Apple is financing all the lending for the Apple Pay Later service

"Apple Financing LLC," has obtained state lending licenses and will operate independently from the main corporate entity to power the newly announced Apple Pay Later service.

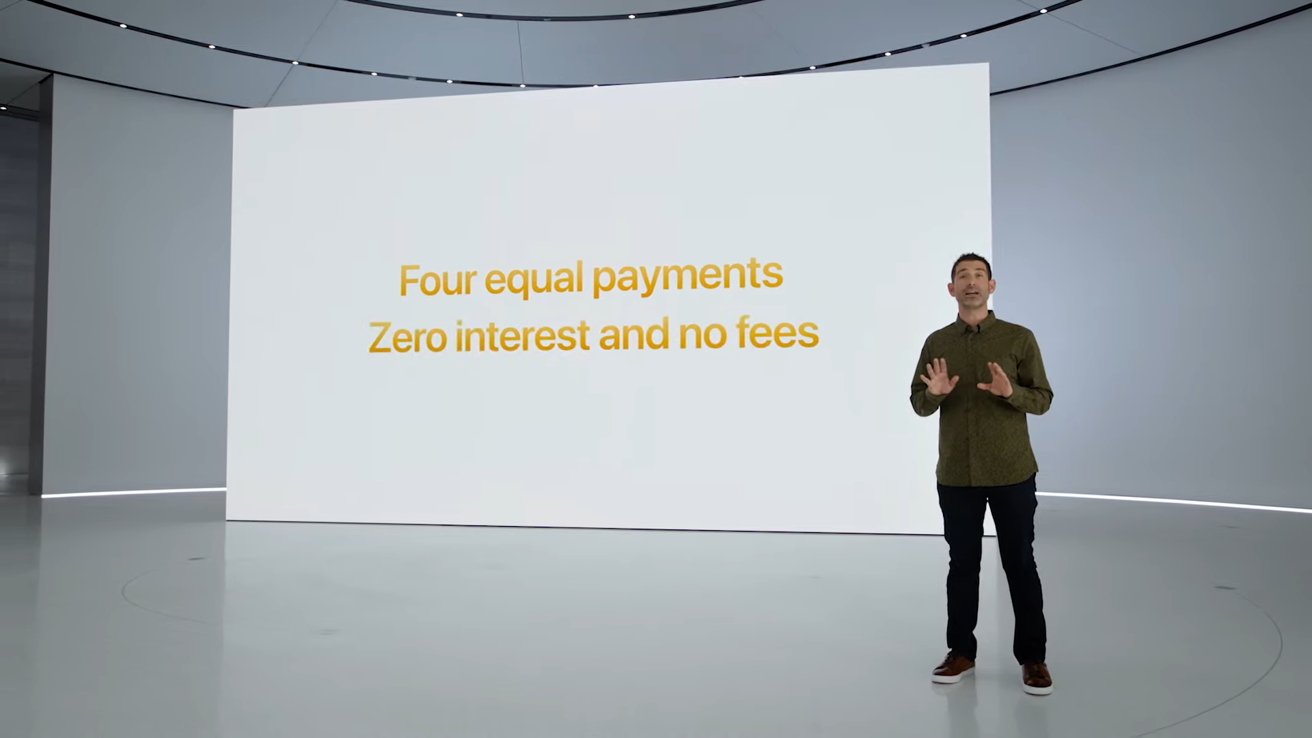

Introduced at WWDC 2022, Apple Pay Later gives users who are conducting a transaction through Apple Pay to split the cost into four payments over six weeks. The service charges no fees or commissions.

To power the service, Apple has established a wholly-owned subsidiary. It has spun off Apple Financing, LLC, to handle the lending.

This marks the first time that Apple has incorporated loans and credit assessments among other financial businesses into the firm, according to a report by Bloomberg.

The report added that Apple has been moving many of the financial services offered under the Apple brand "as part of a 'secret initiative'" the company internally calls "Breakout." The initiative is also slated to power the rumored upcoming device subscription program that splits the cost of new hardware into smaller month installments.

While interest-free lending is not directly a source of profit from the consumer, there are two avenues of cashflow the company will rely on. First, will be easier purchase of Apple hardware by consumers, paid with monthly installments outside of a traditional credit card.

The second profit avenue is transaction fees for each pay-as-you-go transaction that will be applied to the merchant. It's not yet clear what these fees will be, or if they will be in line with existing credit card merchant fees.

After years of partnering with credit card companies for Apple-only transactions, the company's first foray into payment tools was in September 2014, with the introduction of Apple Pay. The company then entered the credit card business in March 2019 in the launch of Apple Card, a culmination of a partnership with banking services firm Goldman Sachs.

Read on AppleInsider

Introduced at WWDC 2022, Apple Pay Later gives users who are conducting a transaction through Apple Pay to split the cost into four payments over six weeks. The service charges no fees or commissions.

To power the service, Apple has established a wholly-owned subsidiary. It has spun off Apple Financing, LLC, to handle the lending.

This marks the first time that Apple has incorporated loans and credit assessments among other financial businesses into the firm, according to a report by Bloomberg.

The report added that Apple has been moving many of the financial services offered under the Apple brand "as part of a 'secret initiative'" the company internally calls "Breakout." The initiative is also slated to power the rumored upcoming device subscription program that splits the cost of new hardware into smaller month installments.

While interest-free lending is not directly a source of profit from the consumer, there are two avenues of cashflow the company will rely on. First, will be easier purchase of Apple hardware by consumers, paid with monthly installments outside of a traditional credit card.

The second profit avenue is transaction fees for each pay-as-you-go transaction that will be applied to the merchant. It's not yet clear what these fees will be, or if they will be in line with existing credit card merchant fees.

After years of partnering with credit card companies for Apple-only transactions, the company's first foray into payment tools was in September 2014, with the introduction of Apple Pay. The company then entered the credit card business in March 2019 in the launch of Apple Card, a culmination of a partnership with banking services firm Goldman Sachs.

Read on AppleInsider

Comments

I remember people seriously suggesting this when ApplePay was announced.

Bank of Apple! I’d open an account in a heartbeat! They already have all of my information on their devices. And, I’ve spent thousands on apps, music, movies etc.. through the App Store and iTunes. If they have the capital, then do it! You know that your accounts will be under heavy security and protection. It’s a start! I support them! Tim Cook is brilliant!

Inflation is taking a toll on consumers and some will start defaulting on payments. Timing of this is not good.

Think about the ones who said that in 2008-09 (S&P bottomed out at 666 then, it's now over 6x that). For example, Tesla (under Musk) started during those years. Look where its market cap is now.

All of this builds transactions which don’t cost Apple 3% to 6% in processing fees from the credit card companies. While that may seem trivial, scale that up to tens of millions of dollars in transactions and the savings become significant. It also gives additional experience and data to Apple as it continues to build out a fintech division—one that might be responsible for car sales/leasing in a few years.

My only qualm about this is a subtle concern that Apple is starting to look more like a conglomerate and falling into a pattern not unlike that of GE. I still think of Apple as a technology-first company but their forays into movies, financial services, entertainment, etc., are a little bit less technology-first than I’d prefer. They’ve also reduced their footprint in other technology areas like networking. I guess I shouldn’t worry until Apple spins-up a plastics, nuclear power, aircraft engines, large scale financial capital services, etc., business units under the Apple name.

Why the concern about an Apple conglomerate? Potential loss of focus on their traditional product lines and concerns that it makes them an even bigger target for those who are trying to break up and take down “big tech.”

It's a grim situation. This style of lending is morally objectionable and Apple should be ashamed for entering the market.

There is crypto. There is FedNow. There is coming Central Bank Digital Cash. And similar from other countries.

It makes sense for Apple to split out a separate entity to deal with changing landscape.

E.I., when i bought My $1200 top of the line Pioneer laser player, I had 6 months to pay for it, interest free. I could make payments of any amount for each month, choose to pay it all off in 2 or 3 or 4 months and even not make any monthly payments at all and pay it all off on the 6th month. I get a statement every month (in the mail) stating the amount I still owe, the interest on that for the month, plus the interest accumulated every month from the time i made the purchase. But so long as I pay off the whole amount in 6 months, I don't have to pay any of the interest. Plus, one still had to have a CC, as after 6 months and it's not paid off, they billed your CC on file, for what you still owe plus all the accumulated interest.

Consumers were warned to make sure they pay off the whole amount in time. Many thought that "6 months interest free" meant that they would owe interest only the portion they didn't pay off after 6 months and that the interest started after the "6 months interest free" period was over. But they way it worked was that even if you didn't pay off $20 on a $1000 purchase in time, they would bill your CC $20 and what might be $50 worth of accumulated interest since the purchase.

You will own nothing and be happy everything seems to be going down to that road.