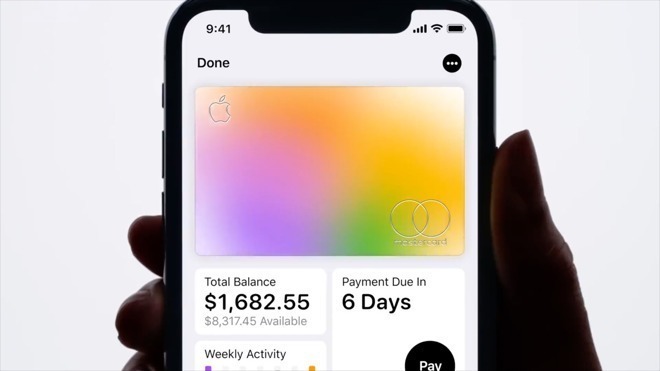

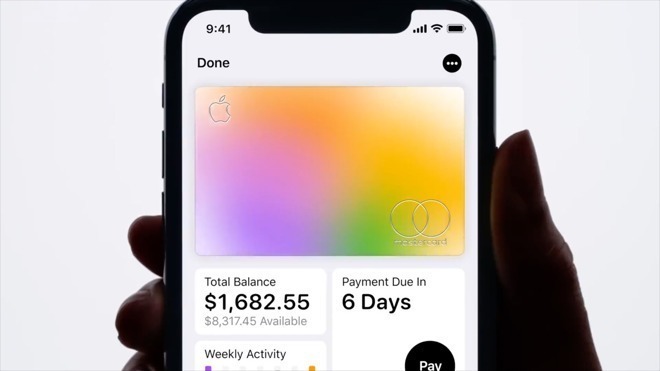

Apple Card had the 'most successful credit card launch ever' says Goldman Sachs

Apple's financial partner company Goldman Sachs reports that its first-ever consumer credit card launch -- the Apple Card -- has been a success, and that here is a "high level" of demand for it.

In an update to investors, Goldman Sachs says that its partnership with Apple to produce the Apple Card has become "the most successful credit card launch ever."

"Since August," said CEO David Solomon, "we've been pleased to see a high level of consumer demand for the [Apple Card] product."

According to CNBC, Solomon was particularly briefing investors on how Goldman Sachs has recently been undertaking several new initiatives.

"In three short years," he continued, "we have raised $55 billion in deposits on the Marcus [savings account] platform, generated $5 billion in loans, and built a new credit-card platform and launched Apple Card."

Without revealing an more specifics about the Apple Card, Solomon said that all of these initiatives had been introduced without disruption to its existing products and services.

"From an operational and risk perspective, we've handled the inflows smoothly and without compromising our credit underwriting standards," he said.

Apple Card is the first consumer credit card from Goldman Sachs, and the partnership represents part of a move into what Solomon described as "next generation" electronic trading platforms.

Goldman Sachs has previously revealed that it spent heavily on Apple Card -- reportedly $350 for each person who signs up -- and these other initiatives.

"Taken together, these investments draw on our returns in the short term," concluded Solomon, "but are critical to expanding our capabilities and our competitive position."

In an update to investors, Goldman Sachs says that its partnership with Apple to produce the Apple Card has become "the most successful credit card launch ever."

"Since August," said CEO David Solomon, "we've been pleased to see a high level of consumer demand for the [Apple Card] product."

According to CNBC, Solomon was particularly briefing investors on how Goldman Sachs has recently been undertaking several new initiatives.

"In three short years," he continued, "we have raised $55 billion in deposits on the Marcus [savings account] platform, generated $5 billion in loans, and built a new credit-card platform and launched Apple Card."

Without revealing an more specifics about the Apple Card, Solomon said that all of these initiatives had been introduced without disruption to its existing products and services.

"From an operational and risk perspective, we've handled the inflows smoothly and without compromising our credit underwriting standards," he said.

Apple Card is the first consumer credit card from Goldman Sachs, and the partnership represents part of a move into what Solomon described as "next generation" electronic trading platforms.

Goldman Sachs has previously revealed that it spent heavily on Apple Card -- reportedly $350 for each person who signs up -- and these other initiatives.

"Taken together, these investments draw on our returns in the short term," concluded Solomon, "but are critical to expanding our capabilities and our competitive position."

Comments

What data points do you offer to cast doubt on his claim? General sour grapes isn't enough.

That says to me he's not stating facts backed by data, but simply rendering an opinion to influence market perception. Pretty sure it was always going to be successful. What else was he going to say? So there's no worry about lying to the SEC. Besides we're all adults here. No sense in pretending any of the financial services companies have any reservations about lying to the SEC. They take their fines and keep moving. If the cost/benefit analysis tells them a lie is more profitable than the truth, they'll lie without compunction.

And yes, there is worry from lying to the SEC. If the rollout was not ultra successful, and he told investors it was the best rollout ever, there would be a problem.

I'm not familiar with the routine practice of financial executives intentionally lying to investors and paying the fines later. What do you have?

Again, no. They aren't really worried about lying to the SEC. https://www.marketwatch.com/story/banks-have-been-fined-a-staggering-243-billion-since-the-financial-crisis-2018-02-20

Interesting on the link, tho it says the majority of that was about mortgage bonds. But still interesting.

Regardless, I find the likeliness of Solomon’s conclusion as CEO of the company that launched it far more likely than the suggestion by a guy on the internet named “Spice-boy” that the card is somehow not a success and the executives are lying about it. He’s provided no evidence to support the implication so it’s pretty worthless.

Since the AppleCard, I’ve barely used my Amex. The only reason I’ll keep it going by paying the fees is for the lounge access, 5x points on travel bookings, and a few other perks. For pretty much everything else, it’s AC. If, at some point, Apple can create a higher tier card — obviously with fees — with Amex-style perks, it could put Amex out of business.

eh, you know what? I think I’m thinking of something else. Never mind.

Well done Goldman Sachs!

Apple Federal Credit Union

http://bit.ly/2IWuH6s

I do get the acceptance piece in the EU tho.