5G iPhone impact underestimated by investors & analysts, says Jefferies analyst

Investors are being too conservative in their guesses of how much impact 5G will have on the iPhone's sales in the coming years, a Jefferies analyst suggests, with Wall Street apparently underestimating how many people will upgrade their devices to take advantage of the communications technology.

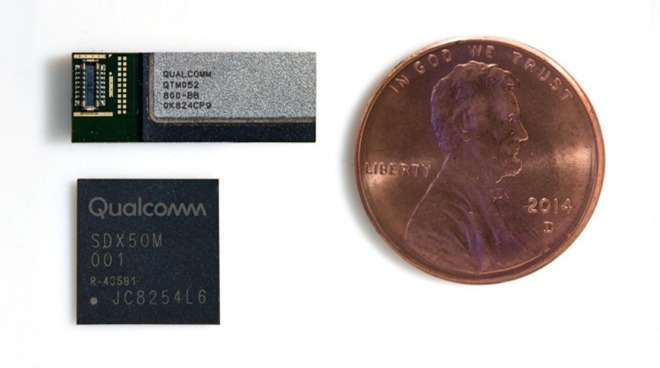

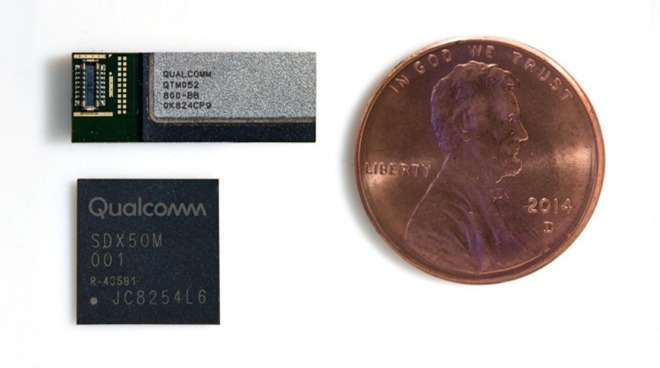

Qualcomm's 5G hardware for smartphones

The iPhone is currently anticipated to have a major upgrade in 2020 to enable it to connect using 5G, using modems sourced from Qualcomm as part of an agreement to end legal battles between Apple and the chip producer. While the iPhone 11, iPhone 11 Pro, and iPhone 11 Pro Max all use Intel modems, it seems the first opportunity to use Qualcomm modems will be in the 2020 models, and serves as a prime opportunity to introduce 5G support at the same time.

While some analysts have offered favorable opinions on the 5G cycle, new Jefferies Apple analyst Kyle McNealy advised to investors on Tuesday that the opinions are still too low. McNealy takes over Apple coverage for Jefferies from Tim O'Shea.

"We think the Street underestimates the benefit Apple gets from this heading into the 5G cycle," the note insists.

While Wall Street consensus puts Apple at 190 million iPhone units sold for the 2021 fiscal year, Jefferies suggests the amount is low, 9% below the 6-year unit shipment average for iPhone product cycles. In Jefferies' opinion, the forecast should be closer to 208 million units sold for 2021.

Part of the problem is where analysts are failing to take into account the amount of iPhones that need upgrading for that cycle. Jefferies suggests that, even if there is a three-year upgrade cycle for consumers, the demand will still be there.

Marketing will also be a big factor for the iPhone, with carriers in general "driving a 5G message with consumers," something Apple will be able to take advantage of in the coming years.

Jefferies also points out the possibility a 5G iPhone will be drastically different. "Given the advanced technology and components, 5G devices will be high-end," writes McNealy, with Apple currently dominating that sector.

Along with the sales of iPhones, Services are also a major revenue contributor according to the firm. It is estimated by Jefferies that Apple will earn $38 in revenue per active device for fiscal 2020, up from $25 for fiscal 2017 and representing 14% growth.

For fiscal 2020, and assuming the influx of iPhone sales stems from "mostly new iPhone users," Apple stands to earn $342 million in annual services revenue off the 9 million unit difference alone, which is "almost a point of services growth." Services revenue will apparently make up 20% of sales and 38% of operating profit for the 2020 financial year.

Jefferies has set a target of $260 on Apple's shares, making it one of the highest targets among Apple analysts.

Qualcomm's 5G hardware for smartphones

The iPhone is currently anticipated to have a major upgrade in 2020 to enable it to connect using 5G, using modems sourced from Qualcomm as part of an agreement to end legal battles between Apple and the chip producer. While the iPhone 11, iPhone 11 Pro, and iPhone 11 Pro Max all use Intel modems, it seems the first opportunity to use Qualcomm modems will be in the 2020 models, and serves as a prime opportunity to introduce 5G support at the same time.

While some analysts have offered favorable opinions on the 5G cycle, new Jefferies Apple analyst Kyle McNealy advised to investors on Tuesday that the opinions are still too low. McNealy takes over Apple coverage for Jefferies from Tim O'Shea.

"We think the Street underestimates the benefit Apple gets from this heading into the 5G cycle," the note insists.

While Wall Street consensus puts Apple at 190 million iPhone units sold for the 2021 fiscal year, Jefferies suggests the amount is low, 9% below the 6-year unit shipment average for iPhone product cycles. In Jefferies' opinion, the forecast should be closer to 208 million units sold for 2021.

Part of the problem is where analysts are failing to take into account the amount of iPhones that need upgrading for that cycle. Jefferies suggests that, even if there is a three-year upgrade cycle for consumers, the demand will still be there.

Marketing will also be a big factor for the iPhone, with carriers in general "driving a 5G message with consumers," something Apple will be able to take advantage of in the coming years.

Jefferies also points out the possibility a 5G iPhone will be drastically different. "Given the advanced technology and components, 5G devices will be high-end," writes McNealy, with Apple currently dominating that sector.

Along with the sales of iPhones, Services are also a major revenue contributor according to the firm. It is estimated by Jefferies that Apple will earn $38 in revenue per active device for fiscal 2020, up from $25 for fiscal 2017 and representing 14% growth.

For fiscal 2020, and assuming the influx of iPhone sales stems from "mostly new iPhone users," Apple stands to earn $342 million in annual services revenue off the 9 million unit difference alone, which is "almost a point of services growth." Services revenue will apparently make up 20% of sales and 38% of operating profit for the 2020 financial year.

Jefferies has set a target of $260 on Apple's shares, making it one of the highest targets among Apple analysts.

Comments

"Jefferies also points out the possibility a 5G iPhone will be drastically different. "Given the advanced technology and components, 5G devices will be high-end," writes McNealy, with Apple currently dominating that sector."

This is where big doubts creep in on his knowledge on the 5G state of play for 2020:

https://www.androidauthority.com/huawei-cheap-5g-phones-2020-1031206/

It’s an extremely limited technology that offers no new high value or behavior changing application. Compare this to 4G - which made streaming video possible or 3G that made the internet usable. These were extremely valuable leaps that changed people’s lives significantly. What does 5G offer? The ability to download very large files quickly? What else?

Even if 5G does offer some valuable new ability that is meaningful to everyone. There is a critical flaw with the technology. It covers such short distances it will never work widely outside of densely populated areas - this means that it cannot be relied on for any meaningful new service - this is a critical flaw!

These Wall Street analysts are very simply looking back on 3G and 4G and assuming this is the same thing - it is not!

Today 5G phones and networking equipment are being rolled out. There will be important changes ahead that go beyond handsets.

https://www.newequipment.com/industry-trends/managing-big-data-flood

In healthcare:

https://www.businessinsider.com/5g-surgery-could-transform-healthcare-industry-2019-8

5G in intensive care units combined with monitoring devices and AI will vastly improve emergency attention.

It’s an industry where they want have the most revenue possible from their subscribers for the least usage of the network possible. Why would customers upgrade if they don’t have anything gain?

I’m with T-Mobile and the network has gone to @#$ for LTE. My hope is my suffering is temporary, and that T-mobile’s efforts ($$$) are on the 5G rollout. Either people will migrate to 5G freeing up bandwidth /reducing congestion on LTE... or I’ll be upgrading to 5G to leave the issues behind. The question is will I still be with T-mobile by then...

And knowing our esteemed US carriers, they'll roll it out piecemeal all while pricing the service as high as possible.

All of which means that penetration rates are not going to be very high for quite a few years...

story, bro.

Your overall point still applies, though. In the near term, once you sort through the hype there is virtually nothing you can do with 5G that you can't do with a good 4G signal. Beyond that, if you look at the history of technology roll-outs, without exception they have taken longer to be widely available and fallen short of the hype and promises made before their introduction. I see no reason too expect 5G will be any different.

Huawei is investing in flying taxis AND the software AND the hardware to cover it.

It is pushing for an international framework to make everything that is airborne (up to 300m) controlled and safe. LOL!

There you go, bro. Another 5G plus.

I know Huawei isn't alone with its thinking. Amazon? Musk? Apple? No idea.

Now, how long before drones fly injured people to hospital while onboard AI keeps them looked after on their way?

Yep. It's a cool story. It's coming but will rely on 5G to pull it off. It won't be tomorrow, that's for sure but we will live to see it.

Your phone will be just like it is today but more of a control hub than it currently is.

We are going to see a rise in sensors in our lives. Many are already on phones, watches and other devices but there will be more and they will tie in with other sensors in a way that isn't possible over 4G.

One and the same.

Anyway, if you're interested in how cellular infrastructure can be used in civilian airspace and what telecos are looking at, here you are:

http://www.mobilk.net/en-off/mobile-news-12-24764.html

Of course, this isn't possible without 5G.

https://asia.nikkei.com/Opinion/Huawei-affair-growing-Communist-Party-role-in-China-s-big-tech

"Huawei is in many ways a special company, and revered at home. It may shape China's innovation. Yet the gray lines between companies like Huawei and the party may damage their brands abroad. Meanwhile, the harder lines being drawn between millions of other private enterprises and the state sector may turn out to be ideologically correct, but commercially harmful."

P.S. It didn't take long for him to mention that knockoff Apple company did it??