Apple continues dominance over global smartphone profits in 2021

Despite shipping fewer iPhones than Android rivals such as Samsung, Apple managed to take a full three quarters of all profits from smartphone sales in the second quarter of 2021.

iPhone 12 demand gives Apple lead position in market share for premium smartphones

Apple has previously been reported to have grown sales in Q2 2021, driven by the demand for 5G iPhone 12 models. Now new research claims the company was also "the biggest profit and revenue generator" in the market.

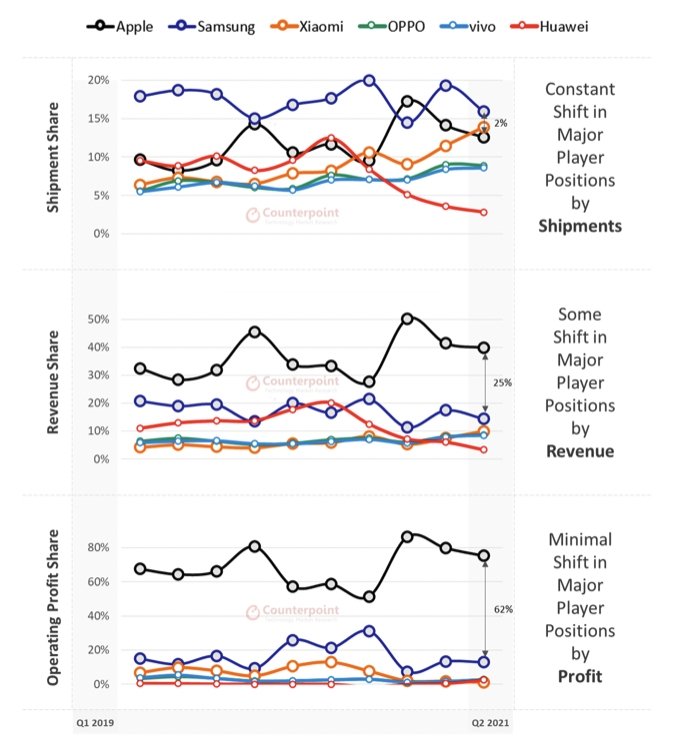

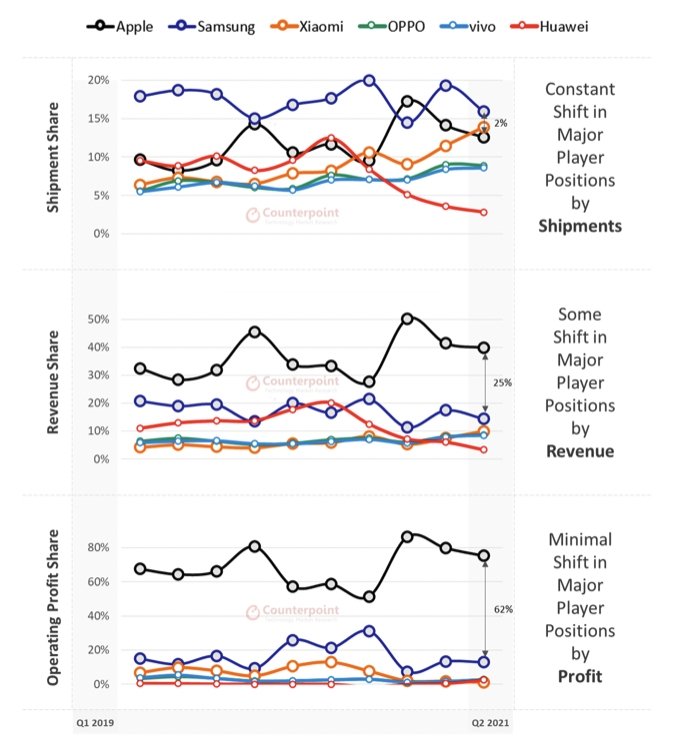

According to Counterpoint Research, there was a continual change in which manufacturer was selling the most number of phones. But there was far less movement over which was earning the most.

"In Q2 2021, [Apple] captured 75% of the overall handset market operating profit and 40% of the revenue despite contributing a relatively moderate 13% to global handset shipments," says Counterpoint Research in a blog.

"While this performance shows the power of the Apple brand," continues the company, " it is still lower than the peak of Q4 2020 when its revenue share reached a staggering 50%, up from 28% in Q3 2020, and its profit share reached an unprecedented 86%, up from 51% in the previous quarter."

Counterpoint Research notes that Samsung, "usually follows Apple in revenue and profit share," despite being "the biggest global smartphone vendor in terms of annual shipments."

The research company does not state figures for Samsung, but does show the gap between it and Apple. For revenue share, it says Apple exceeded Samsung by 25%. And for operating profit, Apple was 62% ahead of its rival.

Major handset vendor market shift Q2 2021 (source: Counterpoint Research)

Counterpoint notes that the market was affected both by the demand for 5G in Apple's iPhones, and the fall of Huawei.

"Despite relative stability at the top, a major shift in recent quarters was caused by Huawei's decline following the imposition of US sanctions against it," says the research company. "Huawei's fall has been accompanied by the rise of other Chinese OEMs, particularly Xiaomi, OPPO and vivo, which were the biggest revenue generators respectively after Apple and Samsung in Q2 2021."

The firm believes that Xiaomi has been concentrating on growing its number of shipments. "[Its] next goal will be to convert its high-volume smartphone business into a highly profitable one," says Counterpoint Research.

"Apple is likely to retain [its] edge, enabling it to continue charging premium prices for its handsets, thus maintaining high operating profit margins," the company concludes.

The second quarter of 2021 ended on June 30. Consequently the figures reported cover solely the iPhone 12 range, not the iPhone 13 which was launched in September, and saw very great demand.

Read on AppleInsider

iPhone 12 demand gives Apple lead position in market share for premium smartphones

Apple has previously been reported to have grown sales in Q2 2021, driven by the demand for 5G iPhone 12 models. Now new research claims the company was also "the biggest profit and revenue generator" in the market.

According to Counterpoint Research, there was a continual change in which manufacturer was selling the most number of phones. But there was far less movement over which was earning the most.

"In Q2 2021, [Apple] captured 75% of the overall handset market operating profit and 40% of the revenue despite contributing a relatively moderate 13% to global handset shipments," says Counterpoint Research in a blog.

"While this performance shows the power of the Apple brand," continues the company, " it is still lower than the peak of Q4 2020 when its revenue share reached a staggering 50%, up from 28% in Q3 2020, and its profit share reached an unprecedented 86%, up from 51% in the previous quarter."

Counterpoint Research notes that Samsung, "usually follows Apple in revenue and profit share," despite being "the biggest global smartphone vendor in terms of annual shipments."

The research company does not state figures for Samsung, but does show the gap between it and Apple. For revenue share, it says Apple exceeded Samsung by 25%. And for operating profit, Apple was 62% ahead of its rival.

Major handset vendor market shift Q2 2021 (source: Counterpoint Research)

Counterpoint notes that the market was affected both by the demand for 5G in Apple's iPhones, and the fall of Huawei.

"Despite relative stability at the top, a major shift in recent quarters was caused by Huawei's decline following the imposition of US sanctions against it," says the research company. "Huawei's fall has been accompanied by the rise of other Chinese OEMs, particularly Xiaomi, OPPO and vivo, which were the biggest revenue generators respectively after Apple and Samsung in Q2 2021."

The firm believes that Xiaomi has been concentrating on growing its number of shipments. "[Its] next goal will be to convert its high-volume smartphone business into a highly profitable one," says Counterpoint Research.

"Apple is likely to retain [its] edge, enabling it to continue charging premium prices for its handsets, thus maintaining high operating profit margins," the company concludes.

The second quarter of 2021 ended on June 30. Consequently the figures reported cover solely the iPhone 12 range, not the iPhone 13 which was launched in September, and saw very great demand.

Read on AppleInsider

Comments

At this point in time, in a mature smartphone market, I think it's pointless to be making quarter by quarter comparisons. A more meaningful graph would be a rolling average of the above graphs over many years. The trend would probably show that Apple continues to suck all of the oxygen (profits) out of the proverbial room, leaving the rest of the industry to battle it out for scraps.

Anyone remember the days of every new Android, Blackberry, Nokia, Windows, Samsung phone being the next "iPhone-killer"?