Apple earned 66% of the entire smartphone market's profits in 2019

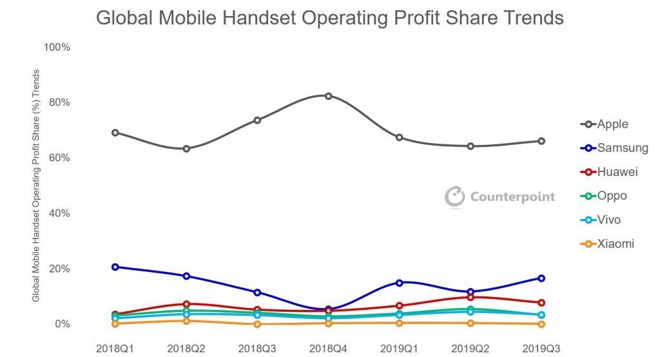

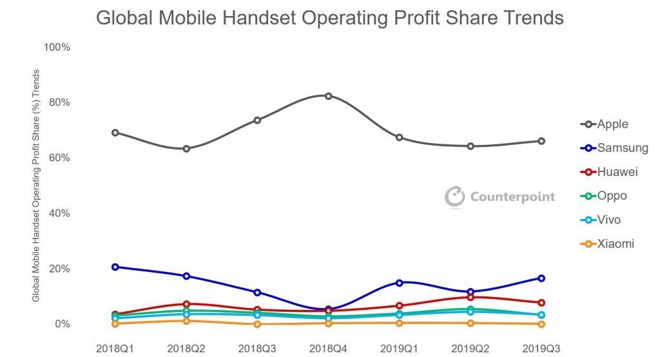

Research claims that while the entire market's smartphone profits declined by around a tenth in 2019, Apple continued to dominate with 66% of all profits and the nearest competitor being Samsung on just 17%.

Apple's iPhone 11

The global profits from cell phone sales fell by 11% in the third quarter of 2019, earning companies an estimated total of $12 billion. Apple has again dominated those profits, though, earning a reported 66% or almost $8 billion. When compared to revenue instead of profits, Apple remains in the lead with 32%.

According to Counterpoint Research, the remaining 34% of profits was chiefly divided between Samsung, Huawei, Oppo, Vivo and Xiami. Of all of these, Samsung was the closest to Apple, but it only earned 17% of the profits.

These figures are broadly similar to 2018's, and like that year's, doesn't include companies that didn't turn a profit. But, 2019 marks growth for Samsung, which Counterpoint ascribes chiefly to the launch of the Galaxy Note 10 Series.

The research firm believes the overall decline in smartphone profits in the last quarter is because premium smartphones are facing greater competition from mid-tier devices.

Counterpoint also reports that Chinese brands are expanding outside China, and that they are providing flagship phones at more affordable prices. These firms are also said to be looking at providing an ecosystem that includes financial services.

The most profitable smartphone handset companies. (Source: Counterpoint)

The ability of Chinese firms to increase their profits has been hampered, however, by users holding on their devices for longer -- and Apple introducing price cuts and trade-ins.

The company believes that Apple's ecosystem is strong enough to guarantee it steady revenue for years, but also that it will see increased profits this holiday season with the iPhone 11, iPhone 11 Pro and iPhone 11 Pro Max.

Apple's iPhone 11

The global profits from cell phone sales fell by 11% in the third quarter of 2019, earning companies an estimated total of $12 billion. Apple has again dominated those profits, though, earning a reported 66% or almost $8 billion. When compared to revenue instead of profits, Apple remains in the lead with 32%.

According to Counterpoint Research, the remaining 34% of profits was chiefly divided between Samsung, Huawei, Oppo, Vivo and Xiami. Of all of these, Samsung was the closest to Apple, but it only earned 17% of the profits.

These figures are broadly similar to 2018's, and like that year's, doesn't include companies that didn't turn a profit. But, 2019 marks growth for Samsung, which Counterpoint ascribes chiefly to the launch of the Galaxy Note 10 Series.

The research firm believes the overall decline in smartphone profits in the last quarter is because premium smartphones are facing greater competition from mid-tier devices.

Counterpoint also reports that Chinese brands are expanding outside China, and that they are providing flagship phones at more affordable prices. These firms are also said to be looking at providing an ecosystem that includes financial services.

The most profitable smartphone handset companies. (Source: Counterpoint)

The ability of Chinese firms to increase their profits has been hampered, however, by users holding on their devices for longer -- and Apple introducing price cuts and trade-ins.

The company believes that Apple's ecosystem is strong enough to guarantee it steady revenue for years, but also that it will see increased profits this holiday season with the iPhone 11, iPhone 11 Pro and iPhone 11 Pro Max.

Comments

/s

So you buy products you think aren’t any good, in the hope that a product that you haven’t seen yet is perfect.

All of Apple's move's over the last few years have included measures to shore up handset sales and increase them. It has been a radical shift but in spite of those measures, sales have remained flat or dipped YoY.

Even the most persistent rumours for 2020 include yet more measures to stimulate handset growth (new SE model released out of the habitual refresh).

At the end of the day we are all 'pundits', just in different capacities. That includes Apple management, shareholders, users, competitors.

When Apple releases software targeting Android users to make switching easier, by definition, they are chasing marketshare.

When Apple opens up its services to Android users it is also chasing marketshare.

Perhaps the question you should ask yourself is how much marketshare is necessary to keep the business healthy. But at the end of the day it is still marketshare.

You should also compare Apple's handset business model and compare it to 2015. What has changed and more importantly, why?

There have been massive changes and they didn't come about through experimentation. They came about through necessity.

(Some responses never age. Remember, this is seven years old.)

As far as pricing, again more bullshit. Services: iCloud is cheaper than Dropbox, ATV+ is cheap, Arcade is cheap, Music is about the same as Spotify (I have family plan so it's cheap to me). Hardware: $199 Watch, $329 iPad, $449 iPhone, $799 Mac, $1099 MB, etc.. All reasonable entry points, going up as much as you wish to spend. And guess what? The knockoff brands all sell expensive smartphones now, too. Oops.

Apple famously does not manage to the stock price. They manage for delighting the customer. Plenty of case studies and essays about it.

Nah. Your "but market share!" examples are services. Services which are not tethered to hardware, so there's absolutely no reason not to sell Apple Music on Android. Services is a different business model than hardware. Apple is king of hardware, and is also adding services. And interestingly it became king of hardware while needing developers, yet still didn't foolishly chase market share by making cheapies like your Chinese knockoffs. Just like they didn't make netbooks.

Even during the heyday of peak iPhone, everyone knew and commented upon that the historic, never-before-seen-on-earth success of the iPhone could not last forever. That is normal, expected, and not the sign of desperate flailing you like to pretend it is. Absolutely no one thought it would be otherwise. iPhone has generated more revenue than anything before it and remains the most successful product in history for the most successful public company in history.

Ha! Hadn't read that. Funny stuff. A shame its writer went off the deep edge with his own constant nonsense and got himself banned.

Marketshare is a metric. Not necessarily a key metric. This thinking comes from the days of Windows OS where having over 95% share proved that MS was successful and Apple was not.

However today even with minority marketshare Apple has turned that notion upside down.

The rest of your post is how Apple would like more marketshare, however you fail to mention that they will not go after that goal at all costs. They have kept healthy margins that has enabled them to invest in other technologies like Apple watch, AirPods, HomePod, AppleTV+ etc. And this is what makes them special in the eyes of many of us here. Ecosystem is what keeps many of us coming back for more than just individual features on a smartphone.

So much crap being bandied about here as something to fuss over. It’s mostly inaccurate.