Apple, Inc CEO Tim Cook's piqued peek at Peak iPhone

Halfway through the last quarter, supply chain rumors of iPhone production cuts--purportedly "30 percent" of some unknown number--snowballed into an abominable snow-boogeyman of conjecture that claimed the end to iPhone growth was nigh and speculated about a downhill implosion of Apple's sales overall, an embarrassing lack of interest in Apple's newest iPhone 6s and a rapid evaporation of the world's most valuable company. They were wrong, here's why.

Impressed by some unsubstantiated supply chain rumors and supplier profitability concerns, a series of ostensibly legitimate media outlets began suggesting that Apple's March fiscal Q2 could see something like a 30 percent drop in iPhone sales, and that Apple likely wouldn't even be able to meet its guidance for the December quarter, resulting in a "Peak iPhone" milestone marking the date where Apple's iPhone sales would never again grow, for the first time in the illustrious eight year run of Apple's smartphone.

However, everything about these predictions were wrong. Not just "wrong" as in dramatically exaggerated, but wrong as in fundamentally incorrect, myopically ignorant and distractingly deceptive.

In Apple's fiscal Q1 earnings call, its chief executive Tim Cook outlined what was really happening, although it appears many journalists would prefer to continue believing the incorrect story they made up on their own.

Apple actually sold slightly more iPhones in the December quarter, right in line with its guidance. This occured despite the "10 percent cut" in December orders (of some sort) cited by Morgan Stanley's Asian supply chain channel checker Jasmine Lu (as noted by Philip Elmer-DeWitt for Fortune).

Apple's ability to exceed its iPhone sales record in the December quarter is quite incredible because--as we'd been incessantly told--there was a Difficult Compare year-over-year due to the fact that iPhone 6 had so spectacularly broken sales records via pent up demand for larger screen iPhones, something that would supposedly be very difficult to ever achieve again.

Apple's fiscal 2015 Q1 iPhone performance was like an impossible basketball shot, but it then repeated that performance, only slightly better for Q1 2016. Except in this case, not only did Apple repeat a monumental stroke of operational achievement in building and selling 74 million premium devices within three months (more than Xiaomi could manage to build and sell across an entire year, despite working without environmental or worker rights scrutiny, and leisurely building lower quality devices in batches largely unconstrained by a launch event), but Apple performed this despite increasingly poor economic conditions globally.

Those conditions included an increasingly strong US dollar that forced up prices internationally, making it that much harder to sell iPhones in competition with cheap Android devices that were already budget priced--and which in most cases were not adversely affected by the US Dollar shift. Samsung actually benefited from currency shifts, but still earned near the lowest bottom of its modern smartphone earnings. Samsung's overall sales were also down, and everyone's Android premium phones were down sharply.

Android phones over $500 "have have decreased from ~ 280m units in 2012 to ~ 190m units in 2015," noted Creative Strategies analyst Ben Bajarin. That's a 32 percent drop. Remember all the news reports about Peak iPhone-class Androids? Me neither. But that actually happened, while Peak iPhone has not.

"Apple has over 80% share of smartphones sold globally over $600 dollars," Bajarin added, noting that "$400-500 is also considered high end Android."

On top of that, Apple's iPhone Average Selling Price in the December quarter jumped up to $691, from $687 in the year ago quarter. This is incredible, because it indicates that buyers continued preferring the latest iPhone 6s model over the very similar iPhone 6 with its $100 discount.

Any significant percentage of buyers deciding that last year's 6 was good enough for them would have brought that number down. A minor decrease would be understandable. An increase is nearly absurd.

The fact that iPhone ASPs continue to rise is a direct rebuke of chatter that nobody wanted a 6s model because they weren't different enough or didn't offer enough spectacular newness.

Isolated bits of data on supply chain cuts--even if they were correct--do not on their own mean anything. A year ago, Apple's supply of the entirely new iPhone 6 models was so constrained that the company struggled to meet demand into January. This year, the design and construction of Apple's 6s models were well within known territory, and could be manufactured ahead of time with less difficulty.

Apple is also rumored to be manufacturing a smaller iPhone 5s-sized new phone, so building the 6s line early would enable production of such a second run. The fact that Apple may have changed some of its supplier orders was therefore essentially worthless information to anyone lacking a comprehensive understanding of the entire operational strategy. That's now even more abundantly clear, because the predictions based on the media's interpretations of this data were wrong.

Conversely, the idea that iPhone 6s sales were tanking because nobody wanted one should have been evident in observable changes to the installed base--but there was no evidence indicating that 6s models were accumulating in unsold inventory. Instead there was data showing that 6s was selling fine, despite being less differentiated than last year's model versus the previous year.

Source: Fiksu

Rather than recognizing any of this, a variety of media sources have simply repeated the 'Apple is doomed' narrative they'd previously hoped for, a sort of schwachsinnige Schadenfreude.

For example, perennial Apple-autopsy expert Adrian Kingsley-Hughes, writing for ZDNet, suggested that Apple's latest earnings offered proof that nobody wants iPhones anymore, and that demand for Apple's premium phone is likely gone for good. He originally wrote, "everyone who has an iPhone already has one."

That was actually a typo, as he clearly meant to say something that made sense. But it's easier to excuse the typo than to rationalize what he actually intended to say: that everyone who wants an iPhone already has one. That's obviously not true, if you care about the data.

iPhones aren't like a wedding ring or a DeLorean or a GoPro, where once you buy it you scratch it off your goals list. iPhones are consumables. Some buy a new iPhone every year. Many more buy one every two years, incentivized by mobile contracts. This results in a cyclical pattern of purchasing and repurchasing, augmented by new streams of switchers from other platforms. And there is clear evidence that switchers to iOS far outweigh those leaving the platform.

We know that Apple is inhaling massive numbers of new users among former Android users, because this figure keeps going up. Cook previously noted that around 30 percent of iPhone buyers are coming from Android, and most recently observed that "we were blown away by the level of Android switchers that we had last quarter [in fiscal Q1]. It was the highest-ever by far, and so we see that as a huge opportunity."

For the current quarter, Apple didn't guide for 30 percent iPhone cuts, as predicted by wild interpretations of last month's supply chain rumors. When Bernstein analyst Toni Sacconaghi asked a question in Apple's earnings call involving the assumption that "It looks like your guidance implies about a 15-20 percent unit decline in iPhones for fiscal Q2," Cook answered "we do think that iPhone units will decline in the quarter. We don't think that they'll decline to the level that you're talking about."

So much for "10 percent cuts" followed by "30 percent cuts" resulting in some simple, direct correlation with quarterly iPhone sales.

Cook then noted that Apple wasn't providing guidance for the rest of 2016, but focused on why iPhone sales may not reach last year's peak in the current March quarter. He described extra production done during the previous March quarter to fill the constrained supply Apple ended calendar 2014 with, a tougher economic climate and continuing pressure from currency headwinds that have pushed prices upward internationally.

Notably, Cook made no comment about consumers not finding sufficient interest in iPhone 6s models forcing him to slash prices or offer "buy one get one" deals, nor a significant issue with low end disruption from cheap Androids necessitating a flood of mid-grade budget iPhones.

Those are the kind of problems that Samsung has acknowledged that it has. Its smartphone mix keeps heading downmarket, and even-cheaper producers are eating up its low end bread and butter. That's not a problem Apple currently has, as iPhone ASPs indicate.

On the other hand, Cook has consistently described a huge opportunity for Apple in a variety of new markets beyond China, including India--which now appears to be the largest phone market in the world, albeit one Apple has barely begun to tap.

That leaves the question remaining: would a year-over-year decrease in iPhone unit sales for Apple's March quarter (if it occurs) mean the end of iPhone growth, or is it a temporary anomaly, similar to the single down quarter of Mac sales over the past several years that represented an unusual circumstance rather than "Peak Mac"?

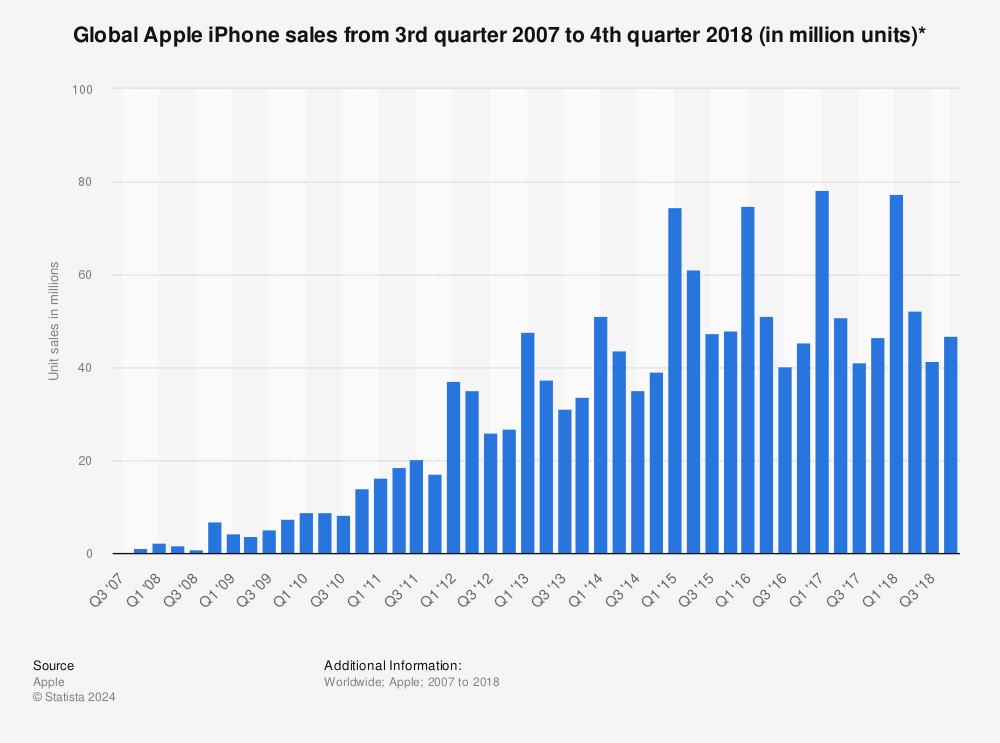

Peak iPhone is partially reliant on the idea that Apple's iPhone sales have leapt upward by a predictable notch every quarter, so any divergence from this signals a crisis. But that has not been the case across the history of iPhone sales, even if Apple's critics conveniently forget or ignore the past whenever it's convenient (or all the time).

In 2008, during the first full year of the original iPhone, sales dropped on a sequential basis in Q2 (March) and again in Q3 (June), ultimately falling below one million units prior to the launch of iPhone 3G. The next year, the same thing happened, with sales falling off immediately after the launch quarter.

This pattern began changing in 2010, when iPhone sales remained high throughout the year (largely due to expanded distribution), followed by a new cycle interruption in the form of Verizon Wireless' spring introduction of the CDMA version of iPhone 4.

In the three years since, iPhone sales in Greater China during the March-quarter Lunar New Year festival have created a new cyclical pattern, a sort of second iPhone launch for the Eastern Hemisphere analogous to the West's December holiday quarter.

However, there's also another cyclical pattern in iPhone sales: the S model year. Apple followed its second generation iPhone 3G with a similar-appearing 3GS model sporting lots of internal enhancements. The fourth generation iPhone 4 was similarly followed by a nearly identical appearing 4S, and the sixth generation iPhone 5 and eighth generation iPhone 6 were identically refreshed with interleaved 5s and 6s generations, following a tick-tock cadence similar to Intel's CPUs.

Looking at historical iPhone sales, it's clear that S generation models extend (or you might say replicate) the original version's sales cycle. iPhone 3G and 3GS formed a plateau of around 7 million units per quarter.

While iPhone 4S set a new high-water mark in launch sales over the previous iPhone 4, this was largely due to greatly expanded distribution rather than huge swell of new excitement for the S model.

Year-over-year quarters of iPhone 5 and 5s sales were again very similar, temporarily causing an irrational freakout among investors--aided by fear mongers predicting that Apple had "lost its ability to innovate" despite the very obvious reality that iPhones were repeating a really simple pattern.

Two years later, all of the same people are again gobsmacked by the fact that S model iPhones follow the same pattern that they always have. It's sort of like being aghast that winter has arrived, or being astounded that the sun goes down every night. Except that this pattern takes place across two years, providing sensationalists with plenty of time to draw up charts showing percentage comparisons that are predictably terrifying.

Imagine if every year, your TV weatherman drew up a daily climate watch showing a decline in temperatures, and gravely warned that all signs pointed toward a lethal deep freeze within 6 months, if things continue as they are, and it sure looks like it from this data we are seeing. How many years could he do that before losing all credibility?

Centuries ago, this sort of thing actually did occur, resulting in sacrifices and rituals to bring back the sun every solstice. Today, people who can't grasp simple patterns are similarly ready to take (or to recommend) irrational actions in response to a shallow (perhaps willfully so) understanding of extremely simple cycles.

Not astonishingly, the same people who can derive terrible portents of doom from percentage comparisons of the nadir and zenith of an Apple cycle have no ability to see any sort of cause-and-effect pattern when a company that is not Apple takes a turn toward irreversible oblivion.

Take, for instance, Samsung. One of the most significant phone makers when the iPhone arrived, Samsung initially experienced a "crisis of design" and responded by initiating an iPhone counterfeiting program. This resulted in a commercially successful chain of new Galaxy S products, at least for three generations.

Samsung didn't, however, generate the same clearly observable cyclical sales patterns as the iPhone. This was because Samsung was also selling large volumes of lower end phones in addition to its premium devices that looked just like the iPhone and ostensibly generated profit margins like the iPhone. Additionally, Samsung does not--and has never--reported quarterly smartphone sales the way Apple always has.

This resulted in two ecosystems: one where Apple was issuing precise, audited temperature reports at regular intervals, and one where Samsung was casually claiming that it was comfortably warm all the time. One was data, the other was marketing. Journalists fell for it.

Daisuke Wakabayashi of the Wall Street Journal was completely bamboozled by comparisons of Apple's transparent data with Samsung's opaque smokescreen of diversion that assured everyone that it had not only copied Apple's product, but had also managed to copy what made the iPhone successful, and was now the Next Big Thing.

To anyone with even a basic understanding of the fundamentals behind Apple's business versus that of Samsung (and the Android platform it was beholden to), it should have been very obvious that Apple was building a vertically integrated, clearly differentiated empire while Samsung was titillating fools with promises that it could do what Apple had, even though it clearly was not, and likely could not.

Apple's critics had so thoroughly convinced themselves that Apple was incompetent and that Samsung was innovative and creative that they failed to believe that Samsung's poor sales of the Galaxy S5 were anything other than a temporary blip. The next year's collapse of Samsung's mobile profits also came as a surprise to them, and even today a few are still holding out hope that some sort of tweak (or perhaps "starting over from scratch") will return Samsung to its "rightful place" this year.

However, if you look at the evidence, it's clear that Samsung has always relied upon high volumes of low end device sales. Samsung's Galaxy S was never selling in iPhone quantities. And without intense--and massively expensive--marketing, sales of Samsung's high end products aren't sustainable. They also aren't sustainable with that marketing expenses, because it simply costs too much ($14 billion in 2013).

That's why Samsung was forced to dramatically scale back its promotional spending, resulting in the "new normal" of low end, minimally profitable smartphone sales just like everyone else in Android land (or in Windows phones).

It's now quite clear that one reason why Apple has scaled back its transparency with regard to hardware unit sales reporting for Apple Watch, Apple TV and iPod is due to the absolutely dishonest and malicious way that Apple's sales data is interpreted when it is available.

In fact, even when Apple clearly explained that it would not be publishing those figures starting in 2015, members of the media continue to giggle among themselves about why they haven't seen the figures published yet. Here's a hint, "journalists": it's kind of like why you don't give a young child any toys with parts that are small enough to choke on. Because they will.

There's still lots of data that Apple does provide, and journalists keep gagging on it in dangerous ways. For example, there's virtually zero major tech or financial outposts who think that iPad is anything other than a plane on fire with a trajectory pointed at the dirt. But iPad is the world's best selling tablet by a huge margin, and really the only one earning a substantial profit (over $20 billion in sales for calendar 2015).

"It's pretty clear that the time of the iPad has come and gone," wrote the same guy who thinks that "everyone who wants an iPhone already has one." But ponder what that means. One company is selling virtually all of the world's tablets priced at over $300. If lower sales figures mean that iPad is going away, what replaces it?

iPads aren't being replaced by PCs, because those are shrinking too. Not netbooks or Chromebooks, neither of which has any traction. Not other tablets, because the same thing is happening there too (slightly worse than iPad). Are we headed toward an Stone Age of non-computer use? Or is it simply a case of a fluctuating cycles, including a difficult economic downturn combined with the shift to the larger iPhone 6/6s Plus and a slower iPad replacement cycle, as Apple keeps maintaining?

Note that while IDC--essentially a wing of Microsoft's public relations--lavishes praise on the growth of "detachables," the reality is that this potential iPad-competition, in the form of the Surface Pro 4, failed to even reach 2 million units in its third launch quarter. That's less than the first holiday quarter of iPhone, or the first holiday quarter of Apple Watch.

Microsoft has been relentlessly promoting Surface Pro--often to its own detriment, as seen in the recent NFL PR flop. But after three years of sales and billions in promotion, Surface Pro has been instantly overshadowed in unit sales, not by another Windows 10 detachable PC maker, but by Apple's own iPad Pro--and in just its first half-quarter of availability.

And as we witnessed over the last year, Surface Pro units have an iPhone-like cycle of their own, where sales collapse before the next launch. The difference is that they never get very high to start with. If that's the most significant competition iPad has, Apple doesn't have much to worry about.

The same fundamental data also exists for iPhones. Is Apple's reign over in smartphones, or are sales just headed 'S for sideways'? The fact that Apple's unit sales and profitability are both so incredibly high--much higher than any of its competitors in comparable offerings--indicates that we should be skeptical of those who think Apple is out of growth potential.

If it were instead the case that consumers were decisively migrating toward lower cost devices, and no longer cared about premium features, fast chips, better cameras and sophisticated apps, we should be seeing evidence of this. Instead, we're witnessing a global retraction in growth among basic PCs, basic tablets and basic phones, even as Apple continues to sell massive quantities of its premium devices. Even within economic turmoil that seemingly "should" result in the opposite.

Really, 2016 is looking a lot like 2008, where Apple's stock price collapsed in half under the leadership of Steve Jobs, largely due to panicked analysts predicting that consumers would shy away from premium products due to "macroeconomic pressures." That didn't turn out to be correct.

Instead, Apple weathered the storm better than its competitors, because they were all living off of razor thin margins. When sales volumes were compressed, they were hurt more than Apple was.

Today, Apple has an even more important fat reserve to get it through a lull of economic uncertainty: over $200 billion in capital. While Apple would likely sell more of everything it makes if the global economy were surging, it's also true that Apple has never had more favorable conditions for unbridled expansion. And because Apple is far ahead of its peers in unit sales of profitable PCs, tablets, phones and wearables, a downturn gives it a prime opportunity to expand for the future.

During an economic downturn, Apple can acquire other companies with less competitive pressure and at more favorable prices. It can also build internationally with strong US Dollars (including those dozen new retail stores planned for Mainland China).

Even Apple's domestic expansion and construction projects (including Campus 2, major peripheral office and R&D projects across Silicon Valley, and its iCloud data center expansions like the one getting started in Reno, NV) will all be easier and cheaper to complete. During a boom cycle, construction is constrained and becomes significantly more expensive.

Campus 2, Phase 2

Other companies also have large cash reserves, including Google and Microsoft. But those companies are already being pressed to contain their expenses, not blow their cash on building new infrastructure to support platforms that aren't generating substantial revenue.

Apple has already been spending big--it already plans to spend $15 billion on capex during fiscal 2016--but analysts and investors have continued to press the company to spend more of its cash pile on tangible new projects capable of returning major new growth, rather than leaving it parked in relatively conservative investments.

It looks like Apple has been saving for a rainy day. The storm clouds are getting pretty dark.

With Apple's stock currently at extreme lows, the company's existing buyback program is also taking advantage of a unique opportunity to reduce outstanding shares at an incredible discount. It's likely that the company will double down on buybacks with a new plan this spring.

However, we've recently seen lots of criticism of the fact that Apple has been buying back its stock over the last year at prices that are now higher than the current value. If only Apple had a time machine or the omniscience of Zeus! Or the retroactive 20/20 hindsight of people today recommending what it could have done different in the past.

The reality remains that Apple's buybacks have achieved their intended goal: to increase Earnings Per Share metrics. At the same time--because Apple is partially financing its capital return program with debt offerings--this has also helped to lower the company's Weighted Average Cost Of Capital.

Essentially, investors expect a certain return on the capital held by a company. To the company, this expectation is a cost of capital. By incurring debt, this cost goes down, further enhancing the company's fundamentals, making it more attractive to investors. Interest on debt can also be tax deductible. So there are a lot of reasons why Apple's buybacks have been a good use of the company's excess cash.

Now consider the advice of one of Apple's primary buyback critics. Writing for Forbes, Eric Jackson stated back in November 2014 that Cooks' buybacks were "madness," and "a total waste of Apple's hard-earned $100 billion," in an article that called Apple's buybacks "Tim Cook's Single Biggest Mistake As CEO."

Jackson recommended instead that Apple should have bought Tesla for $45 billion, paid $39 billion Twitter, $15 billion for Pinterest and then spent another $20 billion to magically "fix" all problems related to batteries and iCloud.

However, there's no evidence that Apple could have run Tesla or a social network better than those companies' existing leadership have, and no reason to believe that the talent currently working in those companies would have stuck around, given that as subsidiaries of Apple they wouldn't have the same tremendous profit potential they have working in an independent startup.

Remember when Apple bought P.A. Semi and some of that company's leadership subsequently left? Also consider how much of a distraction major acquisitions or mergers are in the real world, outside of the financial blogs recommending that Apple can somehow magically buy up companies at their existing valuations and suddenly be competent in new markets. Remember iAd? Remember Google's Motorola fiasco? Remember Microsoft's Nokia and aQuantive boondoggles?

Additionally, over the last year or so since Jackson wrote his critique, Tesla's market capitalization has fallen to $23 billion and Twitter to $11.5 billion (Pinterest has not yet gone public). That indicates the failure of humans to foresee the future is pretty universal.

AAPL is down, but not as badly as recommended acquisitions TSLA and TWTR

I'm sure Cook isn't sad he didn't pay $84 billion to babysit two companies throughout 2015 that are now valued at $34.4 billion. Conversely, Cook has to be quite confident that Apple's own valuation will rebound to new highs that will make last years' buybacks a very obviously good deal again, let alone the stock he's now buying back at an insane discount.

A major reason for that confidence: Cook has $200 billion available to spend on further strategic acquisitions and capital expenditures while the rest of the world is embroiled in a fire sale on the brink of recession. Additionally, Cook also knows exactly what comes after iPhone 6s.

And if history offers any insight, the tenth generation iPhone will be another big growth cycle.

Impressed by some unsubstantiated supply chain rumors and supplier profitability concerns, a series of ostensibly legitimate media outlets began suggesting that Apple's March fiscal Q2 could see something like a 30 percent drop in iPhone sales, and that Apple likely wouldn't even be able to meet its guidance for the December quarter, resulting in a "Peak iPhone" milestone marking the date where Apple's iPhone sales would never again grow, for the first time in the illustrious eight year run of Apple's smartphone.

However, everything about these predictions were wrong. Not just "wrong" as in dramatically exaggerated, but wrong as in fundamentally incorrect, myopically ignorant and distractingly deceptive.

In Apple's fiscal Q1 earnings call, its chief executive Tim Cook outlined what was really happening, although it appears many journalists would prefer to continue believing the incorrect story they made up on their own.

Economic malaise, S-year update couldn't stop iPhone 6s

Apple actually sold slightly more iPhones in the December quarter, right in line with its guidance. This occured despite the "10 percent cut" in December orders (of some sort) cited by Morgan Stanley's Asian supply chain channel checker Jasmine Lu (as noted by Philip Elmer-DeWitt for Fortune).

Apple's ability to exceed its iPhone sales record in the December quarter is quite incredible because--as we'd been incessantly told--there was a Difficult Compare year-over-year due to the fact that iPhone 6 had so spectacularly broken sales records via pent up demand for larger screen iPhones, something that would supposedly be very difficult to ever achieve again.

Apple's fiscal 2015 Q1 iPhone performance was like an impossible basketball shot, but it then repeated that performance, only slightly better for Q1 2016. Except in this case, not only did Apple repeat a monumental stroke of operational achievement in building and selling 74 million premium devices within three months (more than Xiaomi could manage to build and sell across an entire year, despite working without environmental or worker rights scrutiny, and leisurely building lower quality devices in batches largely unconstrained by a launch event), but Apple performed this despite increasingly poor economic conditions globally.

Those conditions included an increasingly strong US dollar that forced up prices internationally, making it that much harder to sell iPhones in competition with cheap Android devices that were already budget priced--and which in most cases were not adversely affected by the US Dollar shift. Samsung actually benefited from currency shifts, but still earned near the lowest bottom of its modern smartphone earnings. Samsung's overall sales were also down, and everyone's Android premium phones were down sharply.

Android phones over $500 "have have decreased from ~ 280m units in 2012 to ~ 190m units in 2015," noted Creative Strategies analyst Ben Bajarin. That's a 32 percent drop. Remember all the news reports about Peak iPhone-class Androids? Me neither. But that actually happened, while Peak iPhone has not.

High end Android shipments ($500 and above) have decreased from ~ 280m units in 2012 to ~ 190m units in 2015. Curse of modular..

-- Ben Bajarin (@BenBajarin)

"Apple has over 80% share of smartphones sold globally over $600 dollars," Bajarin added, noting that "$400-500 is also considered high end Android."

On top of that, Apple's iPhone Average Selling Price in the December quarter jumped up to $691, from $687 in the year ago quarter. This is incredible, because it indicates that buyers continued preferring the latest iPhone 6s model over the very similar iPhone 6 with its $100 discount.

Any significant percentage of buyers deciding that last year's 6 was good enough for them would have brought that number down. A minor decrease would be understandable. An increase is nearly absurd.

The fact that iPhone ASPs continue to rise is a direct rebuke of chatter that nobody wanted a 6s model because they weren't different enough or didn't offer enough spectacular newness.

Wildly incorrect interpretations of supply chain data

Isolated bits of data on supply chain cuts--even if they were correct--do not on their own mean anything. A year ago, Apple's supply of the entirely new iPhone 6 models was so constrained that the company struggled to meet demand into January. This year, the design and construction of Apple's 6s models were well within known territory, and could be manufactured ahead of time with less difficulty.

Apple is also rumored to be manufacturing a smaller iPhone 5s-sized new phone, so building the 6s line early would enable production of such a second run. The fact that Apple may have changed some of its supplier orders was therefore essentially worthless information to anyone lacking a comprehensive understanding of the entire operational strategy. That's now even more abundantly clear, because the predictions based on the media's interpretations of this data were wrong.

Conversely, the idea that iPhone 6s sales were tanking because nobody wanted one should have been evident in observable changes to the installed base--but there was no evidence indicating that 6s models were accumulating in unsold inventory. Instead there was data showing that 6s was selling fine, despite being less differentiated than last year's model versus the previous year.

Source: Fiksu

Doubling down on dumb

Rather than recognizing any of this, a variety of media sources have simply repeated the 'Apple is doomed' narrative they'd previously hoped for, a sort of schwachsinnige Schadenfreude.

For example, perennial Apple-autopsy expert Adrian Kingsley-Hughes, writing for ZDNet, suggested that Apple's latest earnings offered proof that nobody wants iPhones anymore, and that demand for Apple's premium phone is likely gone for good. He originally wrote, "everyone who has an iPhone already has one."

That was actually a typo, as he clearly meant to say something that made sense. But it's easier to excuse the typo than to rationalize what he actually intended to say: that everyone who wants an iPhone already has one. That's obviously not true, if you care about the data.

iPhones aren't like a wedding ring or a DeLorean or a GoPro, where once you buy it you scratch it off your goals list. iPhones are consumables. Some buy a new iPhone every year. Many more buy one every two years, incentivized by mobile contracts. This results in a cyclical pattern of purchasing and repurchasing, augmented by new streams of switchers from other platforms. And there is clear evidence that switchers to iOS far outweigh those leaving the platform.

We know that Apple is inhaling massive numbers of new users among former Android users, because this figure keeps going up. Cook previously noted that around 30 percent of iPhone buyers are coming from Android, and most recently observed that "we were blown away by the level of Android switchers that we had last quarter [in fiscal Q1]. It was the highest-ever by far, and so we see that as a huge opportunity."

Apple's guidance for March isn't Peak iPhone

For the current quarter, Apple didn't guide for 30 percent iPhone cuts, as predicted by wild interpretations of last month's supply chain rumors. When Bernstein analyst Toni Sacconaghi asked a question in Apple's earnings call involving the assumption that "It looks like your guidance implies about a 15-20 percent unit decline in iPhones for fiscal Q2," Cook answered "we do think that iPhone units will decline in the quarter. We don't think that they'll decline to the level that you're talking about."

"We were blown away by the level of Android switchers that we had last quarter" - Tim Cook

So much for "10 percent cuts" followed by "30 percent cuts" resulting in some simple, direct correlation with quarterly iPhone sales.

Cook then noted that Apple wasn't providing guidance for the rest of 2016, but focused on why iPhone sales may not reach last year's peak in the current March quarter. He described extra production done during the previous March quarter to fill the constrained supply Apple ended calendar 2014 with, a tougher economic climate and continuing pressure from currency headwinds that have pushed prices upward internationally.

Notably, Cook made no comment about consumers not finding sufficient interest in iPhone 6s models forcing him to slash prices or offer "buy one get one" deals, nor a significant issue with low end disruption from cheap Androids necessitating a flood of mid-grade budget iPhones.

Those are the kind of problems that Samsung has acknowledged that it has. Its smartphone mix keeps heading downmarket, and even-cheaper producers are eating up its low end bread and butter. That's not a problem Apple currently has, as iPhone ASPs indicate.

On the other hand, Cook has consistently described a huge opportunity for Apple in a variety of new markets beyond China, including India--which now appears to be the largest phone market in the world, albeit one Apple has barely begun to tap.

That leaves the question remaining: would a year-over-year decrease in iPhone unit sales for Apple's March quarter (if it occurs) mean the end of iPhone growth, or is it a temporary anomaly, similar to the single down quarter of Mac sales over the past several years that represented an unusual circumstance rather than "Peak Mac"?

Confusing a blip with a trend

Peak iPhone is partially reliant on the idea that Apple's iPhone sales have leapt upward by a predictable notch every quarter, so any divergence from this signals a crisis. But that has not been the case across the history of iPhone sales, even if Apple's critics conveniently forget or ignore the past whenever it's convenient (or all the time).

In 2008, during the first full year of the original iPhone, sales dropped on a sequential basis in Q2 (March) and again in Q3 (June), ultimately falling below one million units prior to the launch of iPhone 3G. The next year, the same thing happened, with sales falling off immediately after the launch quarter.

This pattern began changing in 2010, when iPhone sales remained high throughout the year (largely due to expanded distribution), followed by a new cycle interruption in the form of Verizon Wireless' spring introduction of the CDMA version of iPhone 4.

In the three years since, iPhone sales in Greater China during the March-quarter Lunar New Year festival have created a new cyclical pattern, a sort of second iPhone launch for the Eastern Hemisphere analogous to the West's December holiday quarter.

However, there's also another cyclical pattern in iPhone sales: the S model year. Apple followed its second generation iPhone 3G with a similar-appearing 3GS model sporting lots of internal enhancements. The fourth generation iPhone 4 was similarly followed by a nearly identical appearing 4S, and the sixth generation iPhone 5 and eighth generation iPhone 6 were identically refreshed with interleaved 5s and 6s generations, following a tick-tock cadence similar to Intel's CPUs.

Looking at historical iPhone sales, it's clear that S generation models extend (or you might say replicate) the original version's sales cycle. iPhone 3G and 3GS formed a plateau of around 7 million units per quarter.

While iPhone 4S set a new high-water mark in launch sales over the previous iPhone 4, this was largely due to greatly expanded distribution rather than huge swell of new excitement for the S model.

Year-over-year quarters of iPhone 5 and 5s sales were again very similar, temporarily causing an irrational freakout among investors--aided by fear mongers predicting that Apple had "lost its ability to innovate" despite the very obvious reality that iPhones were repeating a really simple pattern.

Two years later, all of the same people are again gobsmacked by the fact that S model iPhones follow the same pattern that they always have. It's sort of like being aghast that winter has arrived, or being astounded that the sun goes down every night. Except that this pattern takes place across two years, providing sensationalists with plenty of time to draw up charts showing percentage comparisons that are predictably terrifying.

Imagine if every year, your TV weatherman drew up a daily climate watch showing a decline in temperatures, and gravely warned that all signs pointed toward a lethal deep freeze within 6 months, if things continue as they are, and it sure looks like it from this data we are seeing. How many years could he do that before losing all credibility?

Centuries ago, this sort of thing actually did occur, resulting in sacrifices and rituals to bring back the sun every solstice. Today, people who can't grasp simple patterns are similarly ready to take (or to recommend) irrational actions in response to a shallow (perhaps willfully so) understanding of extremely simple cycles.

Pay no attention to the fundamentals behind the cycle!

Not astonishingly, the same people who can derive terrible portents of doom from percentage comparisons of the nadir and zenith of an Apple cycle have no ability to see any sort of cause-and-effect pattern when a company that is not Apple takes a turn toward irreversible oblivion.

Take, for instance, Samsung. One of the most significant phone makers when the iPhone arrived, Samsung initially experienced a "crisis of design" and responded by initiating an iPhone counterfeiting program. This resulted in a commercially successful chain of new Galaxy S products, at least for three generations.

Samsung didn't, however, generate the same clearly observable cyclical sales patterns as the iPhone. This was because Samsung was also selling large volumes of lower end phones in addition to its premium devices that looked just like the iPhone and ostensibly generated profit margins like the iPhone. Additionally, Samsung does not--and has never--reported quarterly smartphone sales the way Apple always has.

This resulted in two ecosystems: one where Apple was issuing precise, audited temperature reports at regular intervals, and one where Samsung was casually claiming that it was comfortably warm all the time. One was data, the other was marketing. Journalists fell for it.

Daisuke Wakabayashi of the Wall Street Journal was completely bamboozled by comparisons of Apple's transparent data with Samsung's opaque smokescreen of diversion that assured everyone that it had not only copied Apple's product, but had also managed to copy what made the iPhone successful, and was now the Next Big Thing.

To anyone with even a basic understanding of the fundamentals behind Apple's business versus that of Samsung (and the Android platform it was beholden to), it should have been very obvious that Apple was building a vertically integrated, clearly differentiated empire while Samsung was titillating fools with promises that it could do what Apple had, even though it clearly was not, and likely could not.

Apple's critics had so thoroughly convinced themselves that Apple was incompetent and that Samsung was innovative and creative that they failed to believe that Samsung's poor sales of the Galaxy S5 were anything other than a temporary blip. The next year's collapse of Samsung's mobile profits also came as a surprise to them, and even today a few are still holding out hope that some sort of tweak (or perhaps "starting over from scratch") will return Samsung to its "rightful place" this year.

However, if you look at the evidence, it's clear that Samsung has always relied upon high volumes of low end device sales. Samsung's Galaxy S was never selling in iPhone quantities. And without intense--and massively expensive--marketing, sales of Samsung's high end products aren't sustainable. They also aren't sustainable with that marketing expenses, because it simply costs too much ($14 billion in 2013).

That's why Samsung was forced to dramatically scale back its promotional spending, resulting in the "new normal" of low end, minimally profitable smartphone sales just like everyone else in Android land (or in Windows phones).

You want the truth? You can't handle the truth!

It's now quite clear that one reason why Apple has scaled back its transparency with regard to hardware unit sales reporting for Apple Watch, Apple TV and iPod is due to the absolutely dishonest and malicious way that Apple's sales data is interpreted when it is available.

In fact, even when Apple clearly explained that it would not be publishing those figures starting in 2015, members of the media continue to giggle among themselves about why they haven't seen the figures published yet. Here's a hint, "journalists": it's kind of like why you don't give a young child any toys with parts that are small enough to choke on. Because they will.

There's still lots of data that Apple does provide, and journalists keep gagging on it in dangerous ways. For example, there's virtually zero major tech or financial outposts who think that iPad is anything other than a plane on fire with a trajectory pointed at the dirt. But iPad is the world's best selling tablet by a huge margin, and really the only one earning a substantial profit (over $20 billion in sales for calendar 2015).

"It's pretty clear that the time of the iPad has come and gone," wrote the same guy who thinks that "everyone who wants an iPhone already has one." But ponder what that means. One company is selling virtually all of the world's tablets priced at over $300. If lower sales figures mean that iPad is going away, what replaces it?

Where is the Disruption?

iPads aren't being replaced by PCs, because those are shrinking too. Not netbooks or Chromebooks, neither of which has any traction. Not other tablets, because the same thing is happening there too (slightly worse than iPad). Are we headed toward an Stone Age of non-computer use? Or is it simply a case of a fluctuating cycles, including a difficult economic downturn combined with the shift to the larger iPhone 6/6s Plus and a slower iPad replacement cycle, as Apple keeps maintaining?

Note that while IDC--essentially a wing of Microsoft's public relations--lavishes praise on the growth of "detachables," the reality is that this potential iPad-competition, in the form of the Surface Pro 4, failed to even reach 2 million units in its third launch quarter. That's less than the first holiday quarter of iPhone, or the first holiday quarter of Apple Watch.

Microsoft has been relentlessly promoting Surface Pro--often to its own detriment, as seen in the recent NFL PR flop. But after three years of sales and billions in promotion, Surface Pro has been instantly overshadowed in unit sales, not by another Windows 10 detachable PC maker, but by Apple's own iPad Pro--and in just its first half-quarter of availability.

UPDATE: #Patriots Tablets are working again after Johnny demonstrates the correct way to fix them. https://t.co/bK9XGbuRcg

-- Sports Nation Ohio (@SN_Ohio)

And as we witnessed over the last year, Surface Pro units have an iPhone-like cycle of their own, where sales collapse before the next launch. The difference is that they never get very high to start with. If that's the most significant competition iPad has, Apple doesn't have much to worry about.

The same fundamental data also exists for iPhones. Is Apple's reign over in smartphones, or are sales just headed 'S for sideways'? The fact that Apple's unit sales and profitability are both so incredibly high--much higher than any of its competitors in comparable offerings--indicates that we should be skeptical of those who think Apple is out of growth potential.

If it were instead the case that consumers were decisively migrating toward lower cost devices, and no longer cared about premium features, fast chips, better cameras and sophisticated apps, we should be seeing evidence of this. Instead, we're witnessing a global retraction in growth among basic PCs, basic tablets and basic phones, even as Apple continues to sell massive quantities of its premium devices. Even within economic turmoil that seemingly "should" result in the opposite.

Who will weather the storm best?

Really, 2016 is looking a lot like 2008, where Apple's stock price collapsed in half under the leadership of Steve Jobs, largely due to panicked analysts predicting that consumers would shy away from premium products due to "macroeconomic pressures." That didn't turn out to be correct.

Instead, Apple weathered the storm better than its competitors, because they were all living off of razor thin margins. When sales volumes were compressed, they were hurt more than Apple was.

Today, Apple has an even more important fat reserve to get it through a lull of economic uncertainty: over $200 billion in capital. While Apple would likely sell more of everything it makes if the global economy were surging, it's also true that Apple has never had more favorable conditions for unbridled expansion. And because Apple is far ahead of its peers in unit sales of profitable PCs, tablets, phones and wearables, a downturn gives it a prime opportunity to expand for the future.

During an economic downturn, Apple can acquire other companies with less competitive pressure and at more favorable prices. It can also build internationally with strong US Dollars (including those dozen new retail stores planned for Mainland China).

Even Apple's domestic expansion and construction projects (including Campus 2, major peripheral office and R&D projects across Silicon Valley, and its iCloud data center expansions like the one getting started in Reno, NV) will all be easier and cheaper to complete. During a boom cycle, construction is constrained and becomes significantly more expensive.

Campus 2, Phase 2

Other companies also have large cash reserves, including Google and Microsoft. But those companies are already being pressed to contain their expenses, not blow their cash on building new infrastructure to support platforms that aren't generating substantial revenue.

Apple has already been spending big--it already plans to spend $15 billion on capex during fiscal 2016--but analysts and investors have continued to press the company to spend more of its cash pile on tangible new projects capable of returning major new growth, rather than leaving it parked in relatively conservative investments.

It looks like Apple has been saving for a rainy day. The storm clouds are getting pretty dark.

Buybacks and acquisitions

With Apple's stock currently at extreme lows, the company's existing buyback program is also taking advantage of a unique opportunity to reduce outstanding shares at an incredible discount. It's likely that the company will double down on buybacks with a new plan this spring.

However, we've recently seen lots of criticism of the fact that Apple has been buying back its stock over the last year at prices that are now higher than the current value. If only Apple had a time machine or the omniscience of Zeus! Or the retroactive 20/20 hindsight of people today recommending what it could have done different in the past.

The reality remains that Apple's buybacks have achieved their intended goal: to increase Earnings Per Share metrics. At the same time--because Apple is partially financing its capital return program with debt offerings--this has also helped to lower the company's Weighted Average Cost Of Capital.

Essentially, investors expect a certain return on the capital held by a company. To the company, this expectation is a cost of capital. By incurring debt, this cost goes down, further enhancing the company's fundamentals, making it more attractive to investors. Interest on debt can also be tax deductible. So there are a lot of reasons why Apple's buybacks have been a good use of the company's excess cash.

Now consider the advice of one of Apple's primary buyback critics. Writing for Forbes, Eric Jackson stated back in November 2014 that Cooks' buybacks were "madness," and "a total waste of Apple's hard-earned $100 billion," in an article that called Apple's buybacks "Tim Cook's Single Biggest Mistake As CEO."

Jackson recommended instead that Apple should have bought Tesla for $45 billion, paid $39 billion Twitter, $15 billion for Pinterest and then spent another $20 billion to magically "fix" all problems related to batteries and iCloud.

However, there's no evidence that Apple could have run Tesla or a social network better than those companies' existing leadership have, and no reason to believe that the talent currently working in those companies would have stuck around, given that as subsidiaries of Apple they wouldn't have the same tremendous profit potential they have working in an independent startup.

Remember when Apple bought P.A. Semi and some of that company's leadership subsequently left? Also consider how much of a distraction major acquisitions or mergers are in the real world, outside of the financial blogs recommending that Apple can somehow magically buy up companies at their existing valuations and suddenly be competent in new markets. Remember iAd? Remember Google's Motorola fiasco? Remember Microsoft's Nokia and aQuantive boondoggles?

Additionally, over the last year or so since Jackson wrote his critique, Tesla's market capitalization has fallen to $23 billion and Twitter to $11.5 billion (Pinterest has not yet gone public). That indicates the failure of humans to foresee the future is pretty universal.

AAPL is down, but not as badly as recommended acquisitions TSLA and TWTR

I'm sure Cook isn't sad he didn't pay $84 billion to babysit two companies throughout 2015 that are now valued at $34.4 billion. Conversely, Cook has to be quite confident that Apple's own valuation will rebound to new highs that will make last years' buybacks a very obviously good deal again, let alone the stock he's now buying back at an insane discount.

A major reason for that confidence: Cook has $200 billion available to spend on further strategic acquisitions and capital expenditures while the rest of the world is embroiled in a fire sale on the brink of recession. Additionally, Cook also knows exactly what comes after iPhone 6s.

And if history offers any insight, the tenth generation iPhone will be another big growth cycle.

Comments

GO!

Want to another graph? Here ya go:

As long as Apple remains a publicly traded company, this is what Cook needs to be concerned about. Even after Apple released their sales numbers, the stock continued to fall so obviously that's not the problem. No Apple isn't doomed, and no we don't need a page full of "Apple is doomed /s" posts, but clearly there's a problem here that Apple needs to address in the future. Hopefully March will be an opportunity for that.

Is something wrong with Apple? Analysts say there is. Why? To make money dumping the stock then pumping the stock. Every analyst who went negative on Apple with 30% cut has begun to pump the stock. Can Tim Cook name names? Yes. Should he? No. Thankfully Tim Cook is pushing Apple forward to remain strong and become stronger.

Here is an example of how bloggers push Apple below its competitors. The View Master VR device can be purchased from Apple and Amazon. Apple sells the device for $29.99, Amazon $17.12. Experience Packs cost $14.99 each. Amazon sells a package for $84.99. While reading the numbers, I easily realized Apple had the less expensive total deal. Apple-focused bloggers chose not to point out that fact. They chose to highlight Amazon. I bought the total package from Apple using the Apple Store app and Touch ID on my iPhone.

Hey Cash907censored... They are on topic!! .... You said "As long as Apple remains a publicly traded company, this is what Cook needs to be concerned about." which sounds like to me was in regards to the stocks and the stock market. Unless we have all fallen in some alternate universe Exxon and Apple are part of the markets.

Rob53 is right!

Yes... the way markets are today wall street has fallen in love with the growth trap. Profit is somehow irrelevant in todays world. Good news is, the train tickets for many companies have gotten cheaper to take that ride back up the Mtn. Until then, I'm happy to collect compounded interest in dividends while I wait for the trains to leave.

It may not have been a typo, maybe he just wanted to say something that was accurate even if nonsensical?

In spite of that, the worst thing Apple can do right now is to start trying to play the game of directly influencing investor perception. Investors are sometimes slow to come around. That's why we have asset bubbles all the time. Investors don't take the time to ask some important questions. Apple should reject the experts and work on making good products.

And quoting Ben Bajarin, the Techpinions podcast is what I listen to for weekly tech updates. I love the articles they put up.

THAT is just plain awful.

Apple is doomed headlines are such a good clicks bait that everyone is twisting the reality.

I don't know that we've reached peak iPhone and I do think Apple's stock valuation is nuts but I think valuation has a lot to do with sentiment and narrative and because Apple is so secretive about the future it's difficult to paint Wall Street a picture of where future growth will come from. So they see iPad down 25% YOY, Mac flat to slightly down, iPhone flat with guidance to be down the following quarter and wonder where's the growth going to come from?

If Tim and Luca want to change the narrative to Apple being a services company than they should have been building up that narrative for a while not just throwing out one slide on an earnings call where they knew the iPhone story wouldn't be great. And if you look at the slide it's just one number; they didn't break anything out so you could see the trajectory of Music or Pay. For all we know the bulk of services revenue is still probably IAP from the App Store. If Apple really does want to shift the focus to services than I think they need someone better than Eddy Cue leading it. Walt Mossberg and Jim Dalrymple both wrote articles about issues with Apple software. Most of the issues they have fall under Eddy Cue's leadership. He pretty much owns services at Apple and it's the weakest part of the company. IMO Cook needs to do something about that, even if Cue is popular inside the company. Take most of the software and cloud stuff away from him and have him focus on content deals and building out Pay.