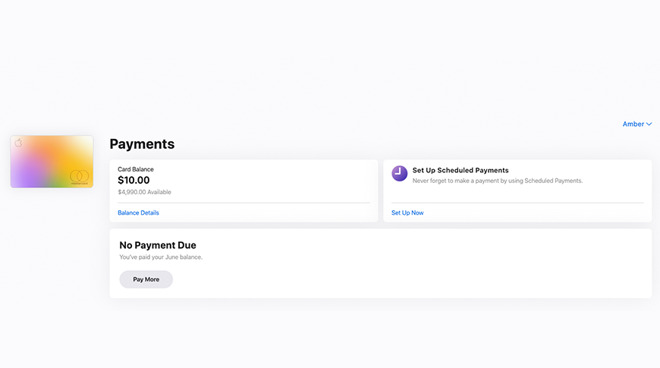

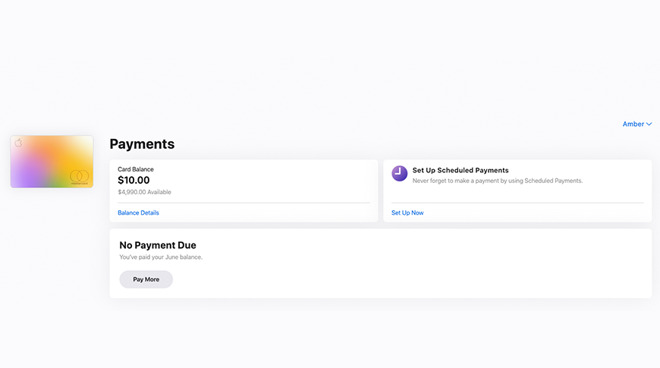

Apple launches online web portal for Apple Card management via browser

Apple on Thursday launched a new online portal for the Apple Card, letting users manage their cards through a browser.

Credit: Apple

Previously, all Apple Card transactions and management tasks were handled on an iPhone through the Wallet app. That include paying bills, viewing statements and seeing other information.

Credit: Apple

Now, there's a web portal available for Apple Card customers to manage their accounts on any web browser. That includes viewing and paying balances, seeing available credit and past statements, and scheduling future payments. That will be a boon to Apple Card users in some situations. For example, before the online web portal, users who lost their devices were required to call Goldman Sachs to pay off their balances.

The Apple Card launched in 2019 in partnership with Goldman Sachs as a mobile-forward credit solution. Since its debut, Apple has expanded the number of retailers to support 3% Daily Cash and has introduced monthly installment plans for various devices across its product lineup.

On May, the company launched a credit coaching program for Apple Card applicants who had been previously denied. And, amid the coronavirus pandemic, Apple has also kept a payment deferment plan running from March through July.

Credit: Apple

Previously, all Apple Card transactions and management tasks were handled on an iPhone through the Wallet app. That include paying bills, viewing statements and seeing other information.

Credit: Apple

Now, there's a web portal available for Apple Card customers to manage their accounts on any web browser. That includes viewing and paying balances, seeing available credit and past statements, and scheduling future payments. That will be a boon to Apple Card users in some situations. For example, before the online web portal, users who lost their devices were required to call Goldman Sachs to pay off their balances.

The Apple Card launched in 2019 in partnership with Goldman Sachs as a mobile-forward credit solution. Since its debut, Apple has expanded the number of retailers to support 3% Daily Cash and has introduced monthly installment plans for various devices across its product lineup.

On May, the company launched a credit coaching program for Apple Card applicants who had been previously denied. And, amid the coronavirus pandemic, Apple has also kept a payment deferment plan running from March through July.

Comments

Are you referring to where you set up a monthly payment via having your bank or credit union paying them? (Bill payer account)

There is a link to schedule a payment on the web portal. However I just click the PAY button and I let it come out of my bank/cu account. Cannot be much easier.

I'm happy that the Apple Card is slowly coming up to par in terms of features, but I can't disagree that they have been slow to come.

It's great that they keep adding to its functionality. The only minor functionality missing -- and that's not a huge deal -- is for one to be able to get actual, physical cards for the other family members.

I hope Apple can maintain this quality in an industry that is otherwise largely in a race-to-the-bottom (don't even get me started on the decline in quality/service of Amex platinum, which used to be -- sorry to be mixing metaphors -- the gold standard).

Here's what the export page says:

If your iPhone has iOS 13.2 or later, you can export or download transactions from a previous month as a .CSV, .OFX, .QFX, or .QBO file.*

Quicken 2019 and newer and QuickBooks 2018 and newer are supported. If you use a third-party financial app or software provider, contact them to see which versions are compatible with these file types.

https://support.apple.com/en-us/HT211236

-- Download the statement and print it

-- Accept each matched transaction & reconcile any mismatches

The problem with CSV is exactly that it’s generic. There is no standard format for CSV files, other than having commas. I don’t know if Quicken can import from CSV files, but if it could you would need to review each import and specify which parameters you were importing each time and which fields they belonged to. It also likely wouldn’t support features like automatic matching of duplicate transactions, etc. Essentially it would be giving you 1995-era functionality. QFX files have more information and are standardized to allow automatic import into financial software. Just like docx has become a de facto standard for documentS, QFX has become the standard for financial data files.

See GeorgeB’s post above. Every other credit card I have ever used allows both direct import from the bank into financial software as well as downloading a QFX file from the web site. After several months the Apple Card finally had QFX file download, but it’s only from the phone so you have to go though the entire convoluted, kludge of a workflow described by GeorgeB.