How Apple Savings compares vs other high-yield savings accounts

Apple Savings requires Apple Card

The finance sector isn't new to Apple, with Apple Wallet, Apple Pay, Apple Card, Apple Pay Later, and now Apple Savings. Customers have multiple avenues to entrust vital financial processes to Apple.

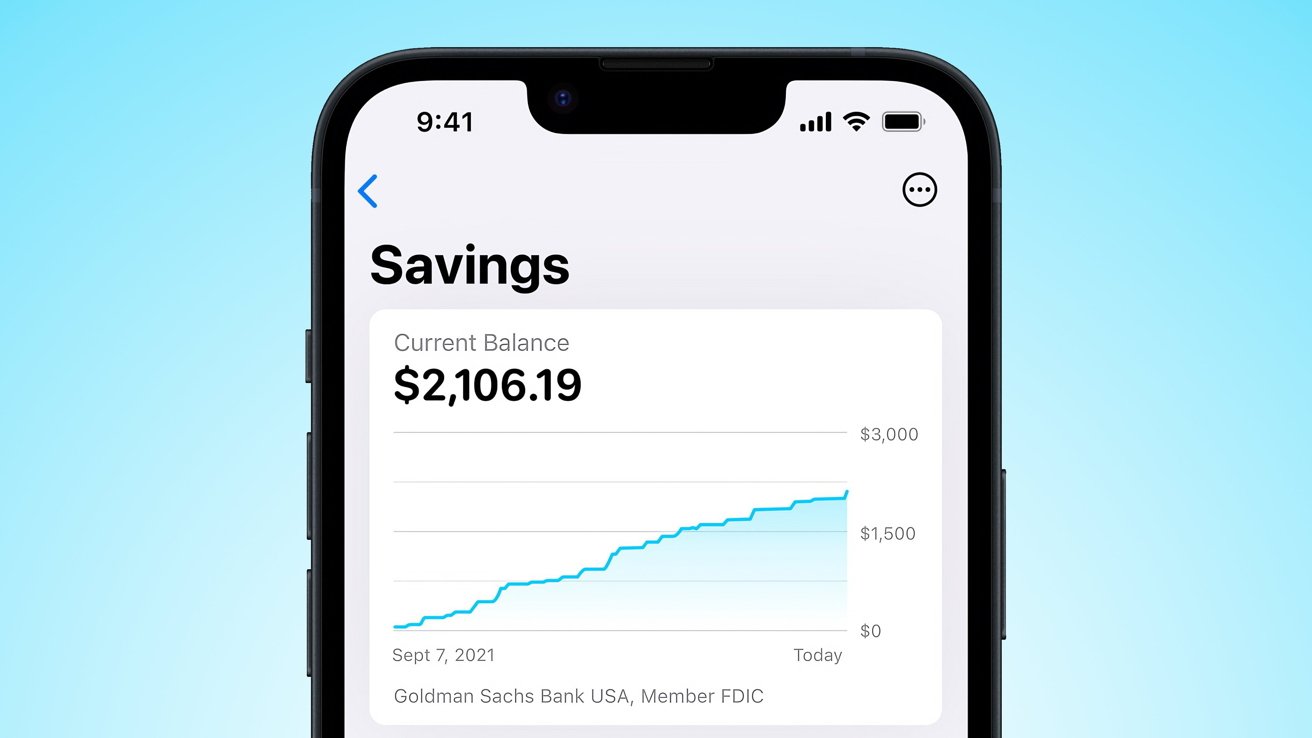

Apple Savings is a high-yield savings account provided by Goldman Sachs. It requires users to have an Apple Card and be over 18 years old. Otherwise, there are no minimum balances or fees associated with the account.

Here's how Apple Savings compares to other savings accounts. Interest rates are current as of April 1, 2024 -- but as Apple says, this can and will change with time.

Apple Savings vs other banks

For the most part, Apple is competitive, but there are some notable differences.

| Bank | APY | Minimum Balance for APY | Minimum Balance to avoid fees | Monthy fee | Maximum balance |

|---|---|---|---|---|---|

| Apple | 4.4% | $0 | $0 | $0 | $250,000 |

| Marcus | 4.5% | $0 | $0 | $0 | $3 million |

| UFB | 5.25% | $0 | $0 | $0 | N/A |

| PNC | 4.65% | $0 | $0 | $0 | $5 million |

| SoFi | 4.6% | $0 | $0 | $0 | N/A |

| Vio Bank | 5.3% | $0 | $0 | $0 | $2.5 million |

| Barclays | 4.35% | $0 | $0 | $0 | N/A |

| Citizens | 4.5% | $0 | $0 | $0 | N/A |

| American Express | 4.35% | $0 | $0 | $0 | N/A |

| Bank of America | 0.01% | $100 | $500 | $8 | N/A |

Note that some values have changed since this article first run in April 2023 and a January 2024 update. Several banks have increased their APY to be more competitive since Apple joined in, with Apple falling behind some of the competition.

Apple decreased its APY for the first time in April 2024 from 4.5% to 4.4%.

The maximum balance portion of the table was interesting, as many of these accounts list a specific value. Banks that did not directly reference a maximum balance are labeled as N/A. Apple's maximum of $250,000 is directly related to FDIC insurance limits, without extra fees.

All-in on Apple and digital

Users have to access their account via the Apple Wallet app on iPhone or the Settings app on iPad. There is no website or other option for Mac, Windows, or Android users.

You'll need an iPhone or iPad to manage Apple Savings

Every other bank listed has an app and website to manage accounts. Most banks even offer ATM access for withdrawals -- Apple Savings does not.

Apple's Savings is competitive in the industry, even though users have to be all-in on Apple and retain either an iPhone or iPad to manage the account. Users can transfer money to Apple Cash or a certified bank account, but the Savings account isn't available for direct payments to Apple Card.

Users can set up direct deposits to Apple Savings thanks to an account number and routing number provided in the app. Though, users should be wary before going all in on the Apple Savings account.

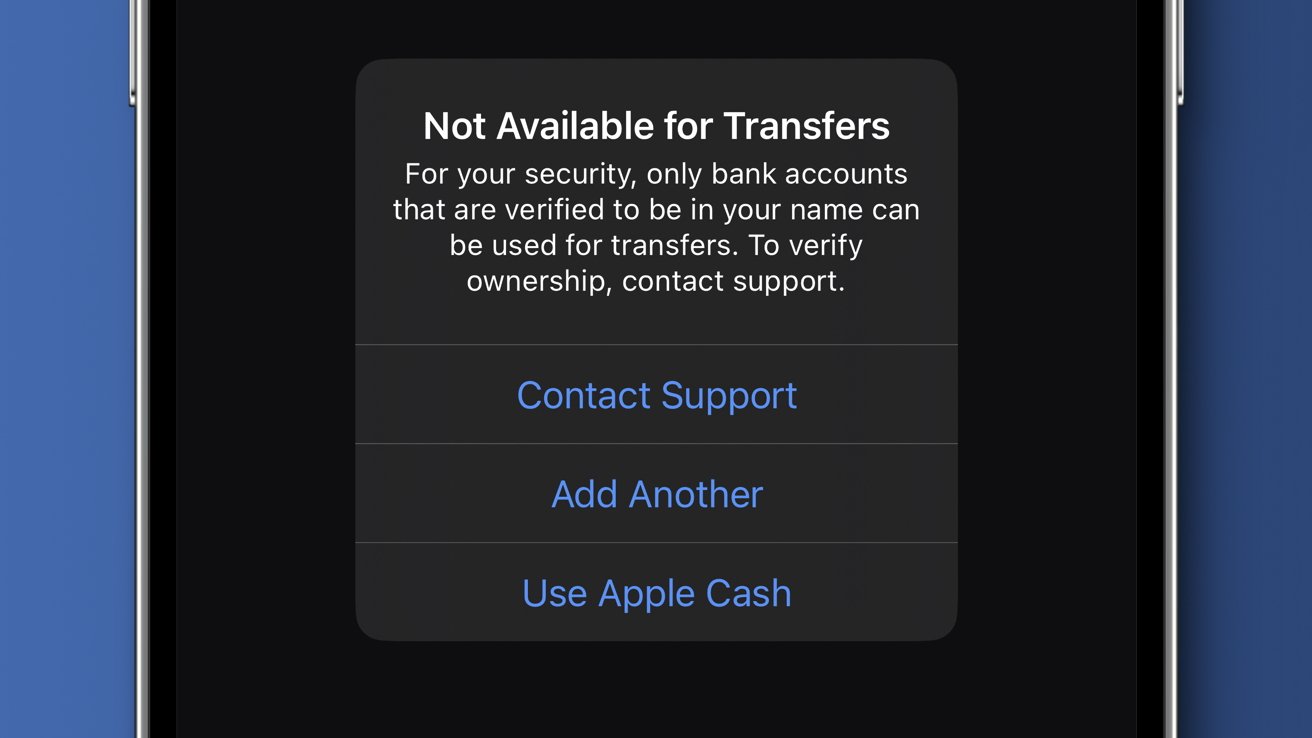

Some checking accounts can't be properly verified for use

Some checking accounts do not immediately qualify for direct transfer from Apple Savings through the app. Apple says users with banks that do not qualify will need to use the account and routing number to perform transfers from their institution's website -- at least until they get their external bank verified.

Alternatively, users can still add money to Apple Cash and then transfer the money to Apple Savings or vice versa. Paying Apple Card balances isn't possible with Apple Savings either, users will need to transfer from Savings to Cash, then to Apple Card.

Choosing Apple Savings over others

Apple Card users have an obvious entry point into the Apple Savings account. Everyone else will have a little overhead.

Other banks have little to no requirements to create an account. Most banks will create a checking and high-yield savings account after a person fills out a few forms, even without a history with that bank.

Apple Savings can't be created without an Apple Card

Apple users interested in an Apple Savings account will need to go through a credit approval process for Apple Card. Once approved, the Apple Savings account will become available.

We recommend checking with your existing bank to learn about their high-yield savings options before jumping on Apple Savings -- there might be a better deal or easier access. That and the all-digital aspect of Apple Savings and Apple Card might not appeal to you.

For the average Apple fan that has no intention of switching away from iPhone, there is no risk in getting an Apple Savings account. Provided you're eligible for an Apple Card.

And of course, as it is with many Apple financial systems and regulatory differences worldwide, Apple Savings is US only. Everyone else will have to wait until Apple Card launches in other countries, followed by Apple Savings.

Update April 1, 2024: Changed the APYs to reflect current rates.

Read on AppleInsider

Comments

Once you clear that 10 days, I imagine outgoing transfers will probably take 2-3 days.

The only solution that GS could suggest was to withdraw the funds back to my checking account and try another bank. So last night I withdrew the money from Apple Savings back to the checking account from which they originally came. The money was debited immediately from Apple Savings and reappeared this morning in my checking account and is included in my available balance. I have a checking account at another bank (Wells Fargo) which I will use from now on.

I would guess that this problem could be avoided by transferring the funds from your bank to Apple Savings by setting up Apple Savings as an external account with your bank and then "pushing" the money to Apple Savings. Then verification would be done with micro deposits/withdrawals instead of by phone calls.

Both of my credit union accounts are shown in the Bank Accounts tab associated with the Apple Savings. I thought this meant they were linked. Apparently not.

Moving money around to get the highest rate is unreasonable. But when my banks offer only 0.04%, I knew I had to do something.

That same day, I got an email from Amex telling me that my Platinum (or Gold) Amex account allowed me to add a savings account with a 4.35% APR. It has a $500,000 limit. Setting it up was a breeze, and I already have a linked bank account for paying my Amex balance every month. The transfer from my Bank to this Amex savings account was as smooth as silk, and $100,000 went through with a click. I was told it would take two days to complete, but I could click expedite at no charge if I was in a hurry.

Transfering back (i.e., withdrawing cash) is just as simple.

Even better is that it’s cheaper and accepted more widely than AMEX.