Antitrust questioning of Cook should focus on App Store fees

Days ahead of Apple CEO Tim Cook's appearance at an antitrust hearing alongside other tech company leaders on July 29, NYU Stern professor of marketing Scott Galloway has offered ideas for questions the House Antitrust Subcommittee could ask, to determine how much power Apple has.

Apple CEO Tim Cook

Cook, along with Alphabet and Google CEO Sundar Pichai, Facebook CEO Mark Zuckerberg, and Amazon CEO Jeff Bezos, will be speaking to the House Antitrust Subcommittee on Wednesday, to try and ease concerns the companies have too much power over their respective markets.

For Apple, the discussions are largely expected to cover its App Store business, as well as the practice of "Sherlocking" third-party apps, along with the management of parental control apps and other pertinent topics.

In a blog post published on Friday, Professor Scott Galloway makes suggestions about how proceedings will go for each of the big four tech giants, as well as pointed questions that each company could potentially face from lawmakers in attendance.

Galloway, a professor of marketing at the New York University Stern School of Business who has a background in economics, has a history of writing and speaking about major brands and how they communicate with customers. As part of his research, he has analyzed the four companies at length, including their economic models, strengths and strategies, and their impact on society.

In terms of how the meeting will fare, Galloway believes the remote nature of the meeting will make it harder for the committee to "go deep on any one issue," and reduces the chance of an "unscripted moment that reveals something the American public didn't previously know."

Most of the heat from the committee will be aimed at Zuckerberg, while Bezos will have a much easier time from lawmakers. Cook and Pichai will attempt to "stay out of the line of fire and fawning for Zuck and Bezos, respectively," according to the professor.

For the kind of questions that could be asked, Galloway suggests the group could be pressured on their earnings and growth, such as questioning whether they would "be concerned that too many of the spoils are being registered by increasingly fewer firms and people?" Referencing how the market cap per employee is thousands of times higher than other companies in respective sectors, such as Apple's $11,749,562 figure per employee, they could be asked "Do you think your companies contribute to income inequality?"

On the timely subject of COVID-19, it is pointed out that major tech companies and firms deemed "too big to fail" have avoided losing substantial levels of value, with the four firms instead benefiting from an increase in value and a transfer in power from most other companies to the group in some way. Galloway proposes asking "Should we be concerned that your considerable advantage pre-Covid is now unassailable?"

The matter of competition is brought up by the claim small business formations is at a multi-decade low, with investors seemingly avoiding providing much funding in the fastest-growing sectors. With this in mind, Galloway asks "Why should someone invest in a search engine right now, or a music streaming business, or a social media platform, or an e-commerce firm, given the sizes of your companies?"

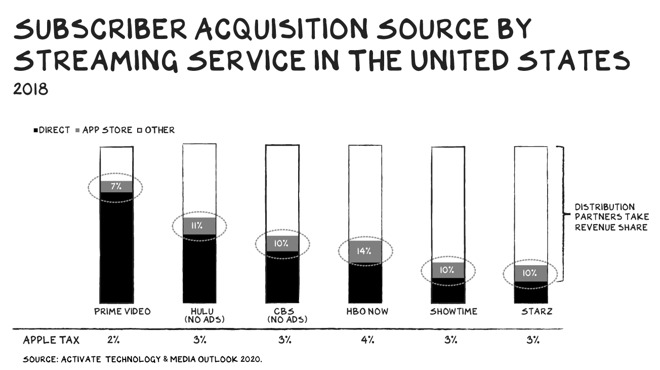

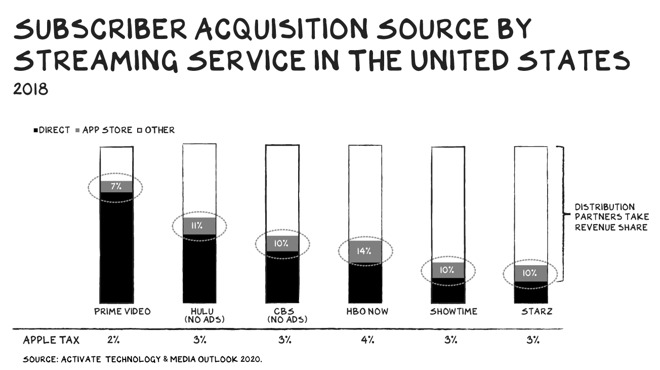

A graph of where video streaming services acquire subscribers in the US (via Prof Scott Galloway)

For Apple-specific questions aimed at Cook, Galloway concentrates on the App Store and the Apple TV and Apple Music streaming services.

Referencing the concept of "monopoly rent," where a monopolistic firm can sell products at a higher price than in a more competitive market, Galloway fixates on the fee Apple applies to App Store purchases, in-app purchases, and subscriptions. Referencing the between 7% and 14% of overall subscribers of video streaming services derived from the App Store, the suggested question to Cook is "Do you think any of these firms believe that paying you this rent is a choice?"

On the subject of the Apple TV+ subscription, Galloway believes Apple has consumers paying $0.80 per billion dollars of content it invests in, a figure similar to Netflix's $0.90 but far away from HBO's $7.50 equivalent. It is reckoned that Apple's offer of a year of free access to buyers of its hardware enables such a low relative cost to the consumer for the content itself.

Suggesting the deal lets Apple offer a media product at below its cost of production, Galloway suggests "Isn't Apple guilty of 'dumping,' that is, buying market share with unfeasibly low prices?"

The professor's focus on Apple Music is centered around its ongoing spat with Spotify, which has made antitrust complaints about Apple before relating to its fee. After claiming Spotify is "consistently rated as a superior music service" and pointing out Apple's faster growth rate in the United States, Galloway proposes asking Cook "isn't this a function of you owning the rail, and being able to levy a 30% tax on a competitor while illegally reducing their discoverability in the App Store?"

While the questions asked by Galloway may not necessarily be asked by the committee in such a direct fashion, it is highly probable that the subjects will be brought up during the event. Lawmakers on the committee will then work on a report that could propose new antitrust regulations that could impact the tech giants and their respective products and services, in a bid to even out the playing field.

Apple CEO Tim Cook

Cook, along with Alphabet and Google CEO Sundar Pichai, Facebook CEO Mark Zuckerberg, and Amazon CEO Jeff Bezos, will be speaking to the House Antitrust Subcommittee on Wednesday, to try and ease concerns the companies have too much power over their respective markets.

For Apple, the discussions are largely expected to cover its App Store business, as well as the practice of "Sherlocking" third-party apps, along with the management of parental control apps and other pertinent topics.

In a blog post published on Friday, Professor Scott Galloway makes suggestions about how proceedings will go for each of the big four tech giants, as well as pointed questions that each company could potentially face from lawmakers in attendance.

Galloway, a professor of marketing at the New York University Stern School of Business who has a background in economics, has a history of writing and speaking about major brands and how they communicate with customers. As part of his research, he has analyzed the four companies at length, including their economic models, strengths and strategies, and their impact on society.

In terms of how the meeting will fare, Galloway believes the remote nature of the meeting will make it harder for the committee to "go deep on any one issue," and reduces the chance of an "unscripted moment that reveals something the American public didn't previously know."

Most of the heat from the committee will be aimed at Zuckerberg, while Bezos will have a much easier time from lawmakers. Cook and Pichai will attempt to "stay out of the line of fire and fawning for Zuck and Bezos, respectively," according to the professor.

For the kind of questions that could be asked, Galloway suggests the group could be pressured on their earnings and growth, such as questioning whether they would "be concerned that too many of the spoils are being registered by increasingly fewer firms and people?" Referencing how the market cap per employee is thousands of times higher than other companies in respective sectors, such as Apple's $11,749,562 figure per employee, they could be asked "Do you think your companies contribute to income inequality?"

On the timely subject of COVID-19, it is pointed out that major tech companies and firms deemed "too big to fail" have avoided losing substantial levels of value, with the four firms instead benefiting from an increase in value and a transfer in power from most other companies to the group in some way. Galloway proposes asking "Should we be concerned that your considerable advantage pre-Covid is now unassailable?"

The matter of competition is brought up by the claim small business formations is at a multi-decade low, with investors seemingly avoiding providing much funding in the fastest-growing sectors. With this in mind, Galloway asks "Why should someone invest in a search engine right now, or a music streaming business, or a social media platform, or an e-commerce firm, given the sizes of your companies?"

A graph of where video streaming services acquire subscribers in the US (via Prof Scott Galloway)

For Apple-specific questions aimed at Cook, Galloway concentrates on the App Store and the Apple TV and Apple Music streaming services.

Referencing the concept of "monopoly rent," where a monopolistic firm can sell products at a higher price than in a more competitive market, Galloway fixates on the fee Apple applies to App Store purchases, in-app purchases, and subscriptions. Referencing the between 7% and 14% of overall subscribers of video streaming services derived from the App Store, the suggested question to Cook is "Do you think any of these firms believe that paying you this rent is a choice?"

On the subject of the Apple TV+ subscription, Galloway believes Apple has consumers paying $0.80 per billion dollars of content it invests in, a figure similar to Netflix's $0.90 but far away from HBO's $7.50 equivalent. It is reckoned that Apple's offer of a year of free access to buyers of its hardware enables such a low relative cost to the consumer for the content itself.

Suggesting the deal lets Apple offer a media product at below its cost of production, Galloway suggests "Isn't Apple guilty of 'dumping,' that is, buying market share with unfeasibly low prices?"

The professor's focus on Apple Music is centered around its ongoing spat with Spotify, which has made antitrust complaints about Apple before relating to its fee. After claiming Spotify is "consistently rated as a superior music service" and pointing out Apple's faster growth rate in the United States, Galloway proposes asking Cook "isn't this a function of you owning the rail, and being able to levy a 30% tax on a competitor while illegally reducing their discoverability in the App Store?"

While the questions asked by Galloway may not necessarily be asked by the committee in such a direct fashion, it is highly probable that the subjects will be brought up during the event. Lawmakers on the committee will then work on a report that could propose new antitrust regulations that could impact the tech giants and their respective products and services, in a bid to even out the playing field.

Comments

Spotify is a classic case of winning the marketshare, but barely generating any profits, then complaining about the fees that they have to pay to Apple to gain customers, when in actuality, Apple takes revenue from less than 1% of Spotify's customers.

"In a rare public response, Apple fired back by suggesting that Spotify wanted to “have its cake and eat it too” by taking advantage of the benefits of the App Store without actually expecting to give anything back. Apple later shared that it takes a revenue share from less than 1 percent of Spotify subscribers, since the majority of its customers use the free, ad-supported version, and those that do subscribe are far more likely to do so outside of the App Store, where Apple doesn’t receive any cut at all."

https://www.idropnews.com/news/spotify-says-apple-still-has-a-long-way-to-go-before-its-an-open-and-fair-platform/135260/

Maybe Spotify should spend more time and money on customer acquisition, and less on flinging poo at competitors.

He also thinks a good question to ask Tim Cook is if Tim Cook thinks other companies think it’s fair they have to pay “rent” to Apple to have their app in the App Store. I bet TC’s answer is “yes”. Just like Apple thinks it’s fair to pay rent to malls where they build an Apple Store. I’m going out on a limb here but my feeling is that Apple would not build a store in a location where they didn’t think the rent was fair. Not to mention it’s odd, to me anyway, to pose a question to TC asking him to speculate on how other people feel about a particular subject.

Later he poses a question to Bezos about his personal wealth. Galloway makes the comparison to Rockefeller and Gates, among a few others, who were the richest people in the world and their company was later tried for monopoly abuse. I mean, OK, I guess. But there are others who have been the richest in the world where their company WASN’T tried for monopoly abuse. Again, I’m not really following Galloway here.

It seems that Galloway’s proposed strategy is to shock people with charts that don’t really tell the whole story, show the “awkward reaction” of the person being questioned and quickly move on to the next misleading chart.

It appears to me that the sole focus here is that these companies market caps are “too big” so they must be broken up. Again, I’m not clear on why using market cap is the deciding factor. To do this the right way I think this committee needs to prove that any of these companies has a monopoly and then prove they are abusing that monopoly power.

Also interesting to me, Microsoft is mentioned only one time in Galloway’s article. As of right now, Microsoft’s market cap is second only to Apple’s. They are above Amazon, Google and Facebook. I’m curious to know why the other 4 companies are being questioned when MS isn’t.