving the vast majority of many trillions of dollars to companies, most of which could probably weather the situation anyway, a lot of that money will probably end up more in the investors pockets than payroll.

Find a nice stone to sharpen your charcoal then, and you can probably find some USA paper, I suppose.

I do hope the supply chain becomes a bit more broad, but I'm not sure I'd be holding my breath.

That said, if it shifts too much, and too suddenly, it isn't going to be the CCP that suffers, but a lot of relatively innocent citizens.

The problem is that the money has to have some kind of value behind it, or you end up with inflation (or worse). You can't just keep printing it. The USA kind-of (on borrowed time, though) can get away with this being the default currency of the world (backed by massive military spending to overthrow anyone who challenges that, and then even more massive bad-will in recent decades in response). This can't last though. And, the higher it goes, the bigger the fall.

re: UBI - As much as I'd love that, and take advantage of it to do some cool things that seem pretty distant right now, I have too much understanding of human nature to think it would work out well. First, just from an economics perspective, it would tend to contribute, as above, to inflation. Which pushes the amount up that is needed for 'basic,' rinse and repeat.

But, I think even worse would be the impact on people. Work is actually a good thing for us. Some percentage of us would still work, or invent productive things to do, but a lot of people would do the opposite. If 'basic' were truly enough to live reasonably on, what's the point of putting in the effort to keep learning and working? Or, at least to the same extent or level?

Yeah, that was a question I've been trying to answer as well. As I mentioned in my previous post, people are comparing this to the Great Depression (and we've now surpassed the level of job loss), but weren't the jobs more permanently gone during the Great Depression? Won't they just come right back after Covid? The answer I've gotten so far is, unfortunately, no. The number I was getting back estimated about 40% of the job loss we're seeing won't come back for several years, or if they initially do, the damage will be such that they won't sustain, and be lost for several years, ultimately. If we go more than about another month, we'll see another whole level of deeper job loss and a LOT of companies won't make it.

That's the part people don't seem to be getting about this. The 'grandma vs Wall Street' was a rhetorically powerful, and politically useful meme, but it was a totally stupid one, as well. Instead of trying to do a proper risk assessment, and considering the big-picture loss of life, we've gone to just focusing on minimizing Covid-19 death. The problem is that we're already going to likely see more people die of un/under-diagnosed cancer alone, due to the shutdown, than from Covid-19. (We also saved some lives from lower traffic accidents, and other things.) But, that doesn't get started on all the other things that have already happened, or will be coming. It's just that those things won't be reported on, or the link back to the shutdown be made.

Yes, if it weren't for human nature. That's been around since humans, and is the common denominator in why various systems fail. The question should be, which system, government, etc. is best at keeping human nature in check, while also allowing for human flourishing? I don't think it can be perfect, but we could do much better. There is SO much 'low hanging fruit' that could be accomplished in the USA, just by passing a few laws... but it would take the people understanding that and then forcing the Congress people to actually do it (which they never will until forced, because it isn't in their own interests).

I think there could have been a more balanced approach, in terms of minimizing the lockdown, and protecting the vulnerable.

Cancel big gatherings, absolutely!

Getting everyone who could work from home to do so, was a good idea. But, too many of the companies furloughed a big percentage of those working at home rather quickly (this happened to my sister), because their work dried up, because too many of their clients were part of the chain reaction. And, a LOT of in-person work that isn't dependent on a big client-interaction model could have relatively low-risk continued, as well.

Even a lot of essential worker environments (at least here in Canada) seem more box checking, than ultimately effective. Yet, few of the workers seem to have gotten it. You odds aren't too bad if you're just working somewhat near a few other people, especially if those other people are the same people all day, every day.

But if we'd focused on rapidly protecting the vulnerable, we might have been able to halve the deaths (since over half were those people, often in large amounts among specific communities).

And, since health-factors seem to be a huge player in people being taken seriously down or killed by the virus, going forward, we'd be wise to put way more emphasis on prevention in the future.

The vast majority went to the big corporations. $1200 to the citizens is nice, but will hardly cover what they lose, even after unemployment $ (and how long will that hold up if we don't end this soon)?

But, go listen to that podcast episode I listed above. Our anger should mostly be directed at Congress.

https://www.federalpay.org/employees/national-institutes-of-health/fauci-anthony-s

It's easy to forget that every politician and government employee on TV is 'on welfare' because they are dressed so nicely. Not many private companies would justify paying those salaries for so long, which is why those people don't work in the private sector. That's what a lot of the military spending is for - it's employment for military personnel, same with NASA. It's pretty obscene that publicly funded jobs are making as much as $1m per year now when that can cover so many people's basic needs.

On top of that, tens of millions of retirees getting income for 20 years, this just replaces some of that for retirees so no additional cost. A basic income is to cover food, basic healthcare and housing. Something like $5-10k per year per person. It would end homelessness, reduce healthcare costs long-term, reduce crime, reduce opioid addiction, reduce paperwork, reduce stress, eliminate student loan debt for most students.

The only need to print more money (increase the money supply) is when it gets hoarded by wealthy people and stuck. That can be resolved with taxation.

Some people might live comfortably on that income alone but they wouldn't be able to afford luxuries. Given the choice, nobody would give up a $30k job to live on $10k a year under the impression that they'd have a better quality of life by not working and it gives a break to employers because they can choose to pay $20k of a $30k salary and the rest is made from the basic income so they would have some incentive to hire more people.

It would be best to trial it by giving it to employed people first and then expand it where it makes sense. It would bring a lot of much needed stability in scenarios like the present situation and reduce a lot of the otherwise permanent job losses.

I'll have to read up on it more, I guess. My understanding is that UBI was designed to be a livable amount of money. I don't think $5-10k would do that for most people... maybe those living in the lowest cost of living places. Also, keep in mind that most homelessness is way more complex than poverty, as are addictions. I don't think it would make much of any of that go away (so we'd still have to spend on that). I don't think it would very much touch crime, health-care costs, or student debt either.

Yes, I suppose the majority would still want more and add in a job. But, you might be right that employers would just reduce salaries by the UBI. If that were the case, it wouldn't change much for anyone besides those who weren't wanting to work in the first place, or jobs really near that cut-off (ie. part-time, minimum wage employees).

I think it would have to be higher, and from what I ever read on it, they were talking $20-30k range. This would have a lot of impact, but I fear the downsides I mentioned. That said, it could have a profound impact on pushing entrepreneurial efforts vs corporate work. In that regard, I'm really for it. But, I think the tradeoffs might be too much.