Israel's Isracard to gain Apple Pay after protracted negotiations

Isracard has become the first Israeli financial company to announce support for Apple Pay, following eight months of disagreements over Apple's commission.

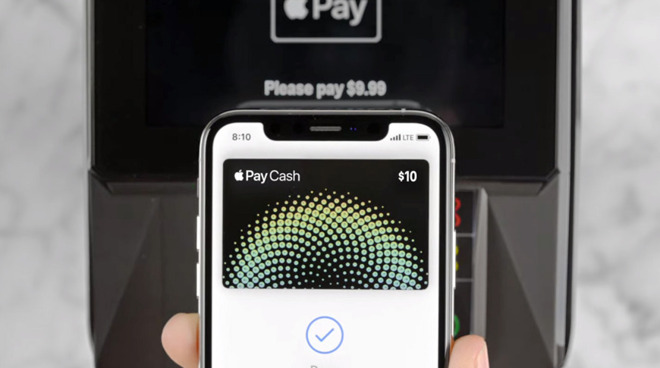

Apple Pay

Six years after it was first launched, and following recent months of negotiations, Apple Pay is now about to be supported in Israel.

The Isracard Group, a financial organization that includes Mastercard, and American Express Israel, has revealed that it is to support Apple Pay. Neither Isracard nor Apple have publicly announced the the support, but the financial company has officially told the Israeli stock exchange.

According to local news publication Ynet, that its customers "who own an iPhone that holds debit cards that support this will soon be able to pay through the device." No specific launch date has been revealed, but Isracard says that it has agreed to support Apple Pay for the next four years.

Apple Pay via an iPhone or Apple Watch is a contactless payment system, but Israel has only this month begun to use this NFC system. It's therefore not been possible for any Israeli company to support Apple Pay until now.

However, Apple began talks with banks and credit card companies in the region in February, in advance of the move to NFC. At the time it was claimed that Israeli firms were balking at Apple's typical commission, however.

Reportedly, Apple usually takes a commission of between 0.15% and 0.25% of each transaction. This represents between one quarter and one third of what Israeli credit card companies earn from transactions.

It's not been disclosed whether Isracard has accepted that rate, or negotiated a better one. Apple has previously halved its rate to get Apple Pay adopted in China.

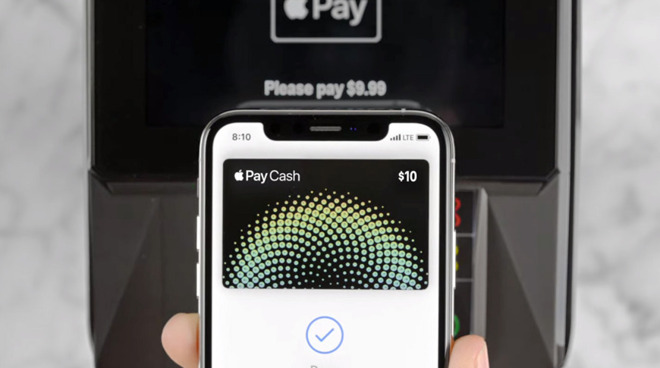

Apple Pay

Six years after it was first launched, and following recent months of negotiations, Apple Pay is now about to be supported in Israel.

The Isracard Group, a financial organization that includes Mastercard, and American Express Israel, has revealed that it is to support Apple Pay. Neither Isracard nor Apple have publicly announced the the support, but the financial company has officially told the Israeli stock exchange.

According to local news publication Ynet, that its customers "who own an iPhone that holds debit cards that support this will soon be able to pay through the device." No specific launch date has been revealed, but Isracard says that it has agreed to support Apple Pay for the next four years.

Apple Pay via an iPhone or Apple Watch is a contactless payment system, but Israel has only this month begun to use this NFC system. It's therefore not been possible for any Israeli company to support Apple Pay until now.

However, Apple began talks with banks and credit card companies in the region in February, in advance of the move to NFC. At the time it was claimed that Israeli firms were balking at Apple's typical commission, however.

Reportedly, Apple usually takes a commission of between 0.15% and 0.25% of each transaction. This represents between one quarter and one third of what Israeli credit card companies earn from transactions.

It's not been disclosed whether Isracard has accepted that rate, or negotiated a better one. Apple has previously halved its rate to get Apple Pay adopted in China.

Comments

I’ve seen these numbers before. How do they support the 1% cash back under such a system?

Apple doesn't support the cash back. Goldman Sachs owns the credit card business. The only thing Apple may subsidize is the extra 1% for Apple Store and promotional transactions that have 3% cash back.