One share to 224: How Apple stock has grown in terms of gas, milk, and Macs

Apple stock is about to split for the fifth time in its 40-year availability. Here's what you could've bought if you sold your shares each time Apple split its stock since it first went public in 1980.

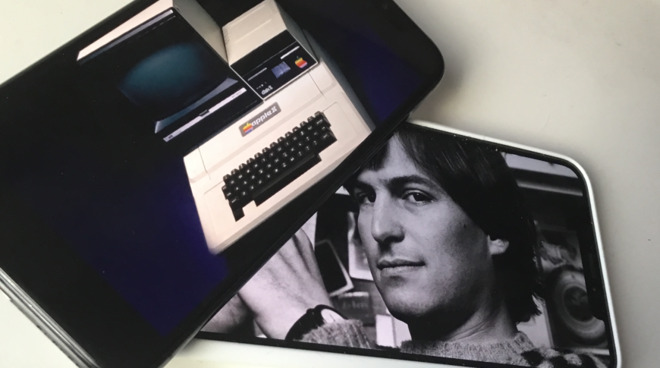

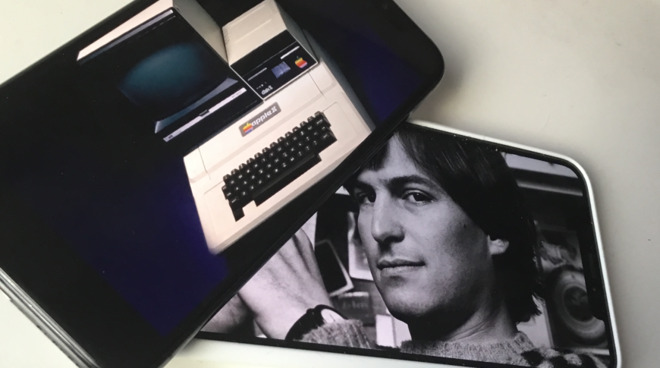

Steve Jobs and an Apple II on 2018/19 iPhones

If you had bought one share of Apple stock when it first went public on December 12, 1980, you got it before Apple wanted you to. While the company was unquestionably on its way to going public, Apple's first-ever CEO Mike Scott says the company was forced into it early -- by Steve Wozniak.

"There are some magic numbers in a company's history," he told Apple Confidential 2.0 author Owen Linzmayer, "and one of them is 500 shareholders. Once you have that many shareholders, you must file all sorts of paperwork with the SEC."

Apple co-founder Steve Wozniak has been giving away so much of his own stock in the company to friends and family, that the firm was close to reaching that number. Scott decided to take the company public sooner than he might have wanted, and did so on that day in December 1980.

According to Linzmayer, going public made 40 millionaires at Apple. According to Walter Isaacson's Steve Jobs biography, it made 300 people that rich.

Whichever is the correct number, Woz did fine. The number of shares he still had left at the time became worth an estimated $116 million.

That seems like a bargain and it was, but 1980 was a long time ago. For comparison, a gallon of gas sold at that time for $1.25, while a gallon of milk was $2.16. You could pick up a dozen eggs for $0.91 and write home about it with a first-class stamp that cost $0.15.

Apple in 1980 meant the Apple II

Alternatively, you could've bought Apple's latest release, the Apple III, for a starting price of $4,340. You shouldn't have, you should really have held on to the Apple II Plus.

Your $22 investment would now be worth a total of $83, or $41.50 per share. Milk hadn't risen quite so much, coming in around $2.20 per gallon. And gas had actually fallen: the average price per gallon then was down to $0.96.

This is the beloved Mac SE/30, but the original SE was the new release of 1987

Which may have helped you a little bit if you were saving up for one of the major Apple releases of the year, the Macintosh II and the Macintosh SE. The former was the first-ever color Mac, and it started at $3,898. The SE, for comparison, started at just $2,898.

Each one of the four shares you had was now worth $101.25. That means for your original $22 investment, by 2000 you owned $405 worth.

This time you might well have been tempted to cash that in because Apple released one of its most gorgeous Macs that year, the Power Macintosh G4 Cube. That retailed, initially, at $1,799, which now seems a bargain compared to previous Macs, but at the time was seen as an expensive luxury computer.

The Power Mac G4 Cube

At the time, gasoline had an average cost of $1.56 per gallon. Eggs were typically once more at their 1987 price of $0.91.

Each of those eight shares was valued at $44.86, though, which is quite a bit lower than at the time of previous split. So if you decided Apple was doomed and you should cash in quick, your initial $22 investment would now get you $358.88.

If the stock value was lower than before, so were Mac prices. Specifically, this was the year that Apple launched the Mac mini, starting at $499.

The first Mac mini from 2005

So all you needed was your share value plus another $140.12 and you had a Mac. Or alternatively you could just take the share price and you could fill up your car with 153 gallons of gas at $2.34 per gallon.

This time, Apple eschewed its old 2-for-1 stock split habit and instead went for a 7-for-1 version. After this split on June 9, 2014, each share was valued at $93.70.

Since you stubbornly held on to that original $22 single share, you now actually owned 56 shares. And that made your investment worth $5,247.20.

Apple's iPhone 6

Which means if you were feeling generous, you could have sold the stock, and bought yourself and seven friends a brand-new 16GB iPhone 6.

As of August 26, 2020, the price of a single share of Apple stock is $503.50. After the four-way split on August 31, 2020, each single share becomes worth $125.88. However, that latest split really means that one single original share from 1980 is now 224 shares. So your $22 investment back then has earned you $28,197.12.

As of July 2020, the average cost of a gallon of milk was $3.45. The average cost of a gallon of regular gas in the US is currently $2.191, and fuel consumption is typically 24.9 miles per gallon.

So if you held on to that single $22 share in Apple in 1980, you could now buy 12,869.5 gallons of gas. If you had a big enough gas tank, and sufficient life support technology, you could drive 1.3 times the average distance between the Earth and the moon.

And, that $28,197 could get you a really nice Mac Pro, or five of the base model.

Keep up with AppleInsider by downloading the AppleInsider app for iOS, and follow us on YouTube, Twitter @appleinsider and Facebook for live, late-breaking coverage. You can also check out our official Instagram account for exclusive photos.

Steve Jobs and an Apple II on 2018/19 iPhones

If you had bought one share of Apple stock when it first went public on December 12, 1980, you got it before Apple wanted you to. While the company was unquestionably on its way to going public, Apple's first-ever CEO Mike Scott says the company was forced into it early -- by Steve Wozniak.

"There are some magic numbers in a company's history," he told Apple Confidential 2.0 author Owen Linzmayer, "and one of them is 500 shareholders. Once you have that many shareholders, you must file all sorts of paperwork with the SEC."

Apple co-founder Steve Wozniak has been giving away so much of his own stock in the company to friends and family, that the firm was close to reaching that number. Scott decided to take the company public sooner than he might have wanted, and did so on that day in December 1980.

According to Linzmayer, going public made 40 millionaires at Apple. According to Walter Isaacson's Steve Jobs biography, it made 300 people that rich.

Whichever is the correct number, Woz did fine. The number of shares he still had left at the time became worth an estimated $116 million.

Apple's initial public offering: December 1980

Apple was valued at $1.79 billion, and initially shares were sold that day for $22 apiece. Before the close of business, though, they were already trading at $29 per share.That seems like a bargain and it was, but 1980 was a long time ago. For comparison, a gallon of gas sold at that time for $1.25, while a gallon of milk was $2.16. You could pick up a dozen eggs for $0.91 and write home about it with a first-class stamp that cost $0.15.

Apple in 1980 meant the Apple II

Alternatively, you could've bought Apple's latest release, the Apple III, for a starting price of $4,340. You shouldn't have, you should really have held on to the Apple II Plus.

Apple's first stock split in June 1987

If you did buy one share instead, and kept it, then 6 years and 6 months later, you would've had two. Apple split its stock on June 16, 1987.Your $22 investment would now be worth a total of $83, or $41.50 per share. Milk hadn't risen quite so much, coming in around $2.20 per gallon. And gas had actually fallen: the average price per gallon then was down to $0.96.

This is the beloved Mac SE/30, but the original SE was the new release of 1987

Which may have helped you a little bit if you were saving up for one of the major Apple releases of the year, the Macintosh II and the Macintosh SE. The former was the first-ever color Mac, and it started at $3,898. The SE, for comparison, started at just $2,898.

Another 2:1 Apple stock split in 2000

Apple again split the stock in a 2-for-1 arrangement 13 years later on June 21, 2000. So if you had bought that one single share originally, it had become two in 1987 and was now four.Each one of the four shares you had was now worth $101.25. That means for your original $22 investment, by 2000 you owned $405 worth.

This time you might well have been tempted to cash that in because Apple released one of its most gorgeous Macs that year, the Power Macintosh G4 Cube. That retailed, initially, at $1,799, which now seems a bargain compared to previous Macs, but at the time was seen as an expensive luxury computer.

The Power Mac G4 Cube

At the time, gasoline had an average cost of $1.56 per gallon. Eggs were typically once more at their 1987 price of $0.91.

And, 2:1 again, in 2005

Five years on, Apple was doing the 2-for-1 split for a third time. So one original share in 1987 was now eight.Each of those eight shares was valued at $44.86, though, which is quite a bit lower than at the time of previous split. So if you decided Apple was doomed and you should cash in quick, your initial $22 investment would now get you $358.88.

If the stock value was lower than before, so were Mac prices. Specifically, this was the year that Apple launched the Mac mini, starting at $499.

The first Mac mini from 2005

So all you needed was your share value plus another $140.12 and you had a Mac. Or alternatively you could just take the share price and you could fill up your car with 153 gallons of gas at $2.34 per gallon.

The big Apple split -- 7 to 1 in 2014

A lot happened between 2005 and 2014, and most of it was down to the iPhone. Apple's most successful product ever -- actually the world's most successful product ever -- had launched.This time, Apple eschewed its old 2-for-1 stock split habit and instead went for a 7-for-1 version. After this split on June 9, 2014, each share was valued at $93.70.

Since you stubbornly held on to that original $22 single share, you now actually owned 56 shares. And that made your investment worth $5,247.20.

Apple's iPhone 6

Which means if you were feeling generous, you could have sold the stock, and bought yourself and seven friends a brand-new 16GB iPhone 6.

August 31, 2020 -- the next big Apple stock split

The latest Apple stock split, announced in July 2020, is to be 4-for-1.As of August 26, 2020, the price of a single share of Apple stock is $503.50. After the four-way split on August 31, 2020, each single share becomes worth $125.88. However, that latest split really means that one single original share from 1980 is now 224 shares. So your $22 investment back then has earned you $28,197.12.

As of July 2020, the average cost of a gallon of milk was $3.45. The average cost of a gallon of regular gas in the US is currently $2.191, and fuel consumption is typically 24.9 miles per gallon.

So if you held on to that single $22 share in Apple in 1980, you could now buy 12,869.5 gallons of gas. If you had a big enough gas tank, and sufficient life support technology, you could drive 1.3 times the average distance between the Earth and the moon.

And, that $28,197 could get you a really nice Mac Pro, or five of the base model.

Keep up with AppleInsider by downloading the AppleInsider app for iOS, and follow us on YouTube, Twitter @appleinsider and Facebook for live, late-breaking coverage. You can also check out our official Instagram account for exclusive photos.

Comments

I bought my first computer on credit (a Mac) in 1984 for over $3 K, including dot matrix printer. It had two programs (MacWrite and MacPaint), 512K of RAM, and required "disc swapping" to save files. Per your "analysis", I should have put it in AAPL instead - notwithstanding that 1984 Mac literally changed my family's lives to the positive, and I consider it my best investment ever.

Without that Mac, my wife would never have gotten into computer sales, would never have ended up working for several years at Apple, and would probably never have bought ANY AAPL. And that's just one person out of my family.

PS: I still own that 1984 Mac, and a ton of software for it. Wonder what that's worth today....