Apple Card statements can now be exported as OFX files

Starting February 11, Apple Card cardholders are now able to export their Apple Card transactions into the OFX file format and import their data into third-party financial management apps.

In January 2020, Apple gave Apple Card cardholders the ability to export their monthly transactions to CSV -- comma separated value -- formats. Now, they've added the ability to export files to OFX -- open financial exchange -- formats as well.

Less widely supported than CSV, OFX files are a highly-standardized format and are often used to record transactions vendors, customers, and financial systems.

For those who use the Apple Card for business purposes, they may prefer to export their data in OFX. Programs such as Quicken, Numbers, and Mint can read OFX data.

One of the biggest complaints that users of the Apple Card have had is that there's no way to import their transaction history into third-party money management apps, such as Mint. There's a reason for this-- Apple's privacy policy. Apple is not too keen on third-party companies having access to customers' private financial data.

While cardholders still won't be able to give third-party apps direct access to their Apple Card transactions, they can manually export their transactions from the wallet app. Once exported, they can take that data wherever they'd like.

In January 2020, Apple gave Apple Card cardholders the ability to export their monthly transactions to CSV -- comma separated value -- formats. Now, they've added the ability to export files to OFX -- open financial exchange -- formats as well.

Less widely supported than CSV, OFX files are a highly-standardized format and are often used to record transactions vendors, customers, and financial systems.

For those who use the Apple Card for business purposes, they may prefer to export their data in OFX. Programs such as Quicken, Numbers, and Mint can read OFX data.

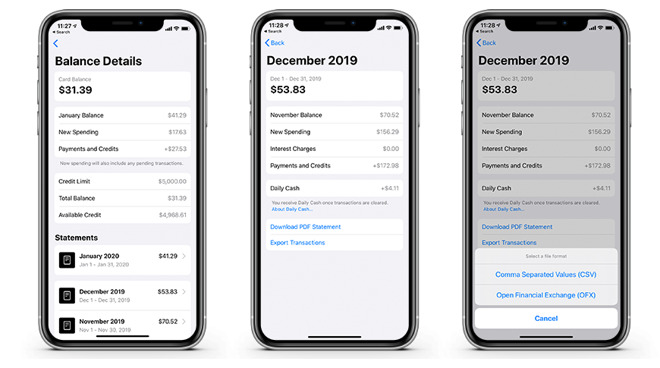

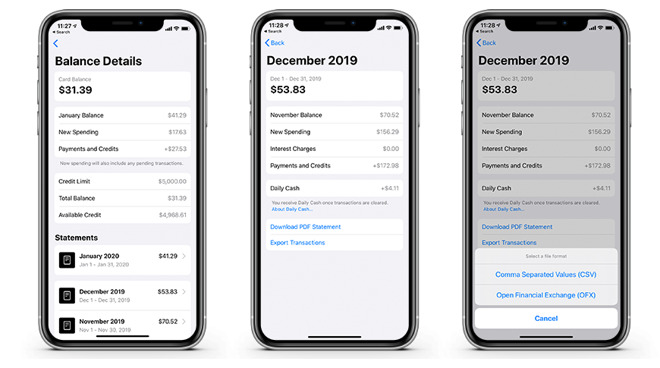

- To export your Apple Card transaction data:

- Open the Wallet app.

- Tap Card Balance.

- Tap your desired monthly statement.

- Tap Export Transactions

- Select the format you'd like to export to.

One of the biggest complaints that users of the Apple Card have had is that there's no way to import their transaction history into third-party money management apps, such as Mint. There's a reason for this-- Apple's privacy policy. Apple is not too keen on third-party companies having access to customers' private financial data.

While cardholders still won't be able to give third-party apps direct access to their Apple Card transactions, they can manually export their transactions from the wallet app. Once exported, they can take that data wherever they'd like.

Comments

It's a freaking credit card, people! If you don't like how it works then don't use it.

1) One can petition Quicken or Mint to support CSV.

2) One can petition Quicken or Mint to support MS's OFX file. I'm sure all the data is there.

3) One can see about converting CSV to OFX or saving MS's OFX to an OFX file that Quicken and Mint can understand.

4) One can wait for GS to alter their OFX.

Despite the silly sky is falling attitude people had at the launch they are clearly making this happen. It seems odd that they wouldn't have an ODF file that was tested with Quicken or Mint, but it's more odd for me to assume that they've decided that they're going to keep it as-is without support for those popular apps.

I have several cards that give varying rebates, so the actual net financial benefit of the Apple Card is not that great. I use financial software to keep track of finances, credit cards, payments, etc and having everything in one place is a huge benefit in terms of convenience, so the the increased hassle and inconvenience of having a single card that is not compatible with my software is a significant cost to me that outweighs any benefits of the Apple Card. Is the sky falling? No because whether or not I have an Apple Card is not that big of a deal. People are complaining about the people making an issue over Quicken compatibility, but honestly I think the bigger issue is that getting an Apple Card is that big of a deal. C'mon, people - it's a credit card!

It seemed like every “solution” was backed by a different bank. There were all these separate and utterly incompatible banking services and software systems, and they didn’t last long. People would end up eventually being forced to abandon their existing data (locked in proprietary file formats) when the product or service went belly-up, proving how short-lived this business model really was.

I’m so glad we’re now in the future and everything is ALLLL better. /s

I’ve been reading Arthur C. Clarke’s “2001” series of books and thinking about just how many future society predictions and idealist notions in various sci-fi stories never came... and are nowhere to be seen *coming*.

My dad is amazed at how dramatically different the world is compared to his childhood. My perspective is very different: All I’ve seen is the endless churn of claims and unfulfilled promises of reliability and convenience.

By my late 20s, I realized that the future was just going to keep repeating the past, albeit displayed via smaller pixels, on slightly faster computers with smaller components, marketed to us with bullet points showing marginally larger numbers. Hell, the dramatically smaller pixels didn’t even come about until... 2010?? (Ironically, the movie version regressed the screen technology seen on the space ship Discovery: it went from sharp text and graphics on flat screen displays in 1968’s “2001” to low resolution blurry CRTs in 1984’s “2010”).

Every time I hear or read about people using Quicken, Quickbooks, various other banking systems, data export formats, and whatnot, I find myself glad that I don’t have much to track (I’m poor as dirt, once I’ve paid the four to six monthly bills) and especially glad I never attempted to run any kind of business. I don’t have credit cards, a spouse, a family...

The actual future is still remarkably primitive compared to the future we were promised.

I learned long ago that every time a new technology comes along, the promises that accompany it are nothing but pipe dreams and the reality will be different from whatever is promised.

Last I checked there were 3 financial software programs for Mac - Quicken, Banktivity and Moneydance. They all have their plusses and minuses but they're all viable programs. Both Banktivity and Moneydance support OFX import.

And what about things that weren't, er, promised to you in Clark's "2001", but are here despite this, like advanced medical imaging systems?

Myself, I view science fiction as narrative prose, inspired by technological imagination, rather than a concrete set of promises on a defined set of dates. Call me crazy...

A converter is available to convert the Monthly PDF file into QFX that will imported into Quicken with no issue.