Apple Card is here, find out all you need to know

After months of waiting, Apple Card has been launched and is potentially available to all iPhone users in the US. If it's right for you, Apple Card is going to change everything.

Apple Card is here.

Since Apple Card was announced back on March 25, 2019, we have steadily learned more and more about it, but now it's here, you can apply for it yourself.

There are conditions, but after a brief small rollout, it's now open to applications from everyone in the US. And there are strong reasons to want one.

Whether you get an Apple Card or not depends on your personal, financial situation, but the process of applying for it is swift.

Then Apple is not going to reveal its algorithm for determining who does or does not qualify, but it's unlikely to be any different to other credit cards. In which case, you may already know whether you can expect to qualify.

If you do get it, though, you get it just about immediately. If you apply right now, when the Card has just been launched, you're likely to find it slow as everyone else applies too, but that should only affect how many minutes it takes for you to get a decision. The actual steps you go through will be fast.

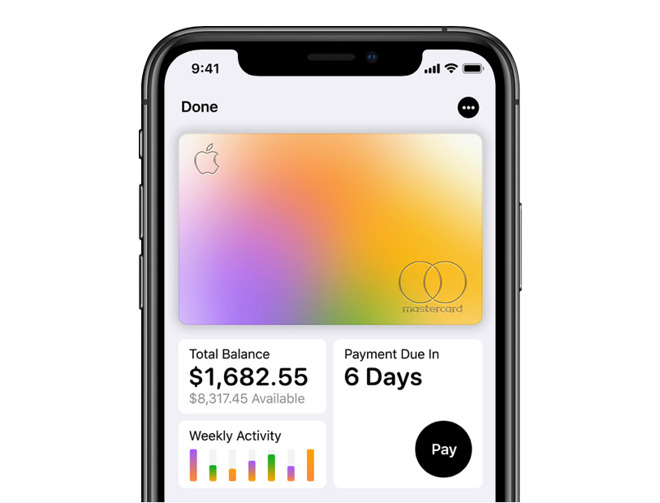

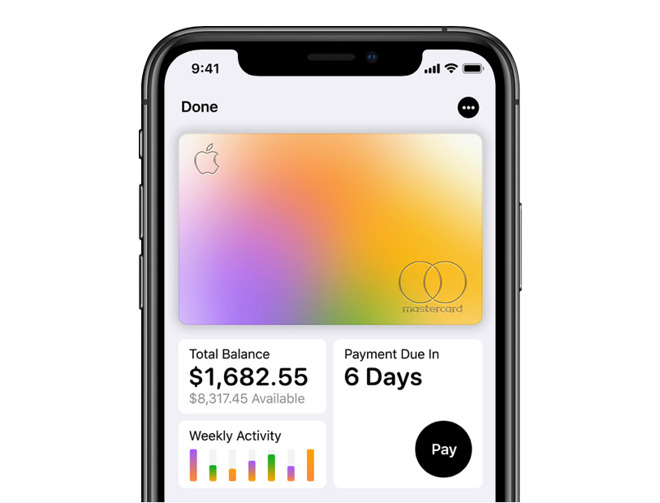

Every detail of your spending will be right there in your Wallet app whenever you need it

From the moment your application is approved, you are the owner of an Apple Card -- just not yet an actual card. Wherever you pay online, you'll be able to use your Apple Card right away.

If you elect to get a physical card, which you really should, then that already famous titanium credit card will arrive in the post after a few days. It'll look like every other credit card, and unlike any other, too. While the shape is the same and it'll have your name on it just like usual, it won't have any numbers on it at all.

The physical card can be optional because once you qualify for an Apple Card, its details will be in your Wallet and you'll be able to pay at any contactless or NFC terminal too. However, with the physical card, you'll also be able to use Apple Card wherever you can't currently use Apple Pay.

If someone steals your card, they don't know the number. If they manage to spend something on it, you'll know because your iPhone will tell you.

And you'll also be able to temporarily freeze or permanently delete the card if you need to. There's no keeping a list of bank phone numbers you have to ring, you cancel it right through your iPhone.

When you absolutely have to give someone your actual credit card number, you won't have to give them your actual one. Apple Card will generate a number you can give just to them and just for this transaction.

Apple has rather trained us to know how to do all of this, but what's new is what happens after we've paid.

First, every single transaction is monitored in detail -- for you, not for Apple. While Apple itself won't know what you've bought or where you got it, you will be able to see exact details.

Rather than seeing an unknown name on your statement at the end of the month, you see the name of the store right now on your phone. If you're looking back over a couple of days and can't recognize the name, your iPhone will show you the location on a map.

And you can also split purchases up into categories that you later track to see just what you're spending your money on.

Every day, every time you use the Card or any time when you need to know, all possible information is available to you immediately. You can't stop people being financially irresponsible, but you can do a lot and Apple has.

There are many credit cards reward you, but often it's with points and always the aim is to get you to use the card more. Doubtlessly Apple wants the same result -- it's predicted to earn $1 billion per year from Apple Card -- but here it's coupled to that monitoring.

While you get a certain amount of money each time you use the card, that's part of having you be aware of your spending. Together with the ability to see just what you're spending, and then with how clear Apple is about the interest you'll end up owing, Apple Card presents an appealing package.

The rewards cash could be better, there are cards that offer more in certain circumstances. Whatever you buy on Apple Card, you get at least 1% of the purchase price back. That might be quite a rare figure to get, as it's the percentage when you're paying somewhere that does not yet accept Apple Pay and so is using this as a regular credit card.

If you buy anything through Apple Pay, via the Apple Card, then you'll get 2% back. And if you do that in an Apple Store or via any Apple-owned online store like iTunes, you get 3%.

Every day, you'll get the cashback from 24-hours of shopping delivered into your account. By default that's a separate Daily Cash account in your Wallet, but you can have it be paid into your actual Apple Card account.

So you can have this daily cash go toward paying off your credit card.

What's more, that detail includes how much interest you are probably going to have to pay at the end of the month.

While Apple doesn't charge an annual fee, and it doesn't charge you with late fees, it still works on a monthly cycle. And so you will owe the company money every month -- in theory.

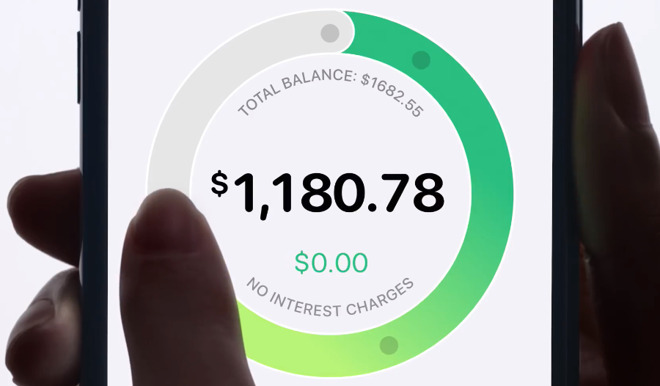

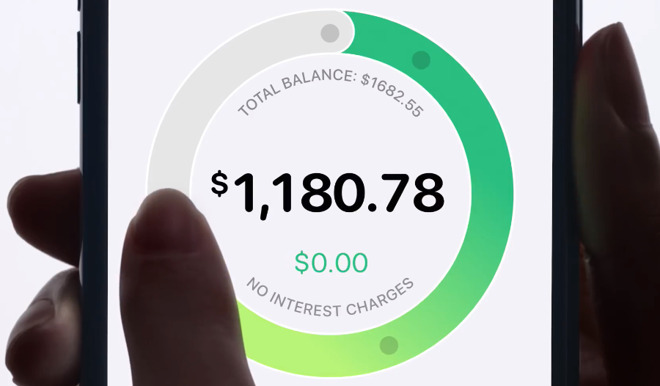

A simple slider shows you how much you'll owe in interest, depending on when you choose to pay off the card

In practice, you can pay off your card at any time, and if you do that regularly, you will be able to avoid high interest charges. The interest rate you pay is dependent on your financial situation when you apply, but in all cases the Wallet app will show you what you're going to owe.

It can only be an estimate, though. What it is really saying is that right now, if you spent nothing else and paid off nothing, at the end of the month, this is what you would owe.

As well as the business of it just being seamless to use, as well as it giving daily cash and letting us avoid high interest payments, it's also cutting out the banks as much as possible.

Apple is partnered with Goldman Sachs, but that firm is not going to stop your card on a whim.

We've had cases, for instance, where a bank has decided to refuse an Apple Pay transaction because we had used Apple Pay too often. We can't tell you how many is too many, because that bank does not publish the information and it refuses to tell us.

You know that won't happen with Apple. So alongside all the tangible benefits and features, now that Apple Card is here, it is surely going to disrupt old-style, consumer-unfriendly banking forever.

Keep up with AppleInsider by downloading the AppleInsider app for iOS, and follow us on YouTube, Twitter @appleinsider and Facebook for live, late-breaking coverage. You can also check out our official Instagram account for exclusive photos.

Apple Card is here.

Since Apple Card was announced back on March 25, 2019, we have steadily learned more and more about it, but now it's here, you can apply for it yourself.

There are conditions, but after a brief small rollout, it's now open to applications from everyone in the US. And there are strong reasons to want one.

Applying

You'll have to have an iPhone. That's because applying is going to be done through the Wallet app. There are other requirements, to do with your finances.Whether you get an Apple Card or not depends on your personal, financial situation, but the process of applying for it is swift.

Then Apple is not going to reveal its algorithm for determining who does or does not qualify, but it's unlikely to be any different to other credit cards. In which case, you may already know whether you can expect to qualify.

If you do get it, though, you get it just about immediately. If you apply right now, when the Card has just been launched, you're likely to find it slow as everyone else applies too, but that should only affect how many minutes it takes for you to get a decision. The actual steps you go through will be fast.

Every detail of your spending will be right there in your Wallet app whenever you need it

From the moment your application is approved, you are the owner of an Apple Card -- just not yet an actual card. Wherever you pay online, you'll be able to use your Apple Card right away.

If you elect to get a physical card, which you really should, then that already famous titanium credit card will arrive in the post after a few days. It'll look like every other credit card, and unlike any other, too. While the shape is the same and it'll have your name on it just like usual, it won't have any numbers on it at all.

The physical card can be optional because once you qualify for an Apple Card, its details will be in your Wallet and you'll be able to pay at any contactless or NFC terminal too. However, with the physical card, you'll also be able to use Apple Card wherever you can't currently use Apple Pay.

Security

One of the strong attractions of the Apple Card is this business of it having no number on it. This card is going to be the most secure credit card around, and that's for many reasons.If someone steals your card, they don't know the number. If they manage to spend something on it, you'll know because your iPhone will tell you.

And you'll also be able to temporarily freeze or permanently delete the card if you need to. There's no keeping a list of bank phone numbers you have to ring, you cancel it right through your iPhone.

When you absolutely have to give someone your actual credit card number, you won't have to give them your actual one. Apple Card will generate a number you can give just to them and just for this transaction.

How it works in stores

If you've used Apple Pay, you already know how most of this goes. You can use your iPhone or your Apple Watch on the NFC terminal, or you can insert the physical Apple Card into a store's reader.Apple has rather trained us to know how to do all of this, but what's new is what happens after we've paid.

First, every single transaction is monitored in detail -- for you, not for Apple. While Apple itself won't know what you've bought or where you got it, you will be able to see exact details.

Rather than seeing an unknown name on your statement at the end of the month, you see the name of the store right now on your phone. If you're looking back over a couple of days and can't recognize the name, your iPhone will show you the location on a map.

And you can also split purchases up into categories that you later track to see just what you're spending your money on.

Every day, every time you use the Card or any time when you need to know, all possible information is available to you immediately. You can't stop people being financially irresponsible, but you can do a lot and Apple has.

Every day

Speaking of every day and every purchase, Apple Card will pay you money each time you use it for anything.There are many credit cards reward you, but often it's with points and always the aim is to get you to use the card more. Doubtlessly Apple wants the same result -- it's predicted to earn $1 billion per year from Apple Card -- but here it's coupled to that monitoring.

While you get a certain amount of money each time you use the card, that's part of having you be aware of your spending. Together with the ability to see just what you're spending, and then with how clear Apple is about the interest you'll end up owing, Apple Card presents an appealing package.

The rewards cash could be better, there are cards that offer more in certain circumstances. Whatever you buy on Apple Card, you get at least 1% of the purchase price back. That might be quite a rare figure to get, as it's the percentage when you're paying somewhere that does not yet accept Apple Pay and so is using this as a regular credit card.

If you buy anything through Apple Pay, via the Apple Card, then you'll get 2% back. And if you do that in an Apple Store or via any Apple-owned online store like iTunes, you get 3%.

Every day, you'll get the cashback from 24-hours of shopping delivered into your account. By default that's a separate Daily Cash account in your Wallet, but you can have it be paid into your actual Apple Card account.

So you can have this daily cash go toward paying off your credit card.

Paying off

The majority of credit cards present you with a bill at the end of the month, and while you can go online in the meantime, you tend not to. With Apple Card, the latest details are right there, on your iPhone, available to you immediately.What's more, that detail includes how much interest you are probably going to have to pay at the end of the month.

While Apple doesn't charge an annual fee, and it doesn't charge you with late fees, it still works on a monthly cycle. And so you will owe the company money every month -- in theory.

A simple slider shows you how much you'll owe in interest, depending on when you choose to pay off the card

In practice, you can pay off your card at any time, and if you do that regularly, you will be able to avoid high interest charges. The interest rate you pay is dependent on your financial situation when you apply, but in all cases the Wallet app will show you what you're going to owe.

It can only be an estimate, though. What it is really saying is that right now, if you spent nothing else and paid off nothing, at the end of the month, this is what you would owe.

Lost

You need to be responsible, though Apple Card is helping you more than most credit cards. If you are diligent about paying off the card, however, this is a really attractive offer.As well as the business of it just being seamless to use, as well as it giving daily cash and letting us avoid high interest payments, it's also cutting out the banks as much as possible.

Apple is partnered with Goldman Sachs, but that firm is not going to stop your card on a whim.

We've had cases, for instance, where a bank has decided to refuse an Apple Pay transaction because we had used Apple Pay too often. We can't tell you how many is too many, because that bank does not publish the information and it refuses to tell us.

You know that won't happen with Apple. So alongside all the tangible benefits and features, now that Apple Card is here, it is surely going to disrupt old-style, consumer-unfriendly banking forever.

Keep up with AppleInsider by downloading the AppleInsider app for iOS, and follow us on YouTube, Twitter @appleinsider and Facebook for live, late-breaking coverage. You can also check out our official Instagram account for exclusive photos.

Comments

I'm also curious what kind of "payment due" notifications will be provided. Yes, you can monitor, but if no statement arrives in the mail, I will want an alert, or even better, a way to set up an automatic payment.

"This Summer" means any time before September 23, 2019, given that Apple is based in the northern hemisphere.

I am as paperless as can be but still get email notifications. I assume there are also app notifications for my financial institutions and utilities, but I mostly keep them turned off with a repeating Calendar reminder set.

Even if they aren't ready for a full rollout I can see them making their launch date by shipping some cards to some customers so they can technically keep their promise. We've seen them do that many times over the years.

I'm just not clear what is so special (except for a metal card) about this card? In a nutshell, why would I want this card when I already have half a dozen other cards?

Why did you want card number 5 when you had 4 other cards?

Why did you want card number 4 when you had 3 other cards?

Why did you want card number 3 when you had 2 other cards?

Why did you want card number 2 when you had 1 other card?

Personally, it seems like a nifty collector's item, but more importantly it's about getting 2% back daily on Apple Pay purchases plus 3% back from the thousands of dollars I spend her year from Apple. Finally, a more tangental desire for this card (but will happen anyway) is getting more people to use Apple Pay (or really any other *Pay service) so we can finally get to a point where not carrying your physical card is commonplace because all merchants are aware fo the benefits and popularity of NFC-based *Pay systems.

Getting another credit card will knock down my FICO score a few points for three months or so.

And how about when I have to generate a number for someone like Amazon which doesn’t accept ApplePay? Am I correct in assuming that number is only good for a single use? If so, that means I can’t use the card for a recurring bill without generating a new number for each use or for a monthly pay-off. For example, I can’t imagine generating a new number each month to pay for the newspaper. Now if that generated number is not for single use, these objections go away but then we are back to comparing the Apple Card to cards I already have which have better benefits.

I don’t need an Apple Card just to be able to say I have one. So am I missing something here? That purchase tracking is kind of neat but frankly I’d rather have the better benefits offered by cards I already have.

More revolving credit can also help your credit score because you are now shown to have more access to credit and your current spending habits will help keep you under credit utilization down as this is deternimated as a percentage of available credit, not a dollar value.

It's not any different than deciding on whether an iPhone, Mac mini, Mac Pro or any other product is a good fit for your needs. If you don't see a need to have one because you have free cards that give you more than 2% back as a minimum (which is something I have yet to see) and more than 3% back for Apple's various store then there is little reason for you to get this card.

I'm still getting one and will get rid of my extra cards I've kept to keep my credit card history higher.

Hey 1-poster. Maybe just Maybe it's from Apple, will make life easier and integrate with Apple.

There's no reason knocking sense into these guys. Every time Apple announces a revolutionary product we get the pessimists.

Reminds me of the people who didn't need an iPhone because they already had an iPod and a samsung flip phone.

Well, I’m not going to list my cards on an open forum but this will get you started:

https://www.creditcards.com/cash-back/

https://www.nerdwallet.com/best/credit-cards/cash-back

Since Apple Pay helps ensure that your card will not be compromised like your physical cards getting more people to use Apple Pay and as a result getting more merchants to advertise their acceptance of it is a good move.

”I haven’t read the articles that explain what’s nifty about this card.”

“But I already have a credit card!”

🤦🏻♂️

Detailed explanation: Different cards have different benefits (and restrictions) in different situations. Whether one card is better than another depends on the individual and their purchasing habits.

I never carry a balance so interest rates are irrelevant for me. None of my cards have an annual fee.

- Card A: Extended warranty protection. New purchase protection. Average rewards program. Superior merchant dispute team. Superior customer service. Very good credit limit. Neither Visa nor MasterCard, not accepted everywhere.

- Card B: Big credit limit. Lousy customer service. 3% rewards at restaurants (regardless of whether it's swipe, chip or Apple Pay).

- Card F: Decent rewards program. Automatic reward deposit to brokerage account every month.

- Card J: 5% rewards for select categories each quarter (Q3 at gas stations, regardless of transaction type).

- Card K: Mediocre rewards program that only gives gift cards. No foreign transaction fees. I usually redeem iTunes Store Gift Cards with my accumulated points.

- Card V: Smallest credit limit, average rewards program. No foreign transaction fees.

Depending on the situation, it is advantageous using a certain card.I don't shop at big box stores. I don't eat at chain restaurants or fast food places. I patronize a lot of mom-and-pop stores. Almost all of my produce is purchased at the city's farmers market (mostly cash transactions). I am not a small business owner.

I do a fair amount of international travel (for personal holiday, not for work) so the foreign transaction fees are noteworthy.

For big ticket items including travel (airline tickets, domestic travel arrangements), I use Card A. If I drop my brand new iPhone in the parking lot of the Apple Store and the screen shatters, Card A will cover the replacement. Getting an extra year of warranty coverage is great for it and similar purchases.

For dining out, I use Card B. No brainer.

For buying gas this quarter, I use Card J.

From a "responsible personal finance" standpoint, using Card F is probably the best since it deposits the reward rebate back into my brokerage account where I am more apt to invest it. However, I'm disciplined enough to fully fund my Roth IRA every year, so that's not really a selling point for using Card F. It might be helpful for others though.

For international travel, I use Card K and Card V. This includes recurring/occasional transactions that use an overseas credit card processing company.

Where does Apple Card fit for me? To me, its main benefits are A.) no foreign transaction fees, and B.) 2% rewards on Apple Pay transactions. Whether or not the Apple Card provides extended warranty protection and recent purchase protection is unclear at this time. What's better, using an Apple Card on a $2,000 Apple Store purchase and getting $60 cash back or using Card A and getting an extra year of warranty protection, recent purchase protection and $20 back?

While I have not seen the full cardmember benefits document, it appears that using the Apple Pay card for me makes the most sense for A.) foreign transactions, and B.) if I can use Apple Pay at a POS terminal unless we are talking about a big ticket item that may benefit from extended warranty protection and recent purchase protection.

A real unknown is Goldman Sachs customer service. Historically they have not been a consumer company. Will them provide the same level of customer service as Card A's issuer?

But that's just me. Each person has their own financial situation and own spending habits. If you do most of your shopping at big box stores, mostly eat at large chains, and never leave the USA, well, Apple Card might be something you use more often than me.

First of all, the Fidelity 2% cashback card, Citi double cash card, and Paypal cashback card are all free cards that offer 2% cashback on ALL purchases. So yes, these all exceed the 2% offered by Apple on Apple Pay purchases only. Not to mention the various sign on bonuses, price protections, and extended warranty coverages these cards offer that Apple has yet to (if at all) announce for the Apple card.

Seconf of all, regarding your "thousands of dollars" you spend each year directly from Apple, well, you're just a fool for spending full price when you can easily find the products (even new ones) for a discount much greater than the extra 1% you get with the Apple card. For example, Amazon is selling the new iPad Air for $469 while selling for $499 at the Apple Store. Many people have the Amazon Store card or Amazon Prime card, both giving 5% discount on ALL Amazon purchases. So in the Amazon example, 6% discount on base price plus 5% Amazon card discount is 11% total discount from purchasing from Amazon vs Apple Store. How does your 3% sound now?

You have fervently defended this Apple Card and decried anyone else with valid facts as to why the Apple card is not the best card as trolls which is clearly untrue.