PC market got hammered in Q3, but Apple saw massive Mac shipment growth

Apple's Mac business growth is a giant high-point in a PC market downturn, with a 40.2% year-on-year increase in shipments for Q3 2022 against a sea of shrinkage from other major PC vendors.

14-inch MacBook Pro

The PC market has been in trouble for quite a while, with worldwide shipments continuing to decline. However, while firms like Lenovo and HP are seeing shipment levels drop year-on-year for Q3 2022, Apple is encountering the opposite.

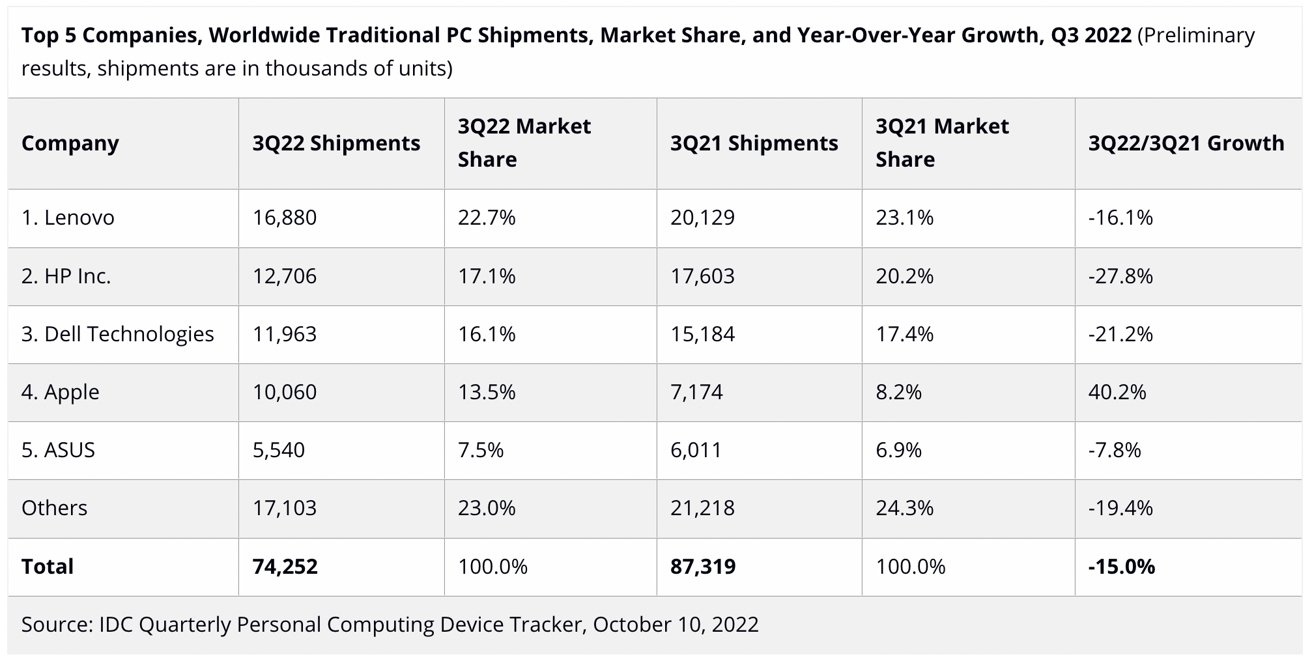

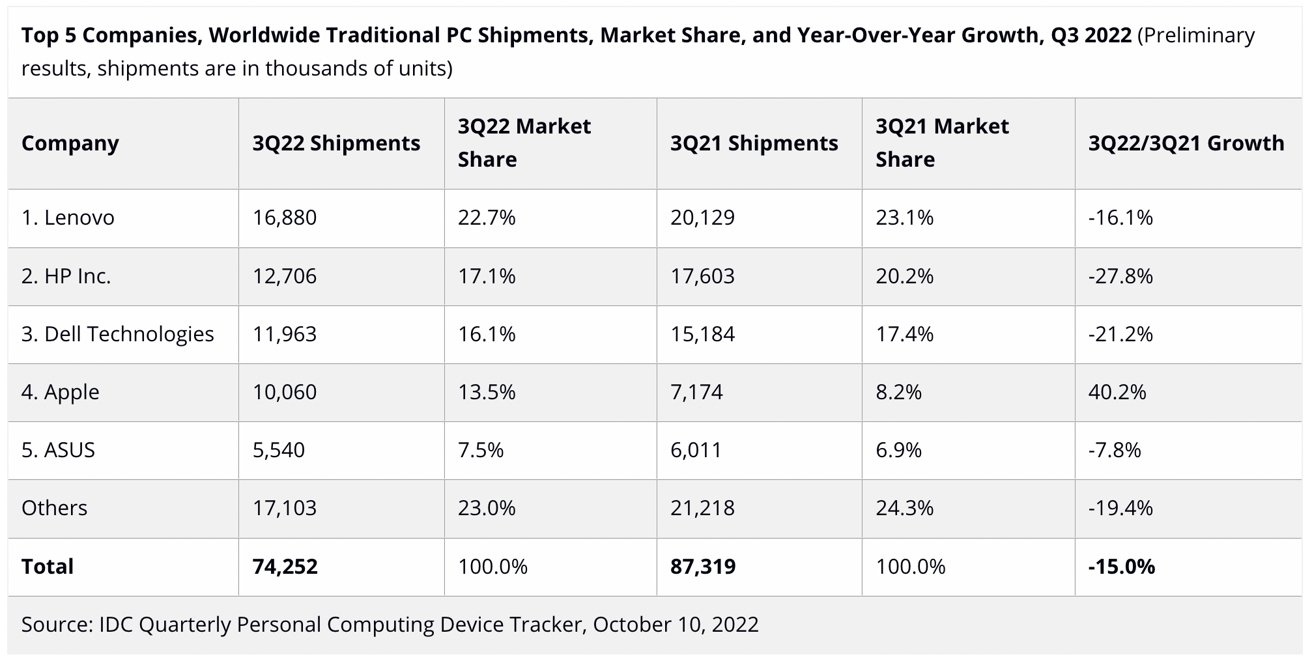

In the Q3 2022 worldwide PC shipments tracker by IDC, overall PC market shipments reached 74.2 million units, a drop of 15% from the same quarter one year ago.

Apple stayed in fourth place for the quarter, generating 10.06 million shipments in the period. Apple's result is an increase from Q3 2021, which saw 7.17 million shipments, and represents growth of a staggering 40.2%.

The growth in a shrinking market also means Apple gained market share, going from 8.2% in Q3 2021 to 13.5% in Q3 2022.

Ahead of Apple, top position Lenovo saw its shipments shrink YoY 16.1% to 16.9 million, HP declined 27.8% to 12.7 million, and Dell dropped 21.2% to 11.96 million. Fifth-place Asus also saw a reduction of 7.8% to 5.5 million units shipped.

"Consumer demand has maintained muted though promotional activity from the likes of Apple and other players has helped soften the fall and reduce channel inventory by a couple weeks across the board, according to IDC research manager Jitesh Ubrani. "Supply has also reacted to the new lows by reducing orders with Apple being the only exception as their third quarter supply increased to make up for lost orders stemming from the lockdowns in China during the second quarter."

While the market as a whole dropped year-on-year, IDC still points out that the shipment volumes are still "well above pre-pandemic levels," a time when PC volumes were "largely driven by commercial refreshes due to the looming end of support for Windows 7."

With claims of increased shipments, the numbers should mean Apple's Mac-related earnings during its upcoming October 27 results call should see a hefty bump in size.

Read on AppleInsider

14-inch MacBook Pro

The PC market has been in trouble for quite a while, with worldwide shipments continuing to decline. However, while firms like Lenovo and HP are seeing shipment levels drop year-on-year for Q3 2022, Apple is encountering the opposite.

In the Q3 2022 worldwide PC shipments tracker by IDC, overall PC market shipments reached 74.2 million units, a drop of 15% from the same quarter one year ago.

Apple stayed in fourth place for the quarter, generating 10.06 million shipments in the period. Apple's result is an increase from Q3 2021, which saw 7.17 million shipments, and represents growth of a staggering 40.2%.

The growth in a shrinking market also means Apple gained market share, going from 8.2% in Q3 2021 to 13.5% in Q3 2022.

Ahead of Apple, top position Lenovo saw its shipments shrink YoY 16.1% to 16.9 million, HP declined 27.8% to 12.7 million, and Dell dropped 21.2% to 11.96 million. Fifth-place Asus also saw a reduction of 7.8% to 5.5 million units shipped.

"Consumer demand has maintained muted though promotional activity from the likes of Apple and other players has helped soften the fall and reduce channel inventory by a couple weeks across the board, according to IDC research manager Jitesh Ubrani. "Supply has also reacted to the new lows by reducing orders with Apple being the only exception as their third quarter supply increased to make up for lost orders stemming from the lockdowns in China during the second quarter."

While the market as a whole dropped year-on-year, IDC still points out that the shipment volumes are still "well above pre-pandemic levels," a time when PC volumes were "largely driven by commercial refreshes due to the looming end of support for Windows 7."

With claims of increased shipments, the numbers should mean Apple's Mac-related earnings during its upcoming October 27 results call should see a hefty bump in size.

Read on AppleInsider

Comments

PC replacement cycles are what, 4 to 5 years now? All those PCs purchased in 2020 and 2021 won't be replaced in earnest until 2024.

I really wish Apple still reported the actual number of Macs shipped so that we wouldn't have to rely on these very noisy estimates. But still, even if the actual growth was just 20% instead of 40% it's still amazing.

All hail Apple Silicon!

Setting that aside, though, the most popular Mac model by far is the MBA and the base models are both competitively specced and priced (especially since they kept the M1 model around at a discount). So I doubt there's huge room to boost sales by cutting margins.

I think the better way to increase sales -- and Apple appears to agree -- is serving more markets and use-case scenarios. There has been a proliferation of Mac models in recent years to serve a wider range of needs and I suspect that helps boost sales more than slashing margins would. Ignoring custom configs, we now have two MBA models (M1 and M2), three MBP models (13, 14, and 16 inch screens), Mac mini, iMac, Mac studio, and Mac Pro. That's 9 distinct models of Mac, all of which can also be custom configured. While there might still be some gaps in the lineup, there aren't nearly as many as there were ten years ago.

I hasten to add that, at least in my view, this is not like the "bad" proliferation of models that occurred during the Performa era back in the mid 90s. Back then the differentiation was confusing and didn't add value for users -- it was just a marketing ploy. Today, the variation really adds value. There might be *some* confusion (more models always leads to some confusion), but I think the benefits of addressing more legit needs offsets that cost.