Apple no longer accepting credit or debit card payments in India

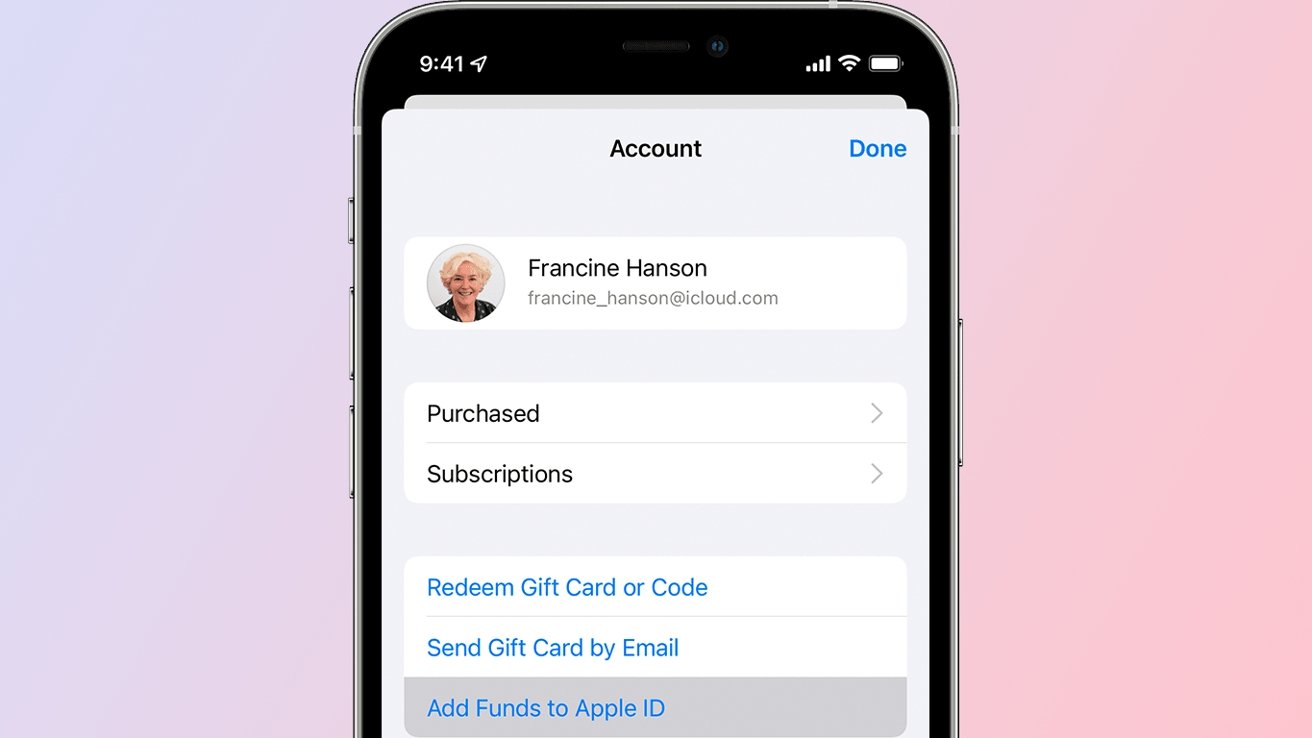

Customers in India will need to fund their Apple ID balance if they wish to purchase apps, media, or subscriptions through Apple.

Image Credit: Apple

In October 2021, a ruling passed by the Reserve Bank of India made it so banks, financial institutions, and "gateways" would need to require approval before completing credit and debit card transactions for auto-renewable subscriptions.

According to the mandate, merchants must obtain user approval through transaction notifications, e-mandates, and Additional Factors of Authentication (AFA). Banks or card issuers will decline transactions that do not meet the directive's requirements.

Because of this regulatory change, users in India will not be able to purchase apps from the App Store, subscribe to Apple TV+ or Apple Music, or buy movies or shows through iTunes with a credit or debit card.

Customers are now starting to see service interruptions, according to The News Minute, as spotted by 9to5Mac.

To prevent seeing interruptions to their subscriptions, users will need to fund their Apple ID balance, Apple's support site explains.

Read on AppleInsider

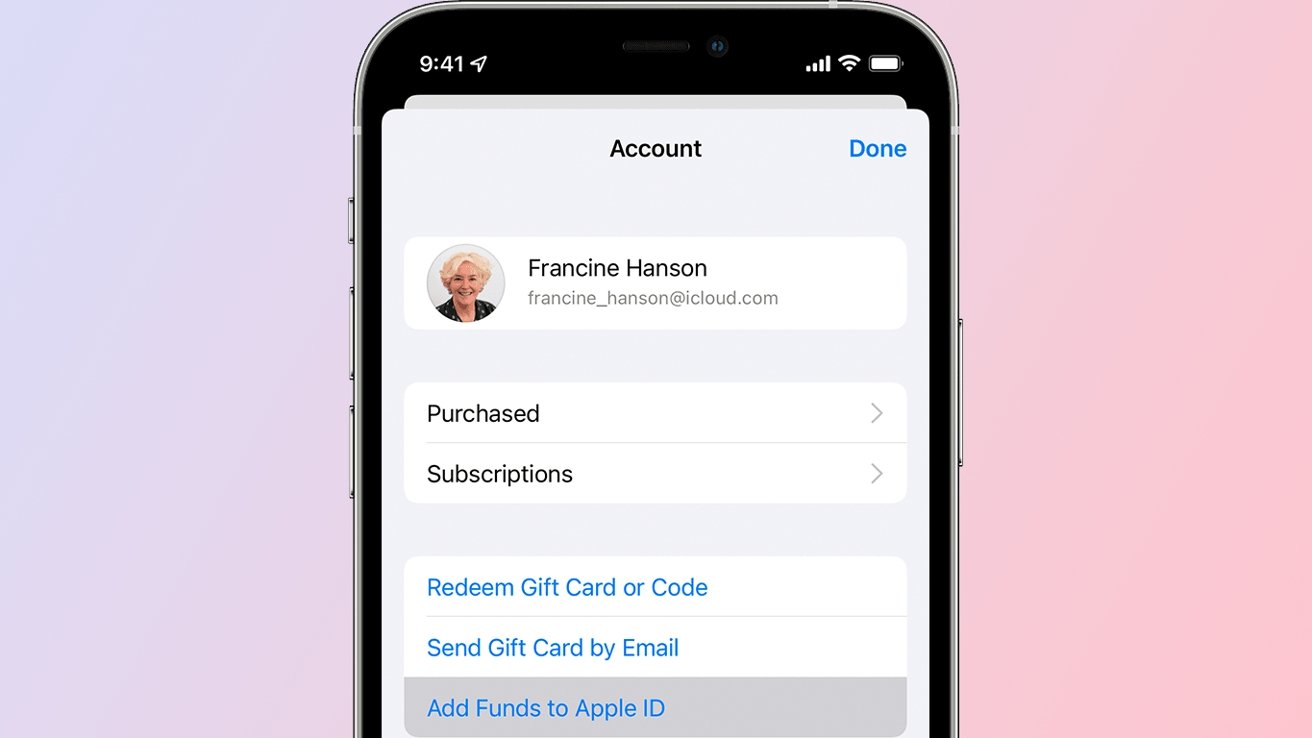

Image Credit: Apple

In October 2021, a ruling passed by the Reserve Bank of India made it so banks, financial institutions, and "gateways" would need to require approval before completing credit and debit card transactions for auto-renewable subscriptions.

According to the mandate, merchants must obtain user approval through transaction notifications, e-mandates, and Additional Factors of Authentication (AFA). Banks or card issuers will decline transactions that do not meet the directive's requirements.

Because of this regulatory change, users in India will not be able to purchase apps from the App Store, subscribe to Apple TV+ or Apple Music, or buy movies or shows through iTunes with a credit or debit card.

Customers are now starting to see service interruptions, according to The News Minute, as spotted by 9to5Mac.

To prevent seeing interruptions to their subscriptions, users will need to fund their Apple ID balance, Apple's support site explains.

In addition to encouraging developers to warn customers about the change, Apple ran a promotion that gave customers in India chance to add funds to their Apple ID to receive a 20% bonus.Regulatory requirements in India apply to the processing of recurring transactions. If you hold an Indian debit or credit card and you have a subscription, these changes impact your transactions. Some transactions might be declined by banks and card issuers.

To continue enjoying your subscriptions, you can pay with your Apple ID balance. You can add to your Apple ID balance using App Store Codes, Net Banking, and UPI.

Read on AppleInsider

Comments

just as well they aren’t building a house.

India is the world leader in digital payment systems, so this will just accelerate that even more. Most people have moved significantly away from cards.

For instance, if one was using Google Wallet to automatically bill a debit card on file, to pay monthly for a 200GB Google One cloud storage account, Google can not process that payment until it's approved by the card holder, every month. The same would be true if Amazon was billing you every month for a Prime account, using a CC you have on file with them. Amazon could not process that payment until the subscriber approve that billing, every month. Plus Apple can not just bill the CC you have on file with an iTunes account, for an app purchase or IAP when you click on "Pay with iTunes". You would need to approve each purchase with the CC issuer. However, if you keep a balance in your iTunes account like for instance from redeeming gift cards, then Apple can withdraw the payment from that balance. What Apple can't do is automactically charge your CC, until you approve that individual purchase.

I have auto CC billing with my Netflix account. Netflix bill my CC every month, without me having to approve it, every month. With my FasTrak account use for paying bridge tolls (without stopping), they will automatically bill my CC on file for $25, when ever the balance drops below $15. This might be every 2 or 3 months. Depending on how often I cross a toll bridge. But I don't have to approve the charge with my CC issuer, every time.

Now it also reads that this only applies to CC and debit cards issued by banks in India. If the CC or debit card in your "digital payment system" is issued by a US bank or other banks that don't have this "Inconvenient Rule", then you can use it to automatically pay recurring bills or any bill, without having to personally approve it every time.

With Walgreens, I have a CC on file where I can pay for my prescriptions by just telling the pharmacist to bill it to my "Express Pay". The pharmacist just tap a button on his computer terminal and then hands me a receipt. In India, I would need to input a password or PIN or sign for the purchase on the POS terminal or approve the purchase by way of an email notification using my smartphone. This, from the ... "world leader in digital payment system"?