Apple says Apple Card billing mixup fixed, but tax firm still inundated with phone calls

Apple on Friday said it fixed an apparent backend Apple Card issue that caused certain AT&T charges to show up as billings from "Waters, Hardy & Co.," though the small Texas tax firm continues to see a deluge of calls from confused customers.

The tech giant contacted Waters, Hardy & Co. to say the mixup was corrected, but the firm's partner, Richard Waters, CPA, suggests the fix has not yet rolled out to all impacted customers.

"Apple contacted us and said it was fixed," Waters told AppleInsider in an email. "We turned on the phones and got swamped again. Perhaps it will take time to work through the system."

Waters was forced to disable the firm's phone lines yesterday after being overrun with calls from Apple Card customers wanting to know why charges from an unknown tax company are showing up on their Apple Card statements.

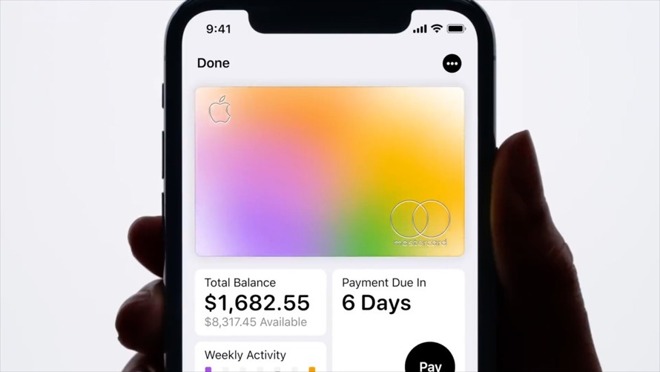

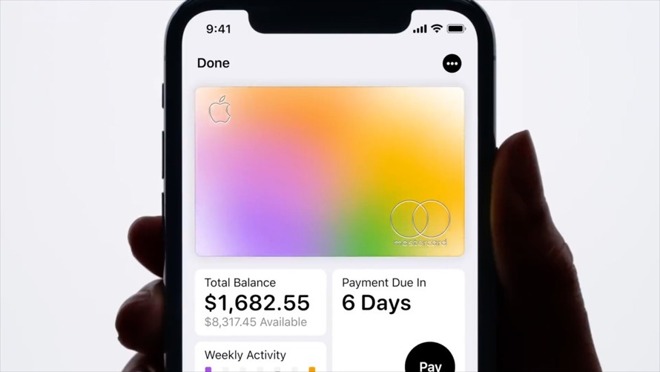

Trouble started on Thursday when Apple Card owners reported seemingly erroneous transactions appear in the Apple Card section of the Wallet app. Some traced the error back to mislabeled AT&T charges.

The incident has caused serious difficulties for the small company. A 10-person outfit, Waters, Hardy & Co. staff is working overtime to complete clients' extended income tax returns by the Nov. 15 filing deadline. Answering calls from confused Apple Card owners eats up valuable time, and the onslaught means its own clients are unable to get through.

"This has been an incredible challenge for us," Waters said. "Our staff have been having to answer the phones instead of working on our clients' returns. None of our clients are able to get through to us. It is so bad, we had to turn on the auto operator and leave a message to the callers explaining what has happened."

Waters was unable to contact representatives at Apple, AT&T or Goldman Sachs yesterday.

Apple has yet to comment on the issue and the cause of the mistake remains unknown.

The tech giant contacted Waters, Hardy & Co. to say the mixup was corrected, but the firm's partner, Richard Waters, CPA, suggests the fix has not yet rolled out to all impacted customers.

"Apple contacted us and said it was fixed," Waters told AppleInsider in an email. "We turned on the phones and got swamped again. Perhaps it will take time to work through the system."

Waters was forced to disable the firm's phone lines yesterday after being overrun with calls from Apple Card customers wanting to know why charges from an unknown tax company are showing up on their Apple Card statements.

Trouble started on Thursday when Apple Card owners reported seemingly erroneous transactions appear in the Apple Card section of the Wallet app. Some traced the error back to mislabeled AT&T charges.

The incident has caused serious difficulties for the small company. A 10-person outfit, Waters, Hardy & Co. staff is working overtime to complete clients' extended income tax returns by the Nov. 15 filing deadline. Answering calls from confused Apple Card owners eats up valuable time, and the onslaught means its own clients are unable to get through.

"This has been an incredible challenge for us," Waters said. "Our staff have been having to answer the phones instead of working on our clients' returns. None of our clients are able to get through to us. It is so bad, we had to turn on the auto operator and leave a message to the callers explaining what has happened."

Waters was unable to contact representatives at Apple, AT&T or Goldman Sachs yesterday.

Apple has yet to comment on the issue and the cause of the mistake remains unknown.

Comments

They should bill Apple (or whoever f’d up) for their time.

Biggest complaints: Access to my Apple card transaction data requires me to jump through too many hoops on my iPhone or iPad to access, the presentation of the card transactions on iOS made on the card is confusing to the point I thought a mysterious entry on the transaction history was fraudulent (it wasn't).

As the owner of a business, easy access to Apple Card activity across all platforms (iOS, Windows, et al) in concert with all my other bank and credit accounts, and the ability to download transaction activity made on the card into my accounting software is extremely or non-limited. There's more, but this is enough to give it a thumbs down.

Bottom-line, even though I think I saved 3% on my iPad using the card, all of the hassles just aren't worth it. Heck, I could have saved 5% on my new iPad buying it at any office supply store using my AMEX.

So, after a just a week, I paid off my Apple Card early, pulled it out of my wallet, and put it in the drawer alongside my dusty collection of 30-PIN charger cords, iPod Classics, and a Blackberry RIM 857.

Goldman-Sachs, if you're listening, please don't screw up my GM Card, too. I like that card.