Apple's Mac sales are up a lot or down slightly in Q2 depending on who you ask

Market research firms IDC and Gartner released widely diverging worldwide PC marketshare estimates for the second quarter of 2019 on Thursday, with one firm finding Mac shipments up nearly 10% while the other saw Apple suffering negative growth.

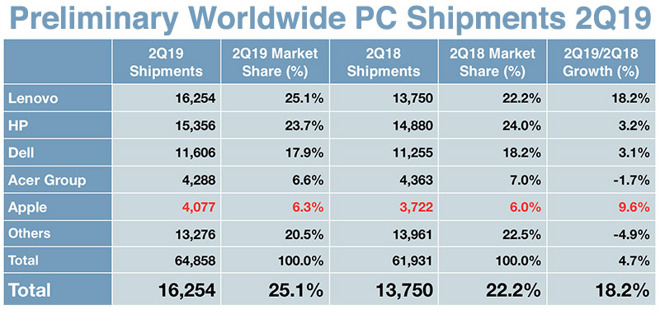

IDC's second quarter numbers.

According to IDC, Apple shipped 4.1 million Macs during the quarter ending in June, up 9.6% from from an estimated 3.7 million units shipped over the same period in 2018. The result earned the Cupertino tech giant a a 6.3% share of the worldwide PC market, up from 6% last year, IDC said.

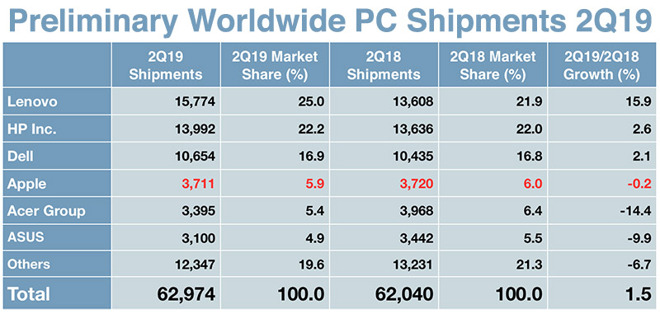

Those figures contrast with estimates from Gartner, which saw Apple ship 3.7 million Macs in quarter two, down 0.2% year-over-year. Apple obtained 5.9% of the global PC market, down from 6% in 2018, Gartner estimates.

Beyond Apple, the research firms disagreed on Acer's performance. The Taiwan-based company landed in fourth place on IDC's top-five list with 4.3 million units shipped, down 1.7% year-over-year. Gartner, however, saw the company slip to fifth place behind Apple on shipments of 3.4 million units, down 14.4% percent from the year-ago period.

Gartner's second quarter numbers.

Both research firms placed Lenovo as the world's top PC manufacturer, with IDC estimating 16.3 million units shipped to Gartner's 15.8 million units. IDC put Lenovo's take of the market at 25.1% percent, not far off from Gartner's 25% estimate.

HP and Dell finished in second and third, respectively, with IDC estimating 15.4 million units shipped for HP, up 3.2% year-over-year. Gartner estimated HP's shipments at 14 million units, up 2.6% from the same period in 2018. Dell shipped 11.6 million computers, up 3.1% year-over-year, according to IDC. Gartner put Dell's shipments at 10.7 million units, up 2.1% from 2018.

Overall, IDC holds a much more rosy outlook on the PC market's vitality, finding the industry grew 4.7% year-on-year. Gartner's lay of the land, on the other hand, is relatively staid with total growth reaching an estimated 1.5% over the quarter.

Both IDC and Gartner's findings have come under fire over the past year, both by industry watchers and manufacturers. With Apple no longer reporting unit sales, however, media outlets are forced to rely on the estimates to gauge the health of Apple's Mac business.

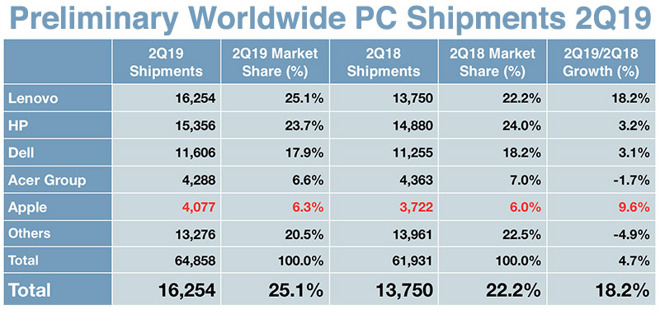

IDC's second quarter numbers.

According to IDC, Apple shipped 4.1 million Macs during the quarter ending in June, up 9.6% from from an estimated 3.7 million units shipped over the same period in 2018. The result earned the Cupertino tech giant a a 6.3% share of the worldwide PC market, up from 6% last year, IDC said.

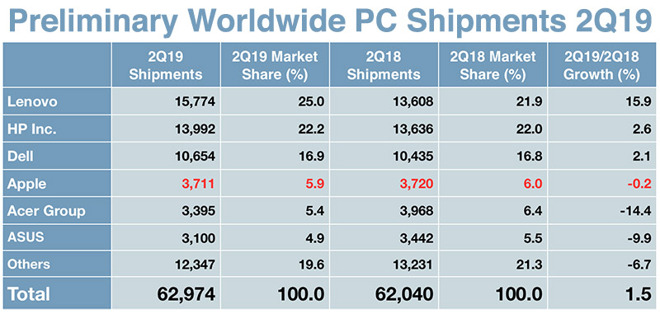

Those figures contrast with estimates from Gartner, which saw Apple ship 3.7 million Macs in quarter two, down 0.2% year-over-year. Apple obtained 5.9% of the global PC market, down from 6% in 2018, Gartner estimates.

Beyond Apple, the research firms disagreed on Acer's performance. The Taiwan-based company landed in fourth place on IDC's top-five list with 4.3 million units shipped, down 1.7% year-over-year. Gartner, however, saw the company slip to fifth place behind Apple on shipments of 3.4 million units, down 14.4% percent from the year-ago period.

Gartner's second quarter numbers.

Both research firms placed Lenovo as the world's top PC manufacturer, with IDC estimating 16.3 million units shipped to Gartner's 15.8 million units. IDC put Lenovo's take of the market at 25.1% percent, not far off from Gartner's 25% estimate.

HP and Dell finished in second and third, respectively, with IDC estimating 15.4 million units shipped for HP, up 3.2% year-over-year. Gartner estimated HP's shipments at 14 million units, up 2.6% from the same period in 2018. Dell shipped 11.6 million computers, up 3.1% year-over-year, according to IDC. Gartner put Dell's shipments at 10.7 million units, up 2.1% from 2018.

Overall, IDC holds a much more rosy outlook on the PC market's vitality, finding the industry grew 4.7% year-on-year. Gartner's lay of the land, on the other hand, is relatively staid with total growth reaching an estimated 1.5% over the quarter.

Both IDC and Gartner's findings have come under fire over the past year, both by industry watchers and manufacturers. With Apple no longer reporting unit sales, however, media outlets are forced to rely on the estimates to gauge the health of Apple's Mac business.

Comments

Which is pretty unbelievable considering that Apple's guidance figures have always been historically more accurate, and thus these analysts would merely need to weight them better in their reporting.

So these estimates/projections/whatever you want to call them could be an explanation (at least in Apple’s case) why this year the Mac seems to be actually getting some love from Cook et al. You have to admit that recent releases are certainly more worthy, and more timely, since the 2013-18 Mac interregnum.

It is best to ignore both because chances are one or both will be wrong.

Media outlets aren’t “forced” to rely—or to even bother passing along—the latest guesswork of any market research firm. Rather, they could simply throw a properly labeled 12-sided die, or utilize a dartboard. Alternatively, they could do something even crazier and simply report the audited figures that Apple provides. Quarterly Mac revenue are an excellent way to gauge the health of Apple’s Mac business—unlike the estimates provided by market researchers—who literally have to guess at Apple Store sales, since Apple does not disclose any data at all that would enable them to make a valid forecast.

When does Apple change stuff just to change it?

If there’s not a valid reason for the update, then why change?

iMac pro definitely needs an update, or at the least repositioned with a price drop.

TDP of the new Xeons are in the 180-200W range, compared to the 140W of the previous generation. So it’s reasonable to expect underclocked CPUs again, even if Apple can save 50W with AMD’s latest GPU (7nm/Navi/RDNA). Ideally Apple would beef up the cooling system a bit, and maximize the CPU/GPU gains that will be available soon.