How to export your Apple Card monthly transactions

Users are now able to export their Apple Card monthly transactions, allowing them to import the data into third-party financial management apps.

One of the biggest complaints that users of the Apple Cardhave had is that there's no way to import their transaction history into third-party money management apps, such as Mint. There's a reason for this-- Apple's privacy policy. Apple is not too keen on third-party companies having access to your private financial data.

Starting January 21 with a gradual server-side rollout, Apple has a solution. While you still won't be able to give third-party apps direct access to your Apple Card transactions, you are able to manually export your transactions from the wallet app. Once exported, you can take that data wherever you'd like.

Once exported, you'll have a CSV -- comma separated value -- file, which can be imported into most money management apps, such as Mint and Quicken. Of course, you could also import that list into Numbers or Excel, if you want to go truly old school.

The caveat is that you can only export transactions from a full month. However, for those who rely on apps such as Mint or Quicken to maintain their budgets, it makes a big difference. It also proves that Apple has taken customers' concerns seriously and is willing to work to improve their experience.

One of the biggest complaints that users of the Apple Cardhave had is that there's no way to import their transaction history into third-party money management apps, such as Mint. There's a reason for this-- Apple's privacy policy. Apple is not too keen on third-party companies having access to your private financial data.

Starting January 21 with a gradual server-side rollout, Apple has a solution. While you still won't be able to give third-party apps direct access to your Apple Card transactions, you are able to manually export your transactions from the wallet app. Once exported, you can take that data wherever you'd like.

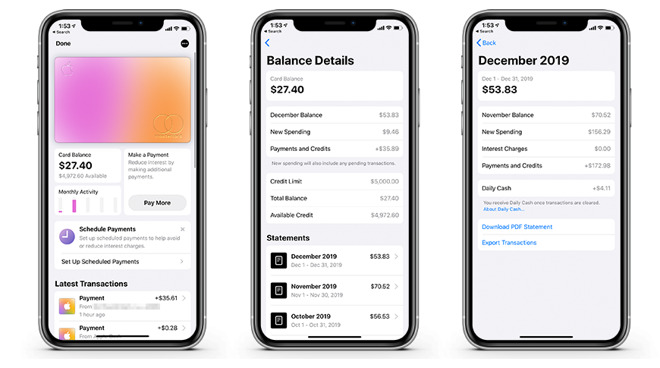

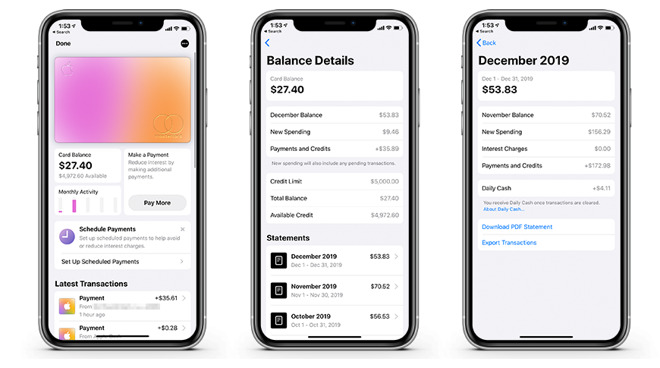

- To export your Apple Card transaction data:

- Open the Wallet app.

- Tap Card Balance.

- Tap your desired monthly statement.

- Tap Export Transactions

Once exported, you'll have a CSV -- comma separated value -- file, which can be imported into most money management apps, such as Mint and Quicken. Of course, you could also import that list into Numbers or Excel, if you want to go truly old school.

The caveat is that you can only export transactions from a full month. However, for those who rely on apps such as Mint or Quicken to maintain their budgets, it makes a big difference. It also proves that Apple has taken customers' concerns seriously and is willing to work to improve their experience.

Comments

It wasn't that you couldn't get the data, but it was previously only available as a PDF. My attempts to then cut and paste the data from those PDF's in Excel/Numbers didn't work (except for the first (beta) month). Which was infuriating.

I've posted about this before, but the number of middle-men in a credit card transaction is astonishing, and they all want part of the money changing hands. Merchant, terminal vendor, terminal network, card processor, card brand, issuing bank, backing bank ... The margins of any individual party between the merchant and the backing bank are razor-thin, so removing even one layer of middle-men can significantly improve profit or allow those margins to be redirected into things like cash back. For example, Walmart became their own credit card processor, which let them cut prices a tiny bit (or get a tiny bit more money where they didn't cut prices).

Otherwise, the rewards are paid pretty directly by the merchant. There's a reason nobody really offers more than about 2% without an annual membership fee.

He may be talking about the physical card, though. I certainly wish it had better cash back. Only 1% means I'm never going to use it unless my 2% card gets frozen due to fraud. With how nice the physical card is, that's a shame.

Would sure be great if Apple Card's existence got other companies to offer nicer physical cards instead of the same plastic ones we've all had for decades.

Most cards charge retailers 2% to 5% to process the transaction, American Express being on that high side. Also do not think retailer are not passing this cost on to every purchase. They do have some control over the selling price of an item and they roll up all their operating costs into the overall cost of the purchases item not everyone takes it out of their profits. I use to only buy with cash or ATM card thinking this was somehow saving me money. Then someone clued be in about above and the fact I am still paying the higher cost of the others using their CC and I do not get to use someone else's money for 30 days. If someone is willing to give me a Cash discount I take it every time, is some time 10% to 20% they will know off their service just to avoid a CC or Check transaction.

Now the whines of 'Boo Apple! Everybody else's card does this! WTF!' can now turn to 'About time Apple! WTF!' or the every popular 'It's a crap card anyway. I'll stick with my AMES Black! The rest of you can eat cake!'

Anyway I like the card, and I'm concerned about cash back, except that it's my default card for Apple Pay. I use it at restraints or anywhere my card goes away to be charged.

It's app for tracking purchases and money owed, etc., is fast and efficient. Another feature I like is the notification on the phone for each charge made on the card. I especially appreciated this feature for items that may be back order or have a some delay in shipping. As most places don't charge until the order ships, getting the notification tells me it's shipped. Often I don't check my email for the confirmation until I have to wade through it. I've got a few cards, but I use this one the most.

See Maestro64's comment above - the Apple card still doesn't do what every other card does. It doesn't allow financial software to connect directly and it doesn't export data to a QIF or QFX file that financial software programs use to import. CSV data provides a workaround but it's still a clumsy, cumbersome process.

You can also download the csv statement to any folder within iCloud Drive from your iPhone .

Yes, lots of merchants still offer such discounts (or go the other way and charge a credit card fee; this is also generally forbidden by card processor agreements). They get away with it because the card processors operate on very thin margins, so they can't really afford to check thoroughly.

I'll give you a second example which is local to me, my corner bakery which uses Square to process its payment, say it will not process any CC for any than less than $15, they would only except cash, they also state if you pay cash for order over $15 they will give you a 5% discount. Also if the language did exist it would be an anti-trust case that any State AG would take up in a second.

My example was not about a retail chain, but I have seen in the past where a retail change would offer incentive to people not to use a CC, it was cash and carry. My example was for businesses that offer some sort of service not a product they buy and resell. Many time if you pay cash they be happy to give you a discount, why they do not have to wait 60 to 90 days to get their money from the CC companies.

Businesses are free to transact as they like and incentivize various payment methods as they see fit.

For people like me who track their financial all in one place like Quicken, the Apple Card lack this very important integration. Beyond this the Apple card has no real advantage other than it being Apple. My chase app show me all the details apple shows, plus more like credit monitoring and credit score. they have paperless statements and rewards points plus they seamless integrate with financial software. Plus quicken mobile give me a complete overview of all my income and expense activities in one place the Apple card sits outside of this other seeing the full payment in quicken when it shows up.