HomePod sales up in fourth quarter, Amazon and Google extending lead

Smart speakers such as the HomePod have helped almost double the global shipments of the product category in the fourth quarter of 2018, but while Apple's speaker is seeing increased sales, it is seemingly falling behind its rivals in terms of overall market share.

The holiday shopping period saw a considerable growth in sales for smart speakers, with Amazon's Echo range, Google's Home family, and Apple's HomePod benefiting from the category's popularity.

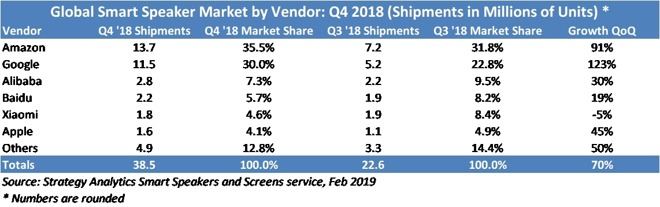

According to a research report from Strategy Analytics, shipments in the fourth quarter for the market as a whole grew to 38.5 million units, an increase of 95 percent on figures from last year. This is said to be more than the total shipments across the entirety of 2017, and brings the 2018 shipment total to 86.2 million units.

The big winners appear to be both Google and Amazon, rather than Apple. While the HomePod did see growth of 45 percent on a quarter-on-quarter basis, it is noted that the speaker's market share dropped from 4.9 percent in the third quarter to 4.1 percent in the fourth.

Strategy Analytics' chart of smart speaker vendor shipments

By contrast, Amazon saw its shipments of Echo devices grow 91 percent in sequential quarters, growing its market share from 31.8 percent to 35.5 percent. Google follows in second place with a 30 percent market share, again an improvement on the previous quarter, but with its 11.5 million shipments representing 123 percent growth over Q3 shipments.

"Smart speakers and smart displays were once again the most sought-after tech products this past holiday season," said director David Watkins. "We estimate that more than 60 million households worldwide now own at least one device."

According to the report, Apple also lags behind a number of other tech giants in the market, including Alibaba, Baidu, and Xiaomi, with the latter notably seeing both market share and shipments slightly contracting on the previous quarter, but not enough for Apple to improve its ranking.

While Strategy Analytics' figures relate to global shipments, it seems Apple is faring better in the United States, with CIRP claiming in early February HomePod occupies 6 percent of the entire U.S. smart speaker install base as of the end of 2018. Even so, Amazon and Google continue to be far in the lead in the market, with shares of 70 percent and 24 percent respectively.

Apple is working to provide the HomePod in more countries, with China and Hong Kong added to the list in January.

While wider availability will be beneficial, it won't help the high-end and premium-priced HomePod take on the cheaper end of the market, which is dominated by the Amazon Echo Dot and the Google Home Mini.

The holiday shopping period saw a considerable growth in sales for smart speakers, with Amazon's Echo range, Google's Home family, and Apple's HomePod benefiting from the category's popularity.

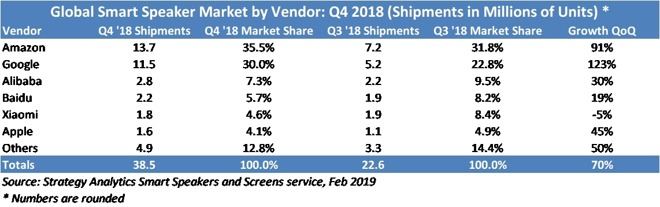

According to a research report from Strategy Analytics, shipments in the fourth quarter for the market as a whole grew to 38.5 million units, an increase of 95 percent on figures from last year. This is said to be more than the total shipments across the entirety of 2017, and brings the 2018 shipment total to 86.2 million units.

The big winners appear to be both Google and Amazon, rather than Apple. While the HomePod did see growth of 45 percent on a quarter-on-quarter basis, it is noted that the speaker's market share dropped from 4.9 percent in the third quarter to 4.1 percent in the fourth.

Strategy Analytics' chart of smart speaker vendor shipments

By contrast, Amazon saw its shipments of Echo devices grow 91 percent in sequential quarters, growing its market share from 31.8 percent to 35.5 percent. Google follows in second place with a 30 percent market share, again an improvement on the previous quarter, but with its 11.5 million shipments representing 123 percent growth over Q3 shipments.

"Smart speakers and smart displays were once again the most sought-after tech products this past holiday season," said director David Watkins. "We estimate that more than 60 million households worldwide now own at least one device."

According to the report, Apple also lags behind a number of other tech giants in the market, including Alibaba, Baidu, and Xiaomi, with the latter notably seeing both market share and shipments slightly contracting on the previous quarter, but not enough for Apple to improve its ranking.

While Strategy Analytics' figures relate to global shipments, it seems Apple is faring better in the United States, with CIRP claiming in early February HomePod occupies 6 percent of the entire U.S. smart speaker install base as of the end of 2018. Even so, Amazon and Google continue to be far in the lead in the market, with shares of 70 percent and 24 percent respectively.

Apple is working to provide the HomePod in more countries, with China and Hong Kong added to the list in January.

While wider availability will be beneficial, it won't help the high-end and premium-priced HomePod take on the cheaper end of the market, which is dominated by the Amazon Echo Dot and the Google Home Mini.

Comments

Not bad considering the competition gives them away for free or 20 bucks.

The sad part is that Apple is being compared to them when Apple never intended to compete with them.

What Apple could do is release a gen 2, drop the price of gen 1 $100 and then surprise us with a portable version. There's already crappy portable speakers copying the HomePod design.

Aux is looking back, Apple needs to look forward. Another poster mentions them being expensive to litter around the house and that's a good point. Which is why a HomePod mini would make sense.

Apple needs to go all in with Home.

Amazon 13.7% (5,274,500 units) x $20

$105,490,000 Revenue

Reasonable to assume less than 5% profit margins

$5,274,500 profit

Apple 1.6% (616,000 units) x $349

$214,984,000 Revenue

Reasonable to assume historic profit margins of 30%

$64,495,200 profit

Think I’ll hold my Apple positions.

13.7 million x $20 x 5% = 13,700,000 profit

1.6 Million x $349 x 30% = 167,000,000 profit

So, it’s actually worse.

Your observations of your acquaintances using voice assistant box and extrapolating it out is a logical fallacy is it not?

My home makes extensive use of automation (HomeKit obviously, not a single Google or Amazon device anywhere).

I don't need HomePods in every room. Why? Because I have an Apple Watch and can use Siri to operate my devices. For people who don't have an AW you can also use your iPhone. However, since getting my AW I no longer carry my iPhone around the house like I used to. I have a large house and don't feel like installing over a dozen cheap "smart" speakers just so I can use HomeKit anywhere I want to. A single AW does that for me.

The USA has about 80 million households. Even if the numbers sold in the USA was 10% of the 30m Q4 number, it would still translate to around 5 to 10m per year in the USA. It doesn’t take long for saturation to hit. I question how many households would really have them and what usage they may have.

Heck, even home automation devices (smart locks, smart switches, smart control boxes), I have to wonder what the actual penetration in homes is. This stuff isn’t cheap. The penetration of CFL and LED lights isn’t all that great either, and that’s the easiest replacement process possible.

Just the other night we're planning a driving trip to Florida. We were discussing different stops we could make and we asked Google the drive time from place to place. Yes, I could've used my phone, but then I'm looking at that and not my family. Speakers are more inclusive.