Apple Pay gains support for 31 Australian credit unions, small banks with Cuscal deal

As Australia's largest banks look to stymie Apple Pay's expansion efforts for their own gains, Apple and payments solutions firm Cuscal on Wednesday local time announced a deal that will bring the fledgling payment service to 31 credit unions and regional banks.

According to Cuscal managing director Craig Kennedy, the new partnership could deliver Apple Pay to more than four million customers if each of Cuscal's client financial institutions opt to participate, news.com.au reports.

Under the terms of the agreement, Cuscal provides backend connection services between the banks, cardholders and Apple Pay systems.

With Cuscal's help, Apple Pay is rolling out soon at the following banks:

In a response furnished to the Australian Competition and Consumer Commission in August, Apple said the banks' actions only serve to hinder mobile wallet adoption. The company maintains Australia's banking "cartel" aims to stall consumer adoption of Apple Pay and other mobile wallet solutions to stifle competition as it prepares its own proprietary offerings.

For its part, the Apple Pay holdouts say Australians have been moving to contactless payments systems long before Apple entered the sector, a spokesman for the banks told AppleInsider. Specifically, the banks claim they, along with Australia's merchants and payments processors, were integral in the rollout of touchless solutions.

As for today's expansion, Apple VP of Apple Pay Jennifer Bailey lauded the Cuscal partnership.

"We want as many Australians as possible to be able to use Apple Pay," Bailey said. "Today more than 3,500 banks across 12 countries already support Apple Pay and we think Cuscal's customers will really love using Apple Pay for everyday purchases in stores, apps and on the web."

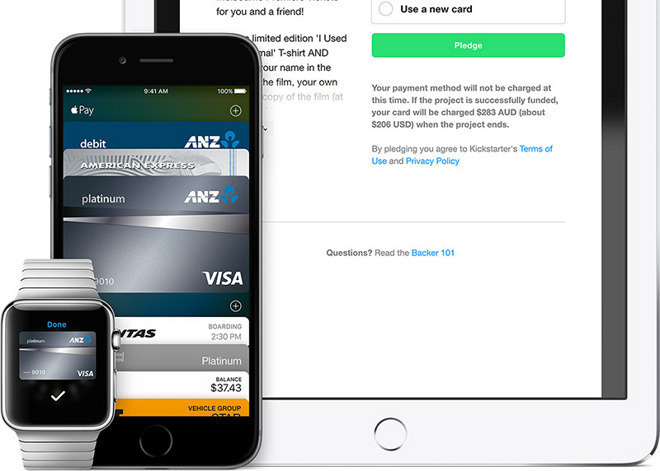

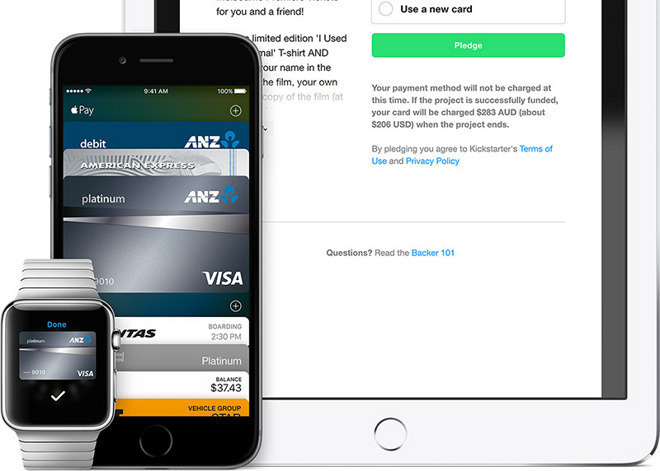

Apple Pay launched in Australia in April through a partnership with American Express and "big four" bank ANZ, the latter of which credited the Apple partnership with a 20 percent spike in credit card and deposit account applications.

According to Cuscal managing director Craig Kennedy, the new partnership could deliver Apple Pay to more than four million customers if each of Cuscal's client financial institutions opt to participate, news.com.au reports.

Under the terms of the agreement, Cuscal provides backend connection services between the banks, cardholders and Apple Pay systems.

With Cuscal's help, Apple Pay is rolling out soon at the following banks:

- Bank Australia

- Bank of Sydney

- Beyond Bank Australia

- Big Sky Building Society

- Australian Unity

- CAPE Credit Union

- Central West Credit Union

- Illawarra Credit Union

- Catalyst Money

- Community First Credit Union

- Northern Beaches Credit Union

- Credit Union Australia (CUA)

- Credit Union SA

- Defence Bank

- EECU

- First Option Credit Union

- Goldfields Money

- Goulburn Murray Credit Union Co-Op

- Holiday Coast Credit Union

- Horizon Credit Union

- Intech Credit Union

- Laboratories Credit Union

- My State Bank

- The Rock

- Northern Inland Credit Union

- People's Choice Credit Union

- Police Bank

- Customs Bank

- QT Mutual Bank

- Select Encompass Credit Union

- South West Slopes Credit Union

- Sydney Credit Union

- Teachers Mutual Bank

- UniBank

- The Mac (Macarthur Credit Union)

- Warwick Credit Union

- Woolworths Employees' Credit Union

In a response furnished to the Australian Competition and Consumer Commission in August, Apple said the banks' actions only serve to hinder mobile wallet adoption. The company maintains Australia's banking "cartel" aims to stall consumer adoption of Apple Pay and other mobile wallet solutions to stifle competition as it prepares its own proprietary offerings.

For its part, the Apple Pay holdouts say Australians have been moving to contactless payments systems long before Apple entered the sector, a spokesman for the banks told AppleInsider. Specifically, the banks claim they, along with Australia's merchants and payments processors, were integral in the rollout of touchless solutions.

As for today's expansion, Apple VP of Apple Pay Jennifer Bailey lauded the Cuscal partnership.

"We want as many Australians as possible to be able to use Apple Pay," Bailey said. "Today more than 3,500 banks across 12 countries already support Apple Pay and we think Cuscal's customers will really love using Apple Pay for everyday purchases in stores, apps and on the web."

Apple Pay launched in Australia in April through a partnership with American Express and "big four" bank ANZ, the latter of which credited the Apple partnership with a 20 percent spike in credit card and deposit account applications.

Comments

Since ANZ still can't show me pending transactions/authorizations in their mobile banking app (GoMoney) it's time for me to start looking for a credit union.

Take that Westpac! And Commonwealth! And NAB!

This is good news, but some credit unions are missing still.

NO

Note the wording "if each of Cuscal's client financial institutions opt to participate".

So Apple takes its cut, Cuscal takes its cut, what's left for the institution?

The ACCC also has its annual petrol price conspiracy investigation, no doubt around the time that employment contracts are due for renewal at the ACCC.

I don't think he's questioning the Apple Pay implementation, but the iOS App ANZ provides. By contrast, Westpac have a well designed, fully featured app, but they just don't allow Apple Pay. (There are a couple of odd things with the app, but nothing too troubling.)