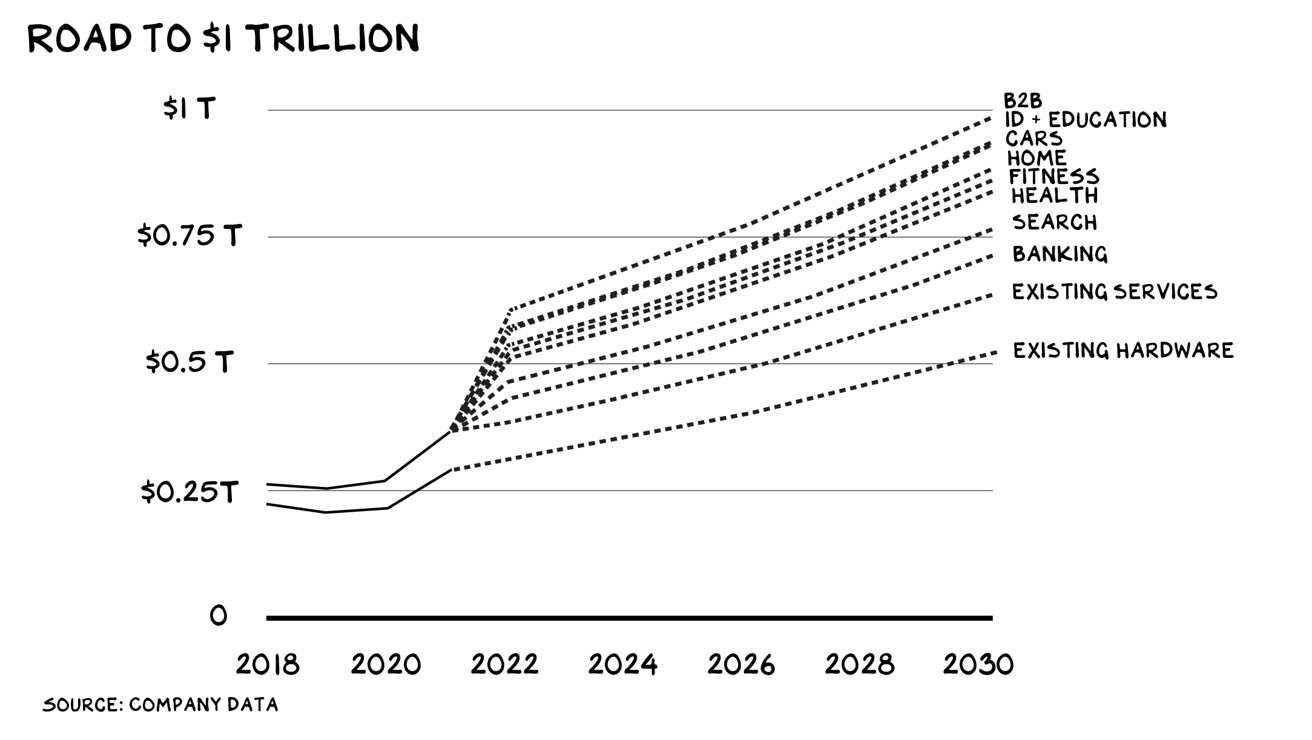

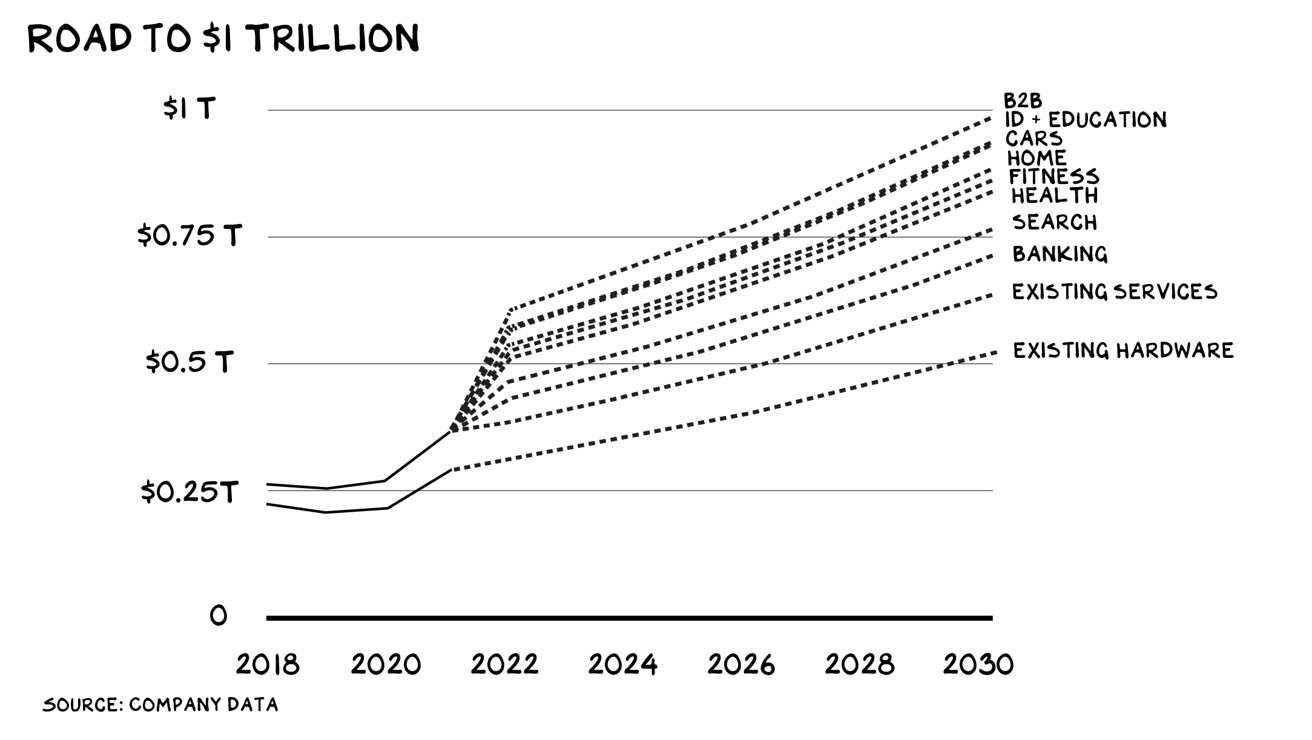

Apple has a clear path to $1T in revenue by 2030

Apple could hit a trillion dollars in annual revenue with a continued expansion of its various businesses, according to an NYU professor, with acquisitions and investments in fields such as banking, search, health, and the long-rumored Apple Car able to help edge Apple to the milestone by 2030.

In January, Apple became the first publicly-traded company in the world to reach a market capitalization of $3 trillion. But while it is a giant in the stock market, it still falls behind others when it comes to revenue.

In an exploration of how Apple could reach a trillion dollars in annual revenue, NYU professor of marketing Scott Galloway points out that Apple earned $366 billion in revenue, just over a third of the way to the milestone. However, that's far behind Amazon's $470 billion and Walmart's $559 billion.

Galloway offered on Friday that Apple has quite a few areas it can work on to reach that level. However, in pushing for growth, it may have to expand and steal markets away from other incumbent firms.

Apple already benefits from having its fingers in many different pies, with an ecosystem and a patchwork of services that are closely linked to each other. So much so that the professor believes "Nobody else has this, or any discernible path to it."

To expand, Apple needs capital, and in 2021 it generated $93 billion in free cash flow. Added with a $22 billion research and development budget, Galloway proposes that Apple has $126 billion per year to invest into its various businesses, including through acquisitions.

Add in that it could use its stock as currency, and that tech companies typically make acquisitions at around 10% of its market cap, that could give Apple another $290 billion to feasibly play with.

As large U.S. banks manage around $35 billion in annual consumer banking revenue, the professor thinks an Apple Bank could become a $75 billion business by 2030.

Search is also a potential route, which would start with Apple losing its billions from the Safari default search deal with Google. However, this would be a "strategic unlock," as Galloway reckons keeping searches within Apple's ecosystem and integrated results with contacts, calendars, and other user information could make the business more valuable.

Though Apple may not managed the same revenue as Google from ads, it's reckoned to manage $50 billion in revenue by 2030.

While Apple has been interested in healthcare for a while, Galloway speculates that Apple could shift into services, and could earn $17 billion a year from making CVS its "default integrated healthcare provider on the iPhone."

It's also hypothesized that Apple "could justbecome CVS," by following the "Jokr-like dark stores" model to deliver any healthcare item to the user's doorstep. This could net $75 billion by 2030, it's believed.

Connected to health, the fitness side Galloway brings up the reduced value of Peloton at approximately $10 billion, which makes the exercise bike-selling firm a potential acquisition target. Though Peloton forecasts $5 billion in revenue in 2022, the professor highlights "that's without the power of Apple behind it," which could make fitness a $20 billion business by 2030.

Home automation is reckoned to be an $80 billion market, and one that could be accelerated by "that $22 billion R&D cannon." While Apple probably won't stray into connected refrigerators, in favor of other more typical smart home elements, it's thought to be "another $20 billion opportunity."

Prof. Scott Galloway's proposals could help Apple reach $1T in annual revenue.

The long-rumored Apple Car is potentially going to generate "the first $250+ billion transfer of shareholder value" from Tesla once the first vehicle is unveiled by Apple, Galloway proposes. After a "conservative estimate" of taking $25 billion of Tesla's sales as well as electric vehicles being a high growth market, a $50 billion business by 2030 is speculated.

Galloway also offers that identity and educational services could add another $10 billion to the total.

Then there's business-to-business operations like payment processing, which can be boosted by the forthcoming "Tap to Pay" feature enabling payments on phones. This would give businesses payment processing without needing the extra hardware, which will eat some of Square's lunch.

Lastly, there's Apple's $10 billion it wants to spend on infrastructure, namely its own data centers so it can pull away from Google and Amazon Web Services. It's offered that Apple could go into the same space, offering businesses access to spare capacity.

Under B2B, Galloway says it could be a $50 billion segment within eight years.

"They've been looking at cars, AR, and televisions for a decade or more," the professor says. "If it's the first company to get to $1 trillion, and we think it will be, it'll likely be because Cook & Company isn't in a hurry to get there."

Read on AppleInsider

In January, Apple became the first publicly-traded company in the world to reach a market capitalization of $3 trillion. But while it is a giant in the stock market, it still falls behind others when it comes to revenue.

In an exploration of how Apple could reach a trillion dollars in annual revenue, NYU professor of marketing Scott Galloway points out that Apple earned $366 billion in revenue, just over a third of the way to the milestone. However, that's far behind Amazon's $470 billion and Walmart's $559 billion.

Galloway offered on Friday that Apple has quite a few areas it can work on to reach that level. However, in pushing for growth, it may have to expand and steal markets away from other incumbent firms.

Apple already benefits from having its fingers in many different pies, with an ecosystem and a patchwork of services that are closely linked to each other. So much so that the professor believes "Nobody else has this, or any discernible path to it."

To expand, Apple needs capital, and in 2021 it generated $93 billion in free cash flow. Added with a $22 billion research and development budget, Galloway proposes that Apple has $126 billion per year to invest into its various businesses, including through acquisitions.

Add in that it could use its stock as currency, and that tech companies typically make acquisitions at around 10% of its market cap, that could give Apple another $290 billion to feasibly play with.

The revenue path

Galloway's first port of call is consumer banking, as Apple has both the capital and trust that banks offer to customers, as well as its Apple Pay and Apple Card businesses. Hypothetically, Apple could offer an Apple Cash consumer account, as well as other standard account-related features, before expanding into loans, investments, and mortgages.As large U.S. banks manage around $35 billion in annual consumer banking revenue, the professor thinks an Apple Bank could become a $75 billion business by 2030.

Search is also a potential route, which would start with Apple losing its billions from the Safari default search deal with Google. However, this would be a "strategic unlock," as Galloway reckons keeping searches within Apple's ecosystem and integrated results with contacts, calendars, and other user information could make the business more valuable.

Though Apple may not managed the same revenue as Google from ads, it's reckoned to manage $50 billion in revenue by 2030.

While Apple has been interested in healthcare for a while, Galloway speculates that Apple could shift into services, and could earn $17 billion a year from making CVS its "default integrated healthcare provider on the iPhone."

It's also hypothesized that Apple "could justbecome CVS," by following the "Jokr-like dark stores" model to deliver any healthcare item to the user's doorstep. This could net $75 billion by 2030, it's believed.

Connected to health, the fitness side Galloway brings up the reduced value of Peloton at approximately $10 billion, which makes the exercise bike-selling firm a potential acquisition target. Though Peloton forecasts $5 billion in revenue in 2022, the professor highlights "that's without the power of Apple behind it," which could make fitness a $20 billion business by 2030.

Home automation is reckoned to be an $80 billion market, and one that could be accelerated by "that $22 billion R&D cannon." While Apple probably won't stray into connected refrigerators, in favor of other more typical smart home elements, it's thought to be "another $20 billion opportunity."

Prof. Scott Galloway's proposals could help Apple reach $1T in annual revenue.

The long-rumored Apple Car is potentially going to generate "the first $250+ billion transfer of shareholder value" from Tesla once the first vehicle is unveiled by Apple, Galloway proposes. After a "conservative estimate" of taking $25 billion of Tesla's sales as well as electric vehicles being a high growth market, a $50 billion business by 2030 is speculated.

Galloway also offers that identity and educational services could add another $10 billion to the total.

Then there's business-to-business operations like payment processing, which can be boosted by the forthcoming "Tap to Pay" feature enabling payments on phones. This would give businesses payment processing without needing the extra hardware, which will eat some of Square's lunch.

Lastly, there's Apple's $10 billion it wants to spend on infrastructure, namely its own data centers so it can pull away from Google and Amazon Web Services. It's offered that Apple could go into the same space, offering businesses access to spare capacity.

Under B2B, Galloway says it could be a $50 billion segment within eight years.

Slow and Steady

Despite laying out a considerable investment plan, Galloway concludes that it may not necessarily happen, as Apple is run with considerable discipline. As an example, the largest acquisition by the company is Beats, which it made for just $3 billion almost eight years ago."They've been looking at cars, AR, and televisions for a decade or more," the professor says. "If it's the first company to get to $1 trillion, and we think it will be, it'll likely be because Cook & Company isn't in a hurry to get there."

Read on AppleInsider

Comments

Globally Apple’s products are not dominant in terms of market share. They have plenty of room to grow while the Android and PC/Windows junk will still grab the majority purely due to low price points.

As for Home Automation aka HomeKit they need to focus more attention. Including routers, as that is the weak link in security since they exited.

The Economist a number of years ago discussed the results of large M&A deals between corporations. Often the resultant companies had worse performance. It certainly did not result in any benefits for shareholders and I personally doubt it helped the companies.

A

whst matters is if they are oppressive to the point where no one else can compete.

Maybe they pass a law that makes it harder for companies above a given size to acquire other companies. That could slow growth, because you have to build up from within rather than buy. But longer term, building up from within might be better anyway. So maybe growth is slower but more enduring.

The only divisions that I can see being "broken off" is services and applications (to make competing on Apple's own platforms more "fair"). At which point most other "platform" companies would have to follow suit, because laws cannot single out a company unless it is considered a monopoly in its respective market... You can't just break up Apple, because they've gotten too big or make too much money. Companies are broken up when it is determined that the market cannot sustain fair competition when there's one company that can control that market and influence other markets due to its size and share of that market. Two of the largest examples are Standard Oil and AT&T. Two other companies that come to mind, but were never broken up are IBM and Microsoft. Both of which had a stranglehold on their respective markets. Microsoft snuck in under the radar and stole IBM's thunder and the mobile market basically killed off Microsoft's dominance.

Long Apple 🍎

APPLE. IS. NOT. BUYING. PELOTON.

"It's not how much money you make. It's how much money you keep."

Growing the top line with no regard for the bottom line is... well, let's just say sub-optimal. Which would you rather have - Apple's net income of ~US$95billion for 2021, or Amazon's ~US$33billion, or Walmart's ~US$14billion?

Amazon and Walmart have higher revenue, but it's pretty easy to equate that to "having to do more work to earn less money" which, last I looked, is not laudable efficiency.

The creativity involved in this "report" is worthwhile, but the underlying assumptions are a hot mess so I rate it a wasted effort.