Examining Apple's record-breaking $89.6B quarter by the numbers

Apple's Q2 2021 results were record-breaking for the company, beating Wall Street predictions on the back of strong growth in iPhone, iPad, and Mac.

Apple had a record-breaking Q2; AppleInsider breaks down the highlights

On Wednesday, Apple held its quarterly release and analyst conference call to discuss its second-quarter results. Usually, the second quarter shows a slowdown in demand for iPhone and other products outside of the holidays, but not this time.

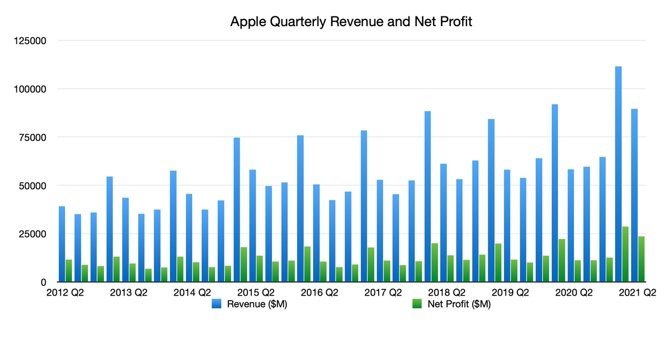

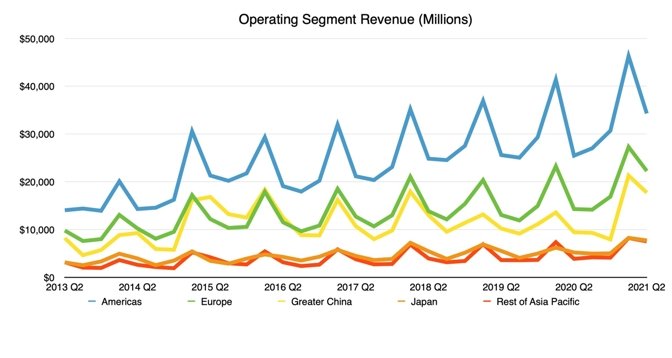

Apple Quarterly Revenue and Net Profit

Net profit rose a staggering 110% to hit $23.6 billion.

Ahead of the results' release, the Wall Street consensus had predicted Apple would report revenue of $77.4 billion, with earnings per share of $0.99. Apple's actual numbers came in at 16% higher.

While the initial effects of the pandemic rocked Q2 2020, Q2 2021 follows a full year of Apple working to mitigate its impact.

Quarterly earnings per diluted share were $1.40. That's technically down from $2.55 in the quarter one year ago, but that's primarily because of Apple's 4-for-1 stock split in August 2020.

"This quarter for Apple wouldn't have been possible without the tireless and innovative work of every Apple team member worldwide," said Apple CEO Tim Cook. "We're gratified by the enthusiastic customer response to the unmatched line of cutting-edge products that we delivered across a historic holiday season. We are also focused on how we can help the communities we're a part of build back strongly and equitably, through efforts like our Racial Equity and Justice Initiative as well as our multi-year commitment to invest $350 billion throughout the United States."

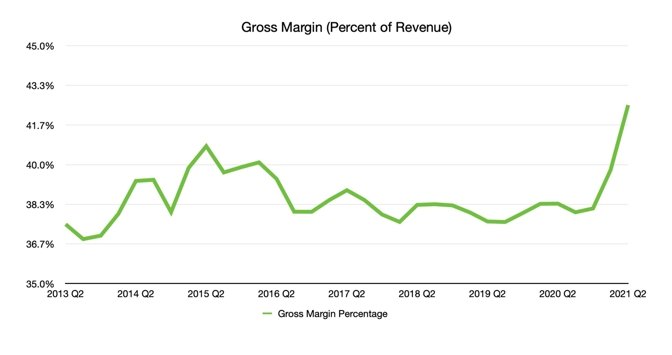

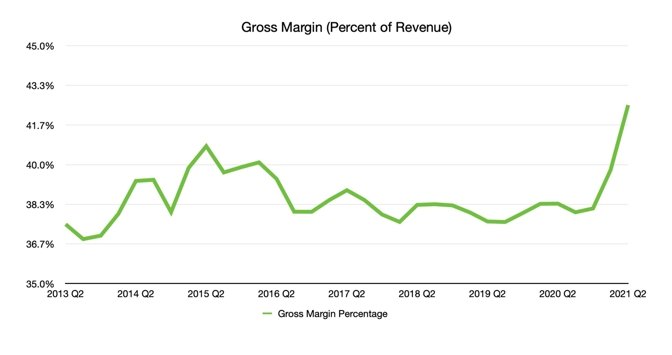

Gross Margin

The gross margin is the highest it's been in nine years, and Apple's CFO Luca Maestri believes the June quarter will show similar results.

"So from March, we were up 270 basis points sequentially really driven by three major factors," said Maestri. "Cost savings which has been good for us during this cycle, a really strong mix on iPhone but in general across all product categories ... and foreign exchange sequentially again from December to March was favorable 90 basis points so that helped as well."

Operating expenses for the period were $10.6 billion, above the $9.5 billion from Q2 2020.

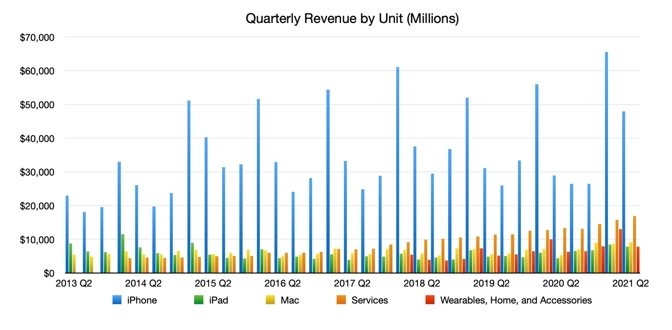

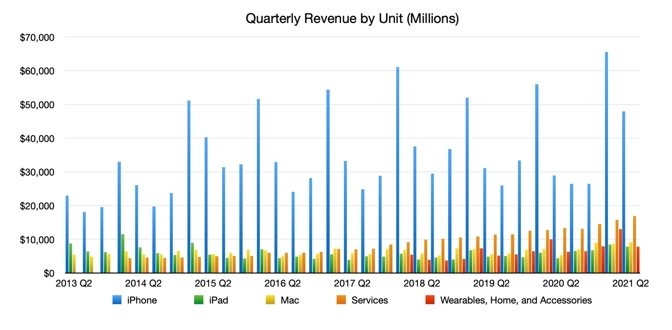

Quarterly Revenue by Unit

Regular observers of Apple's financial results will be familiar with how the iPhone dominates Apple's product revenue, and Q2 2021 is no exception. Looking at all of Apple's product categories reveals a significant difference in how much the iPhone pulls in over the rest.

However, Apple Services, iPad, Mac, and wearables also saw notable growth year-over-year.

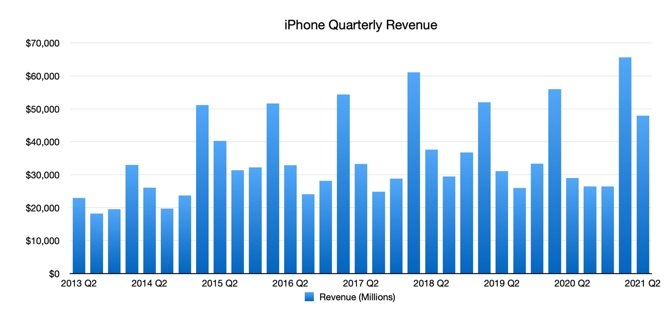

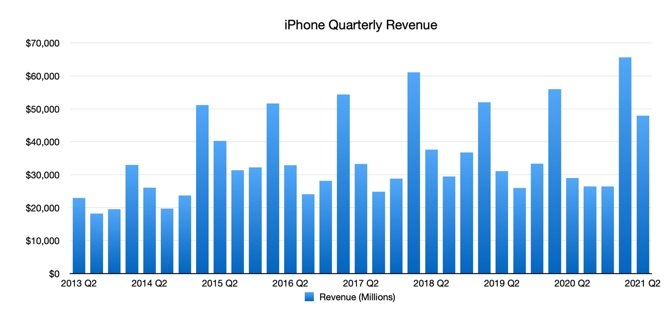

iPhone Quarterly Revenue

The record-setting Q1 revenue of $111.4 billion was aided by considerable growth in iPhone sales due to the release of the iPhone 12 range. Q2 benefits from Q1's lead, with iPhone revenues hitting $47.9 billion, up from the $28.96 billion from Q2 2020.

Cook noted that the iPhone 12 was the best-selling unit in Apple's lineup, but the iPhone 12 Pro and iPhone 12 Pro Max also saw strong sales. There was no mention of the iPhone 12 mini, which multiple analysts have described as disappointing.

The 5G upgrade cycle is also "important," according to Cook, but that "we are in the early days of it." He pointed out that the China and U.S. markets have been the quickest to adopt 5G with network build-outs.

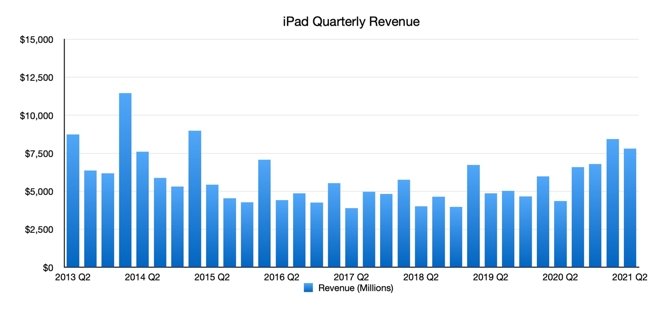

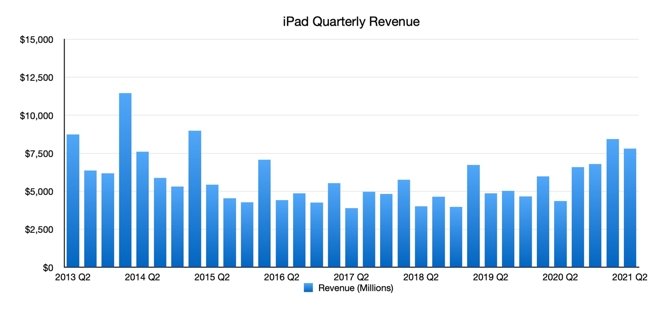

iPad Quarterly Revenue

Apple raked in $7.8 billion from iPad sales. That's a 78.7% year-over-year increase, up from $4.4 billion one year ago.

CFO Luca Maestri said the iPad grew in every geographic segment with sales records in Japan. Customer satisfaction of iPad is 94%, with half of all new purchases belonging to new users.

For both the iPad and Mac, Cook said work-from-home and remote learning are helping to drive new sales.

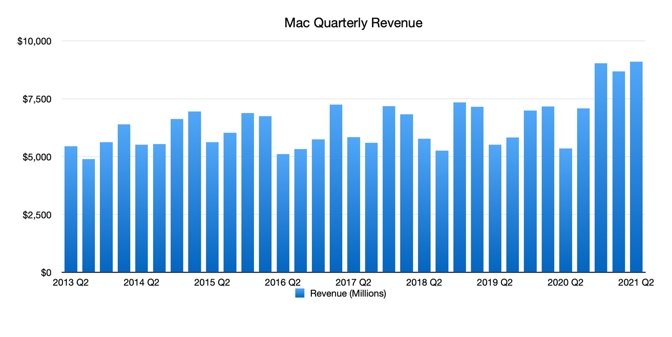

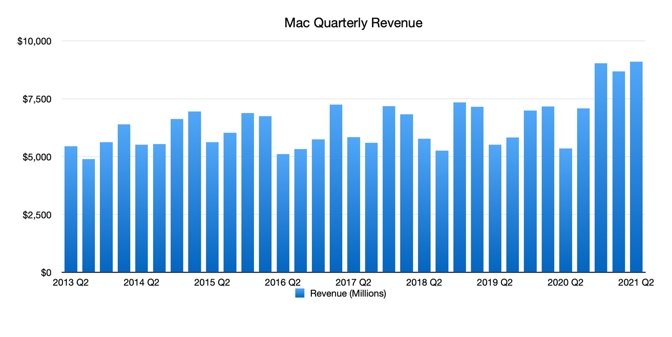

Mac Quarterly Revenue

Mac revenue hit $9.1 billion, up from $5.4 billion in Q2 2020. That makes for a 70.1% year-over-year increase.

Cook said the last three quarters for Mac had been its best quarters ever.

Q2 was the first full quarter with the first M1 Macs. These included Apple Silicon versions of the 13-inch MacBook Pro, MacBook Air, and Mac mini.

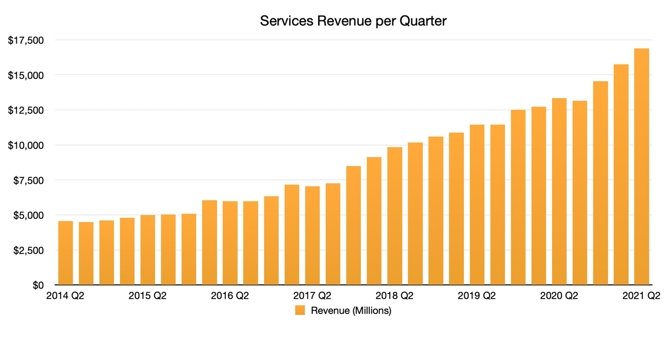

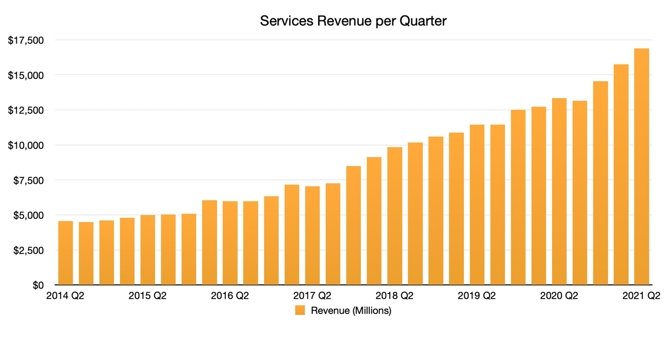

Services Quarterly Revenue

That figure marked a 26.6% increase over one year ago when it brought in $13.4 billion.

"Our services business did better than what we were expecting when we had the last call in January," said CFO Luca Maestri. "It was stronger across the board."

Unlike the other physical product-led categories, the Services arm is more likely to be a stable financial source for Apple. This stability is because Apple relies on devices in use for App Store purchases and subscriptions, rather than hardware sales.

While other categories may wane in the future, Services will likely keep chugging along for a long time without too much change, short of an unexpected event or significant adversity for the company.

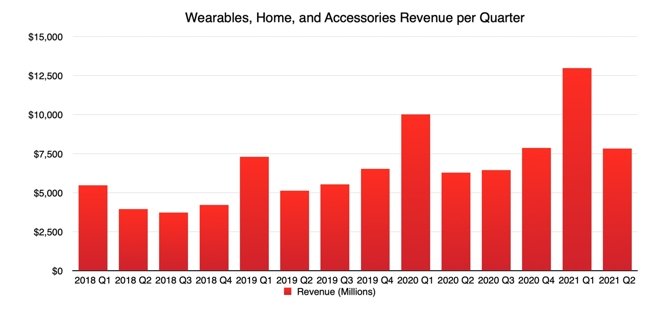

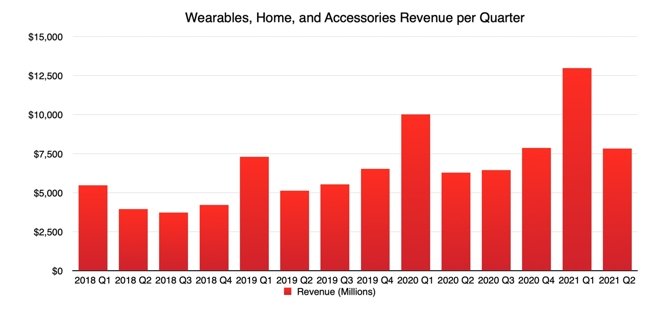

Wearables, Home, and Accessories Quarterly Revenue

The category rose to $7.8 billion in quarterly revenue. That's up from $6.3 billion this time last year, making for a 24.7% improvement. That growth is slowing, however, since Apple reported a 30% growth in the segment during the holiday quarter.

This sector includes not only Apple Watch and HomePod but also Apple TV and the ever-popular AirPods.

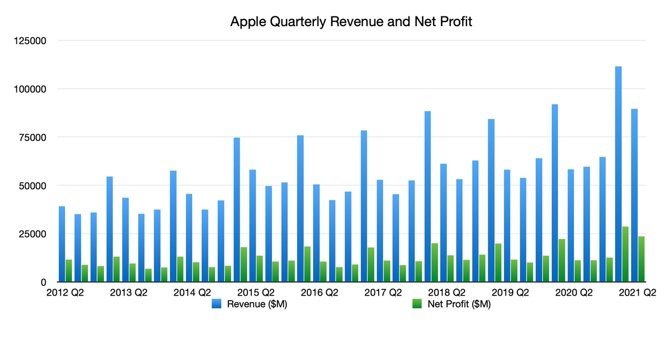

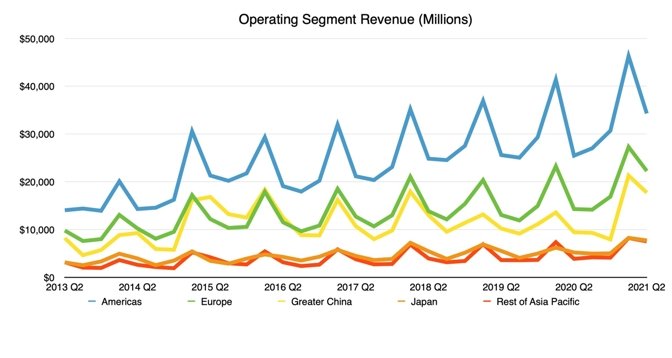

Operating Segment Revenue

On a regional basis, Apple's most considerable revenue stream stems from the Americas at $34.3 billion. That represents a 34.7% increase over Q2 2020.

Following is Europe at $22.3 billion, up 55.8%. Japan was next at $7.7 billion, increasing 47.7% year-over-year. The rest of Asia-Pacific (APAC) produced $7.5 billion, up 94.2%.

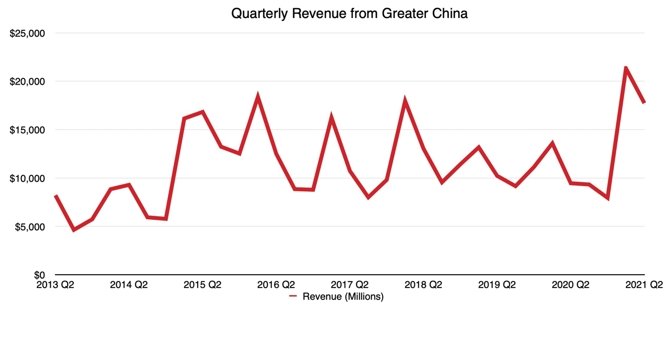

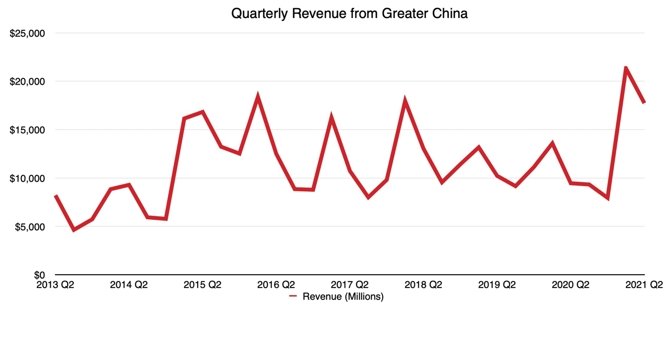

Greater China continues to be a significant growth area for Apple.

China Quarterly Revenue

"We were very pleased with our performance in China," said Tim Cook. "We set a March quarter revenue record and grew strong double digits across each of the product categories and so the revenue growth was."

"We've been especially pleased by the customer response in China to the iPhone 12 family," he continued. "And iPad [and], Mac have had an enormously positive quarters with great strength across the board. And we're seeing a strong reception to the new iPad Pro as well that we that we just announced there are a lot of a lot of great comments."

Cook stresses that the growth in China is continuing after its recovery from the coronavirus. The swift adoption of 5G in China also aided in its growth.

Stay on top of all Apple news right from your HomePod. Say, "Hey, Siri, play AppleInsider," and you'll get the latest AppleInsider Podcast. Or ask your HomePod mini for "AppleInsider Daily" instead and you'll hear a fast update direct from our news team. And, if you're interested in Apple-centric home automation, say "Hey, Siri, play HomeKit Insider," and you'll be listening to our newest specialized podcast in moments.

Apple had a record-breaking Q2; AppleInsider breaks down the highlights

On Wednesday, Apple held its quarterly release and analyst conference call to discuss its second-quarter results. Usually, the second quarter shows a slowdown in demand for iPhone and other products outside of the holidays, but not this time.

Revenue and Net Profit

For the quarter, Apple disclosed it had earned $89.6 billion in total revenue across all sectors. This total set a new March quarter record for the company and represented a 54% year-over-year improvement.

Apple Quarterly Revenue and Net Profit

Net profit rose a staggering 110% to hit $23.6 billion.

Ahead of the results' release, the Wall Street consensus had predicted Apple would report revenue of $77.4 billion, with earnings per share of $0.99. Apple's actual numbers came in at 16% higher.

While the initial effects of the pandemic rocked Q2 2020, Q2 2021 follows a full year of Apple working to mitigate its impact.

Quarterly earnings per diluted share were $1.40. That's technically down from $2.55 in the quarter one year ago, but that's primarily because of Apple's 4-for-1 stock split in August 2020.

"This quarter for Apple wouldn't have been possible without the tireless and innovative work of every Apple team member worldwide," said Apple CEO Tim Cook. "We're gratified by the enthusiastic customer response to the unmatched line of cutting-edge products that we delivered across a historic holiday season. We are also focused on how we can help the communities we're a part of build back strongly and equitably, through efforts like our Racial Equity and Justice Initiative as well as our multi-year commitment to invest $350 billion throughout the United States."

Gross Margin

The gross margin is also typically a good indicator of Apple's profitability. The Q2 gross margin reached 42.5% and is up from the year-ago quarter when it hit 38.4%.

Gross Margin

The gross margin is the highest it's been in nine years, and Apple's CFO Luca Maestri believes the June quarter will show similar results.

"So from March, we were up 270 basis points sequentially really driven by three major factors," said Maestri. "Cost savings which has been good for us during this cycle, a really strong mix on iPhone but in general across all product categories ... and foreign exchange sequentially again from December to March was favorable 90 basis points so that helped as well."

Operating expenses for the period were $10.6 billion, above the $9.5 billion from Q2 2020.

Products

Quarterly Revenue by Unit

Regular observers of Apple's financial results will be familiar with how the iPhone dominates Apple's product revenue, and Q2 2021 is no exception. Looking at all of Apple's product categories reveals a significant difference in how much the iPhone pulls in over the rest.

However, Apple Services, iPad, Mac, and wearables also saw notable growth year-over-year.

iPhone

The Q2 results represent the first full quarter of sales for the iPhone 12 range. It was a blowout quarter, with iPhone sales up 65.5%.

iPhone Quarterly Revenue

The record-setting Q1 revenue of $111.4 billion was aided by considerable growth in iPhone sales due to the release of the iPhone 12 range. Q2 benefits from Q1's lead, with iPhone revenues hitting $47.9 billion, up from the $28.96 billion from Q2 2020.

Cook noted that the iPhone 12 was the best-selling unit in Apple's lineup, but the iPhone 12 Pro and iPhone 12 Pro Max also saw strong sales. There was no mention of the iPhone 12 mini, which multiple analysts have described as disappointing.

The 5G upgrade cycle is also "important," according to Cook, but that "we are in the early days of it." He pointed out that the China and U.S. markets have been the quickest to adopt 5G with network build-outs.

iPad

This quarter also marked the first full period of the iPad Air 4 and 2020 version of the 10.2-inch iPad.

iPad Quarterly Revenue

Apple raked in $7.8 billion from iPad sales. That's a 78.7% year-over-year increase, up from $4.4 billion one year ago.

CFO Luca Maestri said the iPad grew in every geographic segment with sales records in Japan. Customer satisfaction of iPad is 94%, with half of all new purchases belonging to new users.

For both the iPad and Mac, Cook said work-from-home and remote learning are helping to drive new sales.

Mac

Much like the iPad, the Mac segment continued to benefit from social distancing measures and has done so for the fourth successive quarter. The introduction of the M1 processor also aided in the unprecedented Mac growth.

Mac Quarterly Revenue

Mac revenue hit $9.1 billion, up from $5.4 billion in Q2 2020. That makes for a 70.1% year-over-year increase.

Cook said the last three quarters for Mac had been its best quarters ever.

Q2 was the first full quarter with the first M1 Macs. These included Apple Silicon versions of the 13-inch MacBook Pro, MacBook Air, and Mac mini.

Services

Services revenue maintains its standing as Apple's second most important category by the numbers. In Q2, Services brought in $16.9 billion.

Services Quarterly Revenue

That figure marked a 26.6% increase over one year ago when it brought in $13.4 billion.

"Our services business did better than what we were expecting when we had the last call in January," said CFO Luca Maestri. "It was stronger across the board."

Unlike the other physical product-led categories, the Services arm is more likely to be a stable financial source for Apple. This stability is because Apple relies on devices in use for App Store purchases and subscriptions, rather than hardware sales.

While other categories may wane in the future, Services will likely keep chugging along for a long time without too much change, short of an unexpected event or significant adversity for the company.

Wearables, Home, and Accessories

The relative newcomer to the units, the Wearables, Home, and Accessories category is still seeing high revenue gains.

Wearables, Home, and Accessories Quarterly Revenue

The category rose to $7.8 billion in quarterly revenue. That's up from $6.3 billion this time last year, making for a 24.7% improvement. That growth is slowing, however, since Apple reported a 30% growth in the segment during the holiday quarter.

This sector includes not only Apple Watch and HomePod but also Apple TV and the ever-popular AirPods.

Regional Revenue

Operating Segment Revenue

On a regional basis, Apple's most considerable revenue stream stems from the Americas at $34.3 billion. That represents a 34.7% increase over Q2 2020.

Following is Europe at $22.3 billion, up 55.8%. Japan was next at $7.7 billion, increasing 47.7% year-over-year. The rest of Asia-Pacific (APAC) produced $7.5 billion, up 94.2%.

Greater China continues to be a significant growth area for Apple.

Apple in China

Greater China produced $17.7 billion, an 87.5% increase.

China Quarterly Revenue

"We were very pleased with our performance in China," said Tim Cook. "We set a March quarter revenue record and grew strong double digits across each of the product categories and so the revenue growth was."

"We've been especially pleased by the customer response in China to the iPhone 12 family," he continued. "And iPad [and], Mac have had an enormously positive quarters with great strength across the board. And we're seeing a strong reception to the new iPad Pro as well that we that we just announced there are a lot of a lot of great comments."

Cook stresses that the growth in China is continuing after its recovery from the coronavirus. The swift adoption of 5G in China also aided in its growth.

Stay on top of all Apple news right from your HomePod. Say, "Hey, Siri, play AppleInsider," and you'll get the latest AppleInsider Podcast. Or ask your HomePod mini for "AppleInsider Daily" instead and you'll hear a fast update direct from our news team. And, if you're interested in Apple-centric home automation, say "Hey, Siri, play HomeKit Insider," and you'll be listening to our newest specialized podcast in moments.

Comments

Thats technically incorrect. Your numerator [Earnings(2021)] and denominator [(Share Count(2020)] aren’t aligned. If you want to divide by an old share count that’s 4x fewer, you multiply current EPS by 4.

otherwise, good article.

I remember everyone saying Apple was doomed in China.