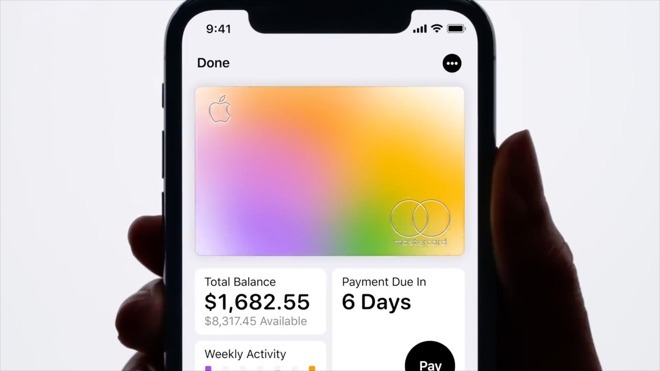

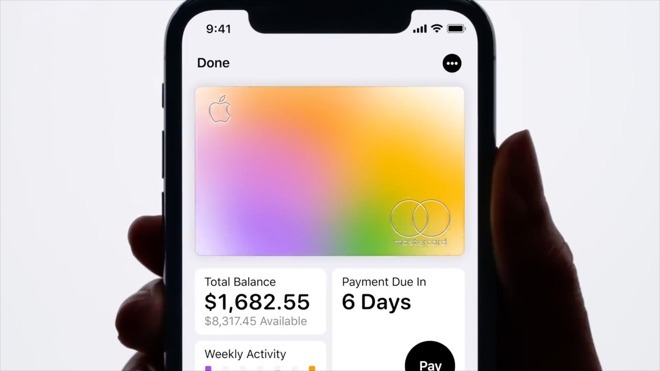

Apple files for Apple Card & Apple Pay Cash trademarks in Canada

Apple is looking at bringing the Apple Card and Apple Pay Cash to Canada, expanding beyond the U.S., according to recent trademark filings.

Both applications were submitted to the Canadian Intellectual Property Office (CIPO) on July 15, according to The Star. The CIPO later registered the Cash trademark on July 17.

It could still take some time for both products to launch in Canada, as it can take up to 10 months for trademark applications to be approved, The Star noted. Apple may also need a Canadian financial partner, though the American card is being handled by Goldman Sachs, which does have offices in Calgary and Toronto.

Apple has yet to launch the Apple Card in the U.S. Its arrival could be imminent though, as the company said it was aiming for a summer release, and the card has been in beta testing for at least two months.

It's expected to go live alongside iOS 12.4, also in beta. Since that code has already undergone several seeds, the finished update could arrive in a matter of days, or weeks at the latest.

Both applications were submitted to the Canadian Intellectual Property Office (CIPO) on July 15, according to The Star. The CIPO later registered the Cash trademark on July 17.

It could still take some time for both products to launch in Canada, as it can take up to 10 months for trademark applications to be approved, The Star noted. Apple may also need a Canadian financial partner, though the American card is being handled by Goldman Sachs, which does have offices in Calgary and Toronto.

Apple has yet to launch the Apple Card in the U.S. Its arrival could be imminent though, as the company said it was aiming for a summer release, and the card has been in beta testing for at least two months.

It's expected to go live alongside iOS 12.4, also in beta. Since that code has already undergone several seeds, the finished update could arrive in a matter of days, or weeks at the latest.

Comments

Also, U.S. cardholders usually do not get the same rewards that we get here when charging outside of the U.S.

If Apple charges no annual fee and offers 1-2% on all transactions, Apple card wins for most people as they will likely not spend enough to make up the difference on a traditional CC. If they at all undercut on the standard 2.5% FX fee then it is an even bigger win for people who travel. This is also not even taking into account the privacy aspect Apple brings to the table.

Do you get equally upset at Target or Disney for having credit cards?

This is a VERY revolutionary game-changing innovation from Apple but if it isn't an iPhone-level revolution, Apple has "failed".