AT&T's WarnerMedia merging with Discovery in $43B deal to form new streaming service

AT&T is spinning off its remaining WarnerMedia services to create a new streaming service together with Discovery, to compete with Netflix, Apple TV+, and other omnibus streaming services.

AT&T's WarnerMedia is merging with Discovery to create a new streaming service

As previously rumored, AT&T has announced that it and Discovery, Inc, will create a new standalone streaming media company. It will include from the services AT&T acquired from Time Warner in 2018.

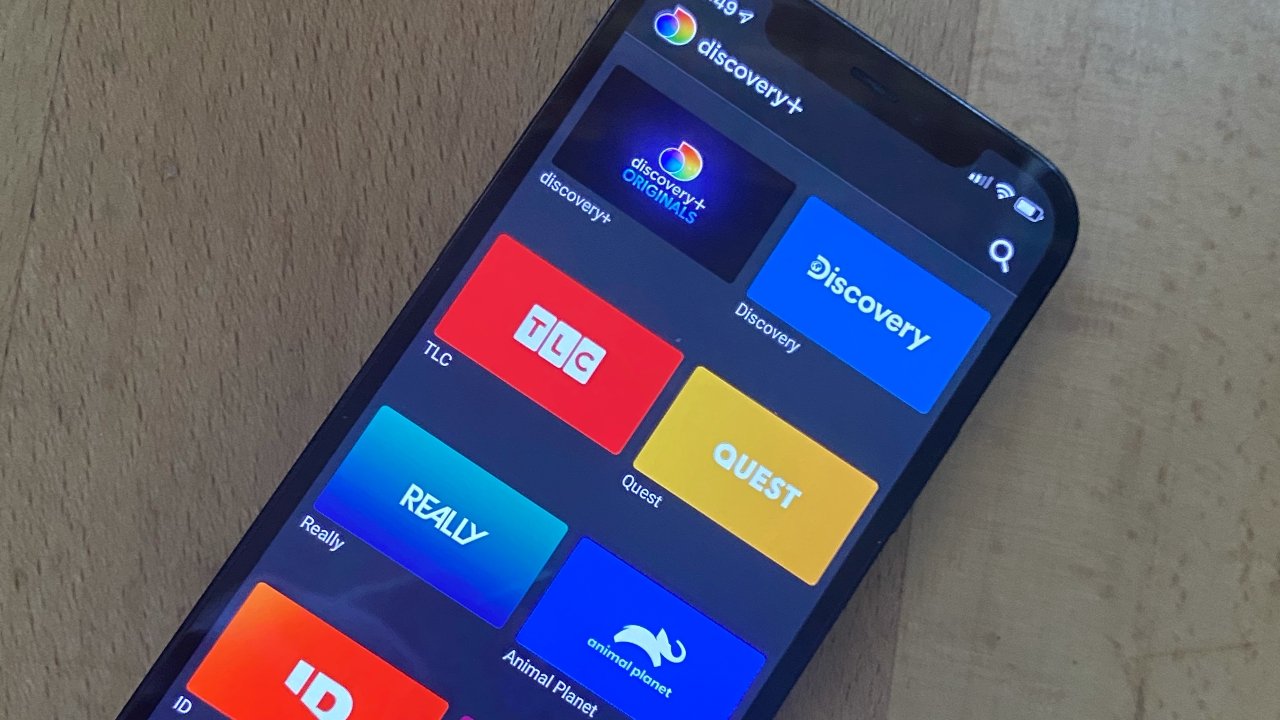

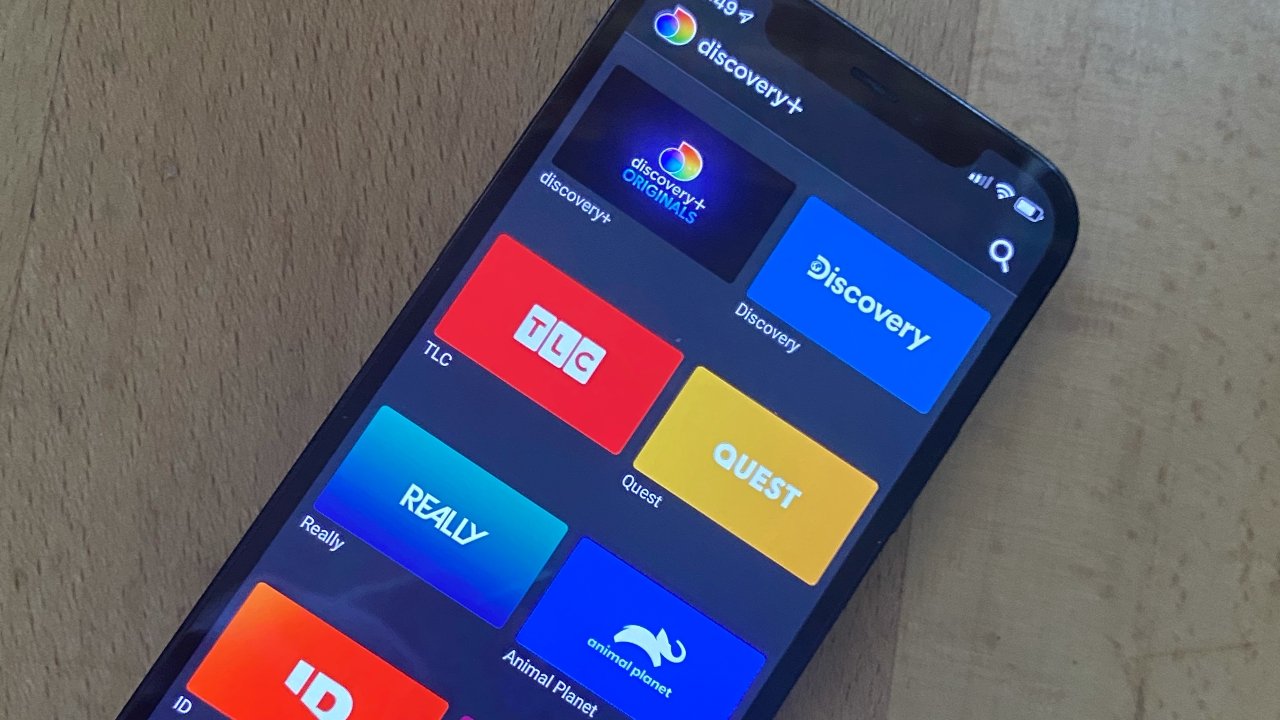

According to CNN, the new and as-yet-untitled service will contain HBO Max, Discovery+, and CNN itself. HBO Max is also reportedly planning to use Discovery's international business to help it expand outside the US.

"This agreement unites two entertainment leaders with complementary content strengths and positions the new company to be one of the leading global direct-to-consumer streaming platforms," said AT&T CEO John Stankey in a statement.

"It will support the fantastic growth and international launch of HBO Max with Discovery's global footprint and create efficiencies which can be re-invested in producing more great content to give consumers what they want," he continued.

The new service will be run by Discovery's CEO David Zaslav, who oversaw the launch of non-fiction streaming utilizing popular channels TLC and Animal Planet. The spinoff is being described as a joint venture, with Zaslav working with "executives from both companies."

However, if the deal gains regulatory approval, it will mean AT&T getting to reduce the amount of debt it has been carrying. "AT&T would receive $43 billion (subject to adjustment) in a combination of cash, debt securities, and WarnerMedia's retention of certain debt," said the companies in a press release.

Shares of both AT&T and Discovery rose on the announcement.

The news follows AT&T's early 2021 revision of its media services. It closed down its previous AT&T TV Now service, and moved subscribers over to its separate AT&T TV platform.

Stay on top of all Apple news right from your HomePod. Say, "Hey, Siri, play AppleInsider," and you'll get latest AppleInsider Podcast. Or ask your HomePod mini for "AppleInsider Daily" instead and you'll hear a fast update direct from our news team. And, if you're interested in Apple-centric home automation, say "Hey, Siri, play HomeKit Insider," and you'll be listening to our newest specialized podcast in moments.

AT&T's WarnerMedia is merging with Discovery to create a new streaming service

As previously rumored, AT&T has announced that it and Discovery, Inc, will create a new standalone streaming media company. It will include from the services AT&T acquired from Time Warner in 2018.

According to CNN, the new and as-yet-untitled service will contain HBO Max, Discovery+, and CNN itself. HBO Max is also reportedly planning to use Discovery's international business to help it expand outside the US.

"This agreement unites two entertainment leaders with complementary content strengths and positions the new company to be one of the leading global direct-to-consumer streaming platforms," said AT&T CEO John Stankey in a statement.

"It will support the fantastic growth and international launch of HBO Max with Discovery's global footprint and create efficiencies which can be re-invested in producing more great content to give consumers what they want," he continued.

The new service will be run by Discovery's CEO David Zaslav, who oversaw the launch of non-fiction streaming utilizing popular channels TLC and Animal Planet. The spinoff is being described as a joint venture, with Zaslav working with "executives from both companies."

However, if the deal gains regulatory approval, it will mean AT&T getting to reduce the amount of debt it has been carrying. "AT&T would receive $43 billion (subject to adjustment) in a combination of cash, debt securities, and WarnerMedia's retention of certain debt," said the companies in a press release.

Shares of both AT&T and Discovery rose on the announcement.

The news follows AT&T's early 2021 revision of its media services. It closed down its previous AT&T TV Now service, and moved subscribers over to its separate AT&T TV platform.

Stay on top of all Apple news right from your HomePod. Say, "Hey, Siri, play AppleInsider," and you'll get latest AppleInsider Podcast. Or ask your HomePod mini for "AppleInsider Daily" instead and you'll hear a fast update direct from our news team. And, if you're interested in Apple-centric home automation, say "Hey, Siri, play HomeKit Insider," and you'll be listening to our newest specialized podcast in moments.

Comments

Joking aside, I am retired and I don't have nearly enough time for our current options; Netflix, Disney Plus/Hulu, and Amazon Prime.

How about the ability in something like the Apple TV app to pick a selection from any streaming service à la carte at a good price of something like $15 a month for any ten shows, from anywhere?

But Randall is living it up with his retirement package and golden parachute. Go figure.

I get HBO Max free through my ATT cell service. We also recently subscribed to Discovery+ (gotta make the wife happy). Maybe they become one service? Here's hoping.

There’s no chance AT&T will offer *nothing*, although I suppose there’s chance they might eventually offer a different service.

What irritates me, though, is when the streaming services that I am PAYING FOR (like Discovery+) do not include current season/episodes of programs. Like, what am I paying for if I have to go watch them on cable TV with ads?

As content contracts are starting to expire or come up for negotiation (my guess?) which are the root cause of the streaming service problem mentioned by @ITGUYINSD. We will slowly transitioning away from the large "provider" packages to either the subscriptions models for shows we want, which is an expensive ala cart options or to buying streaming services + free streaming services. Once the "providers" become only ISP and loose their content the next move will be exactly what @MacPro suggested b/c subscriptions are too expensive and so is purchasing all the streaming services. We're already seeing consolidation in the streaming services, CBS All Access -> Paramount (shame I have seen all their content and I don't care about the new content except for a few shows but not they worth the $9.99/mo and now AT&T (+ DirectTV + HBO) and Discovery, which for me is the opposite, I like the new content. This is starting to cause new consumer behaviors. Like one or two shows but the subscription or plan cost too much. Fine, wait for all the shows to drop. Subscribe for a month. Binge watch what you want. Then cancel subscription until next year. It's a PITA way to view content, waiting and playing w/subscriptions but it saves ~ 11 months of fees per streaming service, which adds up quickly.

As for cost, I pay less than the $120/mo ($79/mo for 1GB internet and a couple of streaming services. One HBO Max is included with my AT&T cell plan and Amazon Prime is included w/my Amazon shipping. So it's hard to make direct comparisons. The problem is the "packages" aren't even close $120/mo they are closer to $180+/mo and what do I get? A landline, I don't need it. A ton of useless channels, I don't watch them. Provider ala cart is/was a joke. The only thing their version of pick your own channels showed us was that it was less expensive to buy a "package" and ignore what we didn't want.

Problem w/provider packages...

"Providers" don't get it, their marketing goals are to increase profits and they are failing. Instead they are slowly becoming ISPs and WE are getting our content where and how we like. Next/eventually we will have competition for ISPs beyond Verizon, AT&T and Comcast b/c we will not be limited by the "providers" fiber to the house controlling the last mile and they will be fighting to survive.

When these companies are thinking of merging, they are barely even considering American issues. They are thinking internationally. Perhaps some media companies will move their HQ outside of the US to reflect their customers better (and save money on cheap wages.)

There have to be quite a few sign offs and nothing is guaranteed.

I have no doubt that AT&T will divest Warner, but it may be sold off in parts. AT&T is the most deeply indebted non-bank corporation in the US and they need to spend billions to build out AT&T Fiber and 5G Wireless.