Cook says Apple's China performance on the rise, trade war less of a threat

Apple CEO Tim Cook sounded a positive note on China in announcing the company's March-quarter results, saying sales there are looking better.

Performance improved there versus the December quarter, and in fact strengthened towards the end of March, Cook said in a CNBC interview. He pointed to help from a sales tax cut in the country, which helped to lower the cost of products, as well as a thawing situation in the U.S.-China trade war.

"I believe that the trade relationship -- I don't mean the tariff, I mean the tone -- is much better today than it was in the November-December time frame," Cook said. "That affects consumer confidence in a positive way."

The fight was originally launched by U.S. President Donald Trump, who has railed against perceived imbalances in trade, jobs, and policies. A contentious issue has been forced technology transfers, in which companies wanting to operate in China are said to be pressured into handing tech over to local branches.

The company reaped $10.22 billion in the "Greater China" region during the March quarter, which includes Taiwan despite that country's contended independence. That's down from $13.02 billion a year ago.

It's unclear to what extent Chinese iPhone sales influenced the quarter, since Apple is no longer providing overall iPhone units, much less per-region numbers. Canalys research claims the company saw its "worst decline in two years," with shipments down 30 percent year-over-year to 6.5 million.

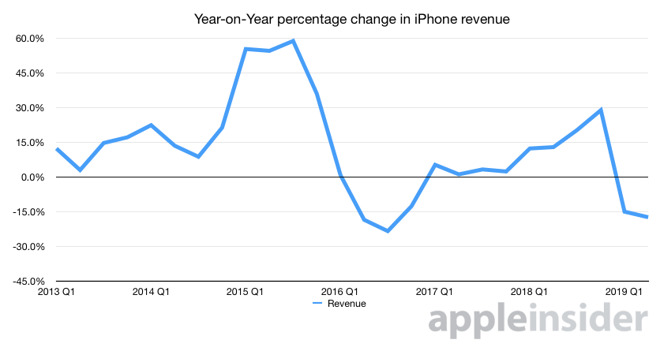

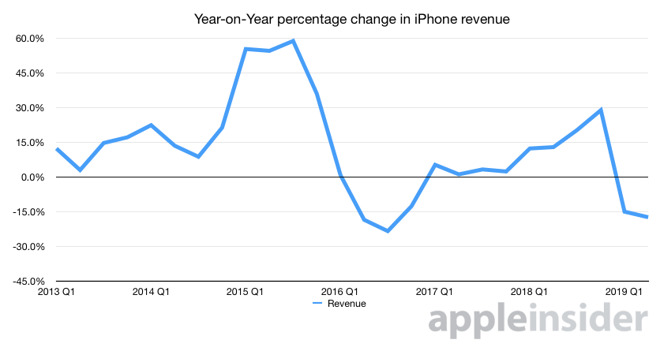

Global iPhone revenue is known to have sunk year-over-year from $37.6 billion to $31 billion. That contributed to overall revenue sliding 5 percent from $61.1 billion to $58 billion, buoyed by increased iPad, wearable, and services income.

During an investor conference call, Cook said four major factors contributed to Apple's China growth including price adjustments to account for a weaker currency, government stimulus programs, trade in and financing programs and an "improved trade dialogue" between the U.S. and China. Of note, Apple saw what it describes as record response rates for product trade-in and financing programs, particularly for iPhone, resulting in both new sales and upgrades not only in China, but worldwide.

"The trade-in looks like a subsidy, so it's a way to offset the device cost itself," Cook said of the program.

Performance improved there versus the December quarter, and in fact strengthened towards the end of March, Cook said in a CNBC interview. He pointed to help from a sales tax cut in the country, which helped to lower the cost of products, as well as a thawing situation in the U.S.-China trade war.

"I believe that the trade relationship -- I don't mean the tariff, I mean the tone -- is much better today than it was in the November-December time frame," Cook said. "That affects consumer confidence in a positive way."

The fight was originally launched by U.S. President Donald Trump, who has railed against perceived imbalances in trade, jobs, and policies. A contentious issue has been forced technology transfers, in which companies wanting to operate in China are said to be pressured into handing tech over to local branches.

The company reaped $10.22 billion in the "Greater China" region during the March quarter, which includes Taiwan despite that country's contended independence. That's down from $13.02 billion a year ago.

It's unclear to what extent Chinese iPhone sales influenced the quarter, since Apple is no longer providing overall iPhone units, much less per-region numbers. Canalys research claims the company saw its "worst decline in two years," with shipments down 30 percent year-over-year to 6.5 million.

Global iPhone revenue is known to have sunk year-over-year from $37.6 billion to $31 billion. That contributed to overall revenue sliding 5 percent from $61.1 billion to $58 billion, buoyed by increased iPad, wearable, and services income.

During an investor conference call, Cook said four major factors contributed to Apple's China growth including price adjustments to account for a weaker currency, government stimulus programs, trade in and financing programs and an "improved trade dialogue" between the U.S. and China. Of note, Apple saw what it describes as record response rates for product trade-in and financing programs, particularly for iPhone, resulting in both new sales and upgrades not only in China, but worldwide.

"The trade-in looks like a subsidy, so it's a way to offset the device cost itself," Cook said of the program.

Comments

Maybe you should delete it. And all further reporting about the firm.

Apples iPhone has been "too expensive" since the first one.

Now, after three years of stagnant iPhone growth, a profit warning (that hinged on an iPhone slump) and a second consecutive YoY drop and adjustments on pricing that have stimulated sales a little, I'd say price is a major factor in all of this and more and more people have simply 'gone' or are holding off on upgrading.