nht

About

- Username

- nht

- Joined

- Visits

- 115

- Last Active

- Roles

- member

- Points

- 2,007

- Badges

- 1

- Posts

- 4,522

Reactions

-

Bernie Sanders says government should examine Apple, Google, Facebook breakup

The bigger picture is the US dominance in technology is a strategic US advantage. It has zero to do with Macs or iPhones. Breaking up our major companies and reducing our competitive advantages only strengthens our adversaries.AppleZulu said:

Keep in mind the bigger picture. It doesn't advance your interests if someone doesn't touch the Mac on your desk but still burns down the building around it.nht said:The only way the Dems can make me vote for Trump is this.

-

Apple investigating move of up to 30% of production out of China

Lol...try maintaining your standard of living 1/3 of your income missing. "Very replaceable"?GeorgeBMac said:

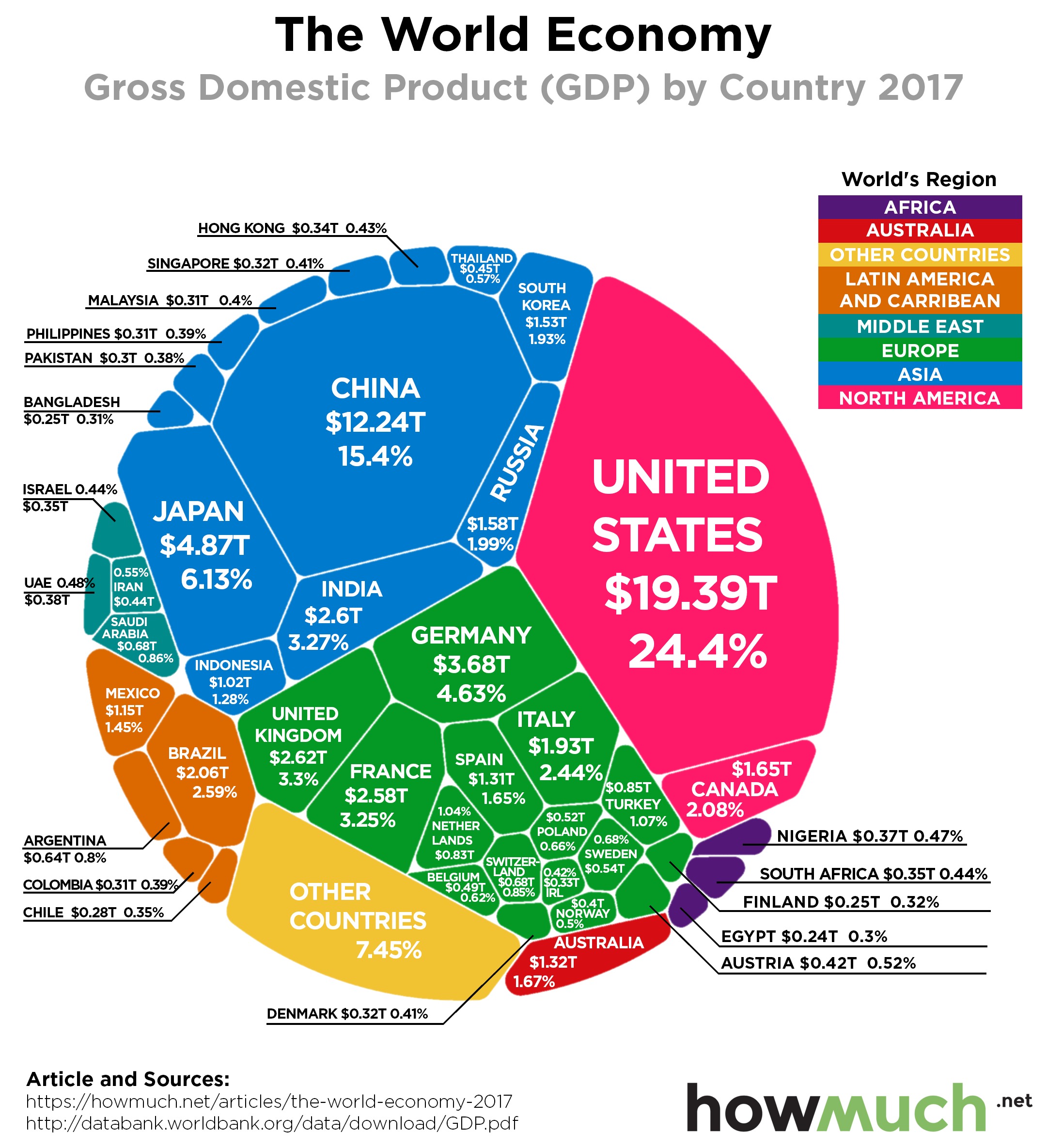

The truth is: The U.S. comprises less than a third of the world's GDP and is very replaceable by the other 2/3's.

The truth is when our economy takes a hit so does everyone else's in a big way. Remove the US from the equation and the global economy would collapse for years. It's like removing the 3rd leg from a 3 legged stool because while the US is only 24% of the Global GDP it impacts EVERYONE else. A hard Brexit will impact a lot of countries...with the EU as one the bigger losers...and the UK is relatively small.

-

Editorial: The new Mac Pro is overkill for nearly everybody, and it hit Apple's own target...

People keep saying Pixar (who will have huge render farms) but the pros that want this machine are customers of Blackmagic, RED and ARRI. BM folks will buy the lower end $6K Mac Pro. RED 8K users will pony up for the top end Mac Pro.dysamoria said:So this computer is awesome for companies like Pixar. Where’s the thermally well-designed modular machine for small businesses, prosumers, hobbyists, and institutions that cannot justify a $12000 setup... but also cannot justify replacing disposable computers every 3 years and want something more powerful than an obsessively compact machine?

Everyone keeps defending Apple with the “if you cannot afford it, it’s not for you” meme. The Mac Pro used to start at $2500. Then $3000. Now that starting price is $6000. It has the same name. It has the same *general* appearance. Yet, the pricing, and, according to you apologists, the intended purpose/market for THIS new “Mac Pro” is big business that can justify spending $12000 for a workstation. Apple went WAY overboard here. They’ve utterly dropped an entire segment of computer using professionals. They’ve aimed at the 1% while shouting “SEE WE STILL CARE ABOUT PROFESSIONALS!”

For Pros that don't need a $6000 machine there's the mini, iMac and iMac Pro. The new Mac Pro is more pro than the old cheese grater Mac pros. For one, it's more easily rackable and it has a lot more expansion ability relative to most other workstations due to the thermal design and the modules.

-

Apple debuts new $5999 Mac Pro with up to 28-core Xeon processors

Minimum for a capital purchase is often $5K. $6K starting price is reasonable.melgross said:

If a scientist or engineer needs this amount of power, then they are doing work where this can be bought. Scientists spend tens of thousands to millions on equipment. Either a grant pays for that, or the company or university does. An engineer rarely works alone, so they’re in a similar situation. Do you have any idea how much a modern scope can cost? Tens of thousands. Power supplies, voltmeters, etc.? If that engineer is doing the kind of work that requires this type of computer, then (s)he’s already using perhaps over $100,000 of test and measurement equipment. The work involves RF, then we’re talking possibly four times as much.davgreg said:

Not true.netrox said:Love how amatuers complain about the costs of Mac Pro... it's for Professionals making lots of money... not for amatuers living on a few hundreds.

There are people who need workstations that are not rolling in money. People like scientists and engineers.

The Pro market extends way beyond the media business.

This is another nice engineering exercise but leaves a gaping hole between the Mac mini and this. A version with something less than an 8 core Xeon CPU could be offered for substantially less.

this computer is just another piece of equipment,

-

Huawei may be open to selling its 5G modem, but only to Apple

Nope. You stated "A foreign country who has never attacked us" which is categorically a false statement genius.GeorgeBMac said:

LOL.... You stated China helped a country we were at war with 70 years ago and used that as justification that we should never do business with them again. I merely pointed out that another country quite literally invaded us, burned our capital, and yet you think that is of no importance or relevance. It seems you are cherry picking the justification for who you have chosen as an enemy.nht said:

If England was constantly attacking us in cyberspace today then yes.GeorgeBMac said:

And, England attacked us... So we should stop buying anything from England?nht said:

They have attacked us. Read history genius. PLA units directly attacked US units in the Korean War.GeorgeBMac said:

So let me get this straight:tmay said:Here's a well considered take on the Huawei 5G problem;

https://www.scmp.com/news/china/diplomacy/article/3005407/us-seeks-freeze-out-huawei-europe-using-rule-law-argument

"The US is engaged in a global campaign to keep Chinese tech companies out of advanced 5G networks promising faster connections, enabling uses such as autonomous vehicles and remote surgery. American officials fear that the Chinese government may force companies such as Huawei to incorporate software code or hardware that would allow Beijing to spy on the US or allies and disrupt sectors ranging from power to transport and manufacturing in a crisis."

“The most fundamental security standard, really, is that you cannot have this extrajudicial, non-rule of law compliant process where a government can tell its companies to do something,” Strayer said on Monday.

and,

"Australia, New Zealand and Japan have acceded to US requests to bar Huawei’s 5G equipment. Those allies have also banded together to provide aid to the Solomon Islands and Papua New Guinea so that they would reject a Huawei submarine cable carrying broadband connections, saying the line represents a national security threat at its connection point in Australia."

This is absolutely about national security, and not about "protectionism"; the U.S. doesn't have any existing 5G telecom manufacturers, relying instead on the marketplace. Unfortunately for Huawei, those CCP and Chinese Government Connections as well as the legal system that is beholden to the CCP, all are high risks for Western Liberal Governments.A foreign country who has never attacked us might, maybe, sometime in the future ask one of their companies to reveal U.S. secretes and that company might, maybe do so in that hypothetical future and might maybe not reveal anything to any of their valued customers in the U.S. -- and that constitutes irrefutable proof that they are spies...Meanwhile asking a country who was in the process of attacking us to expand their attack into cyber warfare in order to over turn our election is not collusion.Got it.

In any case you stated that they have never attacked us which is false. I don’t think that even the Russians have attacked us directly with regular army units. “Contractors” and “individual volunteers” yes. Soviet divisions? No.

It's a problem with many ideologues: They come up with the conclusion first and then look for something to justify that conclusion.

Everything else you're writing is just deflection that you don't know history and stated something completely wrong. The US and UK are linked in a fundamental way and the War of 1812 was declared by the US, not the UK which was busy in the Napoleonic Wars. Something else you are completely unaware of because you don't know history. Genius. They didn't "invade us", they bitch slapped us with a raid of only 2500 soldiers for being stupid in declaring war on one of the major powers of the world while being completely unprepared and unorganized.

On the plus side we managed to recover and not do too terribly badly in such an ill considered war and ended being more trouble than it was worth to actually invade.

Genius.