App Store monopoly case may run into 2020 and beyond

Although the U.S. Supreme Court is allowing the Apple v. Pepper App Store lawsuit to proceed, the case will take at least another year to resolve, analysts with Macquarie Research claimed on Monday.

Headed back to lower courts, the case will take "at least one more year to be decided and possibly longer," the firm's sources said. The Supreme Court voted 5 to 4 in a ruling that crossed party lines -- Justice Brett Kavanaugh for example voted in favor, despite being a Republican nominated by President Donald Trump.

"Most lawyers we spoke with about the case had expected AAPL to prevail and then thought it was likely that a similar case would be filed on behalf of developers," Macquarie wrote.

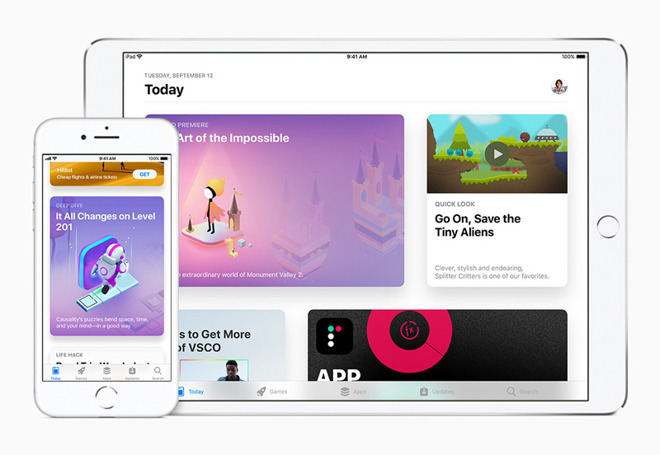

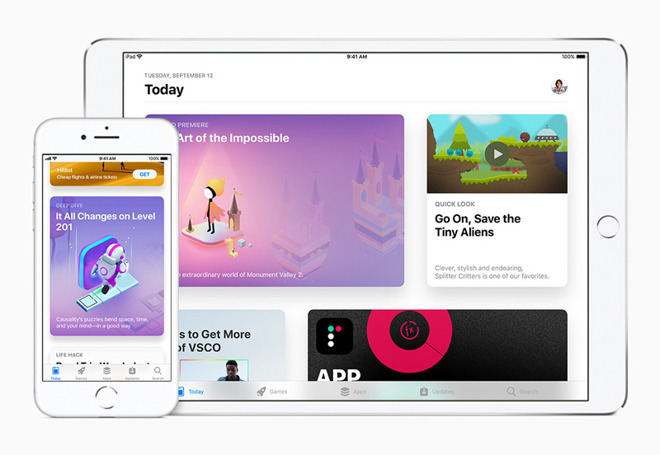

The case dates back to 2011, and accuses Apple of creating artificially inflated app prices through its control of iOS downloads. The App Store is the only sanctioned place to buy iOS apps, and since Apple takes a 15 to 30% cut, some developers may increase their pricing to compensate. A key example is Spotify, which launched a complaint with the European Commission over the matter.

Apple v. Pepper was dismissed in 2013, but allowed to revive in 2017 through the Court of Appeals for the Ninth Circuit. Apple has continually fought back, ultimately bringing that challenge to the Supreme Court.

Apple argues that developers are the ones who set prices, and that it's not in violation of any antitrust laws. It moreover claims that by paying its commission, developers are "buying a package of services which include distribution and software and intellectual property and testing."

If it loses, Apple could be forced to allow third-party app stores and/or reduce its commission. Pressure for that sort of change has been mounting from competition, legal, and regulatory angles, Macquarie wrote, noting that lower commission at either Apple or Google could lead the other to follow suit.

"We believe that if AAPL were to lower its 30% rate to 12%-20%, AAPL's total 2020 EBIT [earnings before interest and taxes] (NOT just App Store or Services, but total EBIT) would fall 7%-15%," the firm projected, suggesting similar results for Google.

Macquarie is maintaining a "neutral" rating for Apple stock with a $190 price target.

Headed back to lower courts, the case will take "at least one more year to be decided and possibly longer," the firm's sources said. The Supreme Court voted 5 to 4 in a ruling that crossed party lines -- Justice Brett Kavanaugh for example voted in favor, despite being a Republican nominated by President Donald Trump.

"Most lawyers we spoke with about the case had expected AAPL to prevail and then thought it was likely that a similar case would be filed on behalf of developers," Macquarie wrote.

The case dates back to 2011, and accuses Apple of creating artificially inflated app prices through its control of iOS downloads. The App Store is the only sanctioned place to buy iOS apps, and since Apple takes a 15 to 30% cut, some developers may increase their pricing to compensate. A key example is Spotify, which launched a complaint with the European Commission over the matter.

Apple v. Pepper was dismissed in 2013, but allowed to revive in 2017 through the Court of Appeals for the Ninth Circuit. Apple has continually fought back, ultimately bringing that challenge to the Supreme Court.

Apple argues that developers are the ones who set prices, and that it's not in violation of any antitrust laws. It moreover claims that by paying its commission, developers are "buying a package of services which include distribution and software and intellectual property and testing."

If it loses, Apple could be forced to allow third-party app stores and/or reduce its commission. Pressure for that sort of change has been mounting from competition, legal, and regulatory angles, Macquarie wrote, noting that lower commission at either Apple or Google could lead the other to follow suit.

"We believe that if AAPL were to lower its 30% rate to 12%-20%, AAPL's total 2020 EBIT [earnings before interest and taxes] (NOT just App Store or Services, but total EBIT) would fall 7%-15%," the firm projected, suggesting similar results for Google.

Macquarie is maintaining a "neutral" rating for Apple stock with a $190 price target.

Comments

Between this case and the China trade war escalation, not a good day for AAPL.

Exactly. A large number of apps are a dollar or free. Apple could have charged a hosting fee for free apps, but they didn't. Apple could also show that before the iPhone, the price of apps was much higher, and the iPhone's app store actually lowered the cost of entry and the price to consumers. I remember Blackberry apps costing around $3-5, or even more, for a lot less functionality and safety.

I suppose at some point, Apple mayhave to open up the iPhone to 3rd party stores. Or allow Netflix and Spotify to use the Apple app store, but charge them a fixed fee for hosting, rather than a 15% cut of the subscription revenue.

However, I will never use a third party app store, since I wouldn't trust it to be safe. And the idea that the app store causes higher prices is ridiculous!

First, as someone who doesn't think SCOTUS allowing the suit to go forward is crazy, I also don't think Apple loses the case. The only thing Apple is doing is taking a commission from developers in a closed system. Granted, it's a monopoly in the iOS world. But there are alternatives to iOS and Apple products.

Secondly, if they ultimately lose, I don't see their profitability being affected. They will find another way to make up for any lost revenue as a result of lower commissions/opening up iOS/whatever the remedy.

Third, the China trade war thing is completely overblown. Right now, Apple isn't affected directly. As things ramp up pre-deal (which I think will happen), there may be some short term mild to moderate pain for Apple and consumers. But the trade war damages China far more than it damages us, today's DOW numbers notwithstanding. They have to make a deal. We have a massive trade deficit with China, which works in our favor. They depend on us buying nearly 20% of their exports. Their GDP growth is already 30% lower than their 20 year average.

This is entirely different from what Microsoft did ages ago and has zero relation to it. Microsoft forced companies to use their software exclusively on PC hardware. Vendors were forced to pay Microsoft even though they didn't install Windows on their machines.

It's Apple's store, they built it, they made it, they run it, they maintain it, and they pay for it.

If somebody doesn't like it, go someplace else.

They should be careful what they wish for.

What's also strange is that it was the Supreme Court that allowed manufacturers to establish not only minimum advertised prices, but minimum selling prices. Isn't that price fixing that increases prices for consumers?

30% selling commission is a bargain and it was a bargain for books as well.

Allowing Amazon to continue their business, which is clearly becoming a monopoly due to their market power to the point where they're also opening physical retail (and Whole Foods) while claiming the AppStore gives Apple monopoly power is clearly absurd on the level of Alice In Wonderland.

Also, I think people forget that there is nothing illegal about having a monopoly (in the US). It’s the abuse of monopoly power that gets corporations into trouble.

But throughout the entire chain, Apple does exactly that

They only allow their own operating system to run on the hardware, they only allow their app store on their operating system, and they only allow apps they deem appropriate on their app store.

A perfect example of software that is legal but not allowed is Kodi, Retroarch, and any app that has gained reputation as a way to get stuff illegitimately.

I use an iPhone because the hardware is some of the best out there and I hope 100% that Apple is forced to allow apps to be distributed outside of the confines of the App Store.

And because Apple licenses the operating system and owners of iPhones and other Apple products do not own their copy, Apple is entirely within their right to control what apps can be installed and how developers must pay to play.

And no, I’m not buying Android, so shove the rhetoric right up where the sun don’t shine.

Speaking of "up where the sun don't shine", you definitely are talking from there when you say you own an iPhone.