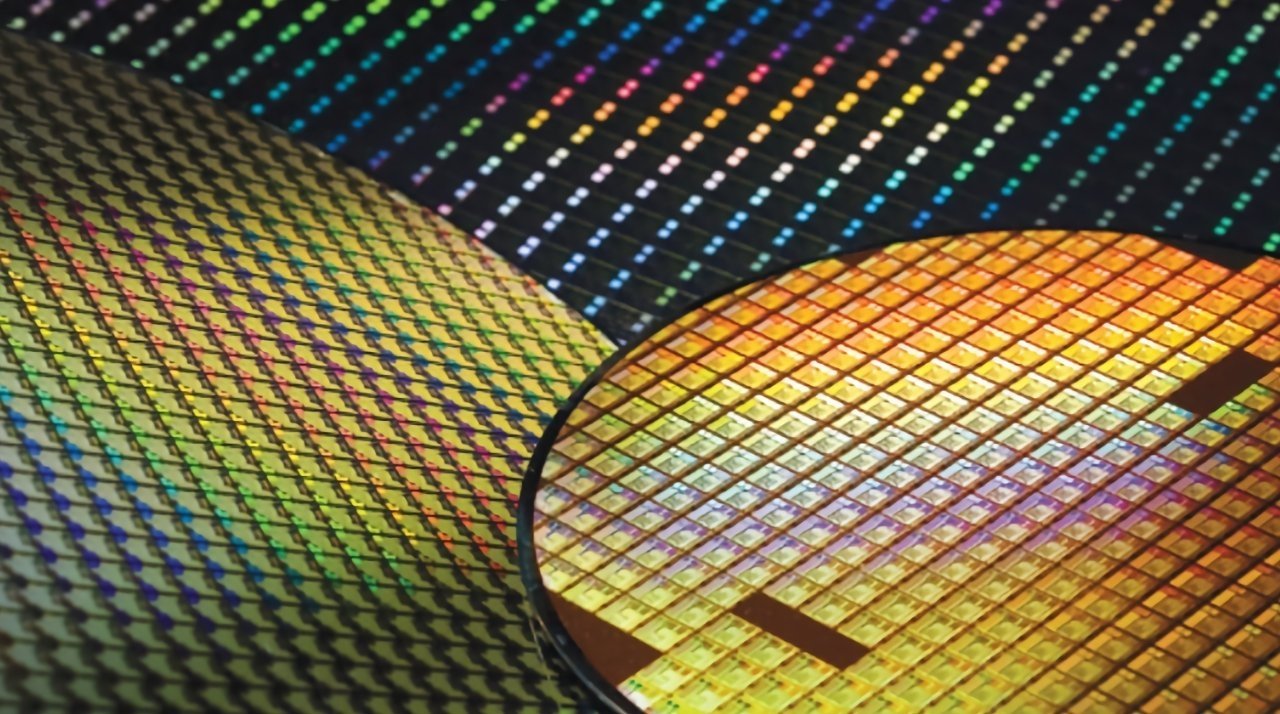

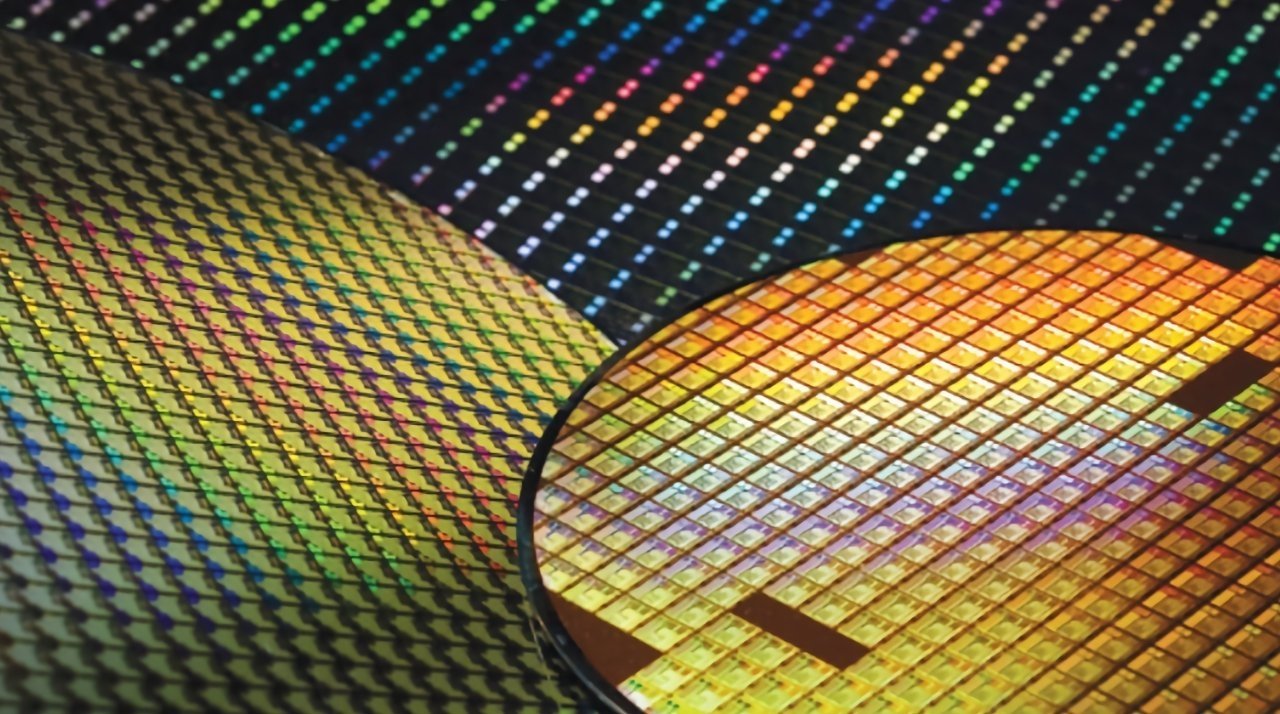

TSMC raising prices, iPhone pricing may get hit through 'iPhone 14'

The cost of the iPhone could grow for future models, after chip partner TSMC raised its production fees for making processors and other semiconductors.

Reports of price rises by Taiwan Semiconductor Manufacturing Co surfaced on August 25, with claims it informed clients including Apple of price hikes. On Monday, a second report said that the changes have been implemented by TSMC.

TSMC has been relatively slow to increase its prices versus its rivals, which have gradually raised the cost of chip production since Q4 2020 due to the global semiconductor crisis. According to Nikkei Asia, the change has been one of the biggest for the company in some time.

"We are all in a great shock and all of our account managers need to speak to our customers to see if we can renegotiate some of the contracts," said a chip executive to the report. "We haven't seen TSMC introduce such a broad rate increase in over a decade."

The initial report claimed the price rises included a 10% increase on 7-nanometer and smaller processes, rising to 20% for chips made using 16nm and larger nodes. The percentages aren't set in stone, as clients will be able to negotiate their own terms with TSMC ahead of their October 1 implementation date.

The price changes reportedly won't affect existing orders. TSMC's existing backlog will mean the effects won't be truly felt by customers until 2022.

TSMC is reportedly known for charging a premium for its service, with fees allegedly 20% higher than rival firms. The increases of rival firms during the chip crisis has effectively given TSMC an invitation to course-correct its pricing.

The increases may also be a way to prevent double-booking, a technique where clients order more chips than actually required, increasing the chance of securing time on production lines during an extremely busy period. The increase of the practice has made it hard for TSMC to determine the "real demand" picture, according to report sources.

As a chip partner that has worked with Apple for many years on its A-series line and Apple Silicon, as well as being effectively in control of over half the global foundry market, it seems unlikely that Apple will be moving off to another producer anytime soon.

Read on AppleInsider

Reports of price rises by Taiwan Semiconductor Manufacturing Co surfaced on August 25, with claims it informed clients including Apple of price hikes. On Monday, a second report said that the changes have been implemented by TSMC.

TSMC has been relatively slow to increase its prices versus its rivals, which have gradually raised the cost of chip production since Q4 2020 due to the global semiconductor crisis. According to Nikkei Asia, the change has been one of the biggest for the company in some time.

"We are all in a great shock and all of our account managers need to speak to our customers to see if we can renegotiate some of the contracts," said a chip executive to the report. "We haven't seen TSMC introduce such a broad rate increase in over a decade."

The initial report claimed the price rises included a 10% increase on 7-nanometer and smaller processes, rising to 20% for chips made using 16nm and larger nodes. The percentages aren't set in stone, as clients will be able to negotiate their own terms with TSMC ahead of their October 1 implementation date.

The price changes reportedly won't affect existing orders. TSMC's existing backlog will mean the effects won't be truly felt by customers until 2022.

TSMC is reportedly known for charging a premium for its service, with fees allegedly 20% higher than rival firms. The increases of rival firms during the chip crisis has effectively given TSMC an invitation to course-correct its pricing.

The increases may also be a way to prevent double-booking, a technique where clients order more chips than actually required, increasing the chance of securing time on production lines during an extremely busy period. The increase of the practice has made it hard for TSMC to determine the "real demand" picture, according to report sources.

As a chip partner that has worked with Apple for many years on its A-series line and Apple Silicon, as well as being effectively in control of over half the global foundry market, it seems unlikely that Apple will be moving off to another producer anytime soon.

Read on AppleInsider

Comments

Investors getting greedy?

Need money to cover lawsuits?

Government getting greedy?

Raw material costs rising?

Labor costs going up?

Because they can?

Presume it’s at least one of them if not all.