asdasd

About

- Username

- asdasd

- Joined

- Visits

- 248

- Last Active

- Roles

- member

- Points

- 1,785

- Badges

- 1

- Posts

- 5,686

Reactions

-

Apple and Ireland win appeal of $14.4B EU tax case

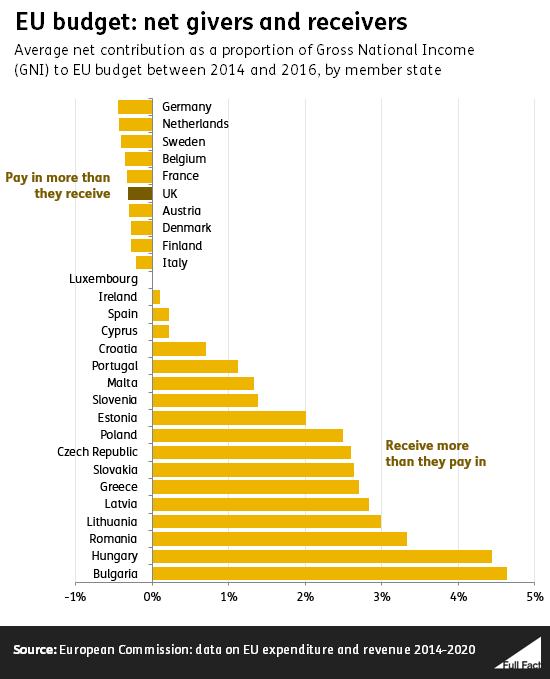

Am I joking? No. You falsely claimed that Ireland was a net recipient of EU aid. Which hasn't been true for a while. I knew that and replied. It's also irrelevant to the whole topic here but I tend to distrust arguments that contain claims I know are untrue, even if I can't verify the rest of the claims. So I merely pointed out that you are incorrect. Finding that Ireland was a net recipient in 1980, 1990 or even 2010 doesn't really amount to much of a defence.anantksundaram said:

Umm... you're joking, right?asdasd said:

Dont know where that map came from, do you have a source? In any case its from 2014-2016.anantksundaram said:

Ireland didn't turn positive in its net contributions to the EU until recently (2018, I think). During the period 2014-2016 (when the case was being brought), Ireland was a net recipient (see below for actual EU -- not Irish Times -- data). Ireland was even more of a net recipient during the period of the supposed "preferential tax treatment", i.e., the period that is actually being litigated (which I believe was the 2000s through the early 2010s).asdasd said:

Ireland is a net contributor to the EU, and has been for a while.anantksundaram said:

You're the one spreading misinformation, I am afraid. If the money gets credited to Ireland, that is money in the bank for the EU since they will have to send a smaller annual check to the country (Ireland is a net recipient of EU largesse).crowley said:

This has been gone over many times, there is no retroactive changing of the law, the law came into force in 1992 (I believe it was Maastricht) and Ireland should have adjusted its tax relationship with Apple at the time. Just because it has taken a number of years for the case to be brought doesn't mean the law has been changed in any way. It is Ireland that is accused of breaking EU law, not Apple; Apple was merely the beneficiary. Also, the EU will not "get" anything much from this - if Apple and Ireland loses the case then the money held in escrow is payable to the tax authorities in Ireland, not the EU.aderutter said:Good news, it was obvious that the EU were on a money grab and trying to retroactively change the law to do so imho.

I’m not saying Apple and Ireland will ultimately win even though I do not believe for a minute Apple broke the law.

I do believe the EU will more than ever given recent economic events do anything they can get to as much as they can from anywhere they can.

Again, this has been covered many times. Please stop spreading misinformation.Moreover, if Apple had lost, the long run consequences for Ireland, by making is less competitive as a destination for US tech investment, might have been for more onerous. You're ignoring some basic facts here.

https://www.irishtimes.com/news/ireland/irish-news/taoiseach-predicts-steep-rise-in-ireland-s-contribution-to-the-eu-budget-1.4084499

As for the comment you were replying to, the law used against Ireland was state aid, not that they had too low a taxation level. Which isn't something that is a competency of the EU.

I recall discussion in the media then about how, if the EU won the case, Ireland might have had to fork over the money to the EU because of its cumulative net recipient status. +

+

Here is what you originally said:

You're the one spreading misinformation, I am afraid. If the money gets credited to Ireland, that is money in the bank for the EU since they will have to send a smaller annual check to the country (Ireland is a net recipient of EU largesse).

You now seem to have moved to goalposts to 2010-2014 but this isn't what you claimed. Clearly you said the payment would have an effect on the net transfers to Ireland were the money credited to Ireland ( i.e. this year).

-

Apple and Ireland win appeal of $14.4B EU tax case

Right the real problem here isnt that Apple should or should not be paying more taxes. It probably should be paying more in fact, in Europe. And maybe taxes should be equalised across the EU. Maybe there is a need for a digital tax.JWSC said:

No. Ireland should NOT have adjusted their tax rate in 1992. That is a fundamental misreading of the law. Margrethe Vestager misread it and the court agreed. The Maastricht Treaty never mandated tax harmonization between the nations of the EU.crowley said:

This has been gone over many times, there is no retroactive changing of the law, the law came into force in 1992 (I believe it was Maastricht) and Ireland should have adjusted its tax relationship with Apple at the time. Just because it has taken a number of years for the case to be brought doesn't mean the law has been changed in any way. It is Ireland that is accused of breaking EU law, not Apple; Apple was merely the beneficiary. Also, the EU will not "get" anything much from this - if Apple and Ireland loses the case then the money held in escrow is payable to the tax authorities in Ireland, not the EU.aderutter said:Good news, it was obvious that the EU were on a money grab and trying to retroactively change the law to do so imho.

I’m not saying Apple and Ireland will ultimately win even though I do not believe for a minute Apple broke the law.

I do believe the EU will more than ever given recent economic events do anything they can get to as much as they can from anywhere they can.

Again, this has been covered many times. Please stop spreading misinformation.

Excerpt from The Spectator:

“The EU has been using tech regulation, and competition policy, as a cover for a naked, federalising power grab. Let’s take the Apple case as an example. The company is perfectly entitled to base a lot of its operations in Ireland, which happens to have a very low corporate tax rate (just 12.5 per cent). Low taxes are one of the ways that what used to be a slightly damp island on the far west of Europe has made itself one of the richer countries in the world.”Ireland was always perfectly happy with Apple’s taxes. It paid what it owed in full. And Apple was quite happy to base itself there, and employ lots of people. And then the EU came along, and tried to redefine that as 'state aid' and slapped it with a huge bill. It is hardly the first time that has happened. The Commission has already lost a similar case against Starbucks, and Google is quite rightly appealing against the billions in fines that have been imposed upon it (its lawyers must be smiling this morning).”Whether you happen to approve of big American companies or not isn’t really the point, whatever the EU’s defenders try to maintain. In reality, under the existing treaties, aside from VAT, Ireland is allowed to charge any taxes it wants. If the Commission wants an EU-wide corporate tax it should argue for it, and change the treaties openly. Instead, it has been trying to do it in secret, and with lots of spin, but, as it has just discovered, without any legal basis.”The EU often tries to portray itself as a 'rules-based' organisation. But it is increasingly acting outside the law. It has now lost a whole series of key cases, and in its own courts as well.”

But this is underhand nonsense, a redefinition of State Aid, all the more appalling as State Aid goes on all the time in the EU. I mean banks were bailed out in 2008. Covid payments are a form of state aid.

-

Apple and Ireland win appeal of $14.4B EU tax case

On what basis except perhaps this is what you have always believed.gatorguy said:

The EU's case presentation was apparently less than stellar, losing on the preparation but not yet on the facts. I tend to agree with you that in the end Ireland (and by extension Apple) won't win this one.carnegie said:

I suspect the EU will ultimately win. I'm surprised Apple and Ireland even won at this stage though.zimmermann said:

Let’s wait to see if the EC goes to the Court of Justice for a final verdict.carnegie said:I think this was a no-brainer, Apple and Ireland should have won this appeal. The European Commission's decision never demonstrated what it claimed it did and what it needed to in order to justify the action it took.

That said, I'm quite surprised that Ireland and Apple did win.

-

Apple and Ireland win appeal of $14.4B EU tax case

Ireland is a net contributor to the EU, and has been for a while.anantksundaram said:

You're the one spreading misinformation, I am afraid. If the money gets credited to Ireland, that is money in the bank for the EU since they will have to send a smaller annual check to the country (Ireland is a net recipient of EU largesse).crowley said:

This has been gone over many times, there is no retroactive changing of the law, the law came into force in 1992 (I believe it was Maastricht) and Ireland should have adjusted its tax relationship with Apple at the time. Just because it has taken a number of years for the case to be brought doesn't mean the law has been changed in any way. It is Ireland that is accused of breaking EU law, not Apple; Apple was merely the beneficiary. Also, the EU will not "get" anything much from this - if Apple and Ireland loses the case then the money held in escrow is payable to the tax authorities in Ireland, not the EU.aderutter said:Good news, it was obvious that the EU were on a money grab and trying to retroactively change the law to do so imho.

I’m not saying Apple and Ireland will ultimately win even though I do not believe for a minute Apple broke the law.

I do believe the EU will more than ever given recent economic events do anything they can get to as much as they can from anywhere they can.

Again, this has been covered many times. Please stop spreading misinformation.Moreover, if Apple had lost, the long run consequences for Ireland, by making is less competitive as a destination for US tech investment, might have been for more onerous. You're ignoring some basic facts here.

https://www.irishtimes.com/news/ireland/irish-news/taoiseach-predicts-steep-rise-in-ireland-s-contribution-to-the-eu-budget-1.4084499

As for the comment you were replying to, the law used against Ireland was state aid, not that they had too low a taxation level. Which isn't something that is a competency of the EU.

-

Apple reportedly evaluating Apple Silicon-powered macOS on iPhone

They abandoned that years ago. It didn’t make that much sense. How many people would need it?inTIMidator said:I don't recall the year, but was EXCITED as hell when Steve talked about something called "Home on iPod"

You plug in your iPod to a Mac, it then boots to your settings and has all your apps installed. It was basically using the iPod as an external drive. Been waiting and waiting and waiting..... then the stupid cloud crap started with half assed web apps compard to their native versions. I'm tired of drop down after drop down after drop down menu. Native apps gave me keyboard shorts cuts. I could type in the field.... now its ALL menu based, constant mouse movement and slow AF!!!!!