Apple parts supplier Nidec cuts 2019 sales forecast citing 'extraordinary' contraction in ...

Nidec, a Japanese company that supplies vibratory motor parts for products like Apple's iPhone, is revising down 2019 sales forecasts due to what its chairman characterizes as an "extraordinary" decline in Chinese demand.

Citing the Chinese sales slowdown, exacerbated by a simmering trade war between the U.S. and China, the parts supplier on Thursday cut full-year profit estimates by more than 25 percent, reports Nikkei.

"We have faced extraordinary changes," Nidec Chairman Shigenobu Nagamori said during a press conference, hinting at sluggish Chinese demand.

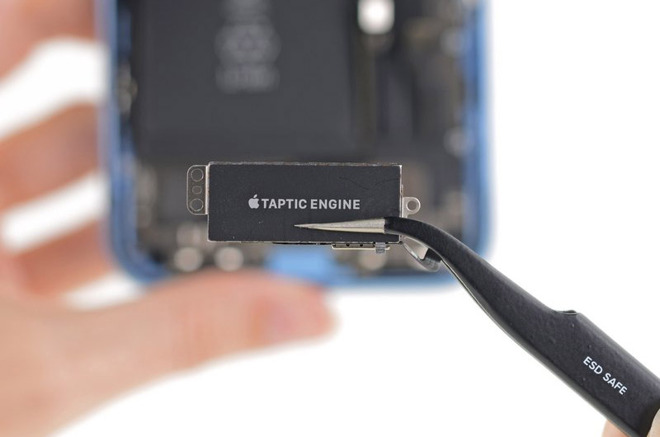

Beyond parts for iPhone, presumably components used in Apple's Taptic Engine, Nidec saw a slowdown in China for motors used in the automotive and home appliance industries. Unlike other Apple suppliers, the health of the Japanese company is not intrinsically tied to the success of iPhone.

It appears, however, that a significant share of Nidec's troubles stems from Apple's recent iPhone miss.

"We saw big slumps in November and December," Nagamori said.

In early January, Apple lowered quarterly guidance for the first fiscal quarter of 2019 due to weak iPhone sales. Apple CEO Tim Cook in a note to investors blamed the revenue shortfall in large part on an unexpected sales slowdown in China over the three month period ending in December.

Nidec is the latest Apple supplier to cut its earning outlook for the coming year. Prior to Apple's announced adjustment, manufacturers AMS, Japan Display, Lumentum, Qurvo and others reduced earnings forecasts, signaling what would become a confirmed drop in demand for iPhone.

Most recently, A-series chip manufacturer TSMC on Thursday slashed its guidance on the back of sluggish iPhone sales and a contraction of the wider smartphone market. According to Nikkei, TSMC CFO Lora Ho reveled the company has implemented a hiring freeze and cost control measures to cope with the market changes.

Citing the Chinese sales slowdown, exacerbated by a simmering trade war between the U.S. and China, the parts supplier on Thursday cut full-year profit estimates by more than 25 percent, reports Nikkei.

"We have faced extraordinary changes," Nidec Chairman Shigenobu Nagamori said during a press conference, hinting at sluggish Chinese demand.

Beyond parts for iPhone, presumably components used in Apple's Taptic Engine, Nidec saw a slowdown in China for motors used in the automotive and home appliance industries. Unlike other Apple suppliers, the health of the Japanese company is not intrinsically tied to the success of iPhone.

It appears, however, that a significant share of Nidec's troubles stems from Apple's recent iPhone miss.

"We saw big slumps in November and December," Nagamori said.

In early January, Apple lowered quarterly guidance for the first fiscal quarter of 2019 due to weak iPhone sales. Apple CEO Tim Cook in a note to investors blamed the revenue shortfall in large part on an unexpected sales slowdown in China over the three month period ending in December.

Nidec is the latest Apple supplier to cut its earning outlook for the coming year. Prior to Apple's announced adjustment, manufacturers AMS, Japan Display, Lumentum, Qurvo and others reduced earnings forecasts, signaling what would become a confirmed drop in demand for iPhone.

Most recently, A-series chip manufacturer TSMC on Thursday slashed its guidance on the back of sluggish iPhone sales and a contraction of the wider smartphone market. According to Nikkei, TSMC CFO Lora Ho reveled the company has implemented a hiring freeze and cost control measures to cope with the market changes.

Comments

Secondly major Android handset manufacturers, such as Samsung, have significantly revised profit forecasts for the quarter. Notably with LG forecasting a 80% decline in their profit for the quarter.

The fact that this company happen to also make parts for Apple is the only reason this even became a story.

Or it could be another one of those “Apple is doomed because they ordered less parts”, not realising that Apple just redesigned it and is now getting it from a different company.

Which Android OEM's are using Nidec's taptics?

That said, I don't think it's likely that most of that reduced expectation comes from Apple. Nidec produces a wide range of products, and the kinds of components which Apple would be buying from it account for a fairly small portion of its revenue.

For the first half of its fiscal year, "Other small precision motors" accounted for 128,852 million Yen (around $1.2 billion) out of the 777,604 million Yen in revenue that Nidec reported. That's 17% for the entire category. That category consists of "other small precision motors for optical disk drives, vibration mechanism for smartphone tactile feedback and silent mode features, electronic cooling fans, refrigerators, DVD recorders, laser printers, copiers, polygon scanners, automobiles and other applications." (Emphasis added.) So not all of that 17% is from the kind of components which Apple would be buying from Nidec. Would Apple account for 3, 6, or 10% of Nidec's revenue? I don't know, but it's something in that range rather than 20 or 50%.