Apple Card PDF statements not itemized for some, fix coming soon

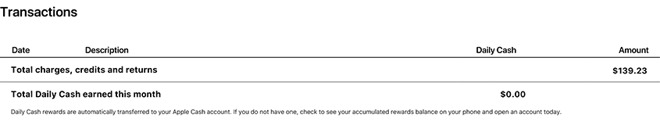

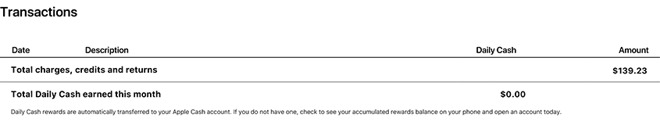

If you've checked your September Apple Card statement, you may have noticed itemized transactions missing.

Apple Card users who have checked their Apple Card PDF statements for September may notice that their statements are not itemized. While the Apple Card still shows itemized transactions within the Wallet app itself, the downloaded PDF currently shows a single monthly transaction, rather than an itemized list.

AppleInsider received a tip from a reader who noticed that their statements were not itemized. Staffers who own the Apple Card were able to recreate this problem upon checking their own statements.

We contacted Apple Card support through the Wallet app. Apple transferred us to a Goldman Sachs representative.

"We are aware that some PDF billing statements are not showing transaction level detail. Transaction details in the Wallet app are correct," said the Goldman Sachs representative. "The PDF Statements are being regenerated and will be available in Wallet later today."

The Apple Card is a collaborative effort between Apple and Goldman Sachs. According to an investor note, Goldman Sachs is spending somewhere in the ballpark of $350 per new Apple Card customer. Goldman Sachs is not expected to make a profit on Apple Card owners until they've been a customer for roughly four years.

Goldman Sachs has already reportedly spent over $275 million in 2019 alone on the Apple Card collaboration. This has resulted in a 0.6% reduction in the investment bank's equity return, according to the firm. Goldman Sachs' CFO has gone on record stating that he felt as though the Apple Card was a risk, and that "We'll continue to look at it on a risk-adjusted return basis."

Currently, the Apple Card cannot be linked to other financial apps, such as Mint. Instead, Apple offers its own financial planning interface that can be accessed by viewing the Apple Card on the iPhone Wallet app. Currently, it is unknown whether or not the Apple Card will be linkable to third-party financial apps in the future.

Apple Card users who have checked their Apple Card PDF statements for September may notice that their statements are not itemized. While the Apple Card still shows itemized transactions within the Wallet app itself, the downloaded PDF currently shows a single monthly transaction, rather than an itemized list.

AppleInsider received a tip from a reader who noticed that their statements were not itemized. Staffers who own the Apple Card were able to recreate this problem upon checking their own statements.

We contacted Apple Card support through the Wallet app. Apple transferred us to a Goldman Sachs representative.

"We are aware that some PDF billing statements are not showing transaction level detail. Transaction details in the Wallet app are correct," said the Goldman Sachs representative. "The PDF Statements are being regenerated and will be available in Wallet later today."

The Apple Card is a collaborative effort between Apple and Goldman Sachs. According to an investor note, Goldman Sachs is spending somewhere in the ballpark of $350 per new Apple Card customer. Goldman Sachs is not expected to make a profit on Apple Card owners until they've been a customer for roughly four years.

Goldman Sachs has already reportedly spent over $275 million in 2019 alone on the Apple Card collaboration. This has resulted in a 0.6% reduction in the investment bank's equity return, according to the firm. Goldman Sachs' CFO has gone on record stating that he felt as though the Apple Card was a risk, and that "We'll continue to look at it on a risk-adjusted return basis."

Currently, the Apple Card cannot be linked to other financial apps, such as Mint. Instead, Apple offers its own financial planning interface that can be accessed by viewing the Apple Card on the iPhone Wallet app. Currently, it is unknown whether or not the Apple Card will be linkable to third-party financial apps in the future.

Comments

So, now that the first month has passed, the AppleCard starts generating interest revenue...

I've not seen anywhere that Apple invested any of their own funds into the venture, except for the obvious need to assist developing the features and extend the platform. That doesn't mean they didn't, but the lack of evidence that they've done so probably means they haven't. Even recent statements from Goldman would support that.

There will be some teething problems as this is so new, but so far I'm really happy with the Card and Apple Pay.

I’m also seeing a revised statement now with itemization and it’s printable right from the Wallet app.

This is the way credit cards should be. I think the incumbents should be scared. Very scared.

The way I see it this arrangement is no different than other affinity cards, except Apple is doing the advertising and the card is virtual, a BIG unique marketing offering that no other card offers. Plus, Goldman Sachs gets to be associated with the most valuable company on stock market. Unless you can cite some facts, I don’t see any reason Apple should give them a ‘cut’ of every purchase.

What is Goldman Sachs afraid they are going to lose being associated with Apple??

There’s no benefit to Apple.