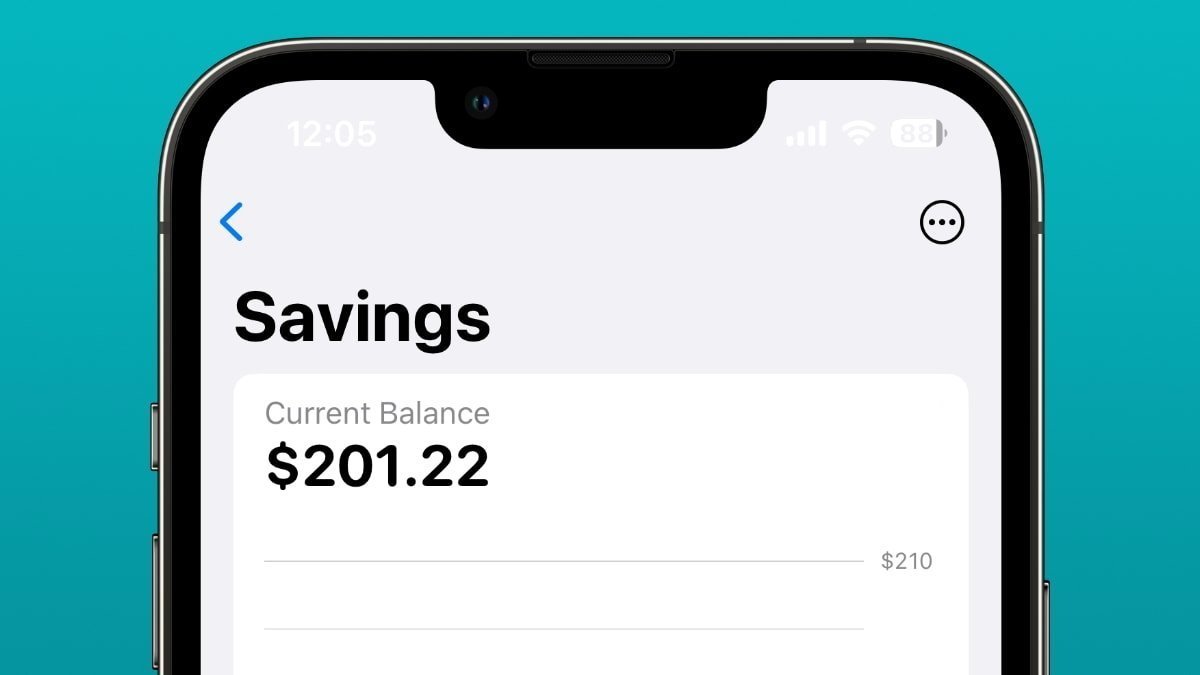

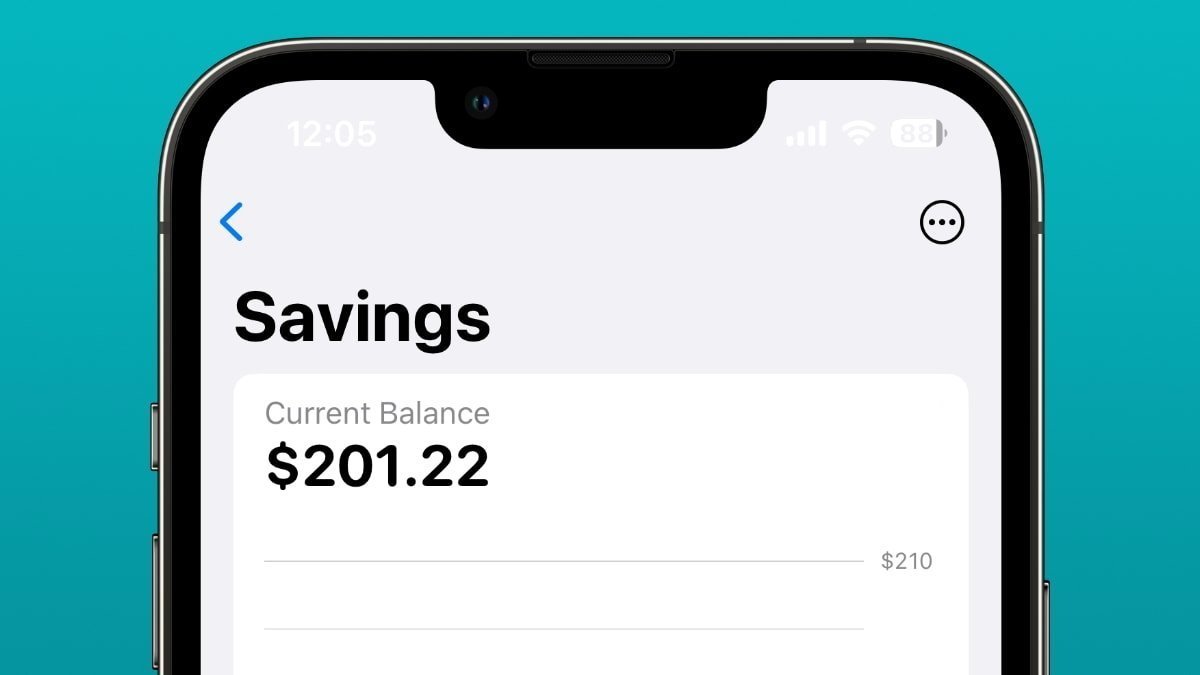

Apple Savings cuts its interest rate again, this time to 3.65%

Apple Savings account holders will get less for their money, after another interest rate cut brings it down to 3.65%.

Apple Savings rates cuts have happened a few times in a row

The Apple Card Savings Account provides a high-yield savings facility for users of the financial service. Following a series of rate cuts over time, the Apple Card Savings Account is now at its lowest level.

On Wednesday, Apple started to advise Apple Savings users of yet another drop of the annual percentage yield (APY). Now, users have to endure a yield of 3.65%.

It is the latest cut to the account, which has seen a steady drop in rate since its 4.5% high in January 2024. Since then , it has seen periodic cuts, with the previous one being to 3.75% in March 2025.

The cuts relative to its 2023 launch are largely forced by Federal Reserve rate cuts, from a period when interest rates were high. It's a phenomena that doesn't just affect Apple Savings users, as competitors are also feeling the sting as well.

Apple Savings users do not need to do anything following the notification, as the new 3.65% interest rate already applies to accounts.

Read on AppleInsider

Apple Savings rates cuts have happened a few times in a row

The Apple Card Savings Account provides a high-yield savings facility for users of the financial service. Following a series of rate cuts over time, the Apple Card Savings Account is now at its lowest level.

On Wednesday, Apple started to advise Apple Savings users of yet another drop of the annual percentage yield (APY). Now, users have to endure a yield of 3.65%.

It is the latest cut to the account, which has seen a steady drop in rate since its 4.5% high in January 2024. Since then , it has seen periodic cuts, with the previous one being to 3.75% in March 2025.

The cuts relative to its 2023 launch are largely forced by Federal Reserve rate cuts, from a period when interest rates were high. It's a phenomena that doesn't just affect Apple Savings users, as competitors are also feeling the sting as well.

Apple Savings users do not need to do anything following the notification, as the new 3.65% interest rate already applies to accounts.

Read on AppleInsider

Comments

T**** (the convicted felon and sexual predator)®™ sure can screw things up easily.

It's his plan.

Looks like it declined near the end of last year and has been flat since then.

https://tradingeconomics.com/united-states/bank-lending-rate

People value convenience. And the Apple Card + Apple Savings are very convenient. That's all there is to understand.

Apple Savings rates have been competitive since its inception and still are. Where do you bank and what is its Savings Account interest rate?

Millions of hard working people use savings accounts for — savings. They don't have the acumen, stomach, or budget for higher paying investing. So many banks don't pay even 1% interest on savings even when the balance is very high. But they're quick to try to steer customers to money market accounts with could pay up to 5x the current savings rate. 5 fucking times! Wow. A whopping <5%. With all the security of your savings account. "Well no there is some risk and no guarantee of profit." Oh really.

So no, 3.65% isn't great. It isn't even good. Yet it's better than most banks offer. Even with a ton of money in a bank savings account I doubt many such a customer would make enough interest to require reporting. Though that could change.

Fair point, it is G-S and not Apple's doing and that would have been edifying to some readers. Another fair point is the article didn't say it was Apple's doing, just that it's happening to Apple Savings, right? I can see where the causal reader might make incorrect assumptions based on what wasn't written. That's not a smart thing to do but it people choose to do it all the time.

The article did mention the Federal Reserve and the rate cut happening to Apple's competition as well, not that the competition was lowering its rates but that it was happening to them.

Yes. The convince isn't insignificant. Apple's Daily Cash back can go to its Apple Cash card or Apple Savings. I have it directed to Apple Savings. It's very convenient and on the plus side, it's very surprising how fast that balance accumulates even if it's not from the interests alone.

I use my Apple Card everywhere I can. It doesn't give me the cash back rates that some cards do but it gives me a lot of convenience especially where the Daily Cash back is concerned.