Apple Card may reap $1.5 billion, be in top 10 card issuers by 2024

Apple Card may reap $1.5 billion in revenue and be in top 10 card issuers by 2024, resulting in a windfall not just for Goldman Sachs, but for the iPhone manufacturer as well, an HSBC analyst said in a Thursday memo.

The card has a "large potential captive market," HSBC's Nigel Fletcher argued in a note seen by AppleInsider, potentially as much as half of the estimated 146 million adults in Apple's U.S. install base. Net income from the card from interest is predicted to be as high has $300 million in the first year, he continued, and up to $1.5 billion five years from launch.

Assuming a 70/30 revenue split between Apple and Goldman Sachs, the investment bank could reap as much as $500 million before tax in the card's second year -- 3.9 percent of what the firm is expected to generate as a whole in 2021.

Fletcher predicts that outstanding balances on Apple Cards could surpass $50 billion in five years, which would be enough to make Apple one of the country's 10 biggest credit card issuers.

Despite this optimism, the analyst is maintaining "hold" ratings on shares for both Apple and Goldman Sachs.

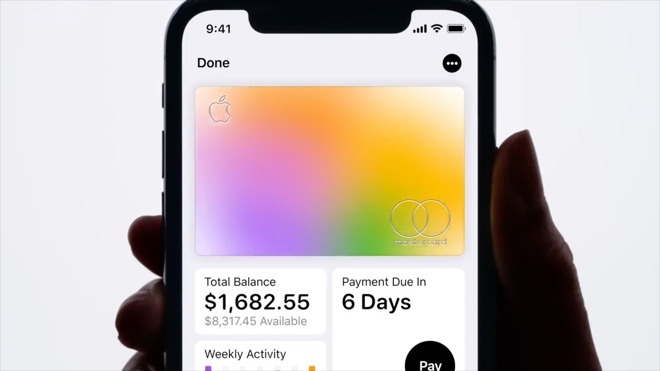

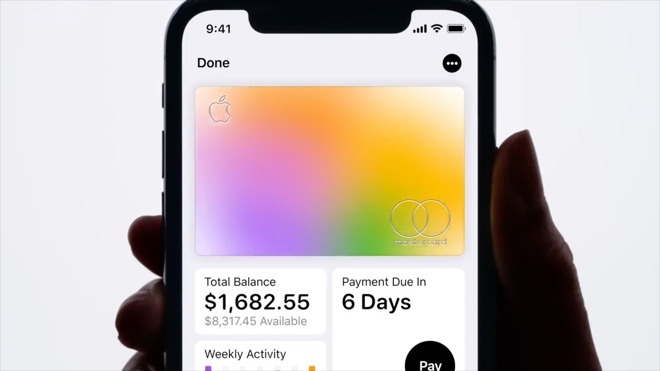

Perks of the Apple Card include same-day issuance handled entirely through an iPhone, "Daily Cash" rewards, and the elimination of any late, annual, or international fees. Apple is even planning a real-world titanium equivalent with minimal personal info.

The card has a "large potential captive market," HSBC's Nigel Fletcher argued in a note seen by AppleInsider, potentially as much as half of the estimated 146 million adults in Apple's U.S. install base. Net income from the card from interest is predicted to be as high has $300 million in the first year, he continued, and up to $1.5 billion five years from launch.

Assuming a 70/30 revenue split between Apple and Goldman Sachs, the investment bank could reap as much as $500 million before tax in the card's second year -- 3.9 percent of what the firm is expected to generate as a whole in 2021.

Fletcher predicts that outstanding balances on Apple Cards could surpass $50 billion in five years, which would be enough to make Apple one of the country's 10 biggest credit card issuers.

Despite this optimism, the analyst is maintaining "hold" ratings on shares for both Apple and Goldman Sachs.

Perks of the Apple Card include same-day issuance handled entirely through an iPhone, "Daily Cash" rewards, and the elimination of any late, annual, or international fees. Apple is even planning a real-world titanium equivalent with minimal personal info.

Comments

So are 1.5 billion in excessive interest rates?

No, debt is nothing to brag about whether it be personal or governmental. But, I believe the Apple card is far more transparent than the usual bank issued card. So, I think it could really help out those who aren't as credit card aware as they should be. And, there are no fees which are often hidden by banks. All good!

I agree with the commentary that there are a lot of nice features about the card and I can't wait to get mine, but I have the same disappointments. For example, my wife is from Mexico, so she doesn't have credit yet (she is legal). Unfortunately, at this point, she can't use my credit/card. And, I'm disappointed that I can get $500 for signing up with a bank card but, nothing for Apple's card. I hope that will change. I'm also disappointed with the 3% cash back for Apple purchases. I can do better ordering Apple products by mail order and saving the sales tax.

That said, I found this announcement to be very exciting for the future growth of Apple and am surprised that the traditional financial pundits aren't raving about it. I see this as a huge revenue source for Apple going forward. And, it will force the banks to be more transparent if they want to compete.

This won't be my only credit "card," but I see it as a viable credit option going forward. Now any bets on how long it will be before Samsung copies the concept and comes out with their card. :-)

If you choose to incur debt then any negative consequences of that decision are on you, not Apple or Goldman Sachs. Credit cards can be used responsibly.

And in case you didn't realize this, a significant portion of credit card revenue comes from POS transaction fees.

Apple’s future is in subscriptions and instalments. Brilliant.

Interest rates for credit cards in Switzerland for example average 12%... and they are profitable too. https://www.deposits.org/world-credit-card-rates.html

FWIW Google had one years before Apple (Dec/2010)

https://www.digitaltrends.com/how-to/how-google-wallet-works/

...but the cell providers and many CC providers were totally uncooperative, in fact cell companies actively fought Google Wallet, blocking it from working. See the link below.

https://www.theverge.com/2012/12/10/3751538/verizon-google-wallet-galaxy-nexus-secure-element

Too many powers were working against it and the cellular companies were in cahoots on their own ISIS payment system where they hoped to control mobile payments in a far less secure manner. Apple with their industry power did a far better job with designing and negotiating the system and TBH the timing was better anyway.

Goldman will indeed be “the” bank but they’re hardly a humanitarian org.

Apple will probably activate some of its immense, undeployed reserves for credit / securing purposes. It will also allow them to “moderate” sales performance over quarterly intervals

The Apple Card seems to be a really nice and secure "store card" for the most part, issued by retailers but governed and handled by a banking organization's Mastercard/Visa issued credit card system. For example Chase has various credit cards offered thru merchants as their own with the retailers name on 'em, even tho it's Chase behind it. In this case rather than a traditional bank it's Goldman backing it as the responsible party.

As I understand it where Apple may be making more money than the typical store card provider is on the interchange fees they will still get since the Goldman-issued card will utilize Apple Pay and those pre-existing agreements that give the a share of it. Whether Apple gets any cut of the interest fees too from Goldman has not yet been determined AFAIK but I wouldn't personally expect they do with the built-in rewards that already should benefit Apple product sales.

Please, you are ignoring facts to make a political statement. You may think the banks and other card issuers are just evil, greedy people, but like most every other product, supply and demand regulate the price, as there are countless companies to choose from, so if the interest rates were simply made up out of thin air based on nothing but greed, then companies who wanted to get more customers and make more money would lower their rates. But it turns out that the card issuers all charge roughly in the same range, based on your credit raring. Why is that? Well, read on.

You cherry picked Switzerland, but that chart shows that Switzerland is pretty much an outlier compared to most of the world. Is that because the Swiss are "less greedy?" Of course not. The Swiss have just about the highest per capita income in the world, meaning they pay their credit card balances. They have nothing like our extremely liberal bankruptcy laws which allows people to run up large credit card debts and then simply walk away from it. Who pays for that? You and I, in terms of higher interest rates. Banks know that the people with the worse credit rating will cost the system the most in non-payments, etc., so they try and lessen those losses in the form of higher interest rates for those customers.

We also have massive fraud. You love the fact that you aren't liable when you card is used fraudulently, but all of us pay for it.

You also want cash back and all the other free services, but those cost money, so that has to be made up for in higher interest rates.

You also ignore the huge amount of money that has to go into developing and maintaining the system to support your credit card system. 24/7 data centers, support centers, etc. etc.

Finally, and most importantly, you make the mistake of assuming the credit card issuers get their money for free. That's not how it works. All the money that allows you to buy on credit comes from people who demand a rate of return on their money, or there wouldn't be credit cards. That has to be recouped in the form of higher interest rates.

That's the facts without the emotion.

Want it to change the equation? Reduce cost of capital by a point or two, create tools to reduce the overall default rate, encourage more frequent payments and save a point by automating most of the features. This can get you under 10% if you work hard at it.

Most of the “greed” in the credit card industry is in extending credit to people that are bad at math, and gaming the process a little to encourage fees. The interest rate is a result of those policy decisions.